Automotive MMI: Volatile Steel and Copper Prices Shake U.S. Auto Industry

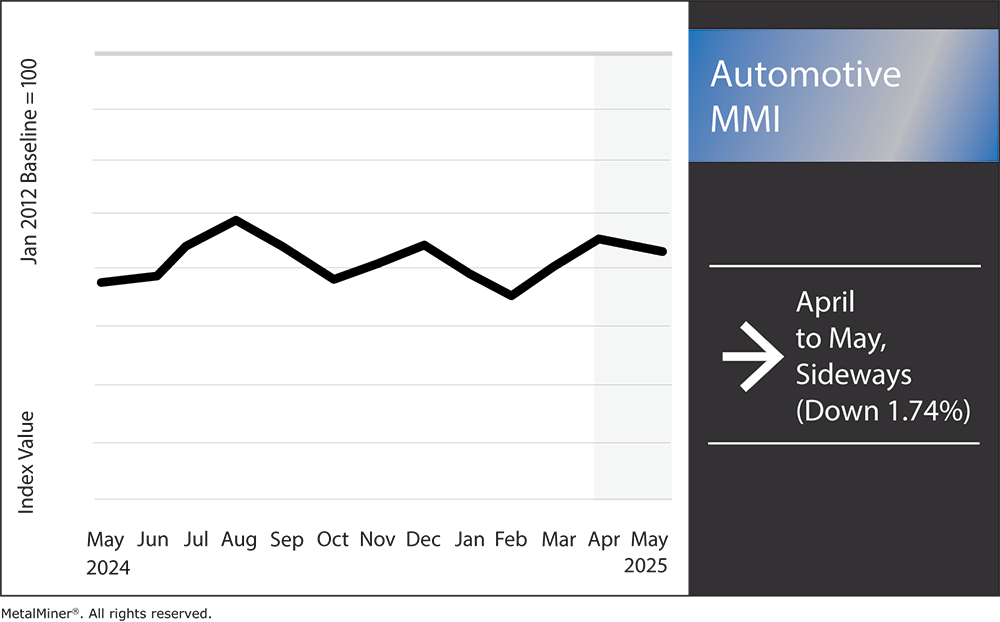

The Automotive MMI (Monthly Metals Index) moved sideways this past month, dropping a slight 1.74%. The US automotive industry faces a bumpy ride as key metal prices continue to swing wildly. In recent weeks, critical inputs like hot-dipped galvanized steel, copper and lead have seen rapid price shifts amid new tariffs and supply chain jitters, according to MetalMiner’s weekly newsletter.

Key Metal Prices Spike on Tariffs

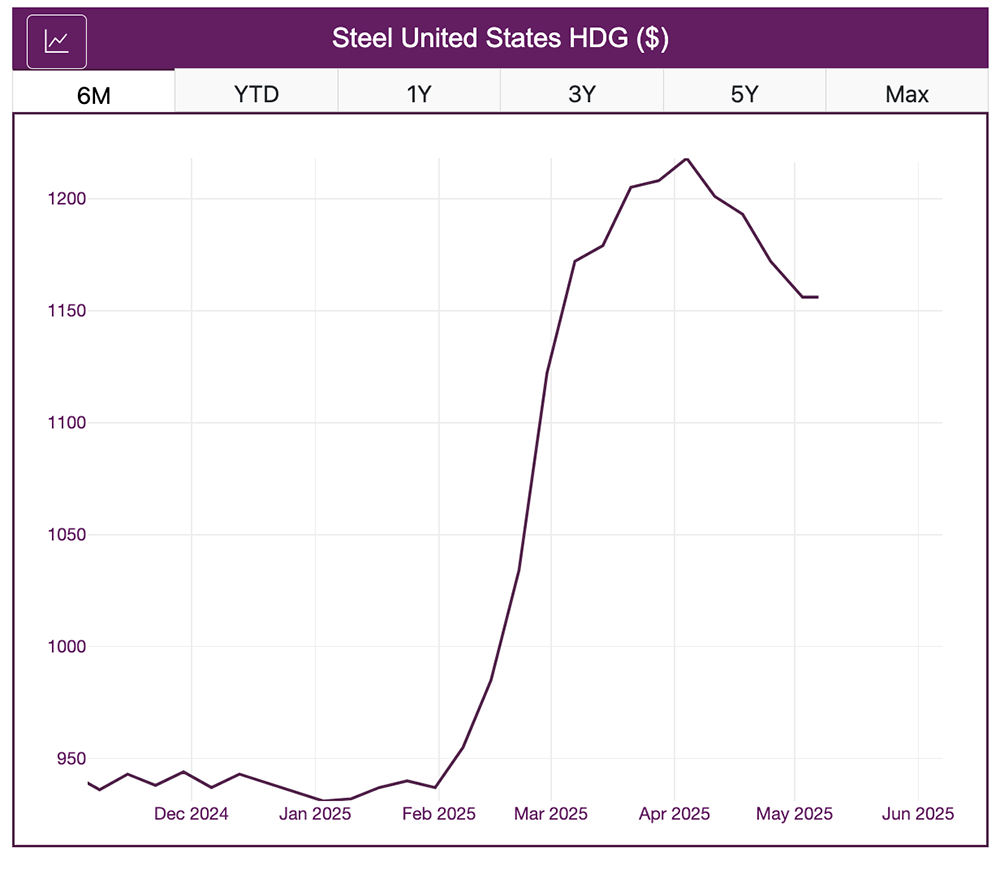

Hot-dipped galvanized steel prices jumped dramatically in Q1. Data shows that HDG prices spiked over 19% in February alone, reaching $1,122 per short ton. They then continued upward to roughly $1,208 by early April. However, late April brought a modest breather as North American galvanized sheet prices dipped.

Meanwhile, copper prices soared to record highs as the anticipation of tariffs on copper imports spurred a rush to stockpile the metal. But as tariff announcements hit, prices whipsawed. In early April, copper plunged nearly 60 cents per pound from its peak, with London prices sinking below $9,000/ton, the steepest weekly drop since 2020. These shifts in the copper market can throw copper sourcing industries off quickly, so MetalMiner’s Monthly Index report provides copper industry trends each month free of charge.

In contrast to copper, lead prices have remained relatively steady. Automotive lead, primarily used in batteries, mainly moved sideways, hovering near $2,300 per metric ton with only minor upticks. Chinese lead prices, a global benchmark, rose a scant 1–2% in recent weeks.

New Car Prices Climb as Consumers Feel the Pinch

The US automotive industry reports that steeper raw material costs and new import tariffs are already filtering down to showroom floors. Analysts warn that new vehicle prices are set to rise significantly for American buyers, with estimates suggesting that the average new car could cost at least $3,000 more. Facing higher steel and component expenses, automakers have little choice but to pass on these costs.

Not only are shoppers already seeing higher price tags, but used car prices aren’t immune to the cost surge. If new cars become pricier or harder to get, more buyers will flood into the used market. According to Car Edge, this will serve to boost secondhand demand and prices.

As of April, the average used vehicle list price is $25,180, down from the $28k peak seen in 2022. However, this is still unusually high by historical standards. Industry observers warn that a second wave of used-car inflation could hit if tariffs or production snags push new car prices even higher.

Automakers Feel the Squeeze

Domestic and foreign manufacturers are already grappling with the dual challenge of pricier materials and disrupted supply chains. Due to recent developments, automotive suppliers are paying more for everything from steel body panels to copper wiring harnesses, squeezing profit margins.

Mercedes-Benz, for example, saw its auto division profit margin slip to 7.3% in Q1 (down from 9% a year prior). The company also warned that US trade policies and tariffs will “negatively affect” its vehicle profit margins further if current policies persist. Ford and other automakers echoed these concerns. In fact, both Mercedes and Ford pulled their 2025 financial forecasts, citing the difficulty involved in predicting business under America’s extensive new import tariffs.

For the US automotive industry and beyond, MetalMiner Insights is key to risk-mitigating strategies, view our full catalog of covered metals.

A Growing Challenge for Suppliers

Supply chains are also finding themselves under increasing strain, especially for foreign-brand carmakers operating in the U.S. The North American sector as a whole, but particularly the US automotive industry, typically relies on an intricate web of cross-border part flows. However, new tariffs threaten to upend that model. The 25% tariff now hitting imported engines, transmissions and other parts means overseas-built components are suddenly far more expensive.

As the parts that used to move freely from Europe or Asia into US assembly plants now carry a hefty fee, prompting carmakers to seek out domestic alternatives or rework their supply lines. According to industry reports, US manufacturers are “scrambling” to source domestic materials for even small components as tariffs make imported parts cost-prohibitive.

Outlook for the US Automotive Industry Rife with Uncertainty

There are early hints that the metals frenzy may be tempering. After peaking at the end of March, US steel prices have begun to “unravel tariff-induced gains” and drift downward. Shorter mill lead times at the end of April also suggest an improving supply balance that could take additional heat off prices. Likewise, copper’s retreat from record highs indicates the market may have found a near-term ceiling, especially now that certain tariff fears (like a direct hit on copper imports) have eased.

Still, industry analysts caution that it’s too soon to celebrate. With China now facing tariffs upwards of 145% on exports to the US, any further escalation of US–China trade tensions could introduce new supply headaches or price spikes. Additionally, non-metal issues such as the global semiconductor chip shortage could re-emerge later in 2025, potentially crimping car production just as materials costs level off.

A Balancing Act

For now, both car makers and car buyers in the US find themselves in a high-stakes balancing act. Automakers must manage higher production costs and potential part shortages without alienating customers with sky-high prices. On the other hand, consumers are watching pricing and inventory updates closely and many are prepared to delay purchases in hopes of relief. For now, all eyes are on Washington and global commodity markets for any signs of cooling.

Automotive MMI: Noteworthy Price Shifts

If you’re only interested in the US automotive industry, why invest in unnecessary metal price points you don’t need? MetalMiner Select allows you to purchase just the metal price points you require.

- Chinese lead prices moved sideways, dropping a slight 2.61% to $2,299.68 per metric ton.

- Hot-dipped galvanized steel prices dropped by 2.98% to $1,172 per short ton.

- Lastly, Korean 5052 aluminum coil premium over 1050 prices rose by 3.15% to $4.44 per kilogram.