Tin plays to a different tune from most LME metals. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook It generally doesn’t attract the same speculative crowd from which copper, aluminum and zinc suffer. Its lack of any applications in jewelry keeps it firmly away from the precious metals camp. It’s termed […]

Tag: L9

USITC Makes Final Affirmative Determination in Chinese Aluminum Foil Case

The U.S. International Trade Commission (USITC) issued a final affirmative determination in the ongoing anti-dumping and countervailing duty investigation of Chinese aluminum foil. Buying Aluminum in 2018? Download MetalMiner’s free annual price outlook The Department of Commerce made its own final affirmative determination Feb. 27. “The United States International Trade Commission (USITC) today determined that a […]

The March MMI Report: Subindexes Lag as U.S. Tariffs Reactions Roll In

It’s that time — our latest Monthly Metals Index (MMI) report is in, covering the second month of 2018. Momentum from the start of the year slowed considerably in this round of readings.Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Four MMIs held at the same reading as the previous month (Automotive, […]

India Contributes $27M for International Solar Alliance Campus

India’s trying to do an OPEC in solar energy, screamed some headlines in Indian newspapers after the founding ceremony of the International Solar Alliance (ISA) was held here recently, witnessed by Indian Prime Minister Narendra Modi and French President Emmanuel Macron. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook It was […]

China’s Drop in Steel Exports Could be Temporary

Li Lizhang, the chairman of state-owned mill Fujian Sangang Group Co Ltd, is quoted in Reuters as saying exports of steel products may continue to fall this year, having plunged by over 30% last year to 75.43 million tons. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook China produced 831.73 million […]

DOC Issues Preliminary Affirmative Determination in Forged Steel Fittings Case

Amid the hubbub caused by President Trump’s recent Section 232 proclamation on steel and aluminum tariffs, the Department of Commerce issued an affirmative preliminary determination on Thursday in the countervailing subsidy case of forged steel fittings from China. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook The Department of Commerce ruled […]

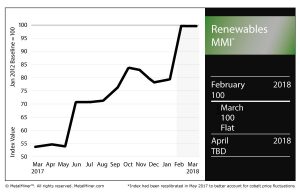

Renewables MMI: U.S. Steel Plate Surges, Cobalt Could be Getting Costlier

[caption id="attachment_88708" align="alignleft" width="300"]

The Renewables MMI (Monthly Metals Index), after a significant surge last month, sat at 100 for the second consecutive month.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

Within this basket of metals, the Japanese steel plate price rose, as did the price of Chinese and American steel plate. U.S. steel plate, in fact, rose 5.5% month over month.

U.S. grain-oriented electrical steel (GOES) coil also jumped in price.

As for the trio of rare and minor metals in this MMI, cobalt cathodes fell 1.1%, while silicon dropped slightly and neodymium made a small gain.

Cobalt Costs

According to a report by the Financial Times, changes to the mining code in the Democratic Republic of Congo will lead to higher costs for consumers of the metal.

According to the report, President Joseph Kabila on Wednesday said he would sign a new order after meeting with representatives from some of the big miners with business in the country, including Glencore, Molybdenum and Ivanhoe Mines.

Cobalt is used in batteries for electric vehicles (EVs), among other things, making it an especially prized material as EVs gain popularity. As such, with a majority of the world’s cobalt being mined in the DRC, political machinations in the country have a significant impact on the metal’s price.

According to the Financial Times, the code could see royalties on cobalt — plus other metals, like copper and gold — rise from 2% to 10%.

Senators Lobby for Electrical Steel Protection in 232

The Journal-News reported on a trio of U.S. senators who lobbied Trump to prioritize electrical steel in the Section 232 trade remedy process.

The only remaining maker of electrical steel in the country, AK Steel, was unlikely to benefit from the Section 232 trade remedy proposal, according to Sen. Rob Portman (R-OH).

In the senators’ letter, they requested the president add a trio of HTS codes to the duty order.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Actual Metal Prices and Trends

How Will Trump’s Proposed Tariffs Impact India?

The Indian metal industry seems divided for now over the implications of U.S. President Donald Trump’s announcement of the intention to impose tariffs on steel and aluminum imports. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook News reports and statements by industry leaders, along with reports by research agencies, show no […]

Gravity May be Reasserting Itself in China’s Aluminum Smelter Sector

In an effort to curb horrendous atmospheric pollution, particularly during the winter heating season, Beijing’s crackdown on energy-intensive and polluting industries resulted in widespread closures across the Chinese aluminum smelting industry. Buying Aluminum in 2018? Download MetalMiner’s free annual price outlook But even as expectations rise that those smelters from Shandong to Shanxi may soon […]

Aluminum MMI: Markets React to 10% Aluminum Tariff Proposal

After last month’s increase, the March Aluminum MMI (Monthly Metals Index) fell two points for this month’s reading. A weaker LME aluminum price led to the retracement. The current Aluminum MMI index stands at 97 points, 2% lower than in February.

LME aluminum price momentum slowed this month. Despite the price retracement, trading volumes still support the current uptrend. The long-term uptrend remains in place.

Buying Aluminum in 2018? Download MetalMiner’s free annual price outlook

[caption id="attachment_90675" align="aligncenter" width="580"]

Domestic Aluminum Market

February brought much uncertainty to the domestic aluminum market with the release of the Trump administration’s Section 232 reports and recommendations vis-a-vis aluminum and steel imports. That release, together with President Trump’s announcement last Thursday of a 10% aluminum tariff on all imports have activated price warning systems for all aluminum and aluminum products.

LME aluminum reacted to the news, increasing only slightly.

Additional information about Trump’s announcement, combined with specific buying strategies, can be found in the MetalMiner team’s Section 232 Investigation Impact Report.

On top of that, the U.S. Department of Commerce announced its final determination on the Chinese aluminum foil import case initiated in March 2017. The aluminum foil investigation includes all Chinese aluminum imports, and the anti-dumping margins vary from 48.64 to 106.09%, while the countervailing margins vary in the 17.14-80.97% range. This case may also add some support for LME aluminum prices in the short term.

MW Aluminum Premiums on the Rise

U.S. Midwest aluminum premiums moved again at the beginning of March and are currently trading at $0.16/pound. The U.S. Midwest Premium has now reached the same levels from March 2015; the pace of the increases appears to have accelerated since the Section 232 report release.

[caption id="attachment_90677" align="aligncenter" width="580"]

The Section 232 outcome and President Trump’s comments around possible import remediation measures have caused increased volatility in the U.S. Midwest premium.

What This Means for Industrial Buyers

LME aluminum price retracement may give buying organizations a good opportunity to buy, as prices may increase again.

In bullish markets, buying organizations still have many opportunities to forward buy. Therefore, adapting the right buying strategy becomes crucial to reducing risks.

Given the ongoing uncertainty around aluminum and aluminum products, buying organizations may want to read MetalMiner’s Section 232 special coverage.

Want to see an Aluminum Price forecast? Take a free trial!

Actual Aluminum Prices and Trends