Construction MMI: China Tariffs Climb to 145%. What it Means for China-Sourced Construction Materials

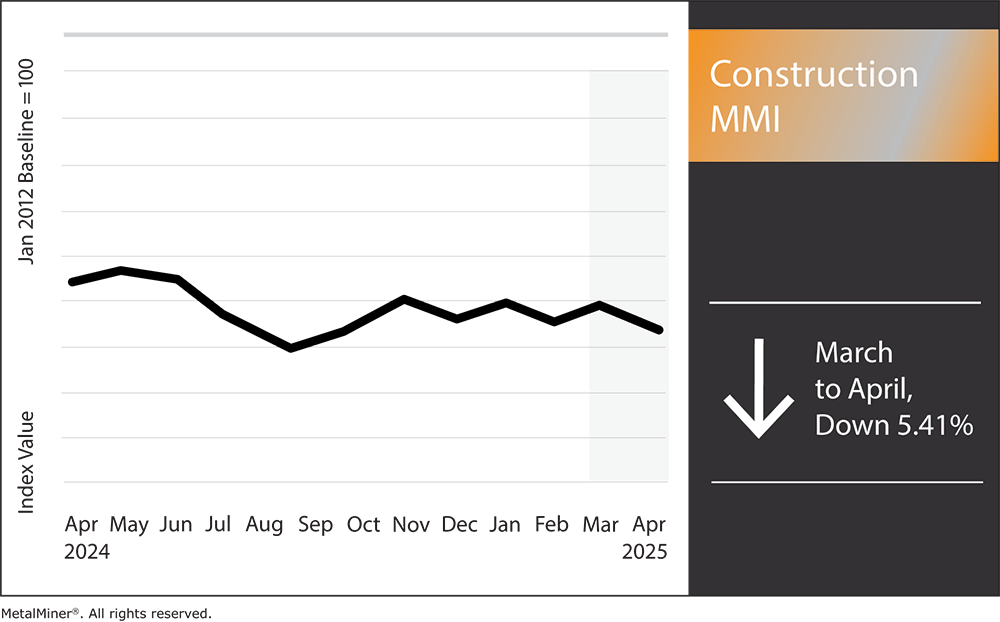

The Construction MMI (Monthly Metals Index) broke out of its over 6-month-long sideways trend to pivot down 5.41%. This new movement outside of its sideways range could indicate more volatility in the short term than the index experienced in the past 12 months.

The new Trump tariffs on China caused some volatility in the price of construction materials, including H-beam steel and steel rebar. If the U.S. and China fail to negotiate these new policies, the index will likely remain unpredictable for the short term.

The U.S. construction and manufacturing sectors are bracing for impact as President Trump’s 2025 10% blanket tariffs take shape. Trump has declared a 10% levy on all foreign goods entering the United States, a sweeping tariff policy aimed at bolstering domestic industry which was recently covered in MetalMiner’s weekly newsletter. That figure excludes Canada and Mexico, which already incurred 25% tariffs earlier this year.

However, as of April 9, the White House announced that the 10% tariffs are on hold for 90 days, except for those levied against China. This trade move could dramatically reshape the flow of construction metals like steel, aluminum and copper into the U.S. market.

Trump Tariffs: 10% Blanket Levy on Imports

Trump’s 10% blanket levy marks a sharp departure from the targeted tariffs of the past. Trump has defended the sweeping tariffs as necessary to address large trade deficits and nonreciprocal trade practices he says have hollowed out U.S. manufacturing. “They give us great power to negotiate,” the president stated, suggesting the tariffs could be a lever for further mediation.

China has been hit especially hard by the Trump tariffs. Imports from China, including construction metals like H-beam steel and steel rebar, faced a punitive 54% duty as of early April. Despite the broad reach, the duties do not treat all products equally, and the administration has carved out some notable exemptions.

According to a White House fact sheet, the Trump tariffs currently exempt certain critical goods and prior tariff regimes from the new 10% levy. For example, steel, aluminum, automobiles and automobile parts remain governed by existing Section 232 tariffs and won’t incur the additional 10% charge, a move that MetalMiner’s free comprehensive tariff guide offers revenue saving strategies on.

U.S. Construction Metals Imports in the Crosshairs

For the U.S. construction industry, metals like steel and aluminum are in the crosshairs of the new trade barriers. Even though steel and primary aluminum fall under pre-existing tariffs, Trump’s latest actions expand and reinforce those duties while including new duties on other construction materials separate from metals. As of March 12, the administration eliminated all country exemptions for steel and aluminum tariffs.

The new 10% blanket tariff further complicates the picture for construction metals that previously went without duties. On July 9, imported construction materials like copper wiring, structural components, nails, fasteners and machinery will soon face a 10% cost increase if the country of origin is subject to the tariffs.

Although raw copper is exempt, many finished products or alloys used in construction will be subject to the extra fees. Indeed, early signs of the impact are already emerging in price indices. The U.S. Producer Price Index for March showed that industrial metals costs were climbing, driven by tariffs on steel and aluminum, which had been in effect for only a month.

Looking to track and predict industrial metal price trends effectively? Subscribe to MetalMiner’s Monthly Metals Index Report and leverage it as a valuable resource for monitoring and forecasting price movements across 10 different metal industries, supporting your strategic sourcing efforts.

Domestic Ripple Effects: Winners and Losers

Domestically, Trump’s tariffs are reshaping the landscape for construction metals, bringing both gains and setbacks. U.S.-based steel producers and aluminum manufacturers stand to gain the most right out of the gate as the new trade barriers tilt the playing field in their favor.

However, these gains come with some pain for downstream industries. Construction firms, real estate developers and manufacturers that consume large volumes of metal will encounter higher input costs almost immediately. Industry observers warn of project delays and cancellations if metal prices continue to climb.

As the Trump tariffs are negotiated, it’s more important that ever to make faster, smarter purchasing decisions. You can get indispensable updates on metal price trends when you sign up for MetalMiner’s weekly newsletter.

Geopolitical Tensions and the “China Factor”

As both the largest source of U.S. non-North American imports and the world’s biggest metals producer, China lies firmly at the center of the tariff storm. Meanwhile, China’s real estate boom has cooled dramatically under the weight of debt crises and slowing growth. On a related note, Chinese steel exports recently surged to a 9-year high, and countries like Turkey and Indonesia have already imposed fresh tariffs or duties to block the influx of Chinese steel.

Construction MMI: Noteworthy Price Shifts

Are you under pressure to generate metal cost savings? Make sure you are following these 5 best practices.

- European commercial 1050 aluminum sheet prices dropped by 13.41% to $3,211.81 per metric ton.

- Chinese H-beam steel (200mm) prices dropped by 4.18% to $422.05 per metric ton.

- Finally, Chinese steel rebar prices moved sideways, dropping a slight 2.13% to $470.13 per metric ton.