Raw Steels MMI: Steel Prices Steady Ahead of Trade Deals

The Raw Steels Monthly Metals Index (MMI) trended sideways, with a 1.37% increase from June to July. With a few exceptions, steel prices remained largely steady as long-awaited trade deals with the U.S. began to materialize.

Nippon Officially Acquires U.S. Steel

After an arduous 18-month process, Nippon Steel officially acquired U.S. Steel. Initially blocked by former President Biden in January 2025, President Trump revived the deal, calling for a new review after months of lobbying efforts. As a result, the previous board stepped down, replaced by ones appointed by the Japanese steelmaker. Nippon Steel kept David B. Burritt, who will remain president and CEO, and named Takahiro Mori, Naoki Sato and Hiroshi Ono as the new board members to oversee the transition.

The terms come with several concessions. Among these include a “golden share,” which, according to a recent filing with the Securities and Exchange Commission, will give the U.S. government influence over things like pay, operations and production. It will also allow the federal government to appoint a board member.

Avoid being blindsided by sudden steel supply constrains or price shifts. Get the data and expert analysis you need to stay competitive with MetalMiner’s weekly newsletter.

Most See the Acquisition as a Boon

For steel buyers, the acquisition appears to be positive news. After the deal was blocked, U.S. Steel warned of impending layoffs and facility closures. Nippon’s acquisition not only reverses those negatives but also prevents further consolidation of the U.S. steel industry, which had given U.S. producers considerably more control over the U.S. steel market in recent years. Especially amid tariffs, which have crimped import supply, this could have spelled big problems for steel prices.

Meanwhile, Nippon plans substantial investments at Big River, Gary Works, Mon Valley, Keetac/Minntac and Fairfieleld Works, in addition to $1 billion towards the construction of a new mini mill.

Want to make every data dollar count? MetalMiner Select allows you to stop paying for unnecessary price points, focusing your investment on data that drives informed purchasing decisions.

Trade Agreements Slowly Start to Roll In

In other positive developments, progress has been made regarding ongoing trade agreements, with several more expected in the coming months. In addition to tentative frameworks with China and the UK, President Trump recently announced a deal with Vietnam. While the announcement has yet to be formally outlined, it will reportedly include a 20% tariff on Vietnamese imports and a 40% tariff on transhipped goods.

The latter would have the largest impact on the U.S. steel market, but many details remain unclear at the moment. Vietnamese CRC and HDG imports have historically offered a substantial drag on U.S. steel prices. High volumes, particularly throughout 2024, fed oversupply, making mill efforts to raise prices difficult. Meanwhile, tariff threats and countervailing duties largely stemmed flows from Vietnam.

Much of the supply from Vietnam appeared to be the result of transhipment efforts, where a country like China ships competitively priced volumes of HRC to Vietnam for Vietnam to process into other forms of steel, such as CRC or HDG.

However, it remains unclear under the terms of the deal whether those processing efforts will be considered sufficient to count as transhipping, where a 40% tariff would be applied, or simply as imports subject to the 20% duty. Regardless of this determination, countervailing duties, which were determined in 2025, will continue to place a cap on steel imports from Vietnam.

Other Deals Currently in the Works

Meanwhile, negotiations remain ongoing with Canada, the EU and Mexico. Depending on their results, these discussions could further ease tariff constraints. As oversupply from China remains the key issue, those deals could hinge on sufficient protections from those countries.

- Canada – Trade negotiations were recently resumed on Canada’s decision to drop a digital services tax. Canada is the largest steel supplier to the U.S., so a deal could put downward pressure on steel prices.

- EU – A deal with the EU appears less certain, particularly ahead of the July 9 deadline. Negotiations remain ongoing, and in the short term, could result in another deadline delay.

- Mexico – Reports suggest Mexico may receive a quota, which would allow a certain volume of steel imports into the U.S. free of duties.

Not sure if MetalMiner can help you with your specific metal purchases? See how MetalMiner helps companies like yours cut through the noise of market volatility and start making smarter, more profitable buying decisions. See our full metal catalog.

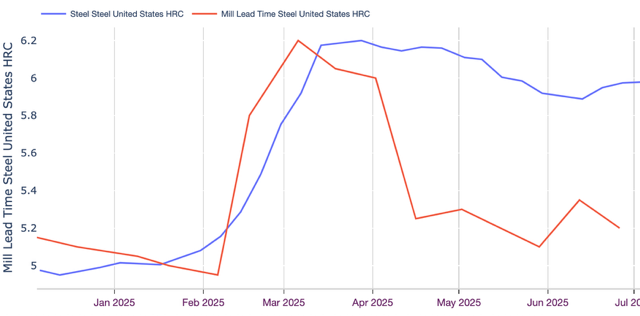

Steel Prices, Mill Lead Times Move Sideways

Amid the trade uncertainty, steel prices trended sideways throughout June. HRC prices experienced a slight increase during the month, while mill lead times fluctuated near the same levels seen at the end of June. Service centers noted that Q3 would likely prove a pivotal month. Any failure among mills to raise or stabilize steel prices could result in the resumption of the downtrend.

If that occurs, mills will likely use fall maintenance outages to regain control of the price trend, as occurred last year. Despite a largely soft market in the second half of 2024, outages reports saw steel prices find a bottom in late July 2024, followed by a modest increase throughout Q3.

Biggest Moves for Raw Material and Steel Prices

- Chinese coking coal prices experienced the largest increase of the overall index, with a 10.26% jump to $118 per metric ton as of July 1.

- U.S. HRC Midwest HRC futures rose 5.96% to $835 per short ton.

- Korean steel scrap prices rose 3.07% to $199 per metric ton.

- LME primary three month steel scrap prices trended higher, with a modest 2.36% increase to $347 per metric ton.

- Meanwhile, Chinese HRC prices slid 0.75% to $404 per short ton.

- Chinese steel slab prices fell 3.08% to $502 per metric ton.

MetalMiner should-cost models: Give your organization levers to pull for more price transparency, from service centers, producers and part suppliers. Explore the models now.