In an April 2 announcement, steel industry leader British Steel stated that the Redcar and Cleveland Borough Council recently approved new equipment following a detailed consultation on its decarbonization project. British Steel originally announced its plans to replace the furnaces at Scunthorpe and Teesside in September under plans that would see the steelmaker cut its […]

Category: Ferrous Metals

A Blow to China’s Steel Dumping Tactics: Triple Tariffs

New China tariffs may soon change the country’s steel market tactics. China continues to sit on a stockpile of steel, and it has no idea what to do with most of it. The exception, however, seems to be dumping it into foreign markets for cheap under the guise of “exportation.” China remains unable to use […]

ThyssenKrupp Responds to Market Turbulence with Bold Production Cuts

Germany flats producer ThyssenKrupp Steel (TKS) recently announced plans to cut its production capacity by an average of 19.5%, citing current market conditions as the main reason. Indeed, the European steel industry continues to face a wide range of challenges, including economic challenges and surging energy costs. “The aim is to make ThyssenKrupp Steel fit […]

Tata Steel Workers to Strike Against Port Talbot Blast Furnace Closures

Tata Steel workers associated with the Unite Trade Union at Port Talbot recently voted to strike over plans to replace the site’s two blast furnaces with electric arc furnaces. The decision immediately led to discussions about the near and long-term future of the UK steel industry as well as Tata’s production capabilities. “Around 1,500 Tata […]

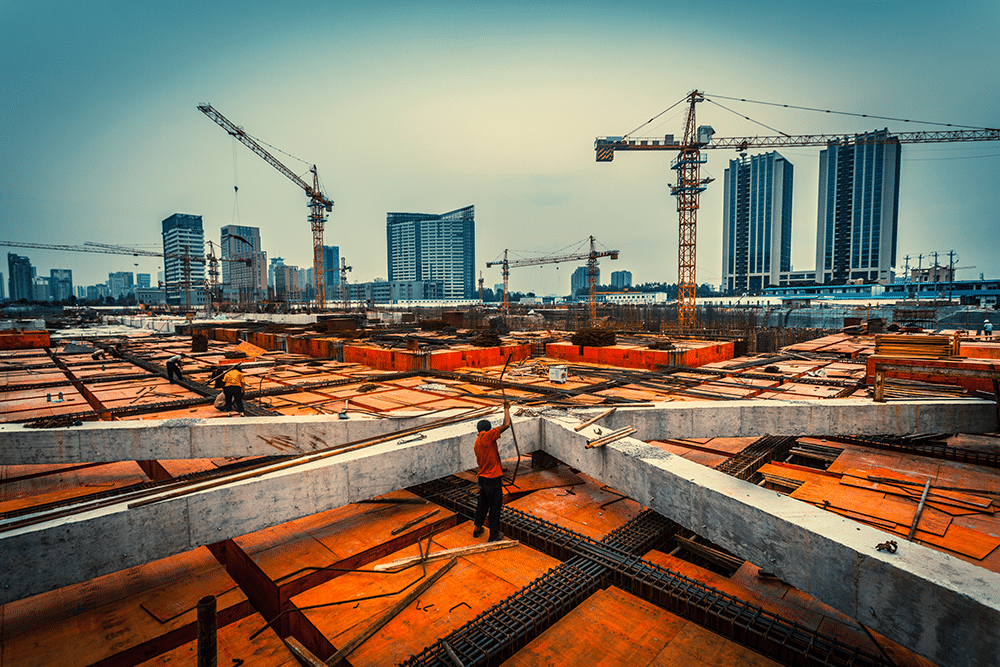

Construction MMI: Manufacturing Boom Helping Industrial Metal Demand, Construction Delays Hurting It

Month-over-month, the Construction MMI (Monthly Metals Index) moved sideways for the fourth month in a row, only sliding down a slight 2.87%. Of all industrial metals, iron ore suffered the worst drop in price by far, hitting a 10-month low before a slight rebound. The main component holding the index up was aluminum 1050 sheet […]

Raw Steels MMI: Steel Prices Flatten, Is an Uptrend Next?

The Raw Steels Monthly Metals Index (MMI) moved sideways, with a modest 1.38% decline in steel prices from March to April. U.S. flat rolled steel prices continued to trade down throughout March. Meanwhile, HRC prices fell 8.35% to close the month at a new lower low. However, hot rolled coil prices traded up during the […]

Liberty Steel’s Ambitious Expansion Strategy Revealed: Hiking Capacity at Rotherham Plant

Liberty Steel recently announced a restructuring plan for its operations in the United Kingdom after signing a new framework agreement with creditors. Among other things, the ambitious plan includes hiking crude steel manufacturing capacity at its Rotherham plant. The London-based company noted that the plan would see Liberty consolidate all its operations in the UK […]

Liberty Pipes Hartlepool Chosen for £4 Billion Energy Infrastructure Deal

Liberty Steel recently won a contract to supply pipelines from its Hartlepool steel manufacturing site in the United Kingdom for energy infrastructure and carbon-capture projects. Liberty’s parent company, GFG Alliance, said in a March 15 statement that Liberty Pipes Hartlepool (LPH), located in northeast England, will supply onshore and offshore pipes to the Northern Endurance […]

Trade Union Eyes Strike Ballot at Port Talbot

The latest steel news and sources from the UK indicates that the Community trade union plans to ballot its members at Tata Steel for strike action. The move comes amid plans by the company to replace two blast furnaces at the Port Talbot site with electric arc furnaces. “Community representatives from all Tata Steel UK […]

Renewables MMI: Is U.S. Renewable Energy Facing Backlash?

After several months of slight upward momentum, the Renewables MMI (Monthly Metals Index) broke the sideways-to-upward trend, declining by 8.89%. Neodymium dropping in price proved to be the main culprit for the index dropping. Every other component of the index either moved sideways or slightly down. Meanwhile, renewable energy news sources continue to keep their […]