In recent days, copper prices managed to break prior highs after experiencing several weeks of pullback. Prices managed to hit short-term demand zones, which typically induce bullish strength. This confirmed the recently-formed uptrend in the copper market, ending the macro downtrend that started earlier in 2022. New data indicates the start of a bullish market, […]

Category: Commodities

India Passes $2.3 Billion Renewable Energy Bill

India has a new plan to reach its renewable energy goals, but it isn’t going to be cheap. However, if India wants to attain its net zero carbon emissions goal by 2070, the country needs to accelerate its efforts. For starters, it can’t just decarbonize the energy sector, but also other industries such as steel, […]

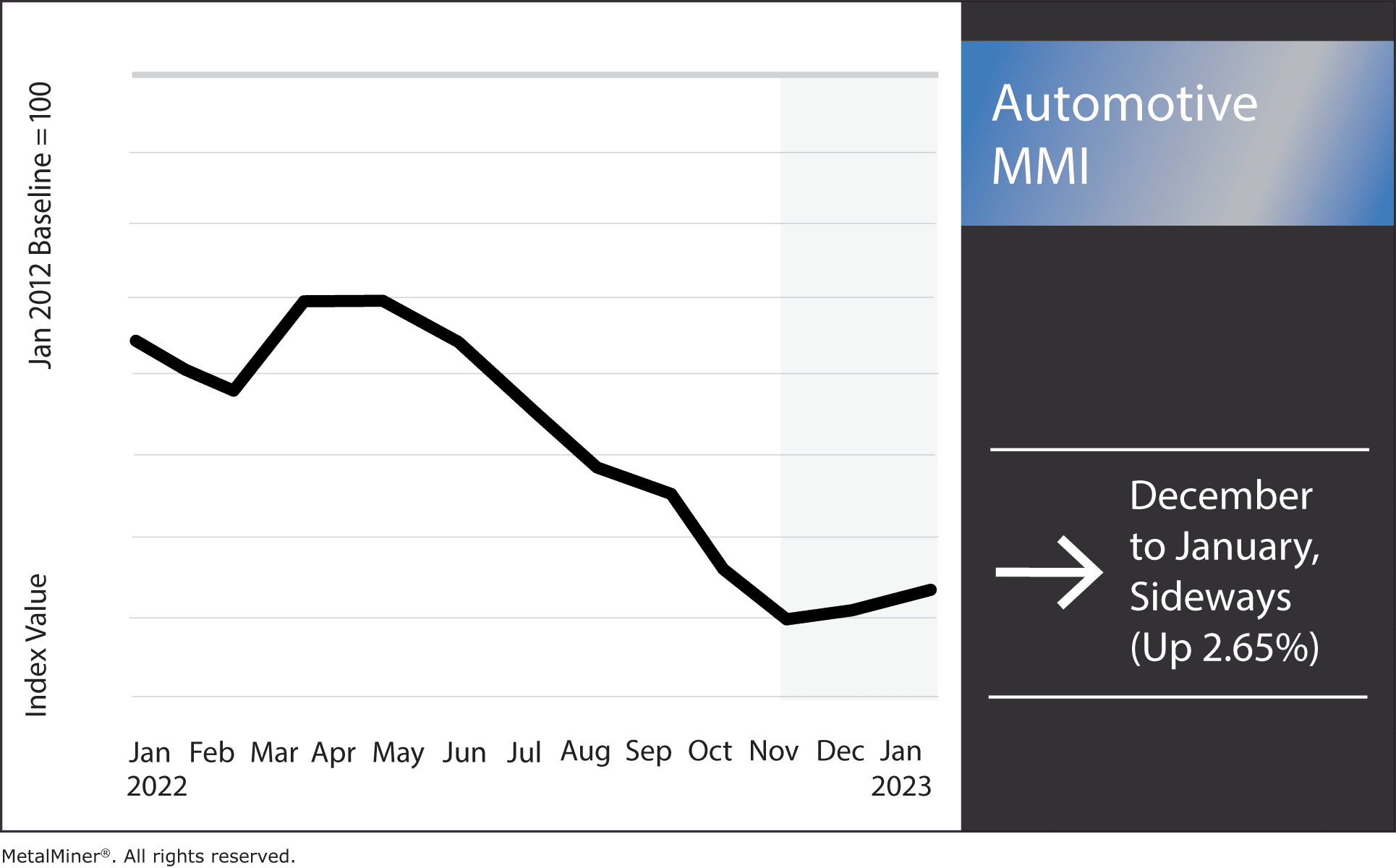

Automotive MMI: 2023 Could Bring More Car Parts Shortages

The Automotive MMI (Monthly MetalMiner Index) traded sideways for the second month in a row, rising by just 2.65%. The automotive index was impacted heavily by China rescinding zero-COVID restrictions, which caused a spike in cases. However, Chinese-sourced lead and HDG steel prices rose significantly, pulling the index upward. The overall volatility in metals used […]

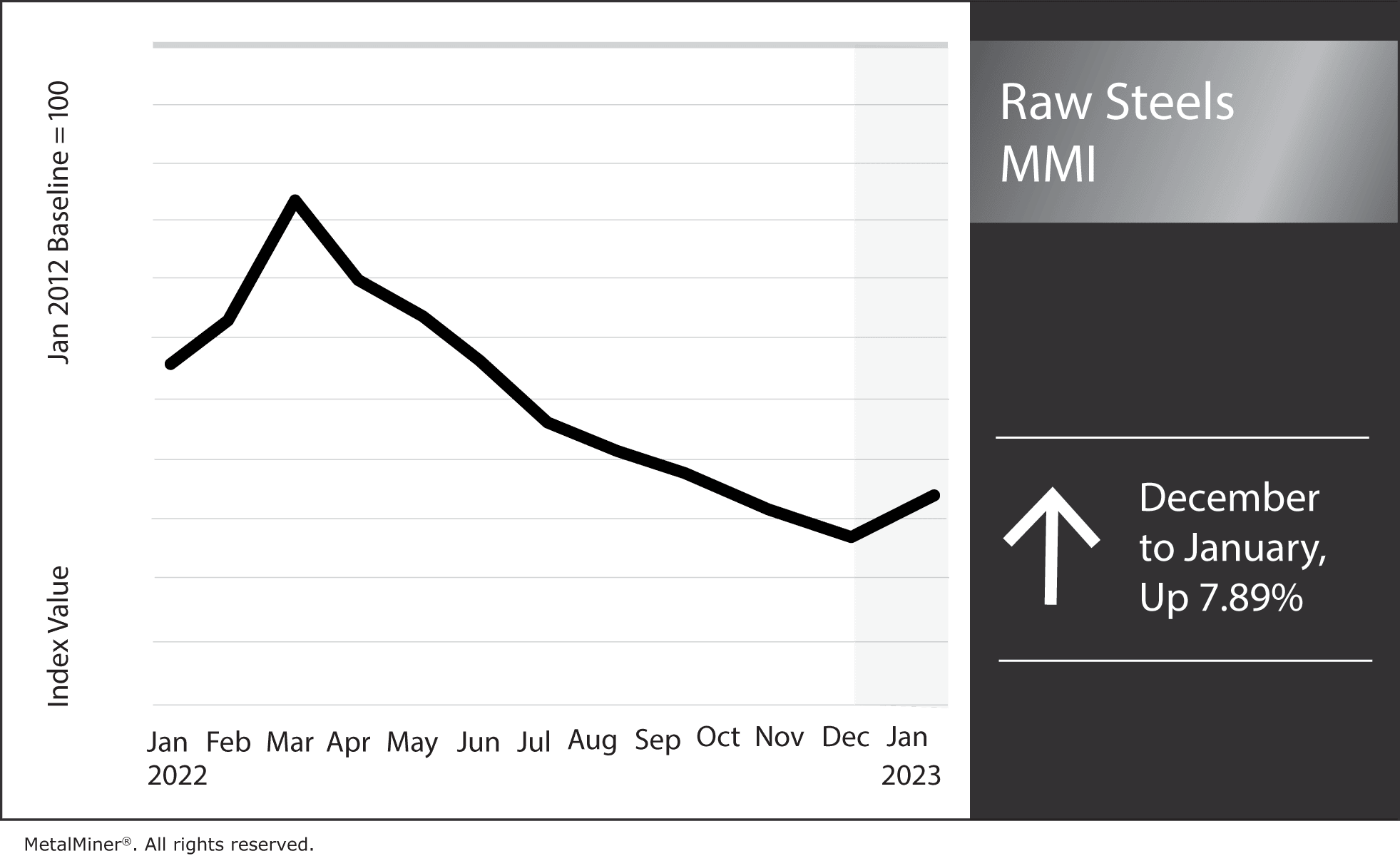

Raw Steels MMI: U.S. Steel Prices Find Bottom, Begin Rising

U.S. steel prices hit a bottom at the beginning of December, then began to climb. Hot rolled coil prices rose over 8% from their December low. Meanwhile, plate prices traded down for the first time since September. Overall, the Raw Steels Monthly Metals Index (MMI) rose by 7.98% from December to January. MetalMiner’s free weekly […]

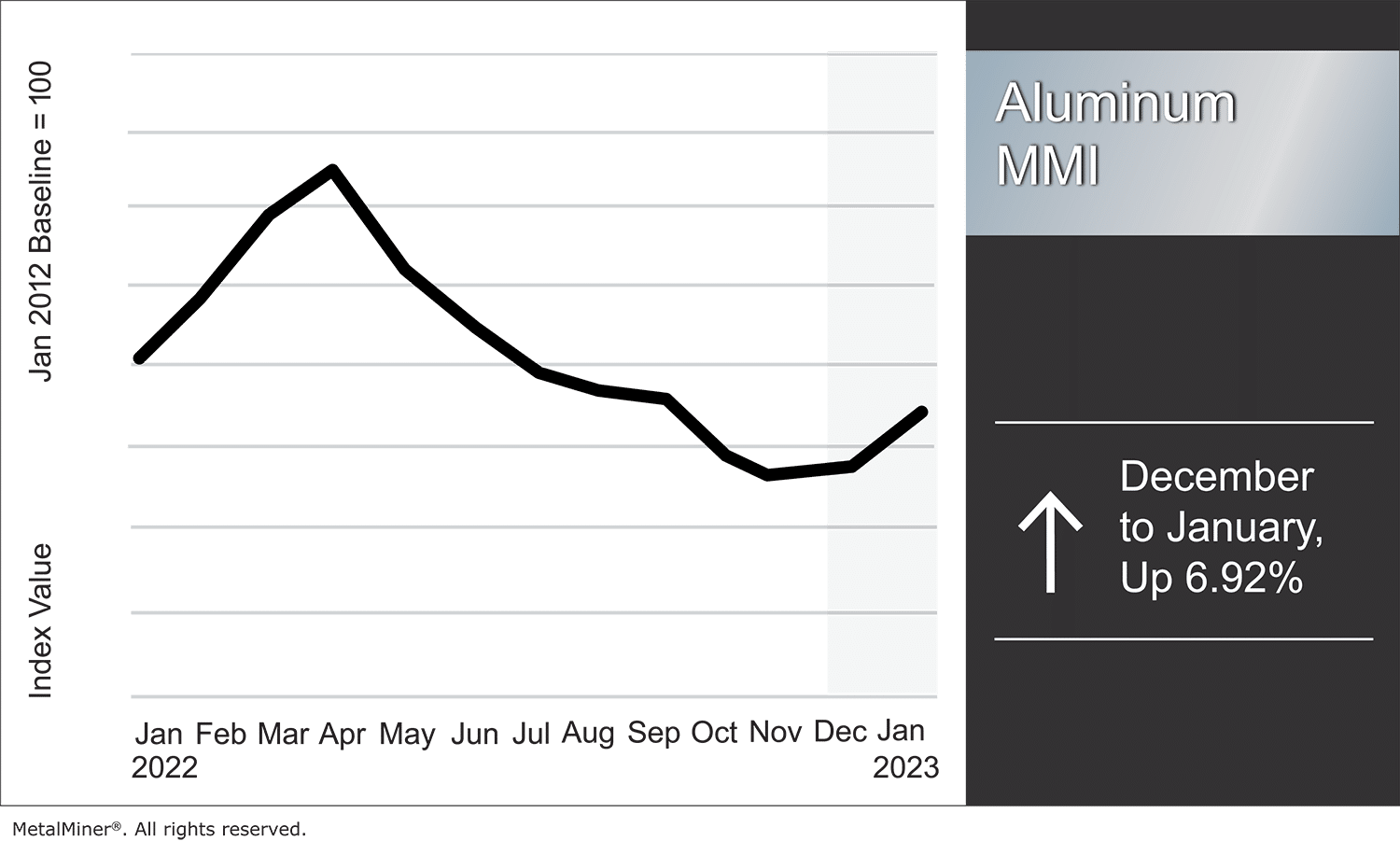

Aluminum MMI: Aluminum Prices Slide From Early-December Peak

Despite the recent short-term bounce, aluminum prices have not quite reversed to the upside following their long decline from March 2022. Ultimately, the rally between November and December was not strong enough to indicate a reversal. Moreover, bearish pressure continues to dominate the market environment at this time. Instead, prices remain largely indecisive. However, the […]

NLMK La Louvière, a Belgian producer of hot-rolled coils (HRC), to recommence production

In steel news, Russian-Belgian strip producer NLMK La Louvière aims to restart rolling operations. A source close to the plant told MetalMiner that the current goal for the restart is the end of January. The announcement comes just weeks after a fire knocked the facility off stream. The December 23 fire was located in the […]

Construction MMI: Chinese Sourced Steel Prices Spike, Supply Pinches Possible

The Construction MMI (Monthly MetalMiner Index) rose considerably by 7.68%, with Chinese steel prices getting a significant boost. In fact, all facets of the index related to China (except for iron ore) increased. The movement came in the wake of zero-COVID restrictions lifting, which resulted in a sharp rise in coronavirus cases. While this was […]

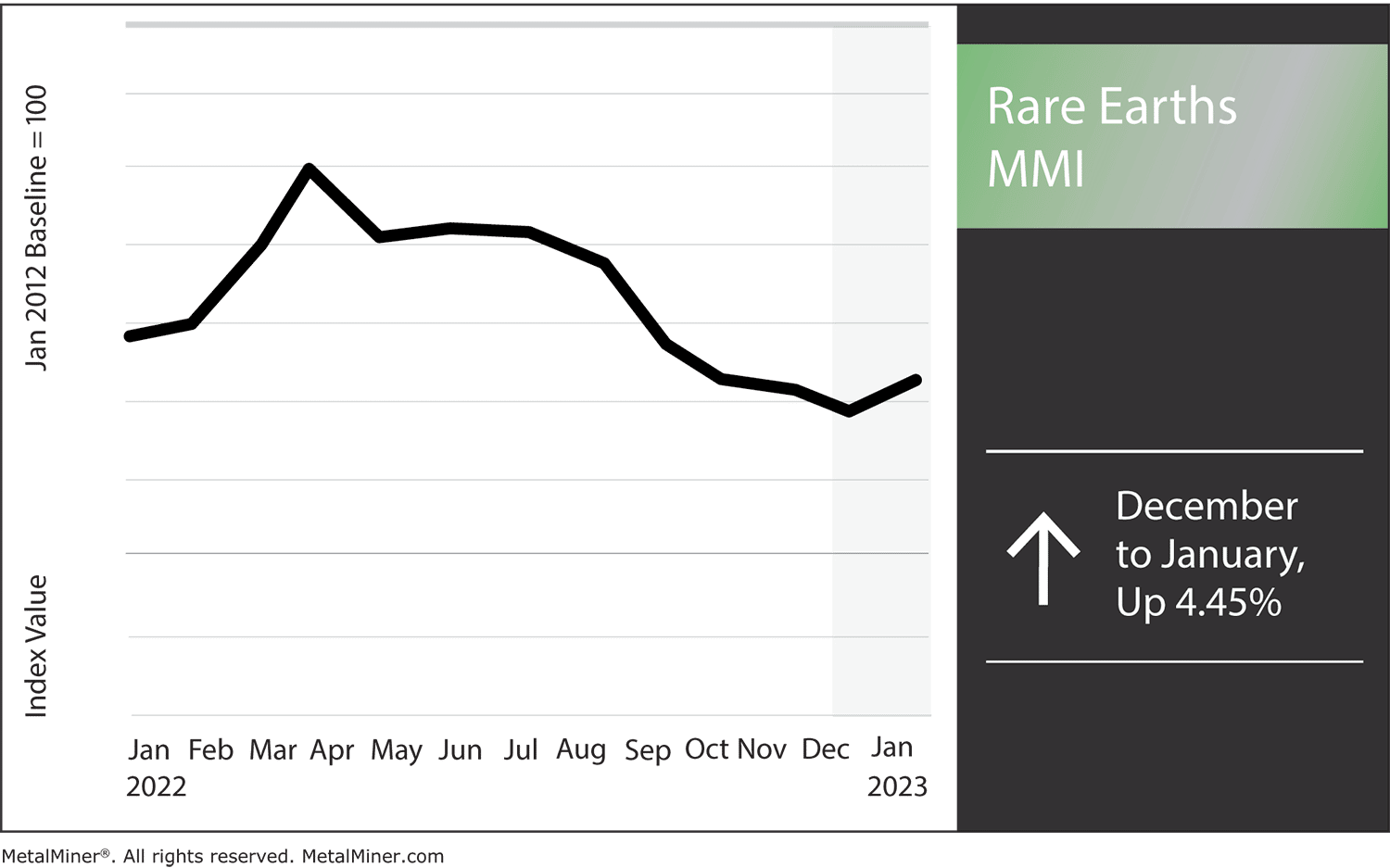

Rare Earths MMI: Surge in China’s COVID Cases Impact Prices

The Rare Earths MMI (Monthly MetalMiner Index) jumped slightly more than in the past six months, rising 4.45%. All month, geopolitical factors, mostly involving China, significantly impacted the index. For instance, production still proved low in the wake of zero-COVID. Then, once zero-COVID restrictions were lifted, the spike in cases across China kept the drag […]

China’s Economy: Don’t Get Your Hopes Up Just Yet

Could China’s economy resume its normal growth trajectory in 2023 after recording one of its lowest growth rates ever in 2022? Recently, the country introduced some more financial stimuli and eased its rather draconian COVID-19 countermeasures. This has left the world waiting for the resurgence of Chinese manufacturing and the economy at large. But will […]

2022 Stainless Steel and Nickel Price Trends

Stainless and nickel price trends fluctuated much more than carbon steel throughout 2022. The LME nickel squeeze greatly strained both the nickel and stainless steel markets. Indeed, LME nickel prices skyrocketed by almost $25,000 per metric ton back in March. Soon after, the rally cooled down again, eventually bottoming out in July. Come November, prices […]