Raw Steels MMI: Steel Prices Level Off, Lead Times Shrink

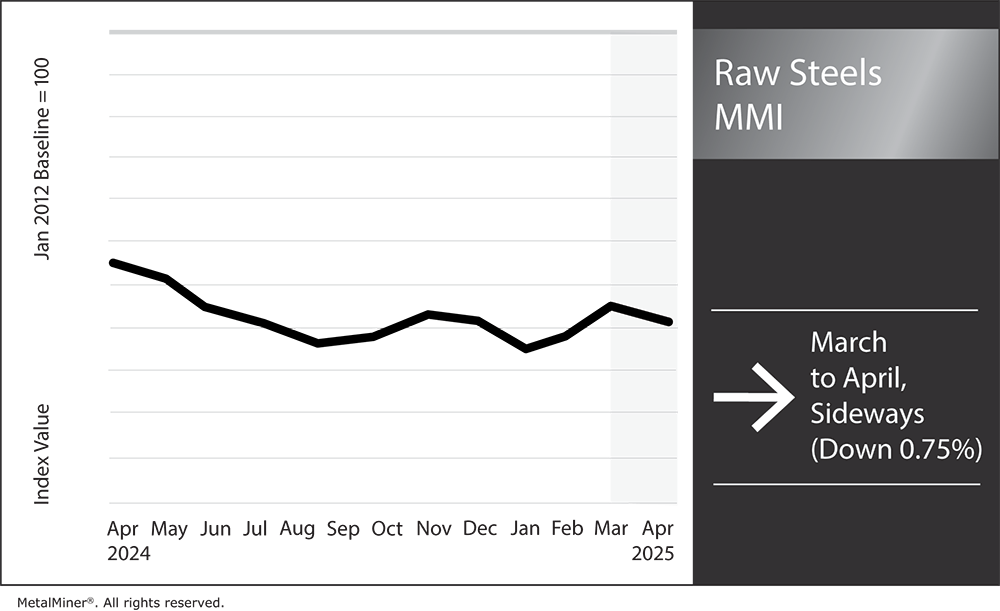

The Raw Steels Monthly Metals Index (MMI) returned to the downside. Overall, the index witnessed a modest 0.75% decline from March to April.

Steel Prices Find Peaks as Reciprocal Tariffs Spare Steel

Steel prices either found a peak or began to stabilize by the start of April. As of April 4, hot rolled coil prices fell from their peak to $920/st. Meanwhile, CRC prices and HDG prices started to move sideways, trending only slightly higher from where they stood recent weeks, and steel plate prices dropped from their peak. Despite leveling off, HRC prices remain 34% higher than where they started the year.

The increase mainly stemmed from buyers rushing into the market ahead of Section 232 tariffs. However, buying activity calmed by the tariff start date of March 12, and markets still remain uncertain about what is to come.

In a relief to buyers, the recently-announced reciprocal tariffs spared metals already impacted by the Section 232 tariffs. This includes steel, which is now subject to a 25% blanket duty. Read how steel tariffs impact metal markets. Sign up for the free weekly MetalMiner newsletter here.

Don’t panic! Learn how to manage tariff threats with MetalMiner’s free guide.

Mill Lead Times Continue to Shrink

As steel prices stabilized, mill lead times mostly shrank. At their peak in early March, HRC lead times extended to their longest range since January 2024, a signal of increased demand and tightening supply. However, following the new tariffs, mill lead times returned to contraction, slipping back to where they stood in mid-February.

It remains difficult to predict how long this will continue, as imports offered a considerable volume of U.S. supply in past years. However, data from the Department of Commerce showed a notable dip in import volumes and licenses since February. Offshore material is now 25% more expensive, theoretically meaning buyers will rely more heavily on domestic supply.

There’s certainly no shortage of domestic supply available, despite tighter lead times. According to data from the American Iron and Steel Institute, imports are not only down, but the current capacity utilization rate from U.S. raw steel production hit 76.2% as of March 29.

Nevertheless, spring maintenance outages and a recently announced demand-related temporary mill closure by Cliffs will continue to pressure overall output. Should demand improve, mills have the ability to increase supply.

Keep your team in sync with steel market shifts, so you can plan better and avoid unnecessary spend on steel by signing up for MetalMiner’s weekly newsletter.

The Automotive Sector Weakens, Cuts Production

While tariff uncertainty has largely eased with the most recent announcement, the bigger question relates to demand. The auto sector, a large consumer of steel, appears weak, with Stellantis recently announcing layoffs at several facilities. Auto production levels have slowly trended lower over the past year, echoing concerns from auto manufacturers like Stellantis.

Cliffs attributed its decision to idle its Dearborn, Michigan plant to weakness in the auto sector, but believed the move would prove temporary as the market adjusted to new tariffs. Though they have multiple goals, the Trump administration intends the broad tariffs to help reshore manufacturing to the U.S., which would benefit steel demand.

Facing challenges in tracking steel price movements? Access monthly price trends for 10 different metal industries by signing up for MetalMiner’s Monthly Metals Index Report, ensuring you’re always ahead in your sourcing strategy.

Manufacturing Returns to Contraction

In the short term, downside risks remain. While durable goods orders indicate a stable trend, the ISM manufacturing PMI returned to contraction following a brief two-month growth trend, painting a bearish outlook for the coming months. Notably, new orders contracted for two consecutive months, which may prove to be a leading indicator for what’s to come for durable goods orders. As higher prices pressure consumers, it could force a greater pullback from the market.

Meanwhile, mills will continue efforts to maintain current price levels. As long as demand remains steady, they will likely be able to minimize the downside. However, those efforts will likely prove futile if the cumulative impact of tariffs on the U.S. economy triggers a broader slowdown. Reshoring manufacturing will take time, and recession fears remain a fixture in headlines, amplified by the significant sell-off witnessed throughout the stock market.

Following the roughly two-and-a-half-month uptrend witnessed since the start of the year, the risk is now to the downside for U.S. steel prices. Steel futures, a leading indicator for national steel prices, appear increasingly bearish, having dropped to their lowest level since early February.

Biggest Moves for Raw Material and Steel Prices

- Chinese steel slab prices witnessed the only increase of the overall index, rising a modest 1.16% increase to $513 per metric ton as of April 1.

- Meanwhile, U.S. shredded scrap steel prices fell by 1.71% to $461 per short ton.

- Chinese HRC prices witnessed a 2.15% drop to $416 per short ton.

- Chinese coking coal prices declined by 7.68% to $137 per metric ton.

- U.S. Midwest HRC three-month futures fell by 11.35% to $820 per short ton.

MetalMiner steel should-cost models: Give your organization levers to pull for more price transparency from service centers, producers and part suppliers. Explore the models now.