The Raw Steels MMI (Monthly Metals Index) increased 7% this month, reaching 92 points. This reading is the highest since June 2012. The skyrocketing MMI came as a result of sharp increases in steel prices, the Section 232 release and President Trump’s comments regarding imposition of a 25% steel tariff.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

Steel price momentum strengthened in February, moving sharply up for all forms of steel. Steel prices have reached more than three-year highs. However, some forms of steel are now even higher. Domestic HRC prices, currently at $762/st, haven’t seen these levels since June 2011.

[caption id="attachment_90758" align="aligncenter" width="580"]

Based on the long-term analysis, steel prices will likely continue to rise this year. Even if the seasonality for steel prices returns in Q2, steel price momentum appears strong.

Let’s Talk Spreads

Section 232 — and the price uncertainty it has unleashed — requires metal-buying organizations to pay more attention to what is called the spread. The spread refers to the price delta between domestic HRC and CRC prices and the spread of each with Chinese prices. Analyzing and understanding these spreads helps to determine by how much mills could increase steel prices (as well as how high they can go).

So, let’s take a look at some examples.

The Domestic HRC-CRC Spread

As with all the other forms of steel, CRC prices also increased again this month. The upward movement remains strong, even if the amount of the increases — and therefore the slope of the upward trend — appears softer (less sharp).

This does not come as a surprise, as the spread between CRC and HRC prices was extremely high. Now, the spread between CRC and HRC prices has returned closer to historical levels.

[caption id="attachment_90759" align="aligncenter" width="580"]

It is important to understand where the spread comes from. CRC (cold rolled coil) is HRC (hot rolled coil) plus one additional rolling process. As per the chart above, from 2011 to 2016 the price spread between the two has been around $100/st (plus or minus).

At the end of 2016, buying organizations could see a $201/st spread between HRC and CRC prices. The spread started to decline at the beginning of 2017, and has increased further in 2018. The domestic spread is currently at $124/st, much closer to its historical levels. (MetalMiner covered domestic spreads in our free Annual Outlook Report published in October 2017.)

A higher spread creates better margins for domestic mills. From a buying perspective, the previous anomaly only helps a buying organization that has not contracted for all of its CRC purchases (and can play a price arbitrage game by purchasing HRC and paying to roll it to CRC).

Chinese Spread

Chinese demand has always been positioned as one of the main drivers of global steel prices. Check out the correlation in the graph below between the domestic HRC and Chinese HRC prices. When Chinese prices increase, U.S. domestic prices tend to increase, too. The same is usually true when prices fall.

[caption id="attachment_90760" align="aligncenter" width="580"]

Even if short-term events (such as the release of the Section 232 report or President Trump’s comments) add support to steel prices in one country, the general trends tend to correlate.

This is exactly what happened with U.S. HRC prices.

The latest increase in HRC prices here in the U.S. came as a result of the Section 232 uncertainty and the announcement of the tariff. Not surprisingly, so far this month, HRC prices in China increased after trading sideways last month. Therefore, watching price reactions in China makes sense in order to better forecast price trends in the U.S.

An analysis of the spread between Chinese and U.S. prices allows buying organizations to better understand the price impacts the tariffs could have on domestic steel prices. In other words, the spread tells us how much domestic prices could rise before it is better to import steel from China.

What This Means for Industrial Buyers

The strong upward momentum for steel, together with the Section 232 outcome and President Trump’s comments regarding steel tariffs, drove steel prices to more than three-year highs. Buying organizations who have concerns about the Section 232 impact on the steel industry may want to read our Section 232 Report.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Actual Raw Steel Prices and Trends

Tag: raw steels MMI

Raw Steels MMI: HRC Prices Hit Highest Level in More than Two Years

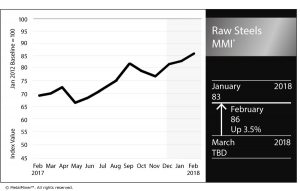

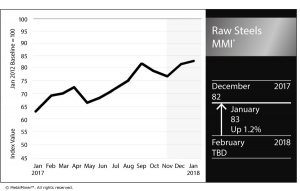

The Raw Steels MMI (Monthly Metals Index) inched three points higher this month, reaching 86 points.

Steel price momentum appears to have continued as prices increased sharply in January. February has already signaled a continuation of this uptrend, with HRC prices breaching the $700/st level. HRC prices have reached the highest levels in more than two years and could continue to climb.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

[caption id="attachment_90232" align="aligncenter" width="585"]

The spread between HRC and CRC prices fell this past month, returning to the $140/st level. Since the beginning of 2016, the spread between HRC and CRC prices increased to around $200/st. The spread has returned to normal levels, with HRC prices increasing more than CRC prices.

President Trump has yet to release results from the Section 232 investigation. Commerce Secretary Wilbur Ross sent his Section 232 steel report to Trump last month; the president has 90 days as of Jan. 11 to act on the report’s findings and recommendations.

Global Steel Sector

According to the World Steel Association (WSA), global production of crude steel increased by 5.3% during 2017. The world map below reflects some of the changes in steel production by country and the impact on total steel output.

[caption id="attachment_90233" align="aligncenter" width="585"]

Chinese global production of crude steel increased by 5.7%. However, China’s exports fell to 75.4 million tons last year from the previous 108.5 million tons. Japanese production of crude steel decreased by only 0.1%, while U.S. crude steel production increased by 4%.

According to Eurofer, European steel demand could increase by 1.9%. In 2017, European steel imports fell by 1% due to defensive trade measures.

Shredded Scrap

Shredded scrap prices increased again in January, shifting the latest short-term downtrend to an uptrend. The long-term uptrend remains in place, and scrap prices have now moved together with U.S. steel prices.

What This Means for Industrial Buyers

As steel price dynamics showed a strong upward momentum this month, buying organizations may want to understand price movements to decide when to commit mid- and long-term purchases. Buying organizations with concerns about the Section 232 outcome and its impact on the steel industry may want to take a free trial now to our Monthly Metal Buying Outlook. Our Monthly Outlook will include a detailed analysis of the Section 232 outcome.

For more efficient carbon steel buying strategies, take a free trial of MetalMiner’s Monthly Outlook!

Actual Raw Steel Prices and Trends

Raw Steels MMI: Steel Picks Up Speed as Industry Awaits Section 232 Outcome

The Raw Steels MMI (Monthly Metals Index) jumped another 1.3% this month, reaching 83 points in January.

Steel momentum seems to have recovered this month. All forms of steel prices in the U.S. increased sharply. Steel momentum typically begins during the middle of Q4, but the increase occurred later this past year. January’s numbers also look bullish.

Benchmark Your Current Metal Price by Grade, Shape and Alloy: See How it Stacks Up

[caption id="attachment_89677" align="aligncenter" width="580"]

In the U.S. market, January will prove to be a decisive month.

The U.S. Secretary of Commerce Wilbur Ross has until mid-January to conclude his Section 232 probes and release a report to the Trump administration, after which the president has 90 days to act.

Shredded Scrap

The long-term shredded scrap price uptrend appears to have turned into a short-term sideways trend. Despite steel price increases in December, January scrap prices decreased.

[caption id="attachment_89678" align="aligncenter" width="580"]

Decreasing domestic scrap prices do not currently support steel prices. However, steel prices appear to be on a sustainable upward trend. Therefore, scrap prices could follow steel prices this month and continue their long-term uptrend.

Chinese Prices Still Strong

Chinese steel prices and U.S. prices usually tend to move similarly. Thus, when one reveals a strong upward or downward movement, the other could follow within that month.

Chinese prices were stronger than U.S. steel prices during November and December 2017. After the latest increase in U.S. steel prices, Chinese prices also continued rising.

[caption id="attachment_89679" align="aligncenter" width="580"]

Chinese steel prices have found support from the curtailment campaign in the country. Therefore, steel prices could continue increasing. Chinese Q4 GDP data, expected to show strength, also support Chinese steel prices. Chinese GDP data has come in over annual growth targets for the country.

What This Means for Industrial Buyers

As steel price dynamics showed a strong upward momentum this month, buying organizations may want to understand price movements to decide when to buy some volume. Buying organizations will want to pay close attention to Chinese price trends, lead times and whether domestic mill price hikes stick.

Buying organizations who have concerns about the Section 232 outcome and its impact on the steel industry may want to take a free trial now to our Monthly Metal Buying Outlook. Our February Monthly Outlook will include a detailed analysis of the Section 232 outcome.

Free Sample Report: Our Annual Metal Buying Outlook

Actual Raw Steel Prices and Trends