Over three years into its invasion of Ukraine, and despite the subsequent sanctions, Russian producers continue to generate significant revenues from exports. This is especially true of metals and minerals, including pig iron and semi-finished steel products, which Russia continues to supply to the European Union. Russian Pig Iron Imports Surged in January In 2024, […]

Category: Manufacturing

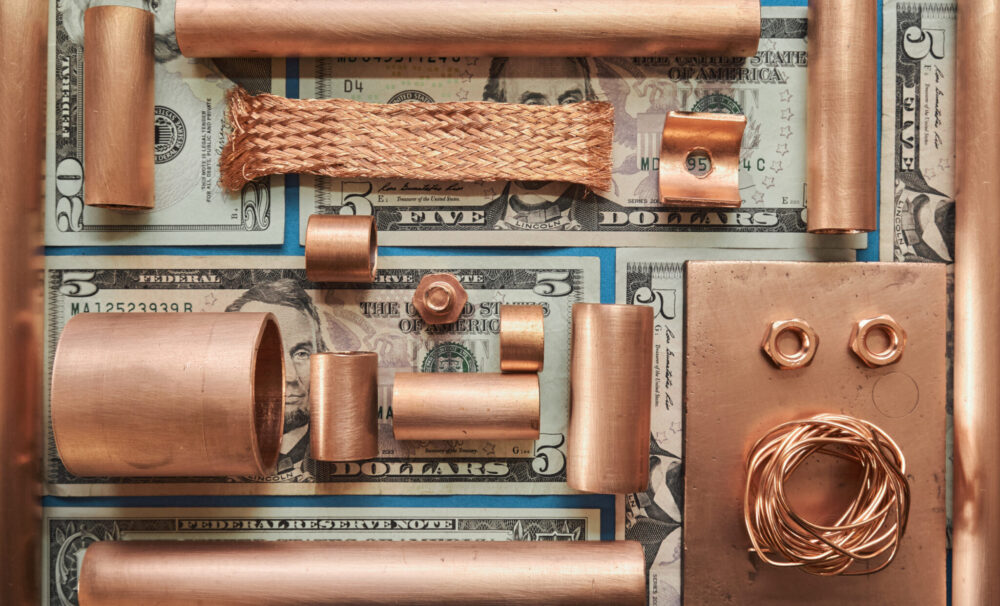

Is Copper About to Spark a Global Commodities Rally?

Copper was touted as the hottest commodity of 2025, as covered in MetalMiner’s weekly newsletter. Capped by April’s tariff-driven turbulence, the last quarter only reinforced that view. Now it seems copper prices are poised to lead other metals in the short term. Many experts believe copper has reached an inflection point. As such, they expect […]

Did the UK Take a Steel Giant Hostage to Save Its Industry?

The UK Parliament recently passed a law allowing the government to take control of British Steel, a major player in the local steel industry. The move follows Chinese owner Jingye’s plans to shut down two operating blast furnaces at its Scunthorpe site. A Bold Move Towards UK Steel Industry Preservation The House of Commons, Parliament’s […]

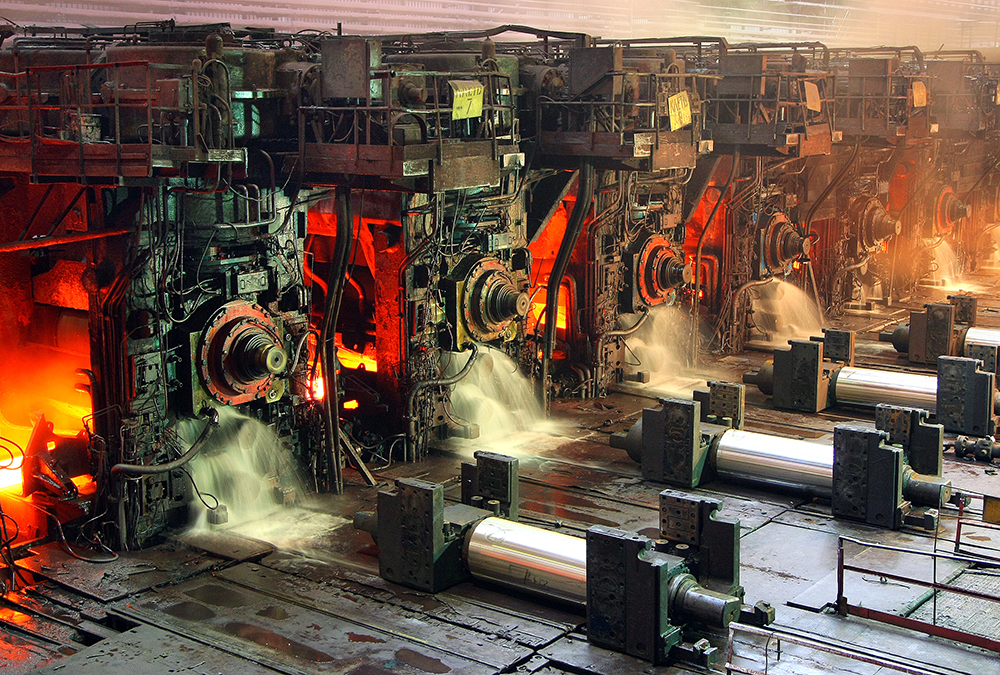

Tata Steel Ups its Game at Port Talbot With $1.56B Overhaul

Tata Steel recently signed an agreement to install a new pickling line at its Port Talbot site in Wales. The steel industry leader’s latest move will offer 50% more capacity than the existing line. According to the company’s April 9 announcement, the new equipment will have an annual capacity of 1.8 million metric tons and […]

Stainless MMI: Stainless Market Extends Slump as Reciprocal Tariffs Spare Steel

The Stainless Monthly Metals Index (MMI) remained sideways, with an upside bias. Meanwhile, nickel prices dropped to lows last seen in 2020. Overall, the index rose by 2.16% from March to April. Buyers Hold Back from Stainless Market The U.S. stainless steel market remains lackluster. While March witnessed a modest increase in shipments, some suppliers […]

Raw Steels MMI: Steel Prices Level Off, Lead Times Shrink

The Raw Steels Monthly Metals Index (MMI) returned to the downside. Overall, the index witnessed a modest 0.75% decline from March to April. Steel Prices Find Peaks as Reciprocal Tariffs Spare Steel Steel prices either found a peak or began to stabilize by the start of April. As of April 4, hot rolled coil prices […]

British Steel to Start Consultations on Closing Blast Furnaces

Steel Industry leader British Steel is set to start consultations on permanently blowing down the operating blast furnaces at Scunthorpe. The move comes after the company failed to reach an agreement with the UK government on financial aid for conversion to green steelmaking. “Since 2020, the shareholder of British Steel, Jingye, has invested more than […]

China Just Redrew the Aluminum Map, and the World Is Watching

At a time when analysts expect the global demand for aluminum to rise, a new development in China may significantly impact both aluminum market demand and the country’s internal consumption. That said, market watchers know that any announcement around metals coming out of Beijing these days also has to be looked at through the lens […]

Fire Erupts at Salzgitter Plant: Hot Rolled Coil Production Grinds to a Halt

German flats producer Salzgitter recently announced a force majeure on hot rolled strip following a fire at its Lower Saxony site. A March 4 letter to steel industry customers indicated that a fire resulted in the suspension of production at the company’s hot strip mill. According to reports circulating in German media, a restart of […]

The Global Copper Race Heats Up: India Moves into Zambia’s Mining Sector

Much like neighboring China has been doing for decades, India is now making inroads into the African continent to mine copper reserves, among other mineral assets. It is a move that is sure to shake up the already-competitive international copper market, where multiple nations continue to show significantly increased interest in Africa. Staring in the face […]