Raw Steels MMI: Steel Prices Search for New Low

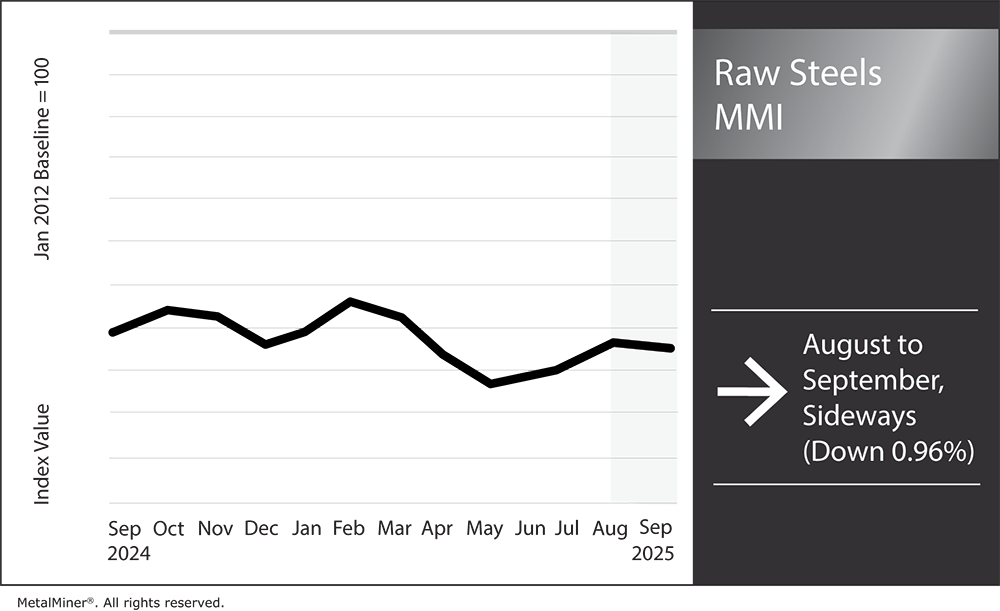

The Raw Steels Monthly Metals Index (MMI) moved sideways with a downside bias, falling 0.96% from August to September.

U.S. Steel Prices Continue to Unravel

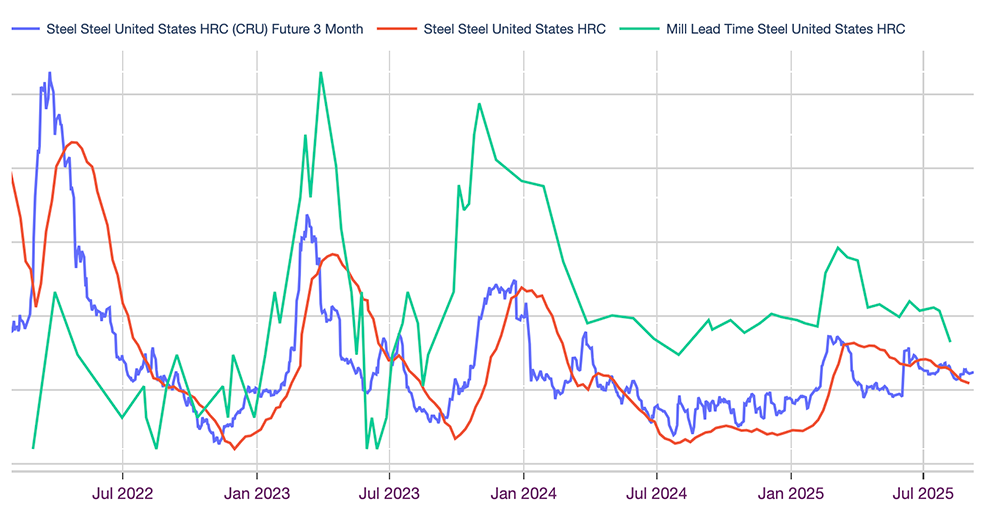

U.S. steel prices remain in search of a new bottom. As of early September, hot rolled coil prices sit at their lowest level since February 21, having unraveled much of the duty-related spike witnessed during the first quarter. Q1 saw prices jump $241 per short ton following successive tariff announcements. However, since reaching their March 27 peak, prices have fallen $109 to stand at $818 per short ton.

Like hot rolled coil, both cold rolled coil prices and hot dipped galvanized steel prices remain within downtrends. While momentum across the steel category has proven somewhat slow, the bias ultimately remains to the downside.

Falling prices come as no surprise to mills, which were largely prepared for softer results. In its Q2 financial reports, Nucor’s Q3 stated, “In the steel mills segment, despite resilient backlogs and a stable demand outlook, we expect margin compression.” Nonetheless, Nucor continues to try to stabilize the steel price trend. For instance, its consumer spot price held steady for the third consecutive week on September 8. At $875/st, Nucor’s price remains at a premium to the rest of the market, but nonetheless suggests that the company aims to halt further price declines.

Outsmart your competition by utilizing vital steel market intel and sourcing strategies with MetalMiner’s weekly newsletter.

Weak Demand From the Construction Sector

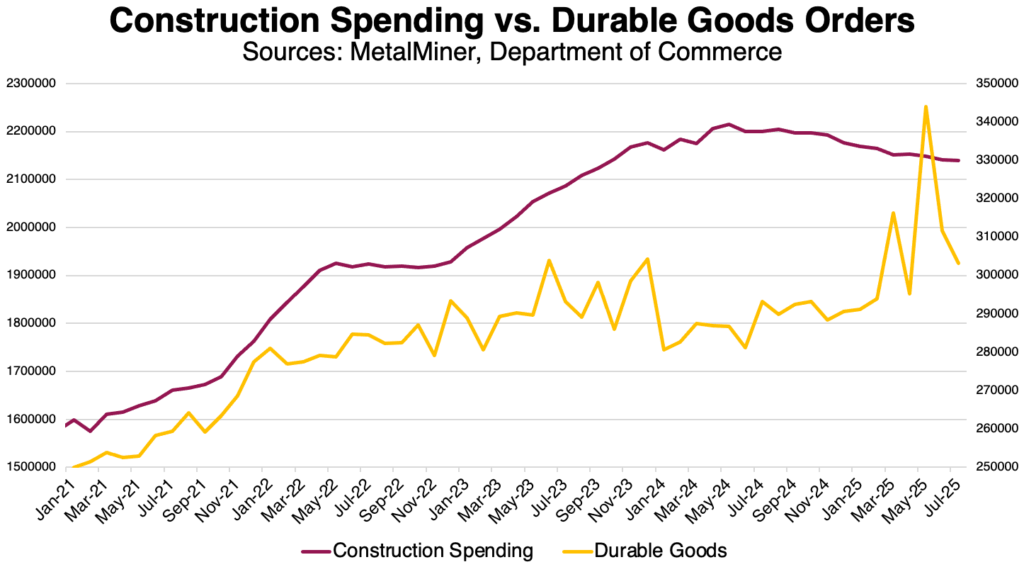

While tariffs have provided a tailwind for steel prices throughout 2025, demand conditions remain a headwind. Construction spending has been in decline for more than a year, although the pace has seemingly accelerated during 2025. Leading indicators for construction, like the Architecture Billings Index, suggest softness will persist.

While the Federal Reserve’s expected rate cut in September will offer support to market conditions, policy adjustments can take up to 12 months before they begin to make themselves apparent, especially in sectors like construction.

Meanwhile, durable goods orders continue to outperform, which is offering at least some counterweight. Still, outside of a short-lived spike in May, overall growth appears somewhat modest. It seems some of 2025’s performance may be the result of “front-load” orders as businesses accelerated purchases before duties took effect.

This temporarily boosts durable goods orders, but is commonly followed by a slump once the tariffs are in place. These swings make monthly order data more volatile, and it remains to be seen whether durable goods orders will be able to maintain their year-over-year growth going forward.

Want more access to the trends related to changing steel prices? MetalMiner Select enables you to pick and pay for the price points that directly influence your business outcomes, avoiding unnecessary costs.

What’s Next for Steel Prices?

For now, the trend for steel prices remains down with no signs of bullish momentum. Mill lead times contracted over recent weeks and now sit within a historically short range. From a demand perspective, a meaningful improvement in conditions appears unlikely. This suggests that further price declines may occur unless something changes with supply.

Speaking of supply, maintenance outages are coming up. Historically, these fall outages often help mills regain control over the price curve. However, it remains unclear how much capacity will come offline this year.

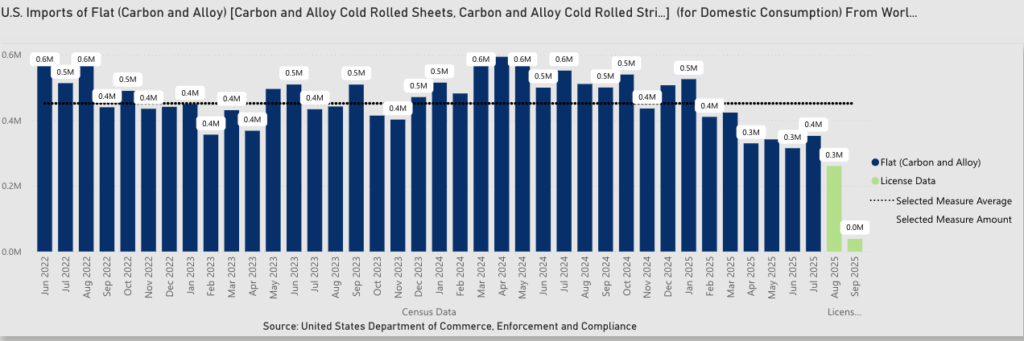

Import supply will also begin to impact domestic supply conditions. Data from the Department of Commerce shows a significant slump in the volume of HRC, CRC and HDG imported into the U.S. since the start of the year. While the slowdown is due in part to weak domestic demand conditions, many imports have been priced out of the market due to tariffs. Price saving strategies for tariff related costs can be found in the Steel & Aluminum Tariff Guide.

Between competing forces of slow demand and tightening domestic supply, HRC futures suggest prices will stabilize soon. Futures also remain at a modest premium to spot prices, which suggests that investors think a bottom is near. Still, a lot can change with the current landscape as quota arrangements remain possible for leading trade partners.

Biggest Moves for Raw Material and Steel Prices

- Chinese HRC prices moved sideways, rising by a modest 0.38% to $428 per short ton as of September 1.

- Chinese steel slab prices rose 0.36% to $521 per metric ton.

- Meanwhile, Chinese coking coal prices stabilized, falling 0.96% to 162 per metric ton.

- LME primary three month steel scrap prices fell 1.98% to $346 per metric ton.

- Standard Korean steel scrap prices fell 2.55% to $189 per metric ton.

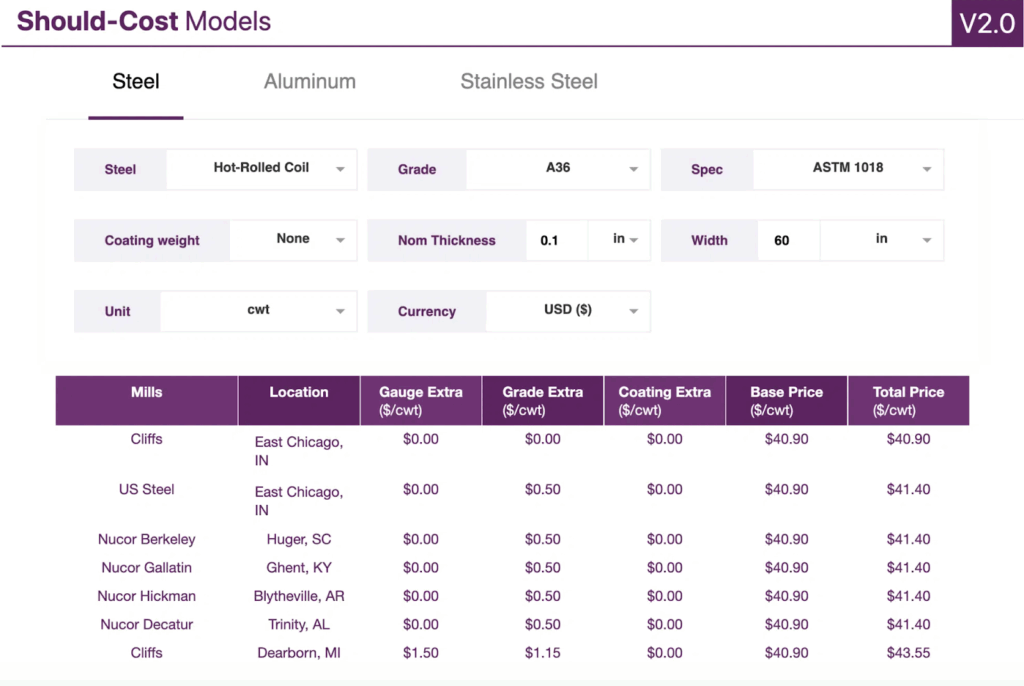

MetalMiner should-cost models: Give your organization levers to pull for more price transparency from service centers, producers and part suppliers. Explore the models now.