The Copper Monthly Metals Index (MMI) rose 3.87% from November to December. As with other base metals, copper prices broke out of range to the upside last month as China began to pivot away from zero-COVID. Copper prices rallied to a peak on November 11 before a brief and modest retracement. Shortly after that, prices […]

Category: Metal Pricing

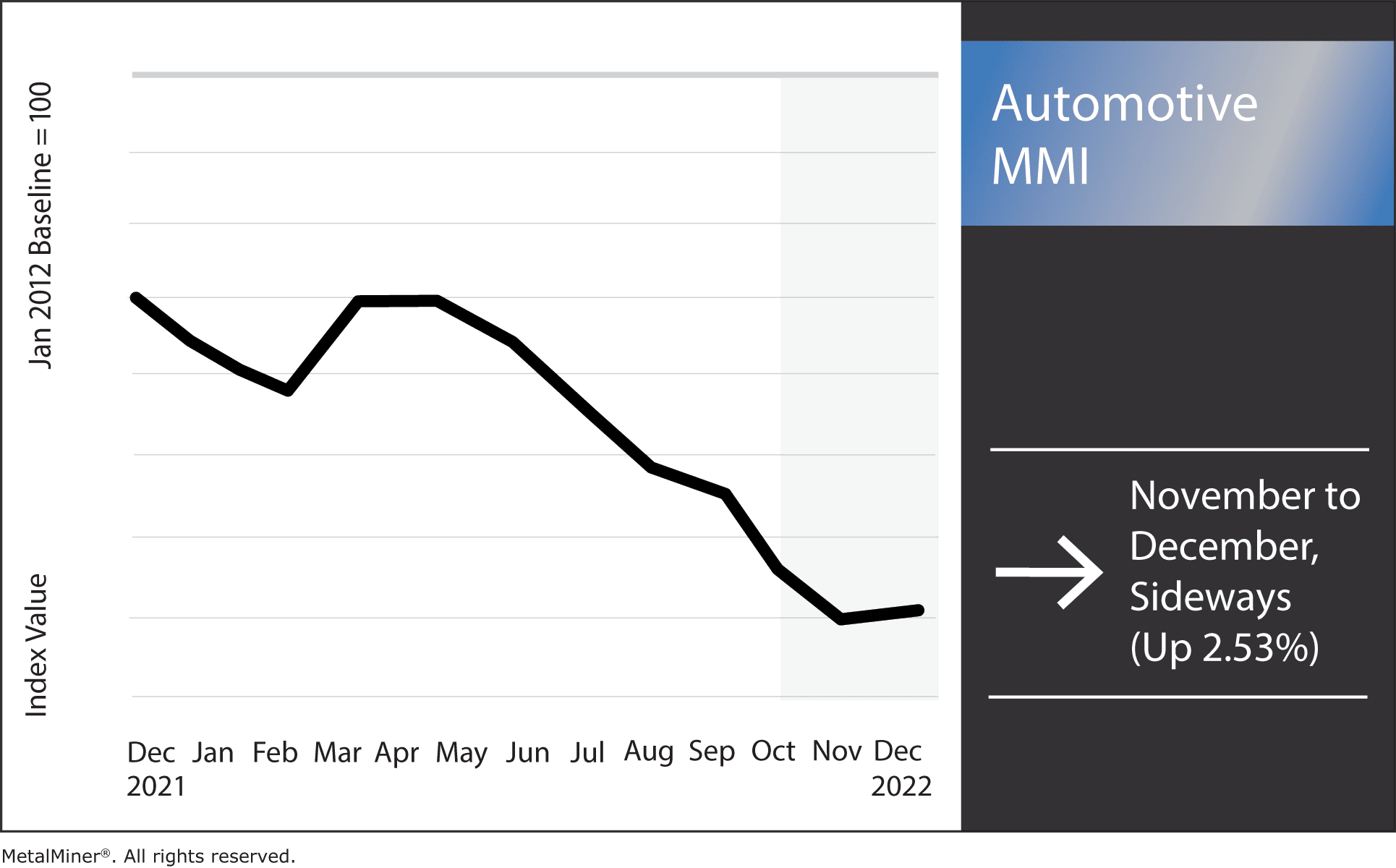

Automotive MMI: Interest Rates Move Up, Consumer Demand Moves Down

The Automotive MMI (Monthly MetalMiner Index) finally broke its downward trend and traded sideways, inching up by 2.53%. Meanwhile, myriad factors continue to pressure metal prices. The demand for vehicles among consumers remains strong. However, low inventories throughout most of 2022 placed a huge strain on the index. Without parts, the manufacturing of new vehicles […]

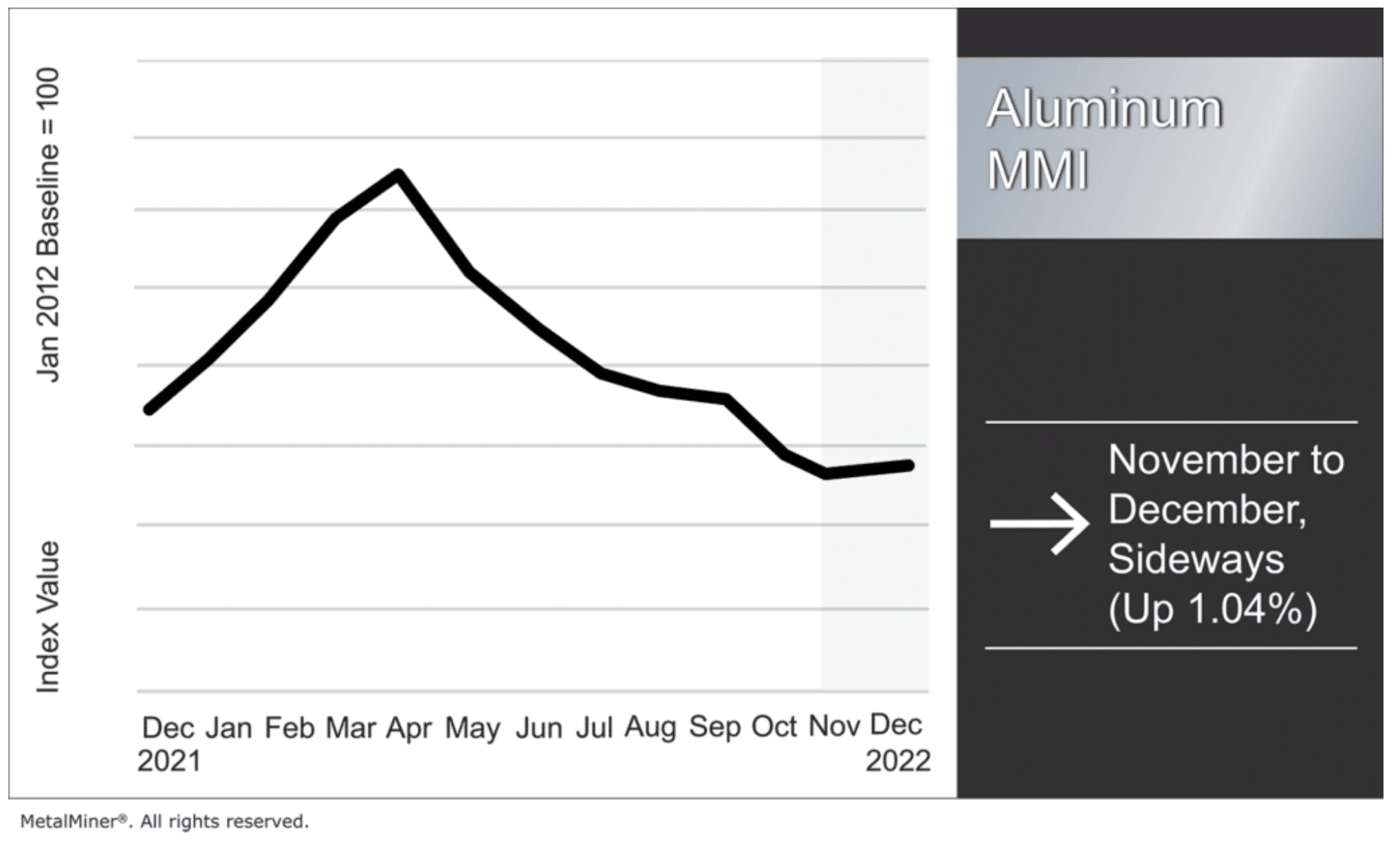

Aluminum MMI: Rally Continues as Aluminum Prices Remain Bullish

Aluminum prices broke out of their sideways trend last month with strong upside price action. Prices rallied during the first half of November, followed by a modest retracement before they continued upward. Overall, the Aluminum Monthly Metals Index (MMI) saw a modest 1.04% increase from November to December. The MetalMiner Insights platform includes global aluminum […]

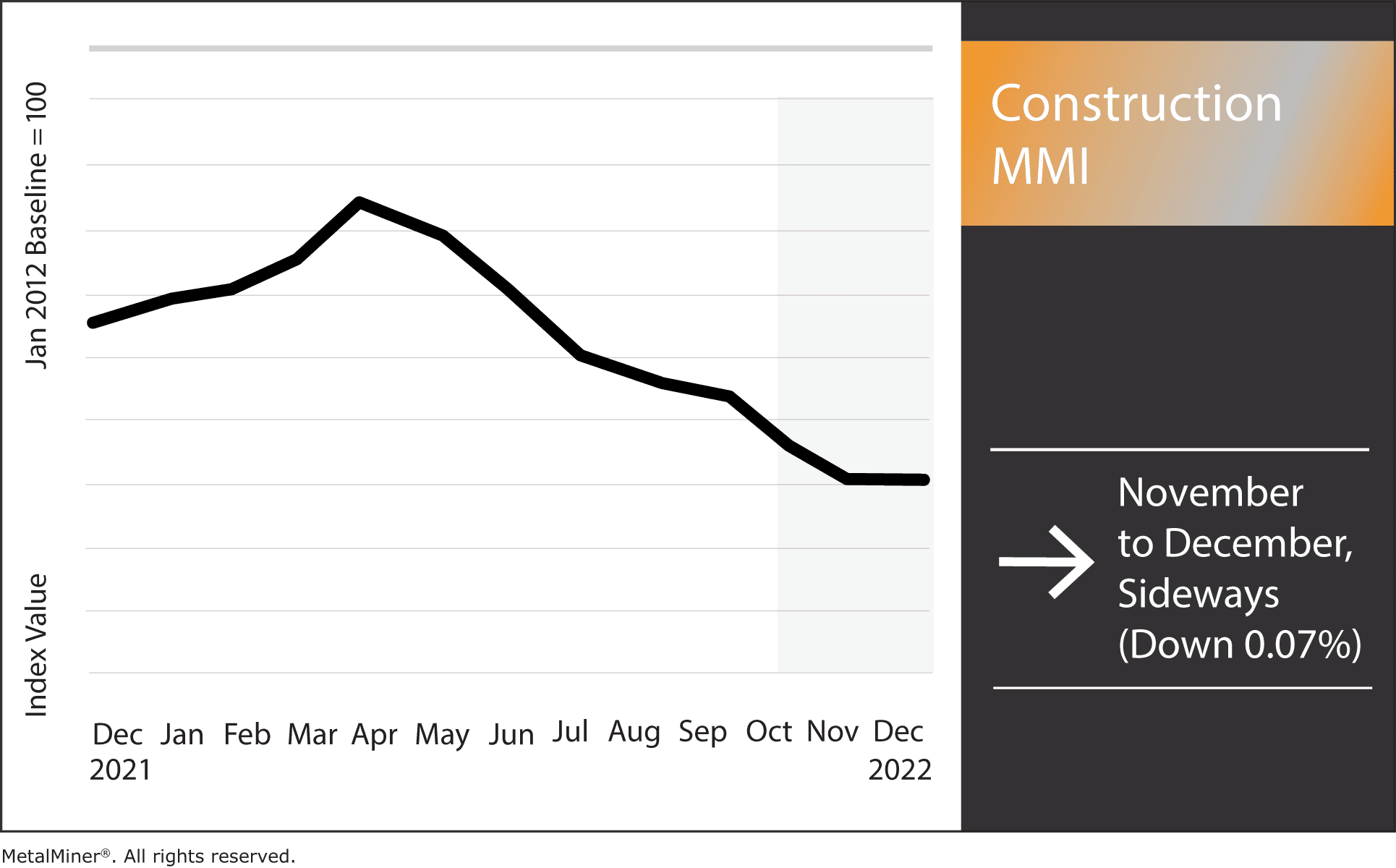

Construction MMI: Aluminum Plate and Steel Rebar Reverse

The Construction MMI (Monthly MetalMiner Index) flatlined sideways, moving downward by a meager 0.07%. The overall volatility of metal prices remains a primary challenge to the index. The near-stationary index contrasts starkly with the downward 2022 trend. Aside from fluctuating metal prices, the industry also had its integrity tested by several other problems. These included […]

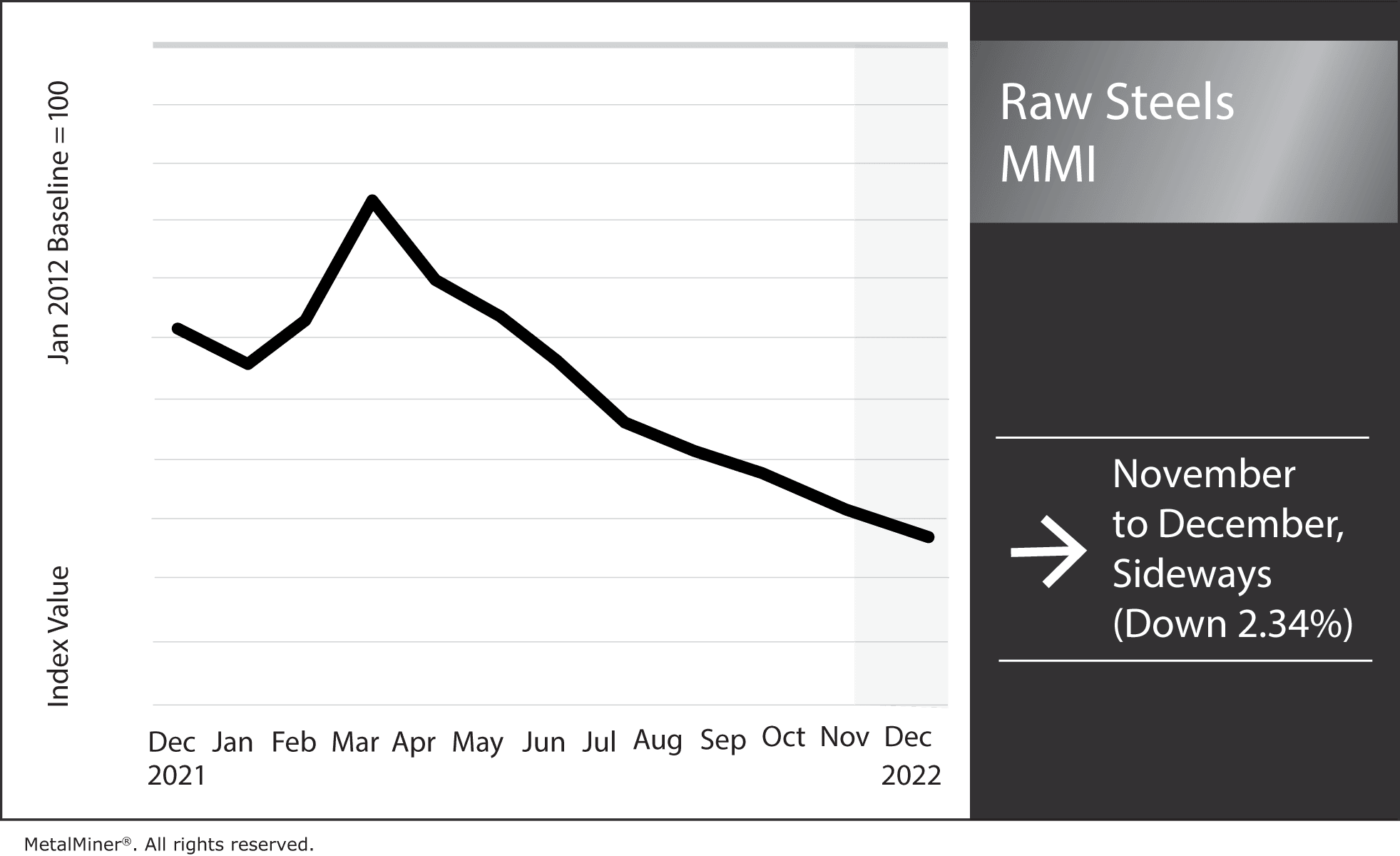

Raw Steels MMI: Where is the Bottom for Falling Steel Prices?

The Raw Steels Monthly Metals Index (MMI) fell by 2.34% from November to December. Ultimately, U.S. steel prices remain decidedly bearish. Meanwhile, hot rolled coil prices saw the most substantial decline, falling 12.6% month over month. Plate prices, on the other hand, mainly remained sideways but continued to edge slowly downward with a 2.9% decline. […]

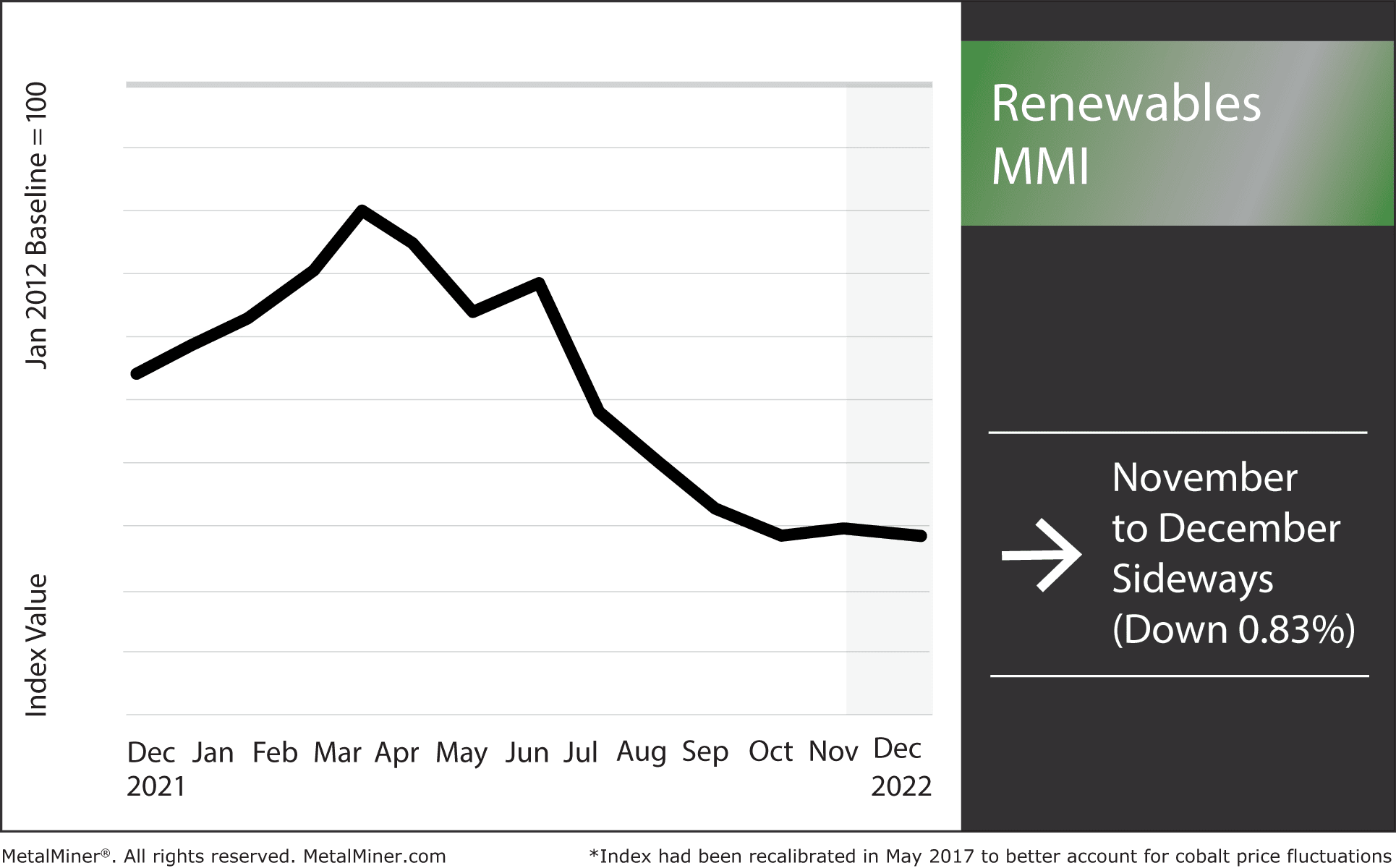

Renewables/GOES MMI: Steel Plate Drops While Battery Metals Hold Strong

The December Renewables MMI (Monthly MetalMiner Index) traded sideways, practically in a straight line. Overall, metal prices within the index only dropped 0.83%. This sideways trend contrasts sharply with the steep drop renewables saw just six months ago. Battery metals within the index, such as cobalt and silicon, held a steady sideways trend, only rising […]

Stainless MMI: Reduced Stainless Imports Could Cause Shortages, Bullish Nickel Price

The Stainless Monthly Metals Index (MMI) moved up with a 7.32% rise from November to December. Meanwhile, the nickel price index appeared decidedly bullish throughout the month. While nickel prices modestly retraced from their early month rally, upside price action continued to support the short-term range breakout. Sustained increases should foster further bullish anticipation, which […]

Rare Earths MMI: Global Rare Earth Supply Chains in an Uproar

The December Rare Earths MMI (Monthly MetalMiner Index) traded sideways for the second month in a row. The index dropped 1.55% and MetalMiner anticipates it will continue sideways, most definitely for the short term and possibly in the long term. This is mostly thanks to the supply of global rare earth magnets being interrupted by […]

Could Macroeconomics Cause a Steel Price Reversal?

Uncertainty regarding China’s stance on zero-COVID, when restrictions might ease, and riots within China throughout recent weeks have all contributed to more flat steel prices. What’s more, recession fears are starting to notably impact commodities. Yet another contributing factor? Fears of a railroad strike. With the cut-off date for meeting railroad unions’ terms fast approaching, […]

Despite Mine Expansion, Copper Price Outlook Still Bearish

Let’s begin with the good news first. Global copper mine capacity rose nearly 5% to 20.38 million tons (MT) between January and September of 2022. According to a report by the International Copper Study Group (ICSG), this was mainly due to the additional production at new or expanded mines. That said, global demand for the […]