China’s Metal Anti-Dumping is Back. What You Need to Know

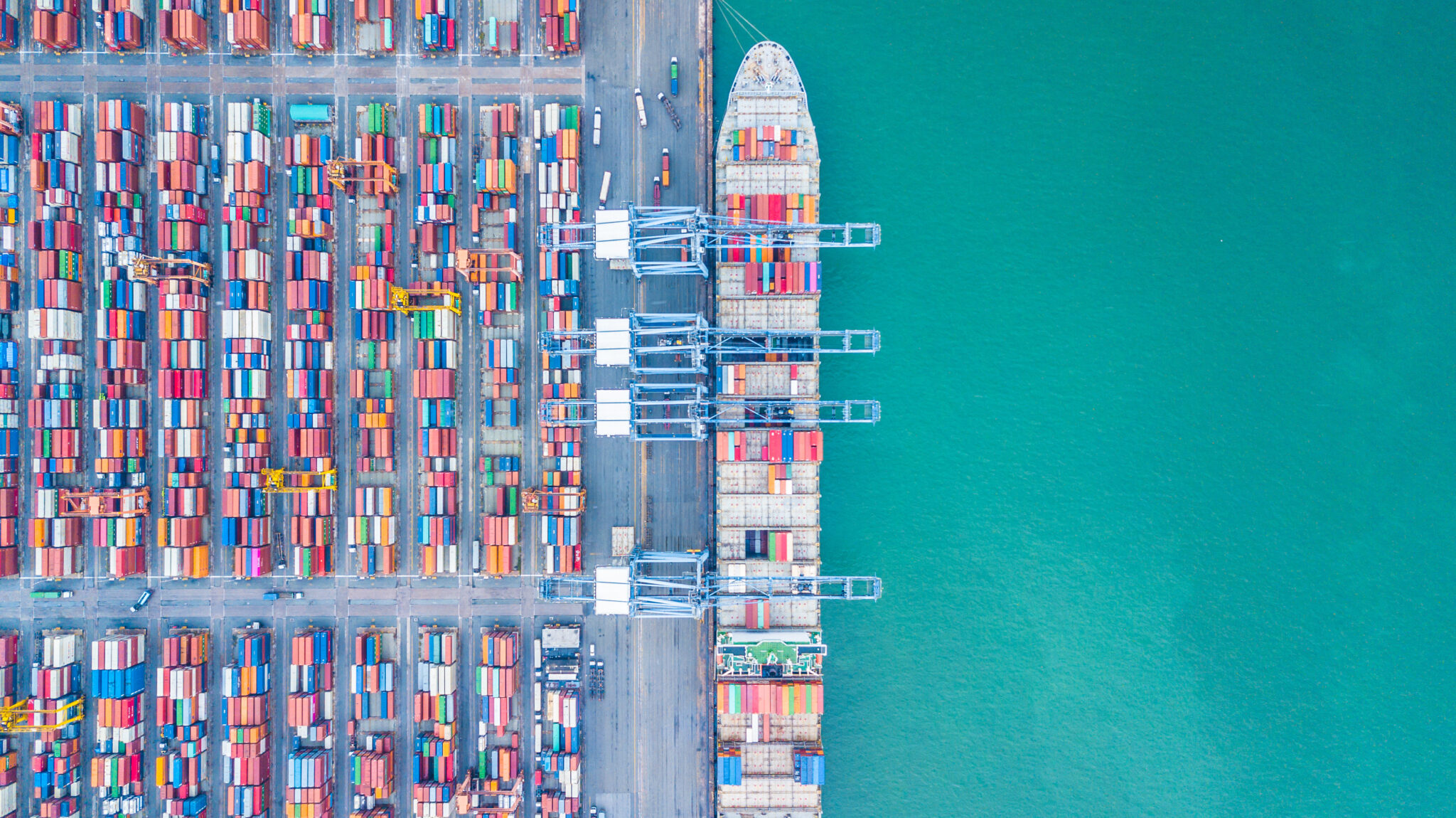

Chinese mills are churning out steel, aluminum and even refined copper at near-record levels and sending the surplus abroad, a trend steel industry analysts say could pressure industrial metal prices in the United States. After a year of lagging domestic demand, China’s exports of construction and manufacturing metals have surged, flooding global markets with cheap supply. U.S. manufacturers and procurement teams are watching closely.

Chinese Steel Exports Hit Multi-Year Highs

China exported 110.7 million tons of steel in 2024, a 22.7% jump from the prior year and the highest number ever recorded. With weak demand at home, China’s domestic steel consumption fell to a six-year low in 2024, pushing the steel industry to aggressively court foreign buyers with low-priced steel.

The strategy worked. First-quarter 2025 steel exports climbed another 6.3% year-on-year to 27.4 million tons, the highest Q1 volume since 2016. “In conditions of overproduction, send the surplus to foreign markets,” quipped one industry analyst, noting the logic behind China’s export spree.

Why invest in unnecessary metal price data when you only need a few price points? MetalMiner Select allows you to purchase just the metal price data you require.

Steel Industry Leaders are Already Pushing Back

However, this “great steel leap outward” is meeting pushback. Trade authorities worldwide have already launched a wave of anti-dumping cases against Chinese steel. At least 29 trade investigations were opened within the past year, double the number seen in the previous three years. Meanwhile, major importers like Vietnam, South Korea and the European Union have slapped tariffs on Chinese steel to block cheap inflows.

According to Reuters, even the U.S., which already levies 25% Section 232 tariffs on most steel imports, tightened the screws further this year with additional duties on Chinese steel transshipped through third countries. “It’s certain that total [Chinese steel] exports will slide in Q2,” said one Shanghai trader via Reuters.com, noting that no other region can absorb such huge capacity if traditional markets erect barriers. Make smarter buying decisions during times of fluctuating demand with expert sourcing strategies from MetalMiner’s weekly newsletter.

Is China About to Flood the World With Steel?

Chinese officials and steel industry leaders appear to be bracing for this slowdown. So far, Beijing has ordered the closure of 50 million tons of steel capacity this year to curb oversupply, with more cuts planned through 2030. Still, even if exports ease, they’ll remain enormous by historical standards. Analysts at S&P Global expect China will ship on the order of 100 million tons of steel by the end of 2025. This is slightly below 2024’s peak, but still a flood by any measure.

China’s ongoing oversupply is having a ripple effect on global markets, and analysts warn the pressure on prices will persist throughout the rest of 2025. Even in the United States, where import tariffs shelter domestic steelmakers, the sheer weight of China’s excess output is expected to cap price gains. “Surging Chinese steel exports put pressure on world prices,” notes the American Iron and Steel Institute, adding that U.S. prices can only remain high if insulated by trade walls.

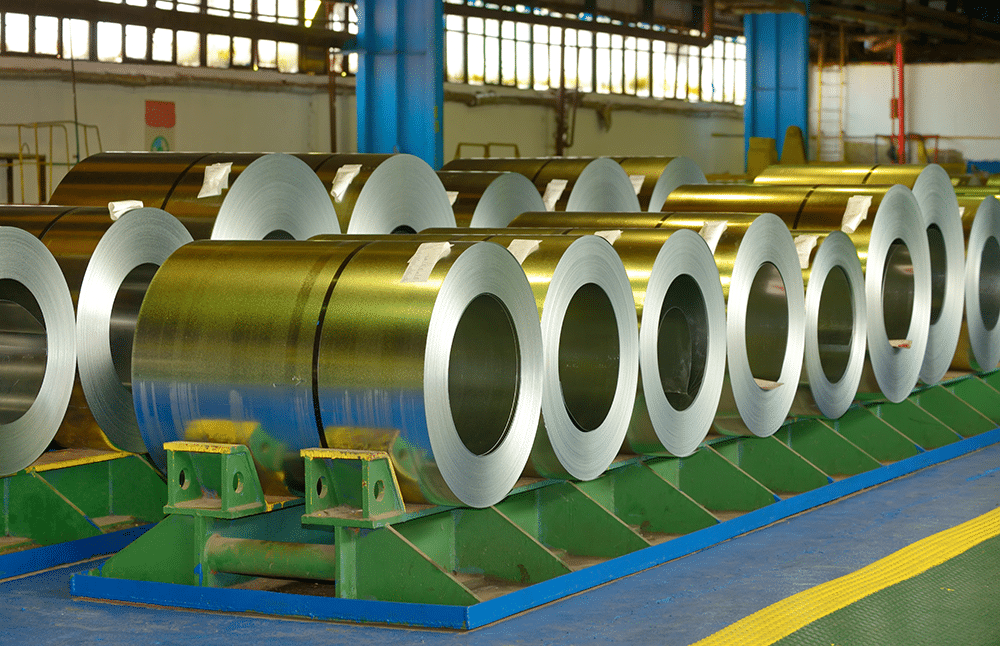

Aluminum Exports Face Policy Curbs but Supply Remains Ample

Aluminum is another metal where China continues to dominate global trade. In 2024, Chinese exports of semi-finished aluminum products, such as rolled sheets and extrusions, climbed by 19%, reaching a record 6.2 million tons. This comes despite efforts by Western governments to slow the flow through tariffs and anti-dumping measures.

China’s advantage stems from its massive production scale and relatively low energy costs. According to Reuters, this enables the Chinese steel industry to offer more competitive pricing on the international market. However, the country’s primary aluminum production is approaching its national capacity limit of 45 million tons per year.

For American manufacturers, this brings both opportunities and challenges. The surge in Chinese supply has helped drive down global aluminum prices from their 2022 highs, benefiting U.S. buyers who rely on the metal for industrial applications. While tariffs still apply, lower international base prices mean many firms are currently seeing more favorable procurement costs.

At least in the short term, Chinese production is helping keep aluminum prices stable for global buyers, including those in the U.S.

Do you know which contracting mechanisms are best for each type of market condition? Check out our best practices.

Copper Stays Plentiful as China’s Demand Cools

In the copper market, China plays a different role. Recently, that sector has also shown signs of a shift. Faced with a slowing economy and sluggish construction activity, China’s appetite for copper has moderated. The International Copper Study Group currently projects that global copper production will exceed consumption by about 285,000 metric tons in 2025, creating the largest surplus in four years.

Notably, Chinese copper inventories have been rising, reflecting weaker domestic demand growth (the ICSG sees China’s copper usage increasing only ~2% this year). Meanwhile, ample stockpiles in China suggest that less of the metal is being gobbled up internally, a development that tends to weigh on world prices.

Market analysts say the expected 2025 surplus is a key factor holding prices down, even as the energy transition underpins long-term copper demand. “In view of [a] likely weaker global economic outlook and negatively impacted copper demand, usage growth rates have been revised down,” the ICSG noted in its latest forecast.

For U.S. companies, a copper glut is more boon than bane. This is mainly because it implies lower input costs for electrical wiring, HVAC components and electronics manufacturing, all of which rely heavily on copper.

Missing out on valuable metal market insights which could save your company money? Subscribe to MetalMiner’s Monthly Metals Index Report and gain a competitive edge with comprehensive analysis across ten different metal sectors, ensuring you’re always informed.

U.S. Manufacturers Weigh the Pros and Cons

For U.S.-based manufacturers and metal procurement professionals, China’s export and production trends carry important implications. In the near term, the global oversupply of metals like copper and plentiful aluminum is largely positive for cost management. When world prices for HRC steel coil or aluminum ingot drop, American buyers benefit from cheaper imports (from whatever countries are not tariffed) and gain leverage in negotiations with domestic mills.

However, procurement experts caution that these global gluts come with caveats and volatility. One concern is the patchwork of tariffs and trade policies that can blunt U.S. access to cheap foreign metal. Under the current U.S.–China trade rift, direct Chinese steel and aluminum imports are effectively shut out by high tariffs.

This means U.S. companies can’t simply order cut-rate Chinese rebar or sheet aluminum and expect big savings. Instead, the global oversupply exerts an indirect influence. For instance, Chinese steel flooding Asia frees up South Korean or Turkish steel that might then be exported to the U.S.

Procurement Strategies to Consider

In terms of procurement, edging and forward buying strategies are gaining traction. With signs pointing to a sustained surplus in metals like copper and steel through 2025, some U.S. manufacturers are securing longer-term contracts or futures at today’s favorable prices, which MetalMiner’s MMO report provides on a monthly basis.

On the flip side, U.S. manufacturers must also consider supply security. Sourcing too heavily from China or any one country carries risks, as the past few years of geopolitical tension and pandemic disruptions have shown. After all, the present glut in Chinese metals might not last forever. Beijing’s moves to curb steel capacity and aluminum exports indicate an awareness that endless oversupply is unsustainable, and the steel industry will likely need to adjust yet again when policies change.