Renewables/ GOES MMI: Cobalt Rallies, Renewable Energy Storage Facilities Expanding

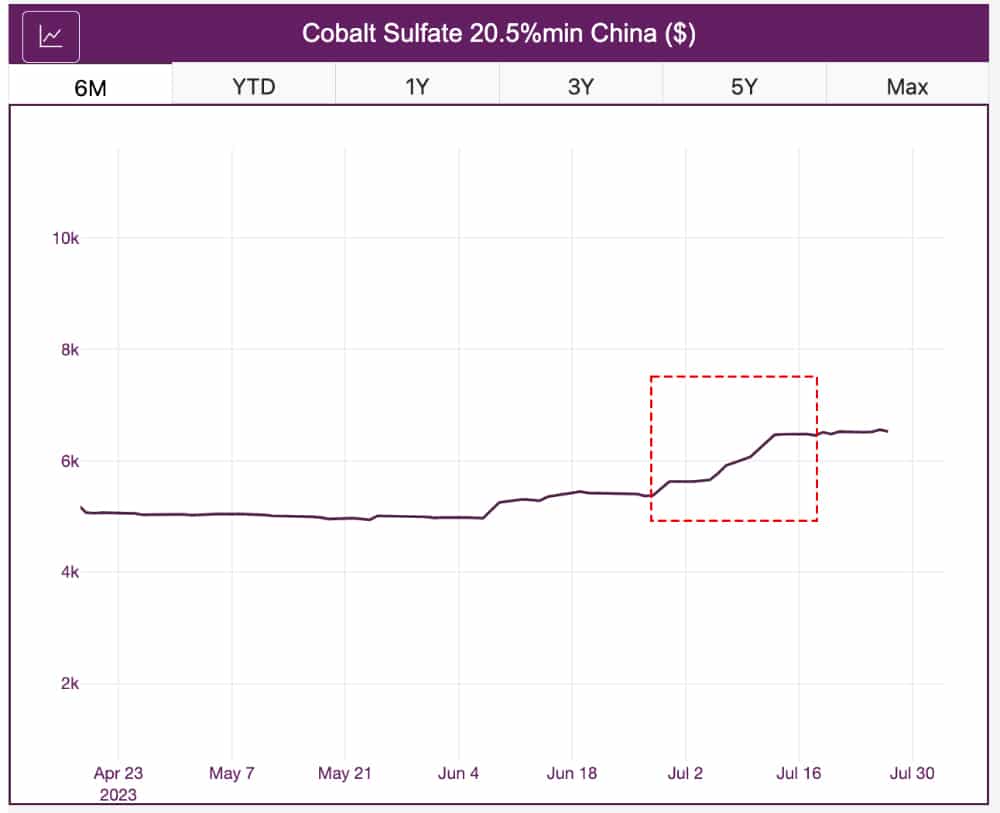

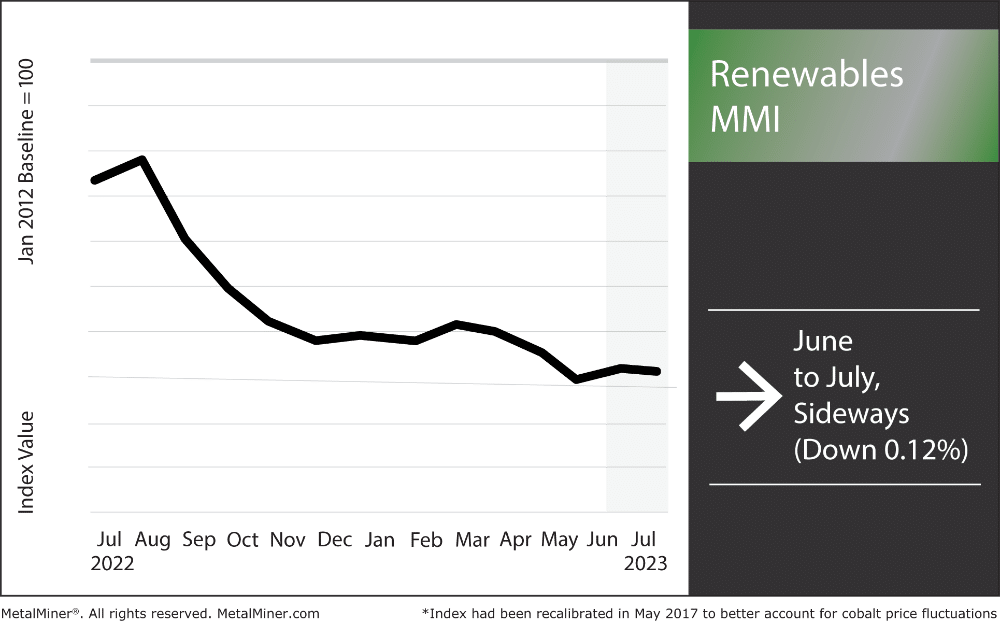

The Renewables MMI (Monthly Metals Index) saw little movement month-over-month. The index held sideways and only dropped a mere 0.12%, just narrowly missing trading flat. Moreover, the main factor which pushed the index sideways instead of down (according to renewable energy news) was cobalt rallying. It’s the first significant price rise cobalt has seen since February. After veering towards historical lows, cobalt was due for a rally (even despite over-supply).

This is mainly thanks to oversupply and a slow recovery in Chinese production after zero-COVID. Besides cobalt, every other part of the index traded sideways or down. Neodymium and grain-oriented electrical steel dropped the most, as cited on MetalMiner Insights.

Metals and other commodity markets are constantly shifting. Get all of the latest updates with MetalMiner’s weekly newsletter.

Renewable Energy News Outlets Cover Battery Storage Capacities

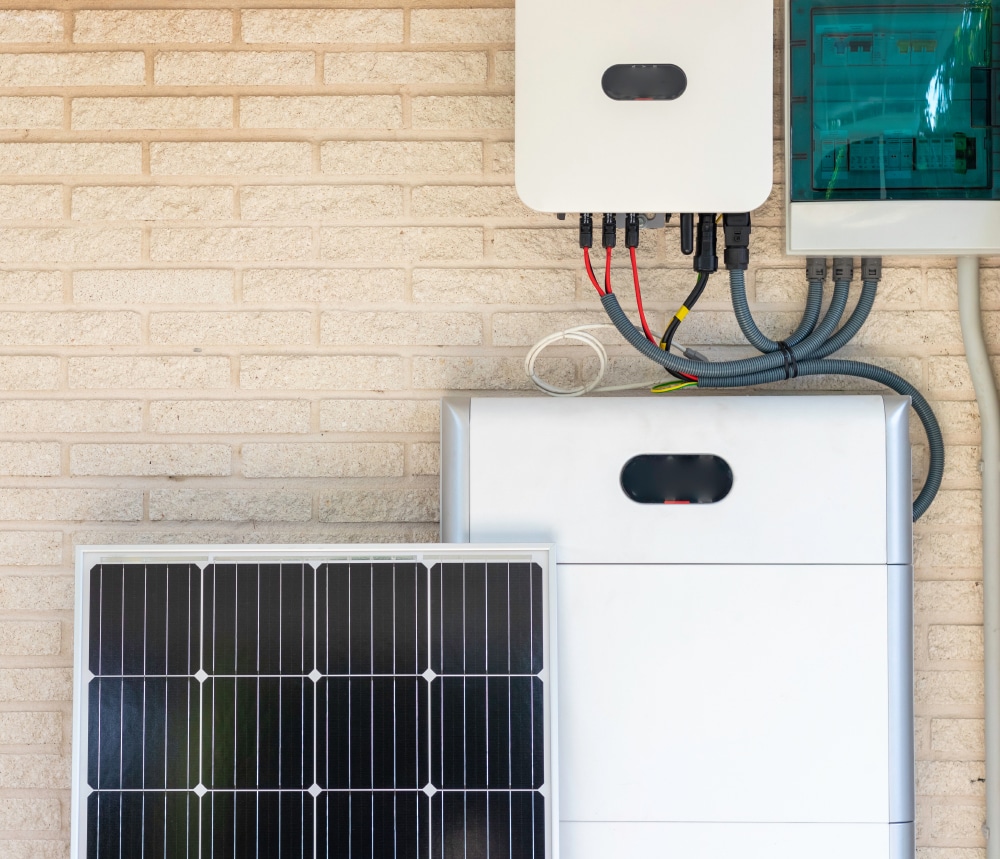

The demand for batteries and battery storage facilities continues developing in tandem with the demand for renewable energy. In recent years, developers and power plant owners in the U.S. have experienced a considerable rise in battery storage capacity. The aiming being to raise utility-scale battery storage capacity to 30.0 gigatonnes (GW) by the end of 2025. However, questions remain regarding whether the present battery storage capacity is sufficient enough to meet the expanding demand for renewable energy.

High-capacity, high-powered batteries hold the potential to improve the resilience of the U.S. power grid. It can also assist in the integration of renewable energy sources. This is critical because renewable energy sources in the U.S., such as solar and wind power, are experiencing issues with having enough outlets to transfer power from wind and solar fields into homes and businesses.

However, cheap or poorly designed batteries and battery storage units can lead to major problems. Batteries may be inadequately designed for cost-effective storage of the vast amounts of energy needed for communities and cities. This proves a problem that the already overburdened U.S. electricity grid doesn’t need. This implies that meeting the expanding demand for renewable energy requires placing more funds into energy storage units.

MetalMiner’s monthly free MMI report gives monthly price trends for 10 different metal areas. This includes copper, stainless, aluminum and precious metals. Sign up here.

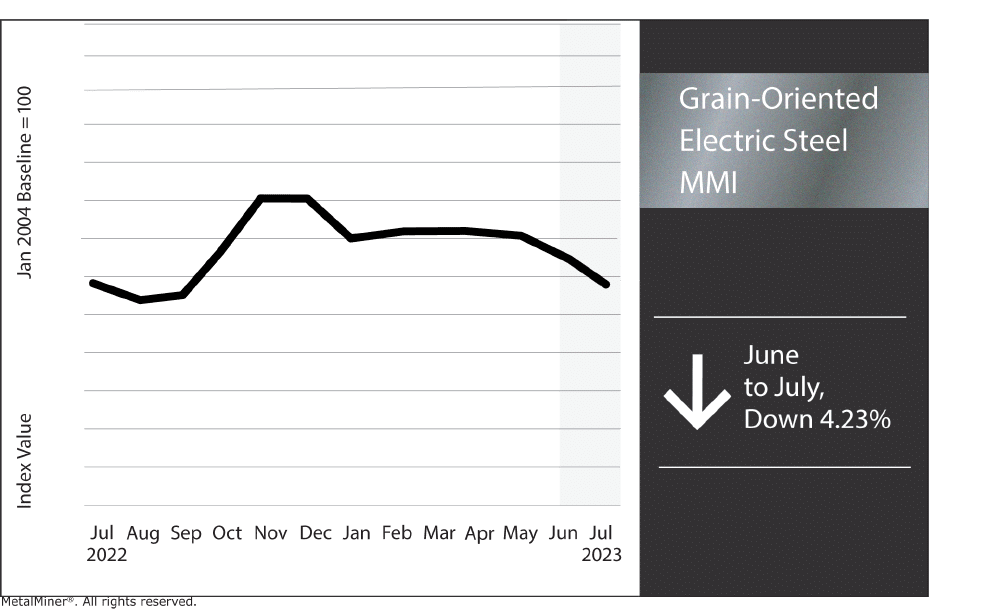

Grain-Oriented Electrical Steel MMI

Month-on-month, the GOES (grain-oriented electrical steel) MMI moved down by 4.23%. Despite the down trend, GOES still remains at price highs not seen since 2015. GOES doesn’t face as much bearish pressure as other forms of steel (like HRC and CRC). This is due to the ongoing need for more transformers within the U.S. Despite this, lower demand persists as an ongoing problem within many metal markets at the moment.

Strengthening U.S. Power Grid Security

A recent renewable energy news article on zerohedge.com article posted on oilprice.com brings up interesting points regarding U.S. power grid security. If the U.S. placed too much reliance on intermitted power sources, it could prove a real threat to U.S. power grid security and reliability. One specific area of concern presented within the article is the U.S. using countless solar panels and solar panel parts (namely silicon) sourced from China. Furthermore, industry studies highlight the crucial role played by Chinese-made components, particularly inverters, in integrating renewable energy sources.

U.S. electric grids could suffer significant consequences if trade relations between China and the U.S. deteriorate. The country’s electricity infrastructure is increasingly digitized and dependent on foreign-made electronics, notably components sourced from China. Furthermore, disruptions in the supply chain, whether due to armed conflicts or trade disputes, may seriously impact part availability. It can also impact reliability of these essential components, thereby endangering the operation of U.S. power grids.

Learn what tactics and strategies you need to be armed with to negotiate your 2024 metal contracts. Join MetalMiner’s August fireside chat: 2024 Annual Budgeting & Forecasting Workshop

Renewable Energy News Touches on Issues With Intermittent Power Sources

One of the challenges faced by intermittent power sources like solar power, according to recent renewable energy news, is their struggle to provide consistent power to communities. Solar power generation relies on the availability of sunshine, which fluctuates throughout the day and is influenced by meteorological conditions. The erratic nature of solar power makes it difficult to maintain a reliable balance between its supply and the demand for electricity. Additionally, integrating renewable energy sources into the electrical grid requires sophisticated management and coordination systems.

The intermittent nature of solar power generation, coupled with challenges in balancing supply and demand, might contribute to system instability.

Renewable Energy News: Biggest Shifts in The Renewables MMI

- Grain-oriented electrical steel coil dropped in price by 4.23%, leaving prices at $4,530 per metric ton.

- Chinese cobalt cathodes rallied at the beginning of the month before flattening out. Prices rose by 8% month-on-month, and prices hit $44,225.77 per metric ton.

- Chinese neodymium dropped in price by 4.16%, bringing prices to $80,745.34 per metric ton.

- Finally, Chinese silicon dropped in price once again month-on-month. Prices fell by 4.32%, leaving prices at $1,794.34 per metric ton.

Improve metal purchase timing and mitigate price risk — learn MetalMiner’s monthly metal buying outlook and receive a free sample copy.

Leave a Reply