Construction MMI: Tariffs Set to Drive Up Metal Costs as U.S. Construction Still Grapples with High Interest Rates

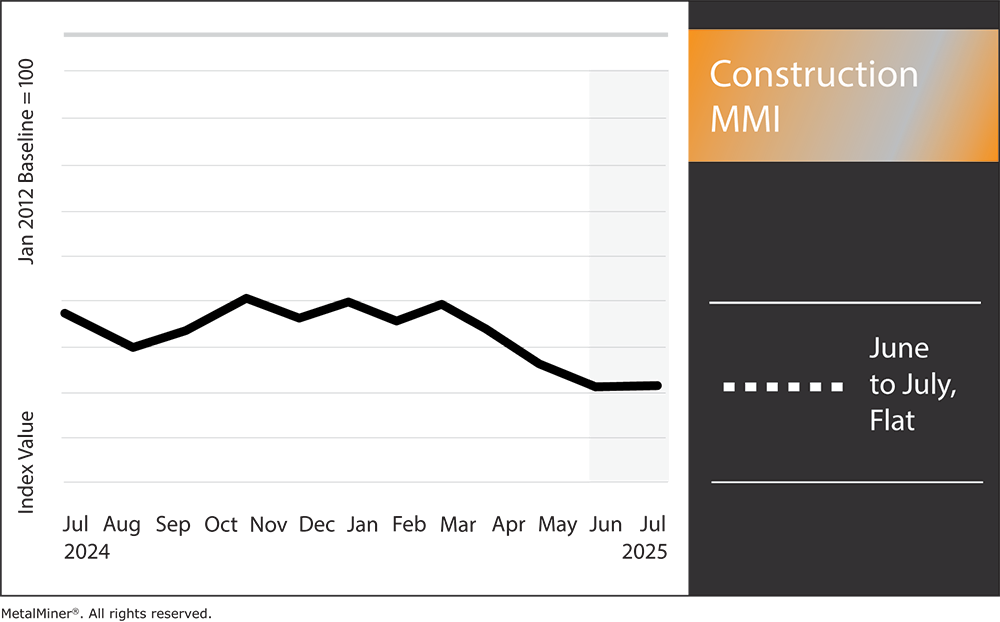

The Construction MMI (Monthly Metals Index) traded flat month-over-month, with no noteworthy price movement in either direction. Meanwhile, the U.S. construction industry is bracing for fallout from a new round of tariffs on key building materials. Industry groups warn that these tariffs, alongside persistently high interest rates, threaten to squeeze project budgets.

Missing out on valuable construction market insights? Subscribe to MetalMiner’s Monthly Metals Index Report and gain a competitive edge with comprehensive analysis across ten different metal sectors, ensuring you’re always informed.

Surging Costs for Steel, Aluminum and Other Metals

As metal prices remain somewhat volatile, contractors nationwide report mounting cost pressures. Now that President Trump has announced more duties, including a 50% tariff on all copper imports, further cost spikes appear imminent. Ken Simonson, chief economist of the Associated General Contractors of America (AGC), cautioned, “It is likely that contractors will be hit with substantial additional price increases shortly, unless the tariffs are postponed or rolled back.”

Such material inflation could strain profit margins across the construction industry. Many U.S. builders operate on thin margins (often <5%), so a jump of 5–7% in overall project costs can damage profitability. Industry estimates forecast that the 2025 tariffs could drive steel prices up by ~8.2% and aluminum by ~5.7%. As a result, total construction costs would rise 5–7%.

Recent Producer Price Index data confirmed that essential products like structural steel beams, rebar and aluminum components are all more expensive. In fact, prices for aluminum mill shapes were nearly 10% higher this January than a year prior, while copper/brass mill forms surged over 12% year-on-year.

Tariffs and Interest Rates

Not only are material costs facing potential price spikes, but builders are also contending with a challenging financing environment. The Federal Reserve’s 2022–2023 interest rate hikes took benchmark rates from near-zero to over 5%, the highest in decades. Although the Fed eased slightly with a few rate cuts in late 2024, bringing its key rate to about 4.25–4.50%, borrowing costs remain elevated.

This means that commercial construction loans and mortgages are carrying 6–7% interest rates, roughly double the lows seen a few years ago. These higher rates have made it pricier for developers to finance new projects, adding another layer of cost on top of expensive materials.

The Construction Industry Could See Good News Soon

Fortunately, there is hope on the horizon. Cooling inflation earlier this spring prompted optimism that the Fed might cut rates later in 2025, potentially spurring construction activity. “Due to a cooler-than-expected inflation reading in May, the chances of an interest rate cut by the Federal Reserve in 2025 have improved,” noted Anirban Basu, chief economist of Associated Builders and Contractors.

Lower interest rates would reduce financing costs and could help offset the impacts of tariffs by boosting construction industry project demand. However, the latest data complicates that outlook. Inflation ticked up to 2.7% in June (a four-month high) as consumer prices began to reflect the new tariffs. Analysts warn that full tariff pass-through hasn’t even hit yet, meaning inflation could rise further in the coming months. If tariffs keep price levels elevated, the Fed may delay rate cuts to avoid fueling more inflation, leaving builders stuck with high borrowing costs for longer.

For procurement executives navigating these cross-currents, knowledge is power. MetalMiner’s weekly newsletter provides timely market insights on metal price drivers and macroeconomic news, enabling teams to adjust their sourcing strategies in real-time. Sign up here.

Outlook: Navigating an Uncertain Road Ahead

In the coming months, construction industry executives will be keeping a close eye on Washington and the Federal Reserve. For now, tariff policies remain fluid. For instance, a proposed extra 25% tariff on copper and lumber has been floated, but not yet enacted. Any such move could further jolt material markets and hit home builders (many of whom rely on Canadian lumber and Mexican gypsum) especially hard.

On the monetary front, the consensus is that the Fed will hold rates steady for now. If inflation stabilizes later this year, a gentle rate cut or two is possible by late 2025. But until there’s clarity, caution will rule. “Our view is that continued investment into construction will remain cautious, for now,” said Michael O’Reilly of construction consultancy RLB. He went on to note that uncertainty around tariffs and policy changes is keeping developers in “wait-and-see mode.”

What Does Construction Industry Success Look Like in 2025?

Ultimately, the combination of tariff-driven cost inflation and high interest rates is creating a careful balancing act for U.S. construction firms. As a result, industry leaders are focusing on cost control, strategic sourcing and contractual protections to weather the storm.

Many are also leveraging data and forecasts to make smarter buying decisions. For example, some MetalMiner subscribers use customized price forecasting on MetalMiner Select to time their metal purchases and negotiate better with suppliers. By blending such tactics with prudent project planning, construction companies can strive to preserve their margins and keep projects on track.

Construction MMI: Noteworthy Price Shifts

- Chinese steel rebar prices moved sideways, dropping 0.69% to $475.86 per metric ton.

- Chinese H-beam steel prices also moved sideways, falling 2.35% to $383.88 per metric ton.

- Chinese aluminum bar prices traded flat, remaining at $2,962.63 per metric ton.

- Lastly, European commercial 1050 aluminum sheet prices rose 6.94% to $3,335.69 per metric ton.