Global Precious Metals MMI: Gold Steals the Show Again with Brand New Record Highs

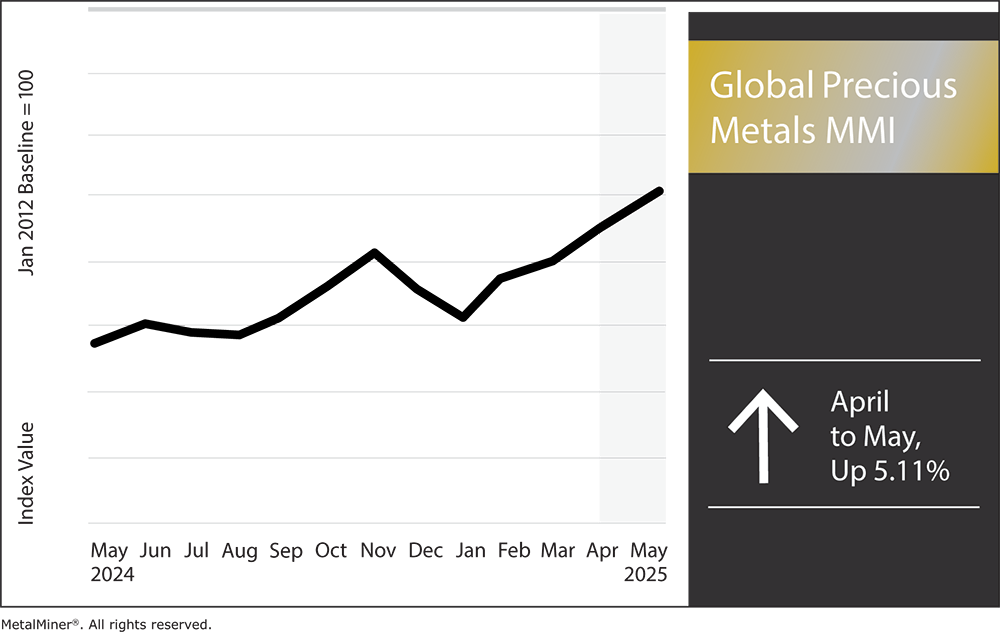

The Global Precious Metals MMI (Monthly Metals Index) rose month-over-month. Overall, the index saw a price increase of 5.11% as precious metals prices fluctuated and gold prices hit new record highs again.

Palladium Remains Lackluster

Palladium continues to put in an underwhelming performance. Its biggest demand driver, automotive catalytic converters, has softened as U.S. vehicle production shows signs of slowing. At the same time, many automakers are switching from palladium to the now cheaper platinum.

On the supply side, analysts anticipate a shift toward surplus by 2025 as EV adoption accelerates and substitution trends continue. With limited bullish catalysts in the near term, palladium prices are expected to remain under pressure heading into the summer.

Keep your sourcing team prepared and informed with expert insights on shifting precious metal prices by joining MetalMiner’s weekly newsletter list.

Precious Metals Prices: Platinum

Platinum saw modest gains over the past month, trading in the high $900s and reaching around $980/oz by early May. According to Kitco, while traditionally driven by jewelry and auto demand, platinum has seen renewed interest as a cost-effective substitute for palladium in emissions control systems.

Still, platinum’s industrial demand is vulnerable to U.S. tariff policy and global growth uncertainties. Analysts currently project a range-bound market between $880 and $1,050/oz, but warn that seasonal lulls or macro headwinds could send prices toward $800.

Silver Prices

Silver has remained a quiet out-performer despite a volatile few weeks. Prices surged alongside gold in early April, but have since retraced. While silver benefits from overall precious metal sentiment, it also faces pressure due to its use in industrial applications, especially as manufacturing data weakens. Silver took a hit earlier this month after U.S. tariff announcements triggered a roughly 9% correction.

Nonetheless, silver is up around 12% year-to-date. Many analysts expect it to trade sideways in the low $30s unless material demand picks up or macroeconomic conditions worsen.

Frustrated with one-size-fits-all metal prices subscriptions? MetalMiner Select offers customizable access to individual metal prices or bundled packages, ensuring you only pay for the forecasts that are relevant to your company’s sourcing.

Gold Hits New Record Highs…Again

Gold took center stage this past month, climbing to new record highs yet again. The precious metal reached $3,406/oz in April before hitting a brand new all-time high of $3,411.40/oz by mid-May. Inflation jitters, a softer dollar and safe-haven demand amid tariff tensions all contributed to the rally. U.S. COMEX gold futures tracked the same trend, with June contracts nearing $3,228/oz.

Going forward, traders are watching U.S. inflation data and Fed policy closely. Any signs of easing rates or weaker growth could drive gold higher again, while a stronger dollar may cap upside momentum.

The Outlook for U.S. Buyers

For procurement professionals and commodity strategists, the next 1–2 months will hinge on Fed decisions, U.S. trade policies and movements of the USD index. If tariffs escalate or rate cuts materialize, precious metals prices, particularly gold and silver, could surge again.

However, if markets regain stability, some of the safe-haven premium may unwind. For U.S. buyers navigating cost volatility, understanding these price levers is crucial, not just for timing purchases, but for building a resilient sourcing strategy.

Precious Metals Prices: Noteworthy Price Shifts

Enjoy this article? MetalMiner’s Monthly Metals Index Report offers price updates, market trends, and industry insights for precious metals and nine other metal industries. Sign up to enhance your market intelligence.

- Palladium bar prices dropped by 3.23% to $929 per troy ounce.

- Platinum bar prices moved sideways, dropping 1.1% to $989 per troy ounce.

- Silver ingot prices also moved sideways, dropping 2.72% to $33.23 per troy ounce.

- Lastly, gold bullion prices once again hit record highs, rising 6.22% to $3,313.30 per troy ounce.