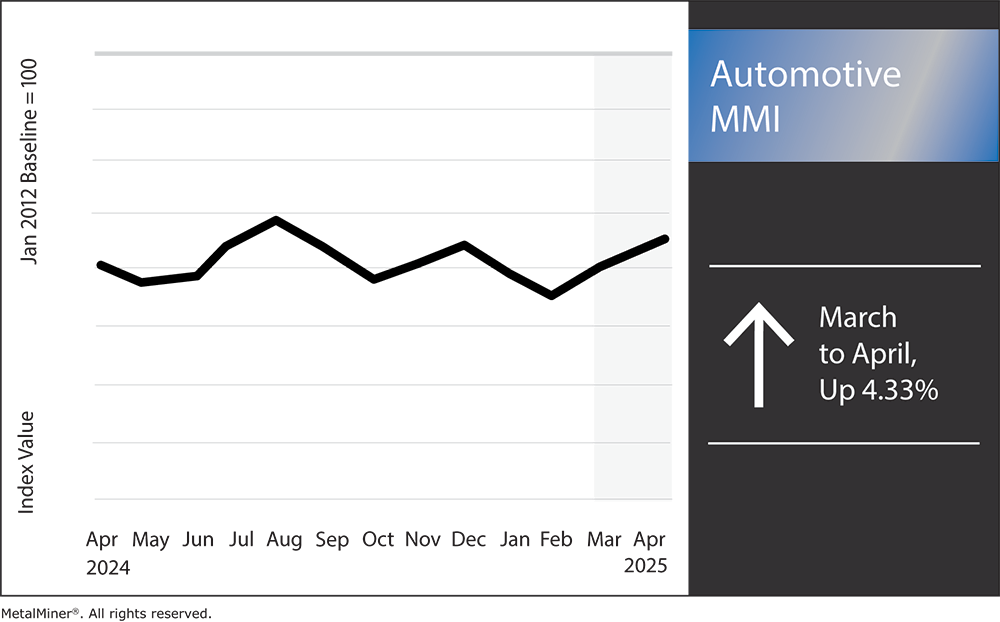

Automotive MMI: New 25% Automotive Tariffs in Effect, How is the Market Responding?

The Automotive MMI (Monthly Metals Index) rose by 4.33% month-over-month. With the 25% Trump tariffs now in effect, the market could be in for a bumpy ride.

New Wave of Trump Tariffs Hit

The Trump Administration implemented two sweeping trade actions, collectively known as the “Trump Tariffs,” that are reverberating across U.S. industries. First came a 25% tariff on imported automobiles and auto parts. Next came the announcement of a blanket 10% tariff on all foreign goods.

These moves mark a dramatic escalation of Trump’s “America First” trade agenda aimed at reshoring manufacturing and shrinking trade deficits. However, according to Reuters, they are also causing panic in supply chains and raising costs for businesses that depend on imported metals and components.

In practice, these new policies carry short-term challenges. Within days of the auto tariff taking effect, automakers announced layoffs, paused overseas production and warned of higher prices ahead. In order to outsmart your competition and stay ahead of the tariff game, get weekly metal sourcing strategies from MetalMiner’s weekly newsletter.

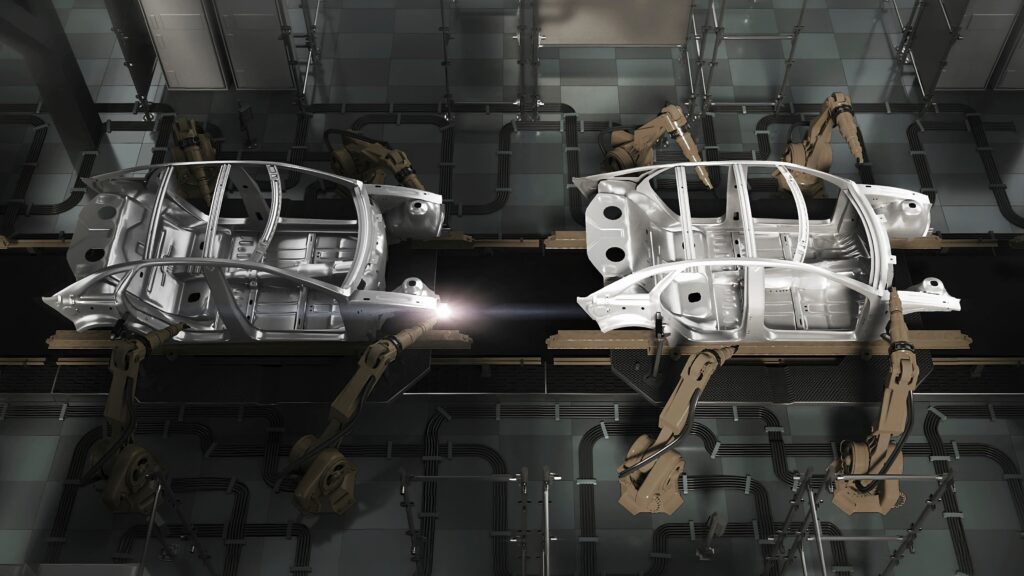

25% Tariffs on Cars and Parts: Disrupting an Integrated Supply Chain

According to The Associated Press, the Trump administration claims that the 25% tariff on imported cars, which will extend to foreign-made engines, transmissions and other parts by May, is intended to foster domestic manufacturing.

The policy targets completed vehicles from Europe and Asia, but every automaker is feeling its ripple effects. This includes U.S. companies that rely on global parts sourcing and metals like steel.

In the Midwest, Stellantis temporarily halted production at factories in Mexico and Canada to avoid the costs of the Trump tariffs, leading to mass layoffs at U.S. plants. Meanwhile, dealerships saw a burst of car-buying as consumers rushed to beat looming sticker shock.

Missing out on valuable industrial metal market insights? Subscribe to MetalMiner’s Monthly Metals Index Report and gain a competitive edge with comprehensive analysis across ten different metal sectors, ensuring you’re always informed.

Reactions From Consumers and Automakers

Due to the Trump tariffs and their effects, many people may have to hold onto older vehicles longer, as the prices of new cars and trucks may simply be too high. Fearing lost sales, automakers have urged the administration to implement tariffs carefully.

The American Automotive Policy Council, which represents Detroit’s Big Three, stated it was “critical that tariffs are implemented in a way that avoids raising prices for consumers and preserves the competitiveness of the integrated North American automotive sector.”

10% Blanket Tariffs

On top of the auto-specific duties, U.S. companies now face a 10% tariff on all imported goods. This is a sweeping policy with few precedents. As of April 5, customs agents are levying this “baseline” tariff on shipments from dozens of countries at U.S. ports.

In practice, this acts like a 10% across-the-board import tax. The tariff applies broadly to industrial inputs, consumer products and commodities, sparing only select strategic goods. The administration has cast this as a “reciprocal” measure to pressure trading partners into fairer deals.

However, it also means that any additional metal parts or raw materials imported for automotive manufacturing will likely incur the 10% surcharge as well. The result is that the price of imported steel, aluminum and other metal inputs for American buyers has climbed even further.

Stop obsessing about the actual forecasted metal prices. It’s more important to spot the trend, read why.

Weighing Competitiveness: Short-Term vs. Long-Term

From a supply chain perspective, businesses are rethinking their strategies to adapt. As a result, trade groups are advising companies to renegotiate contracts with suppliers and seek out alternative sources.

When one looks at the bigger economic picture, Trump’s tariffs present a clear trade-off. The goal is to strengthen U.S. manufacturers like steel mills, aluminum producers and automakers. According to Reuters, early indicators show some success, with increases in domestic steel production and related jobs following earlier tariffs.

Now, companies across multiple sectors are seriously weighing the idea of relocating more parts of their supply chains back to the United States. However, these gains come with a downside: higher costs for materials across much of the economy.

Automotive MMI: Noteworthy Price Shifts

Not sure how industrial metal volatility affects your financials each month? Use the Monthly Metals Outlook to monitor the impact and improve earnings decisions. Dive in with a free sample copy.

- Chinese lead prices moved sideways, increasing by a slight 1.17% to $2,361.35 per metric ton.

- Hot-dipped galvanized steel prices rose by 7.66% to $1,208 per short ton.

- Lastly, Korean 5052 aluminum coil premium over 1050 prices rose by 2.14% to $4.30 per kilogram.