Global Precious Metals MMI: Precious Metals Prices Rise as U.S. Buyers Brace for Volatility

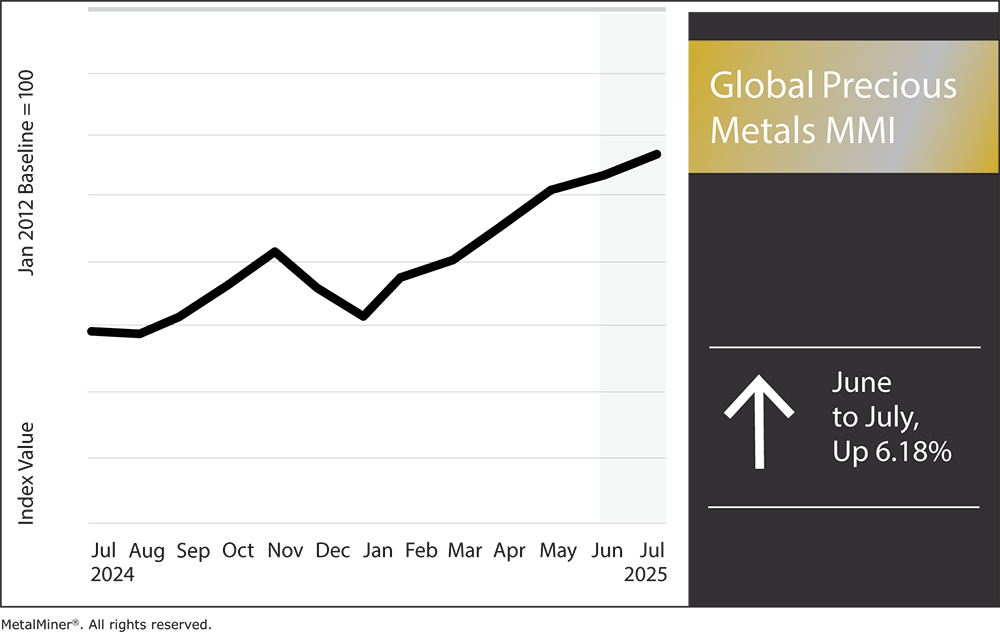

The Global Precious Metals MMI (Monthly Metals Index) rose by 6.18% month-over-month. The past 30 days have seen precious metals prices climb steadily, underscoring a volatile commodities environment for U.S. manufacturers and metal buyers. Gold remains near record highs, while silver, platinum and palladium each enjoyed strong rallies from mid-June to late July.

These moves come amid shifting economic currents, including a softer dollar, speculation around Federal Reserve policy and geopolitical trade tensions, all of which have procurement leaders on high alert. As one analyst told Reuters, the “carnival has moved on from safe-haven gold to silver, platinum and palladium as pro-growth, industrial alternatives.” To stay informed on global metal price trends, buyers can subscribe to MetalMiner’s weekly newsletter, which covers hedging tips, Fed policy impacts and procurement strategies.

Palladium: Surprise Summer Rally Faces EV Headwinds

Palladium prices staged a surprising surge over the past month, with spot palladium jumping roughly 19% since mid-June. In fact, it recently breached $1,300 per ounce, which Investing.com states is its highest level in nearly a year. This rebound has been fueled in part by a broader shift in investor sentiment toward industrial metals as well as some supply-side support. According to Kitco, top producer Nornickel announced maintenance-related output cuts for 2025, a move that could tighten palladium availability.

Yet despite the rally, palladium’s long-term demand profile remains uncertain. About 90% of demand comes from catalytic converters for gasoline engines, a segment that remains under pressure due to the EV transition.

Navigate volatile precious metals prices with confidence. MetalMiner equips you with the critical insights you need to develop a winning category portfolio strategy. View our full metal catalog.

Precious Metals Prices: Platinum

In terms of precious metals prices, platinum has been the breakout star of summer 2025. Prices rose 28% in June alone, peaking in mid-July. According to analysts at Bloomberg, this is the metal’s strongest month in decades. In this case, the rally was mainly fueled by concerns over South African supply and rising investor interest.

Still, analysts expect a cooling-off period in August. While a supply deficit is still forecasted, above-ground stocks remain ample. Therefore, buyers are advised to act strategically, rather than chasing prices.

Silver: Industrial Strength Drives a Shining Performance

Meanwhile, silver continues to shine. Over the past month, prices climbed to nearly $39/oz, which the Silver Institute says is approaching a 13-year high. This also represents an 8% gain since mid-June.

Analysts studying precious metals prices expect silver to test $40/oz in the coming weeks. Procurement teams can follow key trends through MetalMiner’s free Monthly Metal Index report, which offers timely signals on when to buy.

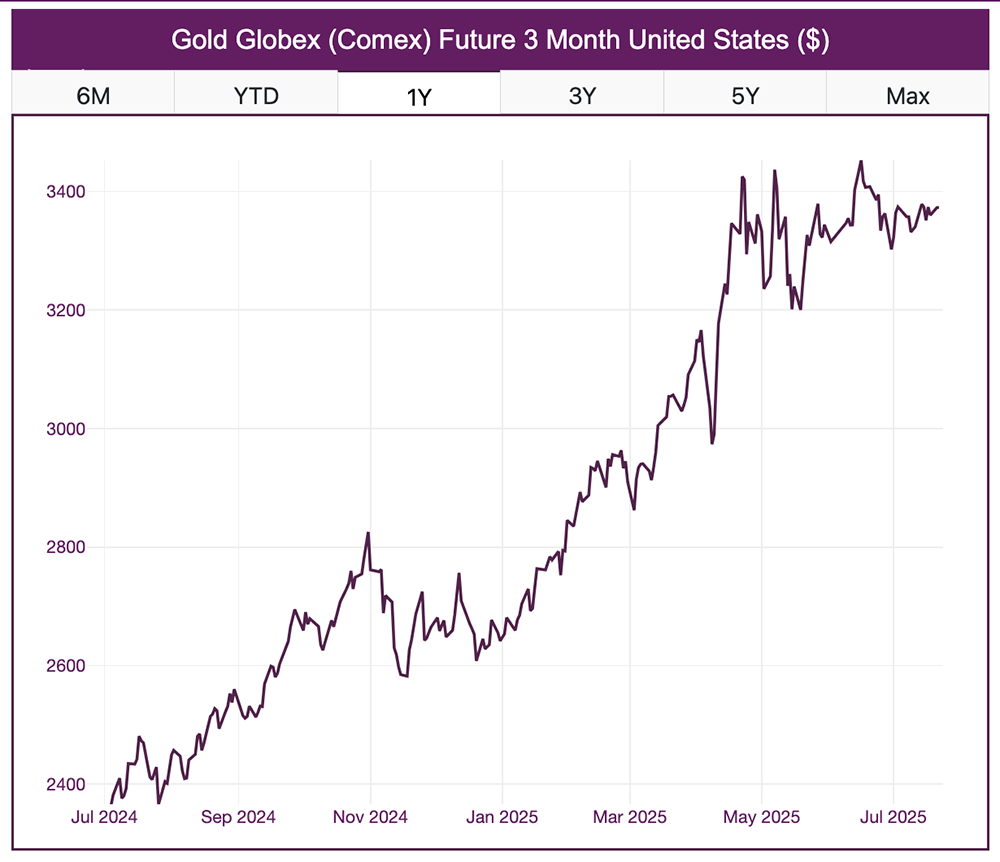

Gold: Holding High Ground Amid Fed Jitters and Geopolitics

Gold remains historically strong, hovering in the $ 3,300 range per ounce, with a gain of about 1% over the past month. The metal has been range-bound as investors balance a weaker dollar and global tensions against strong U.S. economic data.

Outlook: According to Citi, gold will likely hold between $3,100–$3,500 through Q3. Market watchers are closely monitoring Fed signals, with CME’s FedWatch tool showing a 59% chance of a rate cut by September.

Precious Metals Prices: Noteworthy Price Shifts

- Palladium bar prices rose by a staggering 16.25% to $1,109 per ounce.

- Platinum bar prices rose even higher than palladium prices. Month-over-month, prices surged 23.75% to $1,440 per ounce.

- Silver ingot prices rose by 9.33% to $26.22 per ounce.

- Lastly, gold bullion prices rose 1.33% to $3,338.25 per ounce.