Steel price momentum appears significantly stronger with the start of the year. Steel price momentum shifted in December, showing stronger upward movement. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Despite the momentum, MetalMiner remains cautious about steel prices. The U.S. Department of Commerce’s Section 232 outcome might also add some […]

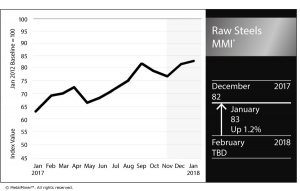

Raw Steels MMI: Steel Picks Up Speed as Industry Awaits Section 232 Outcome

The Raw Steels MMI (Monthly Metals Index) jumped another 1.3% this month, reaching 83 points in January.

Steel momentum seems to have recovered this month. All forms of steel prices in the U.S. increased sharply. Steel momentum typically begins during the middle of Q4, but the increase occurred later this past year. January’s numbers also look bullish.

Benchmark Your Current Metal Price by Grade, Shape and Alloy: See How it Stacks Up

[caption id="attachment_89677" align="aligncenter" width="580"]

In the U.S. market, January will prove to be a decisive month.

The U.S. Secretary of Commerce Wilbur Ross has until mid-January to conclude his Section 232 probes and release a report to the Trump administration, after which the president has 90 days to act.

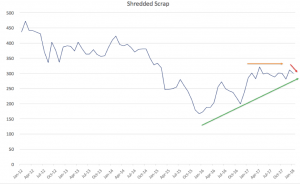

Shredded Scrap

The long-term shredded scrap price uptrend appears to have turned into a short-term sideways trend. Despite steel price increases in December, January scrap prices decreased.

[caption id="attachment_89678" align="aligncenter" width="580"]

Decreasing domestic scrap prices do not currently support steel prices. However, steel prices appear to be on a sustainable upward trend. Therefore, scrap prices could follow steel prices this month and continue their long-term uptrend.

Chinese Prices Still Strong

Chinese steel prices and U.S. prices usually tend to move similarly. Thus, when one reveals a strong upward or downward movement, the other could follow within that month.

Chinese prices were stronger than U.S. steel prices during November and December 2017. After the latest increase in U.S. steel prices, Chinese prices also continued rising.

[caption id="attachment_89679" align="aligncenter" width="580"]

Chinese steel prices have found support from the curtailment campaign in the country. Therefore, steel prices could continue increasing. Chinese Q4 GDP data, expected to show strength, also support Chinese steel prices. Chinese GDP data has come in over annual growth targets for the country.

What This Means for Industrial Buyers

As steel price dynamics showed a strong upward momentum this month, buying organizations may want to understand price movements to decide when to buy some volume. Buying organizations will want to pay close attention to Chinese price trends, lead times and whether domestic mill price hikes stick.

Buying organizations who have concerns about the Section 232 outcome and its impact on the steel industry may want to take a free trial now to our Monthly Metal Buying Outlook. Our February Monthly Outlook will include a detailed analysis of the Section 232 outcome.

Free Sample Report: Our Annual Metal Buying Outlook

Actual Raw Steel Prices and Trends

Stainless Steel MMI: LME Nickel Price Approaches $13K/MT

The Stainless Steel MMI (Monthly Metals Index) jumped six points this month, with a reading of 71. This reading ran higher than November’s (70), which then dropped to 65 for December before bouncing back for our January reading.

Benchmark Your Current Metal Price by Grade, Shape and Alloy: See How it Stacks Up

Skyrocketing LME nickel prices drove the Stainless Steel MMI. However, 304 and 316 Allegheny Ludlum surcharges fell slightly this month.

LME Nickel Makes Big Jump

As reported previously by MetalMiner, nickel price volatility has increased over the past few months.

Nickel prices jumped from the $10,600/metric ton level in October to almost breaching MetalMiner’s current $13,000/mt ceiling.

[caption id="attachment_89668" align="aligncenter" width="580"]

Trading volume remains strong, aligned with the recent popularity of nickel in the base metals complex. Besides stainless steel, nickel’s popularity has increased due to usage in batteries and electric cars. Q4 brought more activity for metals that have a direct impact on electric cars.

Nickel macro-indicators may support this latest rally.

The nickel deficit will continue this year. The International Nickel Study Group (INSG) reported a wider nickel deficit again in 2017, now up to 9,700 tons. A nickel supply deficit may add support to the nickel bullish rally and could create additional upward movements this year.

Buying organizations may want to be aware of these movements to identify opportunities to buy on the dips.

Chinese Stainless Steel

As reported by the International Stainless Steel Forum (ISSF), global stainless steel production increased by 7.4% during the first nine months of 2017. China drove the gains, with an increase in production of 8.8%. Stainless steel prices decreased around 7% in East Asian ports.

[caption id="attachment_89669" align="aligncenter" width="580"]

Chinese stainless steel coil prices increased slightly this month. Chinese prices remain higher than they were in Q2. However, there has not yet been a clear uptrend that signals prices may increase soon.

Domestic Stainless Steel Market

Despite the recovery in momentum of the Stainless MMI, NAS domestic stainless steel surcharges traded sideways this month. Despite trading flat, stainless steel surcharges remain well above last year’s lows (under $0.4/pound).

[caption id="attachment_89670" align="aligncenter" width="580"]

What This Means for Industrial Buyers

Stainless steel momentum appears in recovery, similar to all the other forms of steel.

However, due to nickel’s high price volatility, buying organizations may want to follow the market closely for opportunities to buy on the dips.

To understand how to adapt buying strategies to your specific needs on a monthly basis, take a look at our Monthly Metal Buying Outlook or you can take a free trial now.

Free Sample Report: Our Annual Metal Buying Outlook

Actual Stainless Steel Prices and Trends

Aluminum MMI: Prices Rise and Trading Volumes Have Strong Showing

After last month’s drop, the Aluminum MMI (Monthly Metals Index) index increased by three points. The current Aluminum MMI index reads 98 points, 3.2% higher than the December reading.

Benchmark Your Current Metal Price by Grade, Shape and Alloy: See How it Stacks Up

In December, MetalMiner anticipated a rise in aluminum prices … and that is exactly what happened.

Aluminum prices increased by 10.6% in December, reaching a more than two-year high.

[caption id="attachment_89629" align="aligncenter" width="580"]

Trading volumes appear strong and accompany the current uptrend. Moreover, aluminum’s latest peak has climbed over previous ones, signaling strength in its latest market rally. Other macroeconomic indicators, such as a weaker U.S. dollar and a stronger CRB index driven by higher oil prices, may continue to support aluminum prices.

Moreover, the Department of Commerce’s Section 232 investigation should see a report released mid-January, which will also impact prices. The U.S. Department of Commerce announced a new self-initiated anti-dumping and countervailing duty investigation on imports of Chinese common aluminum alloy sheet at the end of November. The U.S. has launched several anti-dumping campaigns for aluminum products this past year.

Crude Oil

As oil prices serve as a critical part of the CRB index, together with other base metals, buying organizations need to monitor oil price trends.

Moreover, there are some base metals, such as aluminum, that are strongly influenced by oil prices.

[caption id="attachment_89630" align="aligncenter" width="580"]

Oil prices have increased again this month. Current oil prices remain above our bullish level signal, meaning that we could expect some more upward movement for oil.

Similarly, increasing oil prices will continue to provide support to base metals prices.

Aluminum Scrap

Chinese aluminum scrap prices increased sharply this month and appear in a long-term uptrend since 2016.

The latest rally in both LME and SHFE aluminum prices also results in a jump in aluminum scrap prices. Chinese scrap prices increased by 4.9% this month.

[caption id="attachment_89631" align="aligncenter" width="580"]

What This Means for Industrial Buyers

Aluminum prices jumped sharply again this month. After sharp price increases, base metal prices sometimes pull back to digest the previous gains. Aluminum prices may lack some price momentum this month, although that continues signaling bullishness for the light metal.

Therefore, adapting the “right” buying strategy becomes crucial to reduce risks by knowing when to buy.

Free Sample Report: Our Annual Metal Buying Outlook

Actual Aluminum Prices and Trends

Copper MMI: Dr. Copper is Back on the Bulls

The Copper MMI (Monthly Metals Index) jumped five points to 88, driven by skyrocketing LME copper prices. LME copper prices increased by 6.4% in December.

Benchmark Your Current Metal Price by Grade, Shape and Alloy: See How it Stacks Up

LME copper prices are back again over the $7,000/metric ton level. Moreover, copper prices breached a previous peak, signaling strength in the rally. Trading volume also remains heavy, supporting the uptrend.

[caption id="attachment_89608" align="aligncenter" width="580"]

Despite skyrocketing in December, copper prices fell slightly during the first few days of January. However, that does not signal any weakness for the rally yet, as prices increased for the entire previous month. Therefore, copper prices may take a little breather this month to digest previous gains.

The U.S. Dollar

Copper and the U.S. dollar have a negative correlation. This means when the the U.S. dollar appears high, copper prices tend to trade lower.

Right now, we see just the opposite.

[caption id="attachment_89609" align="aligncenter" width="580"]

Some analysts believed that the U.S. dollar had turned the corner and had started to recover. Despite the Fed rate hike in December, the U.S. dollar has continued to fall. The U.S. dollar has also seen heavy selling volume, which suggests more weakness.

Typically, the U.S. dollar trades lower when commodities and base metals trade higher. Copper (Dr. if you will) tells us much about commodities because the dollar has such a great influence on its price (direction).

Therefore, buying organizations will want to follow U.S. dollar price trends closely.

Copper Scrap vs. LME Copper

The price divergence between copper scrap and LME remains wider than historical spreads; though, this month, both moved in tandem.

Chinese copper scrap prices increased by 5.76% this month, compared to the 6.4% jump in LME prices.

Although these two don’t increase by the same amount, they tend to follow a similar trend. Data from both reflects a clear uptrend that appears sustainable, at least for the short term.

[caption id="attachment_89610" align="aligncenter" width="580"]

What This Means for Industrial Buyers

During December, buying organizations had opportunities to buy some volume. The relevance of the price jumps increases when the U.S. dollar shows weaknesses and all the base metals show strength.

Therefore, as copper prices remain bullish, buying organizations may want to “buy on the dips.” For those who want to understand how to reduce risks, take a free trial now to MetalMiner Monthly Outlook.

Free Sample Report: Our Annual Metal Buying Outlook

Actual Copper Prices and Trends