Global Precious Metals MMI: Bulls and Bears Quarrel Over Gold Price Projections

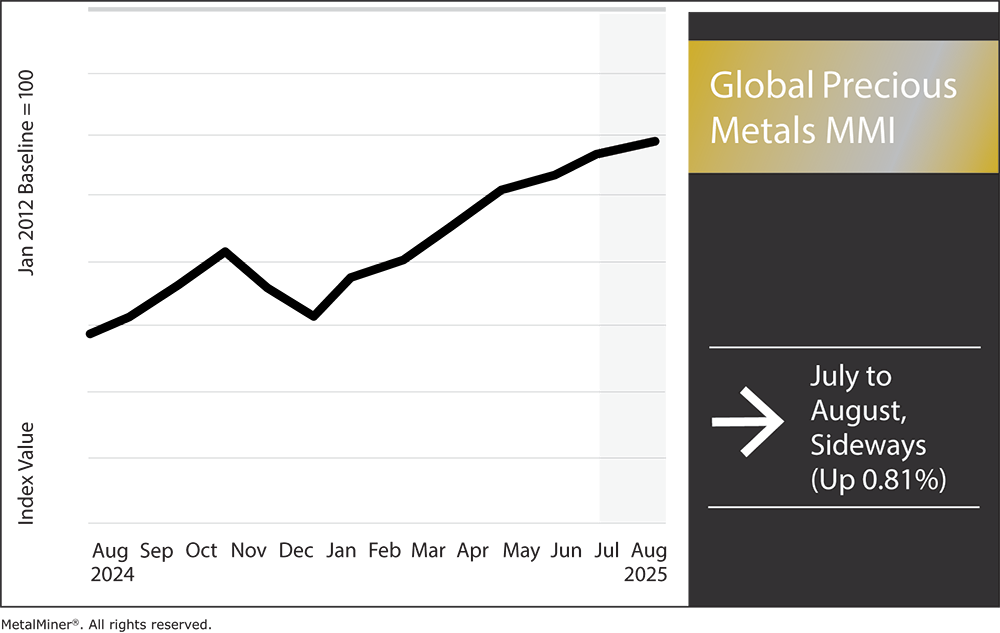

The Global Precious Metals MMI (Monthly Metals Index) finally lost bullish steam and moved sideways, rising only 0.81%. The past month has seen significant swings in precious metals prices. Safe-haven demand drove several metals to multi-year highs in late July, followed by partial pullbacks in August as market winds shifted. Gold and silver, in particular, rallied on economic uncertainty, with gold briefly hitting record territory and silver reaching levels unseen since 2011. Precious metal trends and hedging advice is covered monthly in MetalMiner’s MMI Report.

Palladium: July Spike Fades on Auto Demand Worries

Palladium prices soared in July, rising over 13% for the month. The metal even reached a year-to-date high of about $1,288 per troy ounce on July 11. But by late August, palladium had retreated to roughly $1,100/oz, giving back much of the summer’s gains.

Even so, short-term sentiment isn’t all bearish. The recent U.S. rollback of EV tax credits could delay an electric transition and keep more gasoline hybrids on the road, modestly supporting palladium demand in the interim. Additionally, any supply hiccups, whether from Russian export snags or mining issues, could quickly tighten the market again.

On balance, most sourcing professionals remain cautious. With palladium’s fortunes so tied to a cooling auto sector, many foresee continued price volatility or gradual declines.

Precious metals prices move fast. Stop reacting to sudden changes and proactively plan for the unexpected by utilizing MetalMiner’s weekly newsletter.

Platinum: Rally Persists on Supply Deficit and Substitution

Platinum represents another standout for precious metals prices. Prices surged ~12% in July, before experiencing a slight pullback. Like gold, Platinum benefited from safe-haven buying as U.S. trade policy grew more unpredictable. Jewelry buyers and other consumers also jumped in. Indeed, with the gold-to-platinum price ratio at all-time highs, many jewelers substituted cheaper platinum for gold, boosting demand.

Notably, platinum’s supply-demand fundamentals remain bullish. According to industry reports, the metal is in its third consecutive year of supply deficit in 2025 due to constrained mining output and steady industrial needs. Looking forward two months, many analysts expect platinum to remain well-supported.

Auto-sector demand (for diesel and hybrid vehicle catalysts) and nascent growth areas like hydrogen fuel cells provide a diversified demand base that platinum-only suppliers can count on. Meanwhile, Bank of America recently emphasized platinum’s broader demand profile beyond autos, which represents a key distinction from palladium’s narrow focus.

Does your company have a precious metal buying strategy which align properly with current market trends? Find out.

Silver: Near 14-Year Highs as Tight Supply Meets Safe-Haven Demand

Silver has also enjoyed a stunning climb this summer. In late July, silver touched an intraday peak of $39.91/oz, its highest level since 2011. Even though it has since eased back into the upper-$37 range, silver is still up roughly 30% year-to-date, outpacing even gold’s impressive gains. Again, several factors converged to fuel silver’s rally. As a precious metal, silver was able to ride gold’s coattails. According to HSBC analysts, record-high gold prices exerted a “strong gravitational pull” that lifted silver along with it.

Underpinning silver’s price strength is a deep supply deficit. In fact, industrial use of silver has been surging in sectors like solar panels, electronics and electric vehicles, far outstripping mine supply growth. Over the next two months, silver’s trajectory will likely track a mix of safe-haven sentiment and physical demand trends. Should economic jitters persist (for example, if U.S.-China trade talks deteriorate or inflation surprises to the upside), silver could make another run at the $40 mark.

Want to make every data dollar count? MetalMiner Select allows you to stop paying for unnecessary price points, focusing your investment on data that drives informed purchasing decisions.

Gold: Holding Ground Above $3,300 as Markets Eye the Fed

Gold prices have been more subdued in recent weeks after an explosive first half of the year. Amid the slowdown, many traders describe the market as lacking a new catalyst. “Gold has yet to reclaim April’s highs,” noted Carsten Menke, an analyst at Julius Baer. “And the short-term consolidation is set to continue as the market misses an imminent trigger to restart the rally.”

Looking ahead, the next 8–10 weeks will be pivotal for gold’s direction. For now, market attention is focused on the U.S. Federal Reserve and its interest rate signals. If upcoming economic data or Fed comments hint at rate cuts or a looser policy stance (for example, during the Fed’s Jackson Hole symposium or September meeting), the dollar could weaken, likely pushing gold higher.

Global Precious Metals Prices: Noteworthy Shifts

MetalMiner Select enables you to pay only for the metal price forecasts you need instead of expensive, all-or-nothing subscriptions. View our full metal catalog.

- Palladium bar prices rose by 8.03% to $1,198 per ounce.

- Platinum bars dropped in price by 3.15% to $1,292 per ounce.

- Silver ingot moved sideways, rising 1.08% to $37.81 per ounce

- Lastly, gold bullion moved sideways, dropping 1.42% to $3,338.40 per ounce