Raw Steels MMI: U.S. Steel Prices Find Bottom, Begin Rising

U.S. steel prices hit a bottom at the beginning of December, then began to climb. Hot rolled coil prices rose over 8% from their December low. Meanwhile, plate prices traded down for the first time since September.

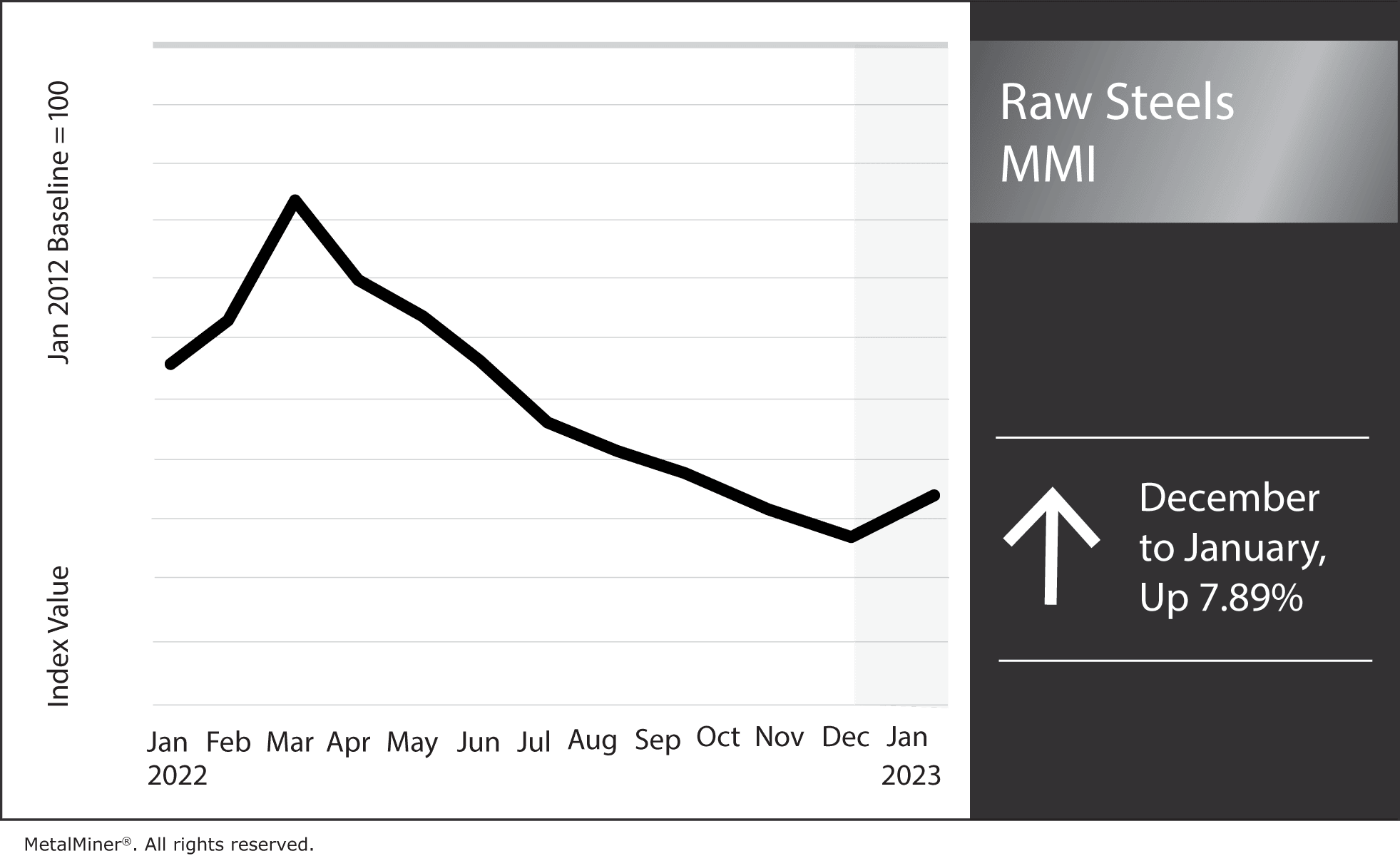

Overall, the Raw Steels Monthly Metals Index (MMI) rose by 7.98% from December to January.

MetalMiner’s free weekly newsletter provides up-to-date metal price intelligence.

Steelmakers Continue Flat-Rolled Price Hikes

Eager to continue the upside momentum, Nucor announced yet another $50 per short ton increase to flat-rolled steel prices. The steelmaker previously raised steel prices by $60 per short ton back in late November. This latest increase follows a $50 per short ton price hike by Cleveland-Cliffs. The Ohio-based producer implemented its increase on December 13, bringing its minimum HRC price to $750 per short ton.

Do you know how to map out your steel spending for 2023? Are you prepared for a recessionary market? Join MetalMiner’s January fireside chat: 2023 Market Predictions, Forecasts & Sourcing Strategies. Sign up here!

Steel Prices: Has the Trend Reversed?

Uninterrupted week-over-week increases since HRC prices inverted at the beginning of December suggest an increasingly bullish market. This signifies further upside potential, at least in the short term. Meanwhile, domestic producers have capitalized on the erosion of competitively priced imports. U.S. HRC prices now sit beneath European prices and within a narrow range of Korean prices. Chinese steel prices, however, still occupy the lowest price levels.

Beyond imports, the market appears to have priced in rising steel prices. Indeed, U.S. Midwest 3-month HRC future prices currently sit at a roughly $120 per short ton premium over current HRC prices.

Up to this point, the U.S. economy has proved resilient. However, compounding rate hikes from the Federal Reserve will continue to weigh on the domestic economy in 2023. This is sure to challenge the control steelmakers currently have over prices. Indeed, mill lead times remain short, suggesting supply is readily available and accessible.

This supply abundance will prevent the same sharp upside steel prices saw following the pandemic, when steel was scarce. And while it may not prove impactful enough to halt any further short-term increases, demand erosion could see the macro downtrend continue further out.

Nucor Keeps Plate Steel Prices Flat as Capacity Grows

On Dec. 28, Nucor announced it would keep its plate prices flat at $1,480 per short ton. This was surprising considering the company lowered prices just a month before. Still, throughout the year, the plate market proved more resilient compared to other forms of steel. Prices mostly moved sideways in 2022, slowly edging downward from their peak. However, declines appeared to accelerate last month, and plate steel prices currently sit at their lowest levels since July 2021. Whether or not Nucor and other steelmakers can steady the increasingly bearish market appears more and more uncertain.

Just before the new year, Nucor also announced that its Brandenburg, KY plate mill had officially rolled its first plate. They also stated that the mill will begin to ramp up its 1.2 million-short-ton-per-year capacity throughout Q1. Additional capacity will follow when Algoma Steel and JSW Steel complete mill their modernization projects. As mill lead times remain short, the market appears increasingly poised for oversupply throughout the year. This will likely continue until and unless demand picks up, which will effect steel prices.

Infrastructure Projects Bolster Plate

Unlike HRC, plate prices still sit considerably higher than their global counterparts. This means imports will continue to weigh on steel prices, although “Buy American” provisions will insulate prices to some extent. The spread between HRC and plate will also add downward pressure. Of course, opposing price directions have seen that spread narrow in recent weeks. Still, lower HRC prices have allowed a substitution opportunity at thicker grades for some manufacturers.

CRU is a popular steel contracting index. But you shouldn’t use it very often. See why!

Fortunately, infrastructure and renewable energy will continue to bolster plate for quite some time. Clearly, demand pressures poses a risk to the downside for other forms of steel. However, government-funded projects and incentives will serve as a limiting factor for future plate price declines.

That said, the full extent of this demand, especially regarding wind towers, will likely begin to hit the market in the long term rather than the short. There will also be a time gap between now and the peak of construction on plate-hungry infrastructure. Amid rising domestic plate capacity, this could mean substantial downside movement for plate prices until the next trend reversal.

See what else is impacting the plate market and generate hard savings on your metal buys year-round. Sign up for a trial of MetalMiner’s monthly outlook report.

Biggest Raw Material and Steel Price Increases

- Standard Korean steel prices saw the largest month-over-month increase as prices rose 21.29% to $275/metric ton as of January 1.

- U.S. Midwest 3-month future prices rose 11.81% to $805 per short ton.

- Chinese HRC prices saw an 11.59% increase to $580 per metric ton.

- Chinese coking coal prices continued their rebound with an 11.38% jump to $400 per metric ton.

- Finally, LME primary 3-month scrap prices rose 10.3% to $380 per metric ton.

Leave a Reply