The Copper Monthly Metals Index (MMI) moved sideways with an upside bias, rising 2.69% from June to July. Comex Copper Prices Nearing All-Time High on 50% Tariff Reports Comex copper prices resumed their uptrend, ending a brief pause witnessed in early June. As of July 7, the price of copper on the exchange stood $266/mt […]

Category: Supply & Demand

Rare Earths MMI: US–China Trade Deal Eases Rare Earth Export Controls

The Rare Earths MMI (Monthly Metals Index) moved sideways, rising a modest 0.66%. Meanwhile, prices for rare earths may experience short-term stabilization in the upcoming months, primarily due to President Trump reaching an agreement with China to ease restrictions on critical mineral exports. Track macroeconomic signals, pricing pressure, and supply shifts before they hit your […]

Nickel’s Critical Role in Stainless Steel and EV Batteries

Nickel plays a vital role in producing stainless steel and powering electric vehicle batteries. In recent years, the metal’s close ties to the burgeoning electric vehicle market have helped push it into the global spotlight. However, rapid shifts in demand, supply and pricing have created both challenges and opportunities in the nickel sector, depending on […]

Construction MMI: New 50% Aluminum and Steel Tariffs Squeeze U.S. Construction

The Construction MMI (Monthly Metals Index) moved sideways, dropping by 2.0% month-over-month. In early June 2025, new Trump tariffs doubled pre-existing steel and aluminum duties from 25% to 50%. As buyers scrambled, U.S. aluminum premiums immediately hit a record 60¢/lb. Meanwhile, the tariff surge is already squeezing the U.S. construction industry. Construction Input Inflation Construction […]

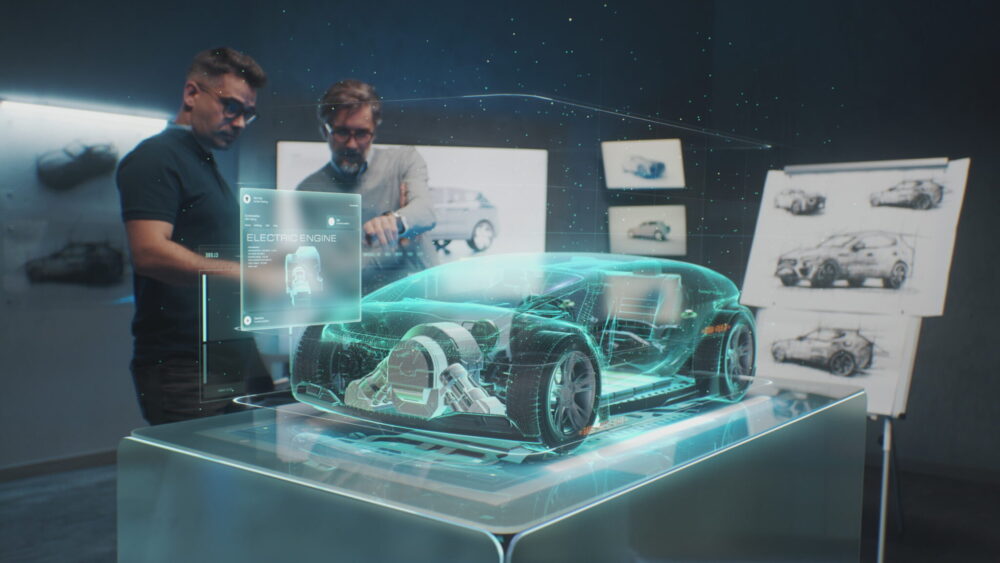

Automotive MMI: Automakers Scramble as Rare Earths Crunch and Tariffs Impact Supply Chains

The Automotive MMI (Monthly Metals Index) moved sideways month-over-month, dropping by 0.70%. This comes as auto industry executives in the U.S. are confronting a whirlwind of trade and supply chain disruptions, not to mention the effects of the recent round of Trump tariffs. In the past month alone, high-stakes U.S.–China trade talks, critical mineral export […]

Copper Market Outlook, H2 2025: Why Are Inventories Still So Uneven?

The copper market outlook for the second half of 2025 has seen significant debate in recent weeks. On the supply side of the equation, new production is coming online. However, this may not happen fast enough to flood the market. According to mining.com, the ICSG projects global mined copper output will rise about 2.3% in […]

Price of Copper Braces for H2 2025: Are Demand Jitters on the Way?

Copper prices are entering the second half of 2025 on a knife’s edge. After a roller-coaster first half that included soaring to record highs in March only to plunge weeks later, the outlook for the price of copper remains clouded by dueling forces. On the one hand, robust long-term demand drivers like electrification and EVs […]

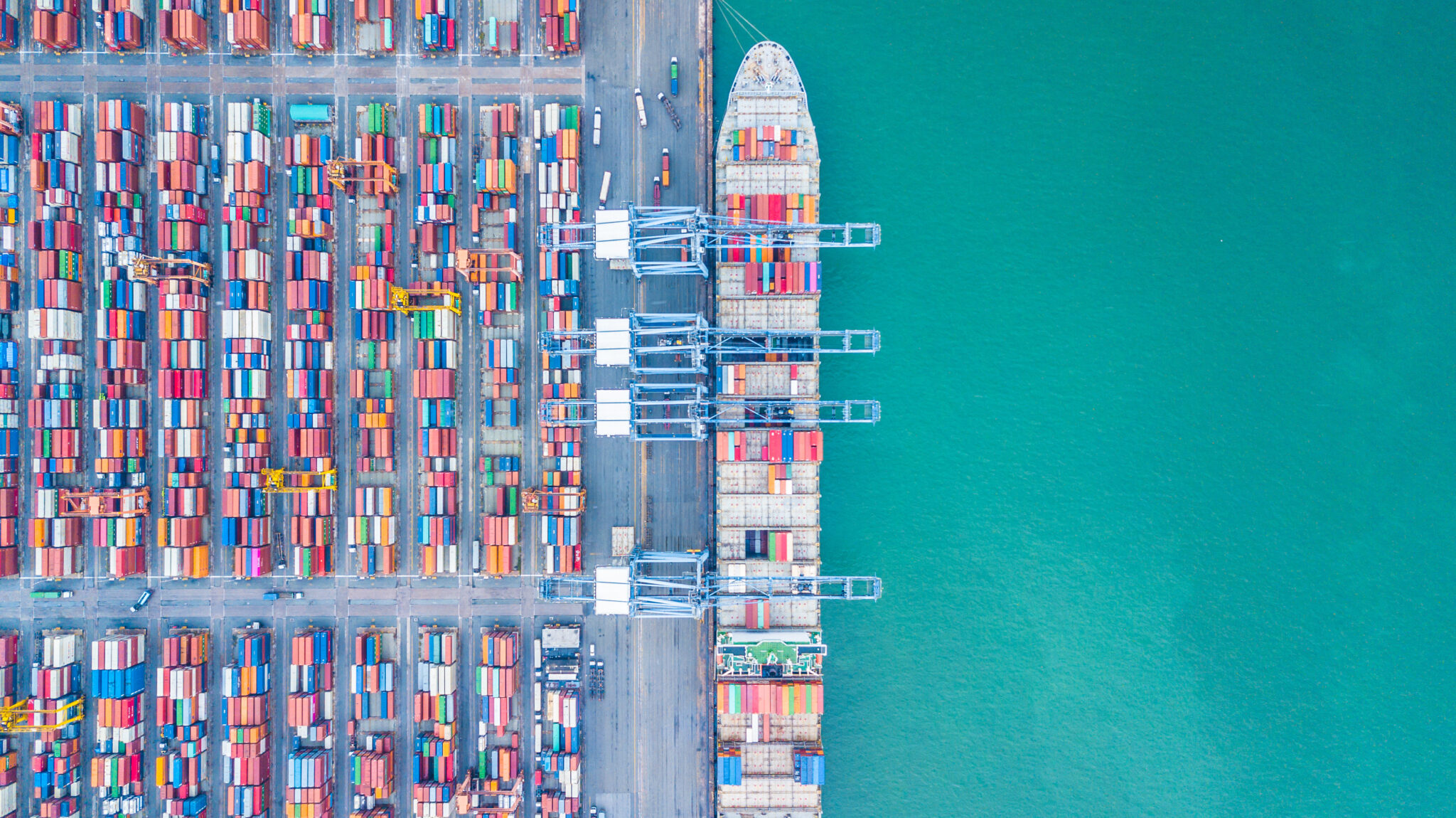

China’s Metal Anti-Dumping is Back. What You Need to Know

Chinese mills are churning out steel, aluminum and even refined copper at near-record levels and sending the surplus abroad, a trend steel industry analysts say could pressure industrial metal prices in the United States. After a year of lagging domestic demand, China’s exports of construction and manufacturing metals have surged, flooding global markets with cheap […]

Volatility’s Back, and It’s Wreaking Havoc on Metal Sourcing Strategies

Speculators may love volatility, but metal buyers hate it. As for Trump Tariffs 2025, the jury is still out. The truth is that a bout of unexpected turbulence like we’ve seen over the last couple of months can knock even the best-laid strategies sideways. The reasons are clear: markets nosedived in March and hit bottom […]

Rare Earths MMI: Ukraine and U.S. Strike Critical Minerals Deal

The Rare Earths MMI (Monthly Metals Index) witnessed a significant rise in price action month-over-month, with a total increase of 7.67%. So far, the global rare earths market has been on a springtime rollercoaster. Between April 1 and May 2, 2025, prices for these critical elements saw abrupt swings, supply chains were tested by geopolitics […]