Raw Steels MMI: Steel Prices Soften, More Tariffs on Deck

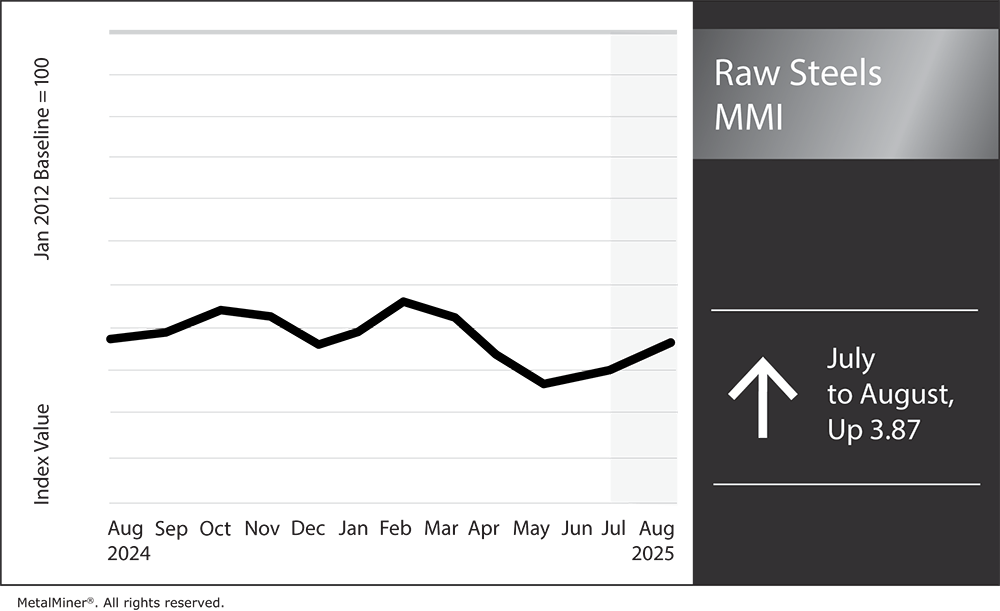

The Raw Steels Monthly Metals Index (MMI) accelerated during the month, moving up 3.87% from July to August as steel prices continued to slide.

U.S. Steel Prices Continue Slow Downtrend

U.S. steel prices have remained within a slow but steady downtrend since their late-March peak. As of mid-August, prices were down 9.49%, falling to their lowest level since late February. MetalMiner’s weekly newsletter reported recently that steel prices remain considerably higher than where they started the year, mills have struggled to maintain pricing levels. This has forced suppliers to continually lower consumer spot prices and offer discounts to buyers to move material.

Meanwhile, mill lead times remain short, albeit steady. One service center described Q3 as a decisive quarter amid soft conditions. As Q4 historically witnesses a demand slowdown, suppliers hoped buying conditions would prove strong enough to prevent further price erosion. However, July proved to be a slow month. Steel supply not only remains high, but manufacturing conditions have yet to rebound. While data center construction and U.S. rate cuts appear to be optimistic signals, there seems to be little expectation that these will translate to an immediate market shift.

HRC Futures Point to Further Declines for Steel Prices

As spot prices slip, the futures market suggests further declines to come. As of mid-August, futures stood at an $839/st discount to spot, pointing in a decisively downward direction. While the futures market is not necessarily a reliable way of determining where prices will land, its overall trend remains a leading indicator for the spot market.

Market Weighs Steel Quotas and More Steel Tariffs

Though current demand conditions account for a significant portion of the drag on steel prices, markets remain cautious amid ongoing trade uncertainty. So far, trade deals with the UK and the EU have left an open door for subsequent quota arrangements. Although those have yet to be agreed upon, markets remain prepared for another disruption.

Meanwhile, leading suppliers like Canada and Mexico have yet to reach deals with the U.S. Though USMCA-compliant material remains free of duties, a quota system is still a possibility for both nations. Mexico recently received a 90-day extension from reciprocal duties, signalling to markets that negotiations remain positive.

Outside of the initial spike, tariffs do not determine market trends. Instead, they serve to raise the price floor for commodities like steel. However, any future quota agreements could significantly undermine the point at which prices are likely to find a bottom. But as demand remains soft, potential downward revisions to the current landscape will offer little incentive for buyers to return to the market.

While they have proven unable to stem steel price declines, mills are likely hoping to minimize them ahead of 2026 contract negotiations. Otherwise, they may use fall maintenance outages to regain their grip on the price trend.

Frustrated with one-size-fits-all steel/metal intelligence and pricing subscriptions? MetalMiner Select offers customizable access to individual steel prices or bundled packages, ensuring you pay solely for the forecasts that matter to your procurement strategy.

Trump Announces New Tariff Measures

Many analysts agree that another round of steel tariffs could prove enough to shift the current bear trend. On August 15, President Trump informed the press that he plans to impose more tariffs on steel and semiconductors, stating, “I’ll be setting tariffs next week and the week after on steel and on, I would say, chips. Chips and semiconductors…we’ll be setting sometime next week, week after.”

While offering no ballpark as to how high or broad the upcoming tariffs would be, the President suggested implementation may be gradual, adding, “I haven’t set some of the tariffs yet. The rate will be low in the beginning. That gives them a chance to come in and build a very high rate after a certain period of time.”

Trump’s comments largely surprised markets, which were awaiting potential quota arrangements rather than a new round of tariffs. Following his comments, the Commerce Department added 407 new product codes to goods subject to current duties on steel and aluminum, effective August 18. It remains unclear whether Trump’s earlier comments were referring exclusively to the broadening of tariffed derivative products or whether the current 50% duty rate will be increased as well.

Steel Suppliers Report Q2 Results, Note Weak Q3 Outlook

Suppliers saw significant benefits from the higher steel prices witnessed throughout H1. However, while mills attracted new business due to tariffs making domestically-sourced steel more attractive, results from service centers did not show the same boost.

Both Reliance and Ryerson witnessed increases in the overall value of sales, as steel prices averaged higher in Q2 from where they stood in Q1. This comes despite the modest depreciation from their late March peak. However, Reliance witnessed a 1.3% quarterly decline in steel tons sold, while Ryerson saw shipments rise by a modest 0.5% during the same period.

Ryerson noted that “tariff-supported higher average selling prices for our carbon and aluminum products [was] partially offset by slowed customer activity following first quarter pre-buying.” However, Ryerson appeared less optimistic about subsequent results, stating that the service center “expects customer shipments to decrease by 2% to 4% quarter over quarter, reflecting both normal seasonality patterns as well as overall recessed manufacturing and industrial metal demand conditions driving cautious customer behavior.” The outlook from Reliance proved similarly muted, noting “we anticipate some weakness in the third quarter.”

Don’t miss out on valuable steel market insights? Subscribe to MetalMiner’s Monthly Metals Index Report and gain a competitive edge with comprehensive analysis across ten different metal sectors, ensuring you’re always informed.

All Three U.S. Mills See Shipments Increase

Meanwhile, Nucor, Cliffs and SDI witnessed a marked improvement in shipments. Overall, the three leading U.S. mills saw shipments improve by 10.34%, 7.55% and 4.58%, respectively. In its Q3 outlook, Nucor anticipated lower prices, stating, “We expect earnings in the third quarter of 2025 to be nominally lower than the second quarter of 2025 due to decreased earnings in the steel mills segment and similar earnings in the steel products and raw materials segments. In the steel mills segment, despite resilient backlogs and a stable demand outlook, we expect margin compression.”

Biggest Moves for Raw Material and Steel Prices

- Chinese coking coal prices surged during the month, rising 39.24% to $164 per metric ton as of August 1.

- Chinese HRC steel prices increased 6.01% to 429 per short ton.

- Chinese slab prices rose 3.54% to $519 per metric ton.

- U.S. HRC three-month futures moved sideways, with a modest 2.75% increase to $855 per short ton.

- Korean steel scrap prices witnessed the only decline of the overall index, falling 2.5% to $188 per metric ton.

MetalMiner should-cost models: Give your organization levers to pull for more price transparency, from service centers, producers and part suppliers. Explore the models now.