Aluminum MMI: Aluminum Prices Slide From Early-December Peak

Despite the recent short-term bounce, aluminum prices have not quite reversed to the upside following their long decline from March 2022. Ultimately, the rally between November and December was not strong enough to indicate a reversal. Moreover, bearish pressure continues to dominate the market environment at this time.

Instead, prices remain largely indecisive. However, the formation of a sideways trend appears increasingly possible, considering the failed break of prior highs. Still, aluminum prices would need to break to the upside or down to indicate a long-term trend direction. From a monthly standpoint, the overall market direction is still unclear.

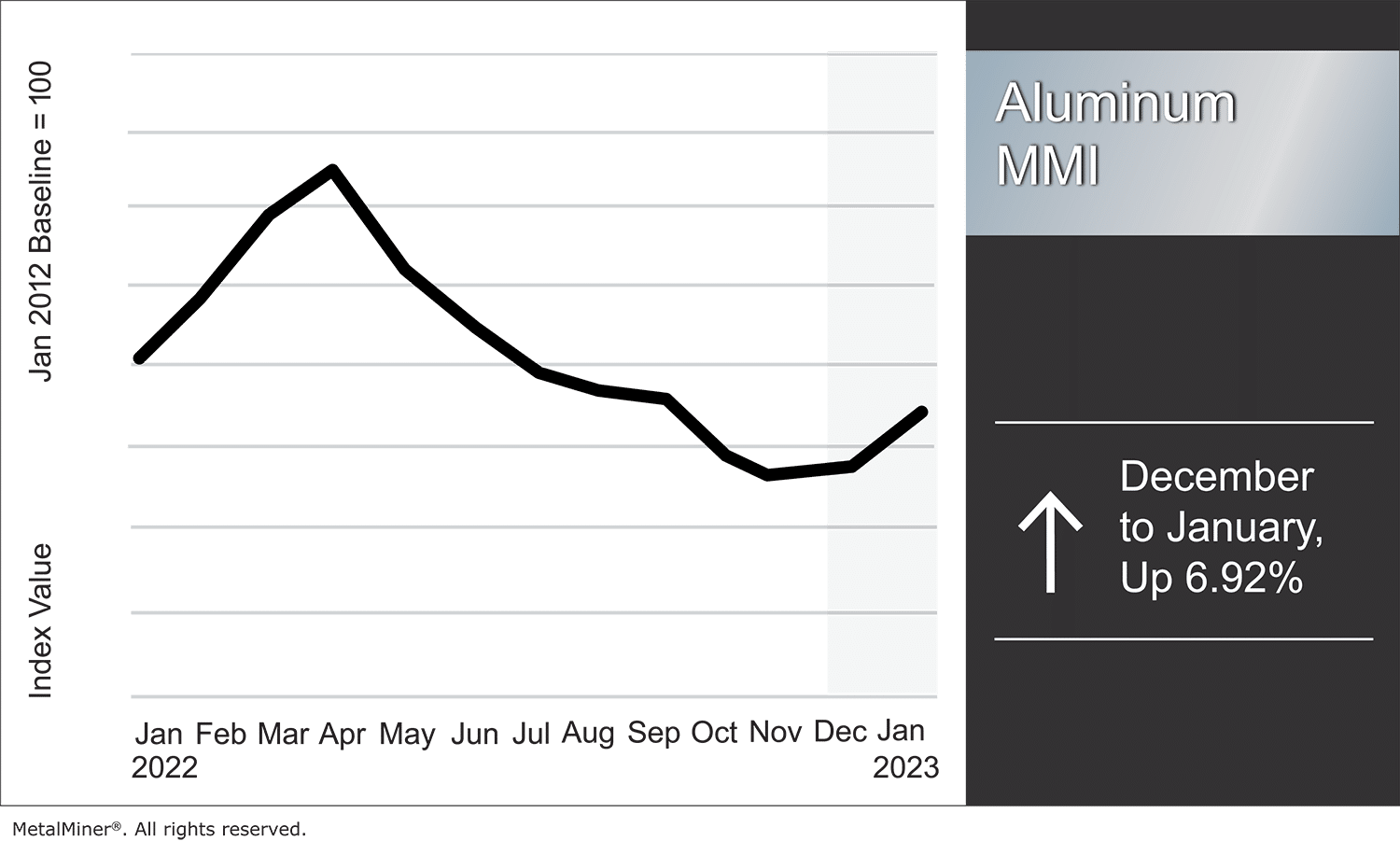

The Aluminum Monthly Metals Index (MMI) rose 6.93% from December to January.

The MetalMiner Insights platform includes global aluminum prices, premiums, forecasts, and specific monthly buying strategies. Request a 30-minute demo of the MetalMiner Insights platform now.

China Raises Aluminum Export Tariffs

At the start of the year, China raised export tariffs on aluminum and aluminum alloys. The change came alongside numerous tariff adjustments aimed at boosting certain domestic industries. While the duties placed on aluminum exports increased, overall, China cut tariffs in the new year to 7.3%. This was a slight decline from 7.4% in 2022.

Meanwhile, the energy crisis continues to shutter capacity throughout Europe and impact aluminum prices. However, rising production from China has helped alleviate the market deficit throughout the year, pushing prices downward. Due to China’s growing market share, increased tariffs will add some upside support to prices and could increase volatility.

However, this may not be enough to overcome the broader market pressures on demand. In the short term, Chinese demand remains constrained as the country grapples with surging COVID cases. Fortunately, current estimates suggest infections will peak in January. After that point, factory activity should begin to pick up again. As a result, prices may rise as they did in November, especially with markets optimistic about the return of Chinese demand. In the long term, concerns about a possible U.S. recession in 2023 persist. Moreover, the Federal Reserve plans to keep raising interest rates, which will add a drag on Western demand.

How do you generate aluminum cost savings in a recessionary market? Join MetalMiner’s January fireside chat: 2023 Market Predictions, Forecasts & Sourcing Strategies.

Aluminum Prices: Indonesia Announces Bauxite Export Ban

Beginning in June of 2023, Indonesia will ban exports of bauxite ore. Indonesian President Joko Widodo announced the ban on Dec. 23 as part of the country’s larger strategy to spur value-add investments in its supply chain. Indonesia already has a nickel ore export ban in effect.

The country previously banned the export of mineral ores, including bauxite ore, from 2014 through 2017. After the ban took effect, prices saw a roughly 6-month uptrend between February and August 2014.

Indonesia also accounted for around two-thirds of China’s bauxite supply at the time. In the years that followed, China substantially diversified its sourcing, relying more heavily on countries like Guinea. This caused imports from Indonesia to China to shrink by around 16% during the first ten months of 2022.

According to the U.S. Geological Survey, Indonesia is home to the fifth-largest bauxite reserves. It is also the sixth-largest global producer.

You want more aluminum market updates on your terms? Sign up for MetalMiner’s weekly newsletter here.

Aluminum Prices: What is the Impact?

Indonesia’s most recent announcement had no significant impact on aluminum prices. Indeed, prices have continued to slide since hitting an almost 6-month high in early December. However, markets could see more upside pressure when the ban goes into effect in June.

Should the ban prove successful and trigger further regional development, Indonesia could start to play a more prominent role within the aluminum supply chain. That said, this would take years to materialize. What’s more, their success could also encourage additional bans, like a previously-suggested copper concentrate ban.

While importing nations might challenge Indonesia’s move, any decision by the WTO will prove non-binding due to its non-functional appellate body. For instance, such a challenge occurred with the most recent dispute regarding Indonesia’s nickel ore export ban.

MetalMiner recently released its quarterly revision to the Annual Outlook. The report consolidates our 12-month view and provides buying organizations with a complete understanding of the fundamental factors driving prices. It also offers a detailed forecast for sourcing metals in 2023, including expected average prices, support, and resistance levels.

Aluminum Price: Notable Price Moves

- Indian primary cash aluminum prices saw the largest month-over-month increase as they rose 10.09% to $2.62 per kilogram as of January 1.

- LME primary three month aluminum prices rose 8.99% to $2,491 per metric ton.

- Chinese aluminum billet prices rose 8.06% to $2,778 per metric ton.

- European commercial 1050 aluminum sheet prices fell 0.79% to $3,956 per metric ton.

- European 5080 aluminum plate prices saw a 9.9% decline to $5,355 per metric ton.

Leave a Reply