Automotive MMI: HDG, Palladium and Shredded Scrap Steel Prices Jump

The Automotive MMI (Monthly Metals Index) rose significantly from March to April, jumping by 9.01%. This represents the highest rise the index has seen in over a year. Numerous drivers helped bring prices up, with every part of the index rising month-over-month, including:

- HDG

- Shredded scrap steel

- Korean aluminum 5052 coil premium over 1050

- Palladium bars

- Platinum bars

- LME copper primary 3-month

- Chinese lead

The steel parts of the index (in particular HDG) followed trend with other steel prices (except for plate), which also rose over the past couple of months. That said, experts believe steel prices could finally be reaching their peak. Platinum and palladium rose primarily due to investors turning to precious metal “safe havens” over recession fears. For copper, anticipated supply chain shortages and ongoing conflicts within Peru could be factors in the rising price. Meanwhile, the rise in lead prices could be indicative of LME inventories dropping.

Stay ahead of the ever-shifting market. MetalMiner Insights provides comprehensive metal price forecasting and AI feeds, giving buyers a significant edge over the competition. Schedule a consultation today.

Electric Vehicles: Hurting, Helping, or Both?

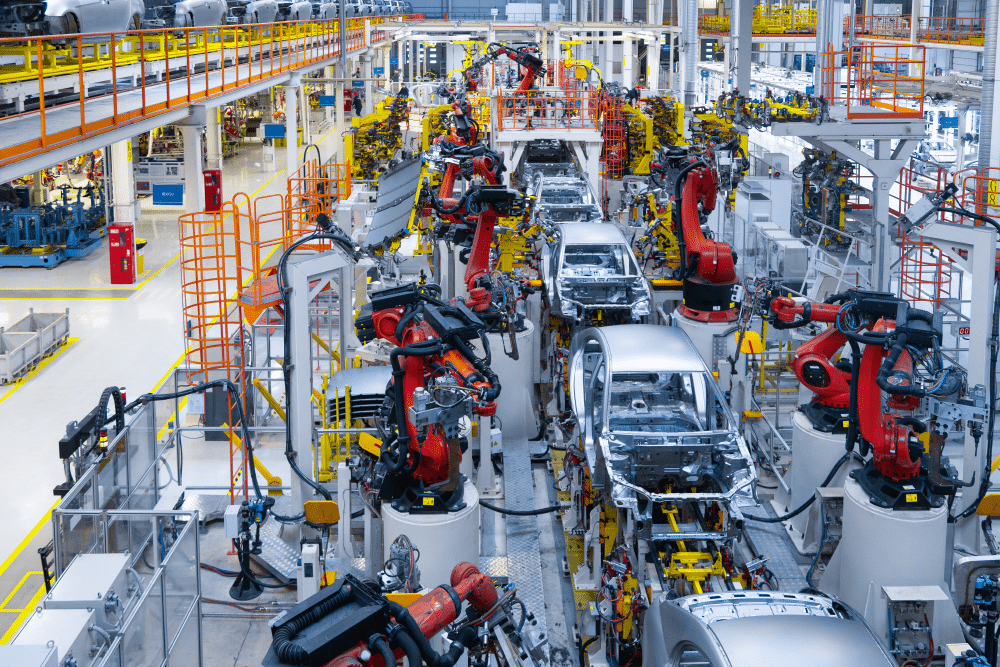

Some believe that the U.S. automotive industry is being negatively impacted by the large influx of electric vehicles. While electric cars are becoming more popular due to their environmental benefits, the industry continues to face supply chain challenges. Moreover, there is a need for significant infrastructure investments to support the transition.

Indeed, the automotive industry continues to struggle to keep up with the rapidly-changing marketplace. Furthermore, many companies could face difficulty adapting and keeping up. The shift towards EV’s requires different parts and raw materials. This has caused a stark drop in demand for many materials used in traditional automobiles. Not only could suppliers of these traditional components begin to feel strained, but the revenue of many such businesses is already declining.

The automotive industry continues to experience the “growing pains” of this shift, just as countless other industries have in the past. The traditional automotive industry must adapt, but the shift is occurring very rapidly. Therefore, those who can adjust fast enough are the ones who will remain competitive in the quickly shifting market.

View MetalMiner’s track record of forecasting where industrial metal prices are headed.

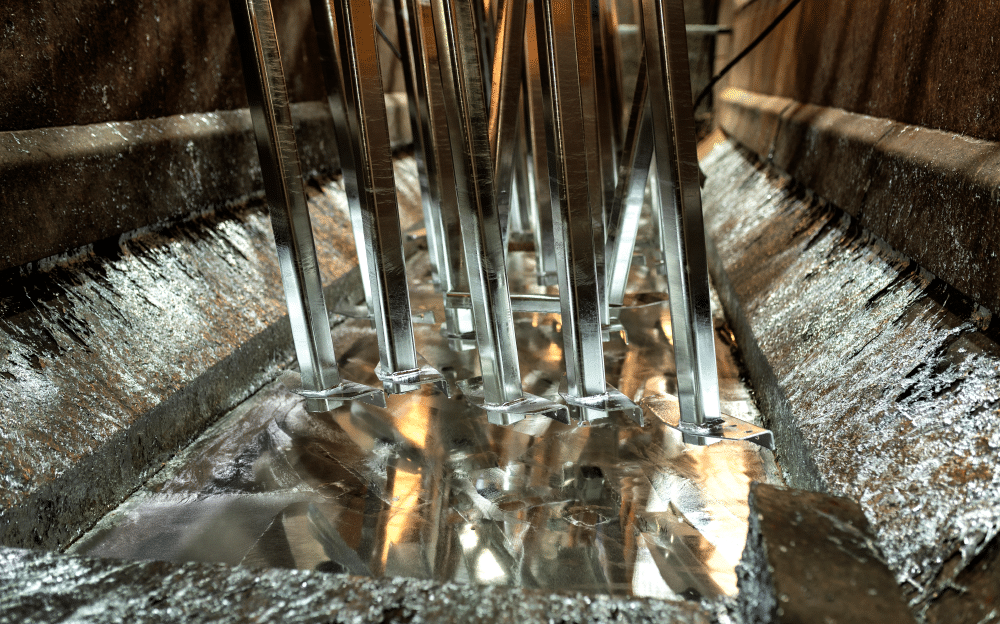

Steel/HDG Prices Peaking: What it Means for Automotive Manufacturers

The U.S. car industry heavily relies on steel, particularly shredded scrap steel and HDG. If steel prices finally do hit their peak and take a turn downward, the U.S. automotive industry could see a negative impact. On the other hand, a drop in steel prices could trigger a drop in production costs, which would aid the industry. Reduced costs could also result in lower prices for consumers, leading to an increase in demand for cars and trucks. If this were to occur, it would be a relief for new vehicle purchases, especially considering the current high interest rates.

High steel prices lead to increased production costs, which could result in decreased profits for automotive companies. While a drop in steel prices could be a welcome friend to automotive producers, it could also be bad news for steel suppliers, particularly HDG steel suppliers. While the automotive industry is far from HDG’s only use, it does provide HDG suppliers with steady business. As a result, a price drop could mean pain on the supplier’s end.

Enjoying this article? Stay on top of all the latest trends with MetalMiner’s monthly MMI Report. Sign up here to receive it free of charge.

Automotive MMI: HDG and Other Notable Price Shifts

- Hot-dipped galvanized steel shot up by 25.26%, leaving prices at $1428 per short ton.

- Korean aluminum 5052 coil premium over 1050 rose in price by 9.24%. Prices currently sit at $4.02 per kilogram

- Chinese lead traded sideways with a slight gain of 0.66%. This brought prices to $2196.04 per metric ton.

Leave a Reply