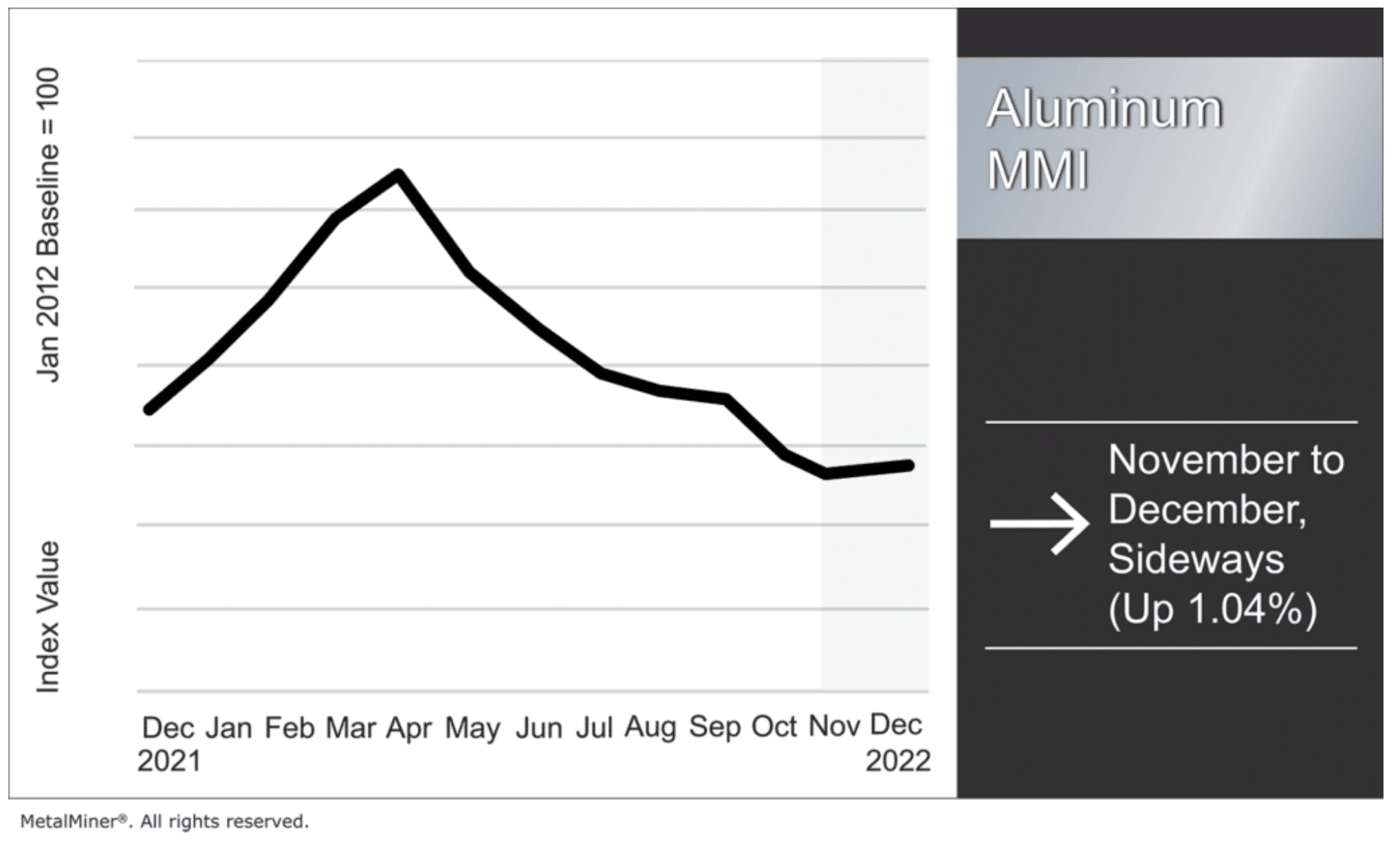

Aluminum prices broke out of their sideways trend last month with strong upside price action. Prices rallied during the first half of November, followed by a modest retracement before they continued upward. Overall, the Aluminum Monthly Metals Index (MMI) saw a modest 1.04% increase from November to December. The MetalMiner Insights platform includes global aluminum […]

Tag: WTO

In May, global production of crude steel surged by 16.5%.

Global crude steel production in May rose by 16.5% compared with May 2020, the World Steel Association reported this week. However, the gain marked a drop from the 23.4% year-over-year surge in April. In addition, as Stuart Burns noted yesterday, May output fell by 0.4% compared with April. Production jumped to 174.4 million metric tons […]

U.S. ups the ante in Boeing-Airbus subsidy saga

Airbus and Boeing — or, more reasonably, Brussels and Washington — are still at it, haggling over subsidies both sides have received over the decades. The action and counteractions, originally started by the U.S. to stem what it saw as a rising European rival to Boeing’s dominance, has been rumbling on for 16 years. Both […]

This Morning in Metals: U.S. steel capacity utilization rate rises to 65.1%

This morning in metals news: U.S. steel capacity utilization reached 65.1% for the week ending Sept. 12, the World Trade Organization released a report covering the U.S.’s Section 301 tariffs on Chinese goods; and the copper price approached a two-year high. Does your company have an aluminum buying strategy based on current steel price trends? […]

This Morning in Metals: Liberty Steel to acquire French steel assets

This morning in metals news: Liberty Steel Group announced it plans to acquire several French steel assets; the nationwide aluminum can shortage is impacting brewers; and the United States Trade Representative (USTR) last week announced changes to its $7.5 billion tariff package on European goods. Stay up to date on MetalMiner with weekly, monthly, or […]

Europe’s steel industry faces an unprecedented threat

President Donald Trump had scant regard, nor interest, in the impact his decision in 2018 to impose 25% import duties on steel products would have on other markets around the world — his focus was, reasonably enough, purely on the U.S.

Week in Review: Housing starts surge; aluminum mills go green; iron ore price falls

Before we head into the weekend, let’s take a look back at the week that was and some of the metals coverage here on MetalMiner, including coverage of: U.S. housing starts; aluminum mills taking steps to make their operations more green; iron ore prices; and the European steel sector. Looking for metal price forecasting and […]

U.S., India to resolve hot-rolled carbon steel dispute

2020 may turn out to be a watershed year in Indo-U.S. relations. Looking for metal price forecasting and data analysis in one easy-to-use platform? Inquire about MetalMiner Insights today! Several announcements and developments on the bilateral trade front, plus a proposed visit by U.S. President Donald Trump in February, seem to indicate that might be […]

This Morning in Metals: U.S. to appeal WTO panel decision in Indian steel dispute

This morning in metals news, the U.S. plans to appeal a World Trade Organization (WTO) compliance panel ruling related to its steel dispute with India, China’s crude steel production again hit a record high in 2019 and General Motors announced plans to invest $40 million at its Spring Hill Global Propulsion Systems plant in Tennessee. […]

Monday deadline looms for comments on E.U. copper products facing 100% tariff rate

Following from the long-running case recently won by the U.S. over whether the European Union (E.U.) provided Airbus with subsidies, on Dec. 2 the World Trade Organization (WTO) rejected the E.U.’s claim that subsidies were no longer provided to Airbus. Looking for metal price forecasting and data analysis in one easy-to-use platform? Inquire about MetalMiner […]