Automotive MMI: Tariffs Fuel Turbulence in Auto Metals, U.S. Automakers Face Summer Price Spikes

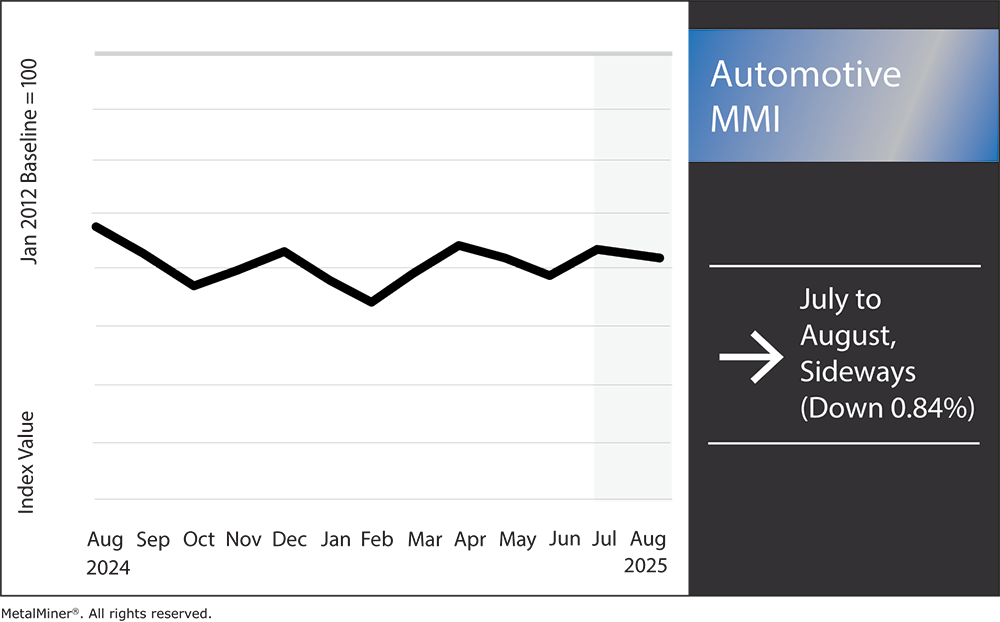

The Automotive MMI (Monthly Metals Index) moved sideways, dropping by 0.84%. The U.S. automotive sector is reeling from recent developments that are dramatically altering the landscape for metal sourcing and procurement. Over the past month, new metal tariffs and trade deals, wild swings in aluminum and copper prices and frank warnings from automakers have converged to create a turbulent environment.

Tariffs Drive Up Costs for Auto Metals

A flurry of tariff actions is piling on new cost pressures on automakers and suppliers. In early August, a 50% import tariff on semi-finished copper products took effect as part of President Donald Trump’s “reciprocal” trade measures. This copper duty comes on top of the existing 50% tariffs on steel and aluminum imports. Together, these tariffs push U.S. duties to their highest levels since the 1930s, as consumers now face an average effective tariff rate of about 18%, a height not seen since 1934.

Thankfully, last-minute trade negotiations provided partial relief for some trading partners. New agreements with the European Union, Japan and South Korea mean those allies’ vehicles and auto parts will face a 15% U.S. tariff instead of the initially threatened 25%. However, tariffs on raw materials remain unchanged. Under the current deal, European exporters must still contend with a 50% U.S. levy on steel, aluminum and copper. Meanwhile, U.S. officials defend these sector-specific tariffs as necessary to bolster domestic production, citing findings that America is “overly reliant” on imported metals.

Avoid reactive purchasing in uncertain demand and supply climates and stay ahead with strategic advice from MetalMiner’s weekly newsletter.

Metal Tariffs Affecting Both Vehicles and Inflation

The tariff shock is feeding into current prices. Moreover, by raising the cost of imported inputs, broad tariffs are nudging overall U.S. inflation upward by an estimated 1.8% in the short run. In terms of automobiles, one analysis indicates metal tariffs could bump the materials portion of a vehicle’s cost from about 5% to as much as 9%.

This surge is pressuring manufacturers to consider passing costs to consumers, which will potentially make cars and trucks more expensive in the coming months.

Metal tariffs and uncertainty go hand in hand. But you can get access to monthly price trends for 8 different metal industries by signing up for MetalMiner’s Monthly Metals Index Report, ensuring you’re always ahead in your sourcing strategy.

Aluminum and Copper Markets in Flux

Metals markets have shifted in response to these trade maneuvers. This is especially true of aluminum and copper, which are vital to vehicle manufacturing. The Midwest Aluminum premium, which represents the extra cost paid on top of London benchmark prices for U.S. delivery, has hit an all-time high. Meanwhile, copper, which is often called “the new oil” for its importance in electric vehicle wiring and electronics, has seen additional volatility.

However, upon formally implementing the copper tariff on August 1, the White House unexpectedly exempted refined copper cathodes, the primary form traded internationally, from the duties. This surprise carve-out triggered a record plunge in U.S. copper prices. New York copper futures quickly fell back into line with LME prices, erasing the tariff premium that had built up previously.

Many Metal Buyers Seeking Domestic, Alternative Sources

Beyond pricing, supply chain adjustments are also underway as metal users seek alternative sourcing and, where possible, even alter materials. Reports indicate that U.S. buyers are scouring for tariff-exempt suppliers and leaning more on domestic metal producers, a strategy encouraged by the administration’s “local sourcing” push.

In copper’s case, Chile and Canada were the top exporters to the U.S. last year, meaning the 50% tariff effectively places taxes on products from those friendly suppliers, which could lead to supply diversions or renegotiated contracts. The administration is considering further measures to shore up supply, including a proposal to require that 25% of all copper scrap collected in the U.S. be sold domestically.

Frustrated with inaccurate price forecasts? MetalMiner uses real-world market signals to support purchasing teams with more accurate and timely pricing strategies. Start with viewing our full metal catalog.

Automakers Respond: Price Hikes and Cost Hits

U.S. automakers and their suppliers are reacting swiftly to this new metals cost environment, as evidenced in recent earnings reports and industry commentary. For example, in its second-quarter results, Ford Motor Co. revealed that tariffs on metals and imported vehicles slashed its quarterly earnings by roughly $800 million. The company has since raised its full-year 2025 tariff impact estimate to $3 billion.

General Motors faced even larger headwinds. GM reported a $1.1 billion hit from auto and metal tariffs in Q2, mainly due to import duties on popular models built in South Korea and elsewhere. GM currently expects $4–5 billion in total tariff-related costs for 2025, and says it plans to offset some of that expense through cost cuts and pricing strategies.

The sourcing pinch is cascading down to parts suppliers as well. After the chaotic copper market swings in July, some auto parts suppliers immediately pushed through surcharges to their customers (the automakers) to cover the sudden jump in costs. Auto companies are also adjusting their procurement tactics, with many drawing down inventory stockpiles of metals and parts that were purchased earlier at lower prices as a buffer to delay price increases on new cars.

Do you know the 5 best practices of sourcing metals, including hot-dipped galvanized steel and copper? If not, read them in our free article, 5 Best Metal Sourcing Practices.

Automakers Burn Off Pre-Tariff Stock

The tactic of working through cheaper inventory helped some companies cushion the initial tariff blow. For instance, analysts believe the absence of immediate sticker shock for consumers this summer is partly because automakers were burning off old pre-tariff inventory. However, this is only a temporary respite.

On a more positive note, some large OEMs are using this moment to revisit their sourcing strategies for the future. There is talk in boardrooms about accelerating the localization of supply chains, such as using more U.S.-sourced aluminum or building closer partnerships with North American mining and recycling companies.

Several automakers have also indicated they will increase their use of financial hedging to manage commodity risk. For instance, manufacturers that traditionally preferred to rely on fixed-price contracts or pass-through arrangements are now considering futures and options contracts for metals to lock in costs. In fact, hedging activity for regional aluminum price exposure has surged. The volume of Midwest aluminum premium futures on the CME hit an all-time high earlier this year, reflecting how companies are turning to financial tools to cope with extreme price volatility.

Strategic Sourcing Recommendations for Metal Buyers

For C-suite executives overseeing automotive procurement, the recent turmoil offers important lessons. To navigate this environment, strategic sourcing leaders should adopt a multi-pronged approach to mitigate risk and control costs. One method is reducing over-reliance on any single country or supplier by qualifying multiple sources in different regions.

Whenever possible, prioritize suppliers in countries with favorable trade terms or within U.S. trade agreements (such as USMCA) to avoid the heaviest tariffs. For instance, one industry survey shows many automakers are now prioritizing local and regional sourcing to improve supply chain resilience. By spreading orders across domestic and allied sources, buyers can buffer against geopolitical shocks and punitive tariffs.

Another method is investing in price forecasting, real-time monitoring of metal markets and logistics agility. With metal tariffs and trade rules changing rapidly, companies need the ability to pivot sourcing strategies quickly. Indeed, automotive manufacturers identified improving supply chain visibility and agility as top risk-mitigation strategies in 2025. To counteract price volatility, hedge key metal purchases through futures, options or long-term fixed-price contracts. For example, companies can lock in aluminum premiums or copper prices for the coming year using commodity exchanges.

Automotive MMI: Noteworthy Price Shifts

Make every data dollar count? MetalMiner Select allows you to stop paying for unnecessary price points, focusing your investment on data that drives informed purchasing decisions.

- Hot-rolled coil steel prices dropped 3.39% to $1,054 per short ton.

- Chinese lead prices moved sideways, falling by 2.6% to $2,298.48 per metric ton.

- Lastly, Korean 5052 aluminum coil premium over 1050 prices traded flat, remaining at $4.44 per kilogram.