New China tariffs may soon change the country’s steel market tactics. China continues to sit on a stockpile of steel, and it has no idea what to do with most of it. The exception, however, seems to be dumping it into foreign markets for cheap under the guise of “exportation.” China remains unable to use […]

Tag: China

Subdued Market Reaction So Far to China’s Targeted 2024 Growth Rate

Investors, traders, and the metals community continue to anticipate fresh stimulus measures from China’s top leaders, which could potentially kickstart economic growth, increase metals consumption, and affect metal prices. However, they remain rather disappointed with Beijing’s target 5% growth for 2024. Moreover, demand has remained subdued since the Lunar New Year holiday. Almost everyone was […]

Rare Earths MMI: Is China Moving Down the Rare Earths Totem Poll?

The Rare Earths MMI (Monthly Metals Index) experienced a pretty significant drop month-on-month, falling 24.73%. Save for cerium oxide, all components of the index either fell or moved sideways. Weaker than anticipated downstream demand ended up hitting certain metals related to rare earth magnets particularly hard, causing a plummet in the index. Another significant factor […]

Indian Steel Demand Battles Influx of Chinese Imports

In July, India became a net importer of steel for the fourth time in the last year. And therein lies a tale of tariffs, changes in steel prices, and supply and demand. However, before discussing those issues, it’s important to revisit the facts. A recent report by India’s Steel Ministry revealed the country became a […]

China’s Iron Ore Imports Surge Despite Evergrande Crisis

The first month of 2024 saw iron ore kick-off to a strong start, mainly due to increasing prices and substantial imports by China. Looking at iron ore futures, many investors were optimistic that the world’s largest purchaser of ore would continue implementing sufficient stimulus measures to enhance demand. Iron ore is a critical ingredient in […]

Rare Earths MMI: Prices Drop, Huge Rare Earths Reserve Discovered in Wyoming

Month-on-month, rare earths prices exhibited sharp downward movement. While weaker downstream demand could potentially prove one culprit in the dropping prices, another potential factor is an increase in global rare earth production outside of China. If true, China could find itself bumped down the totem pole in terms of rare earth magnets dominance. Meanwhile, China’s […]

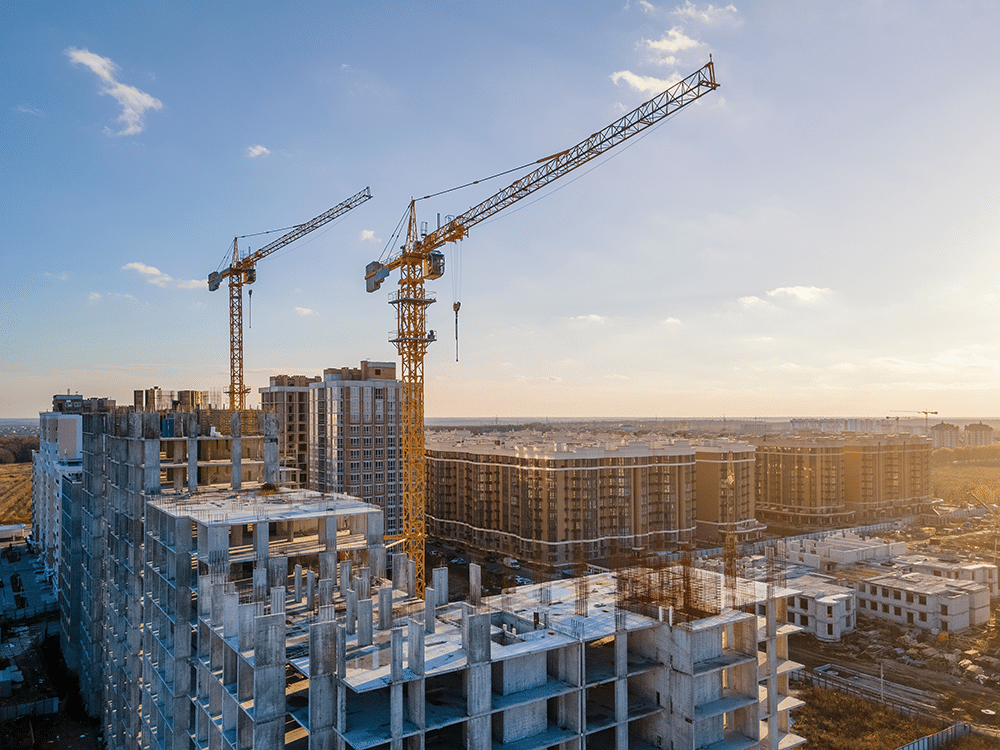

Construction MMI: U.S. Construction Industry Enters 2024 Lacking Skilled Craftsman

The Construction MMI (Monthly Metals Index) moved in a relatively sideways trend, only budging up 0.65%. Steel prices continuing to flatten out, along with bar fuel surcharges dipping in price, kept the index from breaking out of the sideways movement we’ve witnessed since December. As the index enters 2024, U.S. construction news continues to focus […]

Copper MMI: Copper Prices Remain Sideways as China Uncertainty Looms

Copper prices today remain trapped in a sideways range. Prices lack enough bearish or bullish momentum to establish a strong trend in either direction. Prices declined during the first weeks of January, falling to their lowest level since November. However, they rebounded in the second half of the month. This brought them a mere 0.52% […]

China’s Economic Jitters: Evergrande Liquidation Sparks Global Concerns

The recent liquidation order by a Hong Kong court of debt-ridden Chinese property giant Evergrande has once again raised that dreaded question: is China’s economy a ticking time bomb? It is a question experts continue to ask amid worsening Chinese construction news. Not long ago, two rival property construction firms, Evergrande and Country Garden, were […]

Copper Demand: Australian Exports to China Surge to Record High, Signaling Thaw in Relations

The frosty relationship between China and Australia continues to thaw, as evidenced in the bi-lateral trade indices indicate. Now, thanks to China’s growing copper demand, the world possesses one more indicator. According to recently released data, Australia exported 27,500 metric tons of copper ores and concentrates to China in November last year. At U.S. $44.5 […]