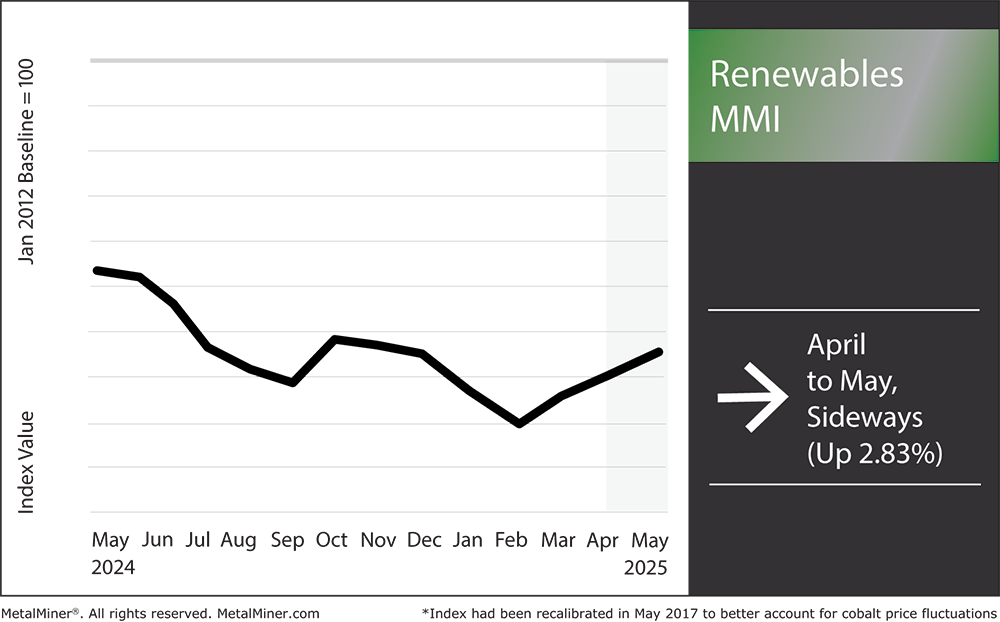

Renewables MMI: Buyers Stock Up Ahead of 10% Tariff Deadline

The Renewables MMI (Monthly Metals Index) moved sideways, rising a slight 2.83%. Metals prices, including those for copper, steel, lithium and cobalt, have seen significant swings in recent weeks as U.S. companies scramble to source material before tariffs are imposed. For instance, U.S. copper prices surged in Q1 as buyers raced ahead of potential import restrictions, only to tumble in early April when China retaliated with steep tariffs on U.S. goods.

Outsmart your competition by utilizing indispensable metal market intel and sourcing strategies with MetalMiner’s weekly newsletter.

Copper Prices Remain Volatile While Steel Plate Stabilizes

Trading data shows U.S. copper futures plunged 14% in a week, briefly dropping below $9,000/ton on the LME. The volatility reflects a classic import-arbitrage play. According to Reuters, with U.S. prices running about $756/ton above global benchmarks, U.S. inventories could jump once actual duties kick in. For now, copper’s short-term trajectory is down from its March peak as tariffs lifted pressure on buyers.

The steel sector shows a milder correction. Tariff anxiety earlier this year sent U.S. hot-rolled and plate prices to multi-year highs, but they had leveled off by early April. One market report noted that U.S. hot-rolled coil slid from its March peak (about $920/st) while steel-plate bids came off the boil. Meanwhile, domestic lead times for mills are already shrinking from the chaotic early-March rush, suggesting short-term demand has softened.

Still, American steelmakers remain in a tight spot as “reciprocal” tariffs announced for April 4 left already-protected items like steel and aluminum under the old 25% levies.

Enjoying this article? MetalMiner’s Monthly Metals Index Report offers metals prices for 10 total industries. Sign up to enhance your market intelligence.

Metals Prices: Battery Metals

Battery metals tell a mixed story. After surging last year, lithium prices remain under heavy pressure. S&P Global notes that a flood of new spodumene output and high inventory levels are driving an unprecedented oversupply. In fact, new mine projects and the restarting of operations in China sent lithium carbonate and hydroxide quotes lower throughout Q1.

S&P forecasts further downward pressure into Q2 2025. This glut has knocked lithium to nearly three-year lows on some Asian indexes, raising questions about whether this is a reset or a longer-term trend.

Cobalt prices have been equally volatile as a year of oversupply pushed prices to nine-year lows in January. In late February, the Democratic Republic of Congo imposed a surprise four-month export pause. Cobalt immediately spiked about 40% through March, closing Q1 around $34,000/ton, but the disruption has left the market on edge throughout May.

Reports indicate that few traders expect the rally to last once Congolese shipments resume. Still, Q1’s rush shows how sensitive cobalt is to geopolitical shifts even as longer-term demand for EV batteries and grid storage continues to grow.

10% Tariff That Could Reshape U.S. Renewables Industry

Overlaying all these trends are ongoing policy shifts, especially after the 2024 Trump campaign unveiled a plan for a broad tariff agenda that would reshape metal markets. A White House “fact sheet” dated April 2, 2025 outlined a new 10% levy on all imports that would go into effect on April 5.

It featured higher reciprocal rates for countries running big trade surpluses, which many argued could have significant impacts on metals prices. Those tariffs have since been placed on hold until July. But if these import restrictions do happen, markets will likely face short-term volatility.

While Trump’s plan sidelines copper from new tariffs, the broad trade war could still constrain supplies of battery metals used by the clean-energy sector, including lithium and cobalt. U.S. renewable projects and EV supply chains remain metal-intensive, and current market signals are mixed. For now, copper and steel prices have paused their tariff-fueled rallies, while lithium and cobalt are adjusting to big swings in supply.

MetalMiner Select enables you to pick and pay for the price points that directly influence your business outcomes, avoiding unnecessary costs.

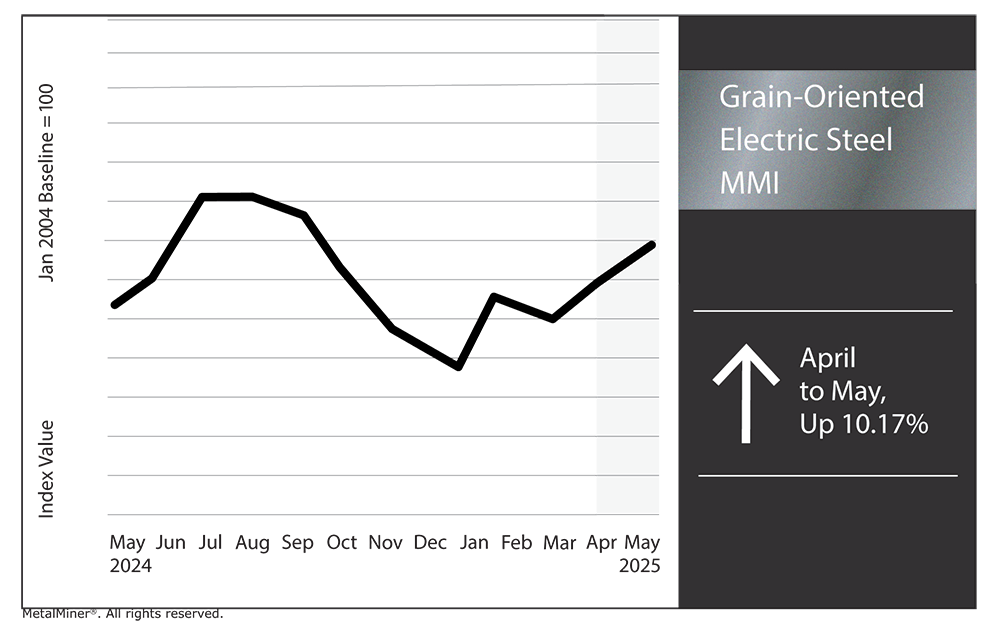

Grain-Oriented Electrical Steel MMI

The Grain-Oriented Electrical Steel MMI (Monthly Metals Index) moved up by 10.17% month-over-month.

In the world of current metals prices, electric-grade steel has its own tale to tell. Prices for GOES have been relatively flat to slightly up in recent weeks. One industry index puts North American GOES at about $3.87 per kilo in May (roughly a 0.5% uptick month-on-month). And with few new U.S. mills and inventories thin, any surge in electrical steel orders could keep contracts firm over the summer.

While grain-oriented steel demand is rising on efficiency mandates, the craft’s tight production base means any hiccup in imports could leave U.S. transformers waiting. All the while, proposed trade curbs have buyers and planners on watch.

Renewables MMI: Noteworthy Price Shifts

MetalMiner Insights is your key to risk-mitigating strategies, view our full catalog of covered metals.

- Chinese cobalt prices moved sideways, dropping 0.99% to $30.90 per kilogram.

- Chinese silicon prices also moved sideways, dropping by 2.87% to $1,375.90 per metric ton.

- Lastly, steel plate prices remained flat, dropping a slight 0.8% to $1,231 per metric ton.