The iron ore slump shows that the Chinese economy continues to struggle. Moreover, if things on the steel front do not improve quickly, demand will be low for the rest of the year. Indeed, the decline in iron ore prices, which recently hit a five-month low, has many analysts worried about the robustness of China’s […]

Tag: steel price

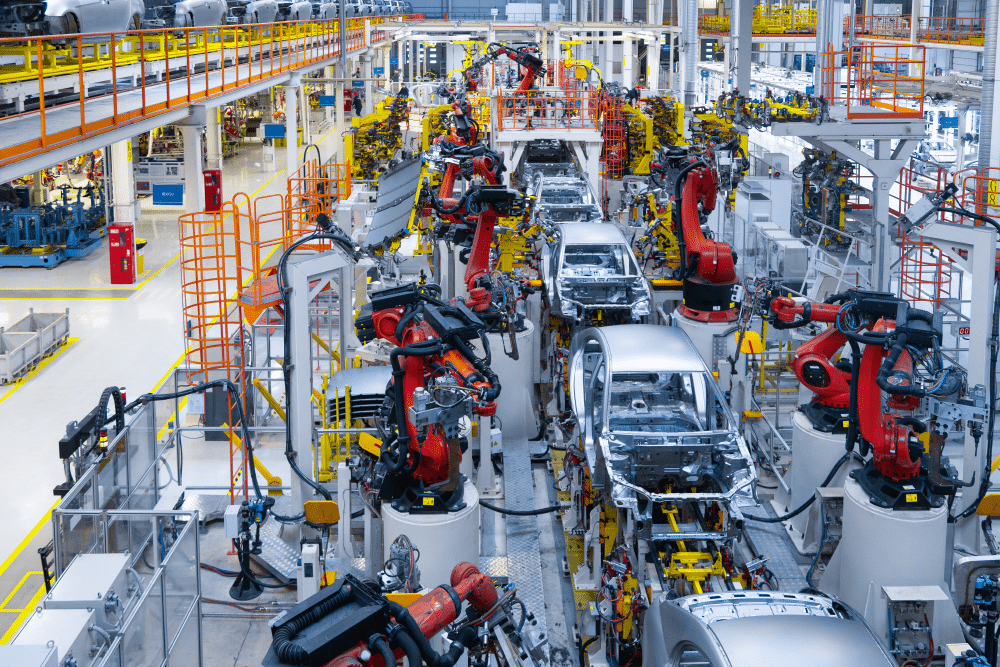

Automotive MMI: Vehicle Sales Up, Steel Prices Dropping

April saw a welcome boost in sales within the U.S. automobile market. New vehicle inventories are now in healthy shape. However, interest rates are still high, as are new vehicle prices. Moreover, the Automotive MMI index still has several factors working against it. Steel prices, notable HDG traded not only sideways, but completely flat. In […]

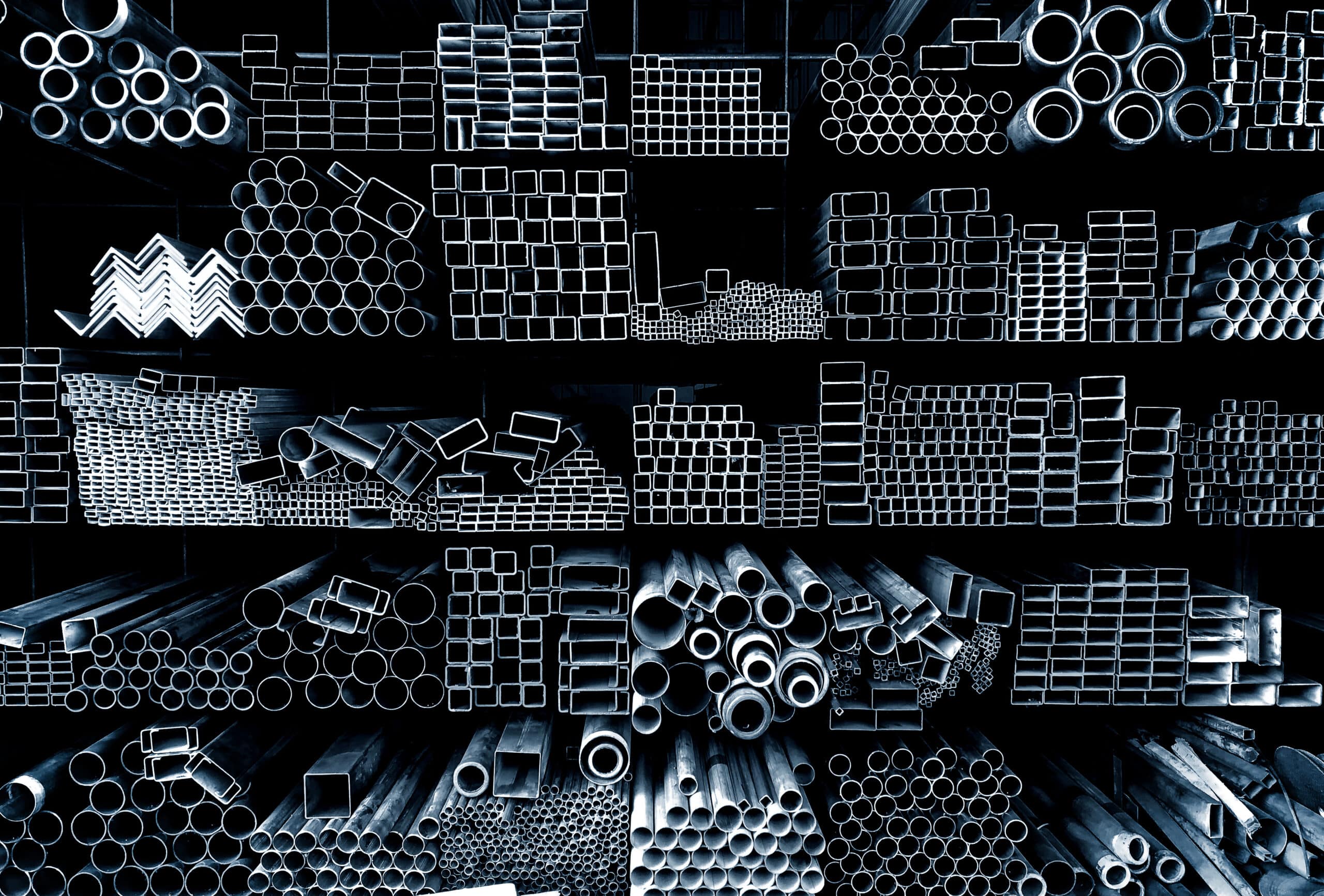

Raw Steels MMI: U.S. Steel Prices Slide as Construction Sector Poses Long-Term Risk

The Raw Steels Monthly Metals Index (MMI) moved down from April to May as all its components declined. After sharp upside movement during March, flat rolled steel prices saw their four-month uptrend falter throughout April. Meanwhile, hot rolled coil prices had risen over 82% from the beginning of the early December uptrend until prices peaked […]

What’s Behind Declining Steel Prices in Northern Europe?

Hot rolled coil steel prices in northern Europe began declining over the past month. Sources told MetalMiner on April 25 that the downtrend was largely due to lower demand and aggressive import offers. One trader mentioned that North European mills are now offering €820 ($900) per metric ton EXW for August rolling and September delivery. […]

Automotive MMI: HDG, Palladium and Shredded Scrap Steel Prices Jump

The Automotive MMI (Monthly Metals Index) rose significantly from March to April, jumping by 9.01%. This represents the highest rise the index has seen in over a year. Numerous drivers helped bring prices up, with every part of the index rising month-over-month, including: The steel parts of the index (in particular HDG) followed trend with […]

Raw Steels MMI: Market in Backwardation Suggests U.S. Steel Prices May Be Near Peak

The Raw Steels Monthly Metals Index (MMI) moved sideways from March to April, with a mere 0.65% increase. A sharp reversal to the downside for Midwest HRC future prices placed additional weight on the index. Meanwhile, HRC price action continued to the upside during the month, with the HRC rally yet to show a meaningful slowdown. […]

How Can Steel Procurement Professionals Survive a Recession?

The irony is not lost on steel buyers when they hear the phrase “the cold, hard truth.” After a massive spike at the beginning of March, HRC, CRC, and HDG steel prices are finally losing momentum. However, as any savvy procurement professional knows, they are not out of the woods yet. Recession indicators continue to […]

Renewables/GOES MMI: Steel Prices Rise, Experts Doubt Solar Energy Efficiency

After holding a pretty steady sideways trend since October, the Renewables MMI (Monthly MetaMiner Index) decreased by a considerable 8.56%. Indeed, multiple components of the index trended downward, including cobalt, neodymium, and silicon. Meanwhile, Chinese silicon costs continue to drop due to overcapacity. Other reasons for the drop included multiple silicon producers coming online and […]

Raw Steels MMI: U.S. Steel Prices Continue Uptrend

The Raw Steels Monthly Metals Index (MMI) rose by 8.74% from February to March. The growth was largely due to the massive increase in the U.S. HRC Futures contract, which jumped by nearly 49%. Because of this, steel prices reacted accordingly. HRC prices continue to show bullish strength in the short term, even breaking out […]

Raw Steels MMI: U.S. Steel Prices Continue Uptrend

U.S. steel prices continue to rise amid ongoing price hikes from domestic steelmakers. The ascent for HRC prices accelerated throughout January as they jumped by over 10%. Meanwhile, plate prices returned sideways with a modest month-over-month rise of just under 2%. Of course, this came after prices traded down throughout December. Overall, the Raw Steels […]