Automotive MMI: Automakers Scramble as Rare Earths Crunch and Tariffs Impact Supply Chains

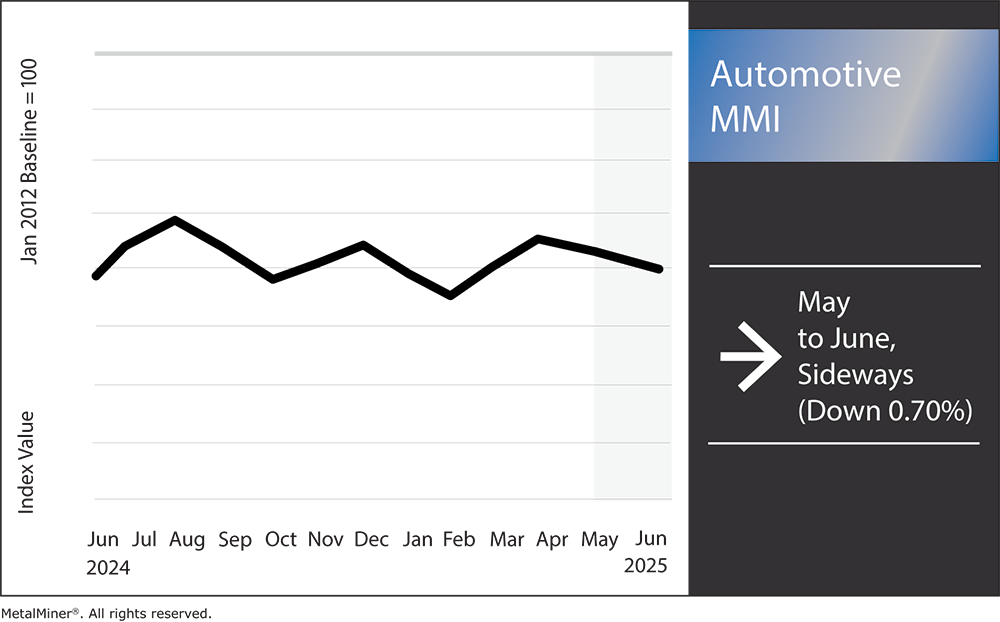

The Automotive MMI (Monthly Metals Index) moved sideways month-over-month, dropping by 0.70%. This comes as auto industry executives in the U.S. are confronting a whirlwind of trade and supply chain disruptions, not to mention the effects of the recent round of Trump tariffs.

In the past month alone, high-stakes U.S.–China trade talks, critical mineral export curbs and seesawing metal tariffs have shaken procurement strategies across the automotive sector. From rare earth shortages forcing factory shutdowns to volatile steel and aluminum costs pressuring budgets, the landscape is shifting daily. The good news? A tentative trade truce may be emerging.

Trade War Tensions Bring New Risks

Urgent closed-door negotiations ensued following China’s rare earths restrictions in April and May. In early June, U.S. and Chinese trade teams met in London and reportedly reached a handshake deal to resolve the impasse. China agreed to resume rare earth shipments in volume, while the U.S. signaled it might ease certain tech export curbs.

In fact, Beijing quietly began approving export licenses for key customers. According to sources at Reuters, China granted temporary rare earth export licenses to suppliers of GM, Ford and Stellantis, the top U.S. automakers. The tentative deal also implies a rollback of some punitive duties. After the so-called Trump tariffs began in the spring, duties on both sides had climbed into the double and even triple digits during the skirmish.

In one striking example, the White House more than doubled U.S. steel import tariffs from 25% to 50%. The goal was to pressure Beijing, but it inadvertently spiked domestic input costs. Now, with a 90-day truce in place, negotiators are expected to scale back the latest Trump tariffs in tandem with China loosening its mineral controls. For automotive procurement teams, any tariff relief on metals is welcome news that could potentially ease the price volatility for steel, aluminum and other key inputs.

Stay profitable even with shifting demand by aligning your sourcing strategy with expert-driven insights from MetalMiner’s weekly newsletter.

Automakers Switch Tactics in the Wake of Trump Tariffs

After the tariffs hit, automakers realized their exposure was frighteningly high. “The whole car industry is in full panic,” Reuters quoted one European magnet supplier CEO as saying. They went on to note that some car factories could be idled by mid-July without backup magnet supplies. In response, companies and governments are racing to diversify sources of both rare earths and base metals.

The industry’s answer is a mix of innovation and old-fashioned resource hunting. Many automakers have been investing in alternative materials and technologies to reduce their reliance on Chinese rare earths. Several major OEMs, including GM, BMW, Stellantis and suppliers like ZF and BorgWarner, are engineering electric motors that require little to no rare earth content, while others are exploring novel magnet compositions or even rare-earth-free speakers and sensors.

Automakers Diversify Supply Chains, Forge Deals

At the same time, Western firms are forging new supply lines. Mining projects for rare earths are springing up from Nebraska to Australia. Even recycling is part of the solution. Reuters reports that companies like Heraeus in Germany are currently trying to reclaim rare earths from used magnets, albeit on a small scale. Automakers are also directly investing upstream in base metals needed for electric vehicles.

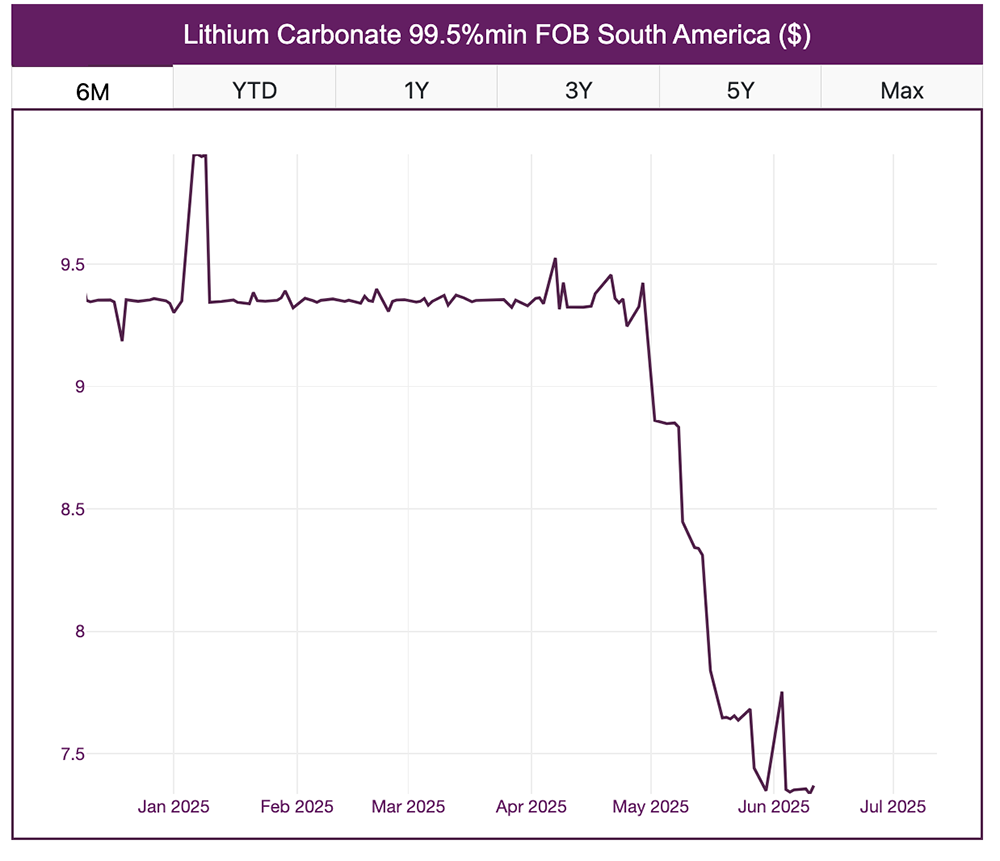

In one recent example, Volkswagen took a 9.9% stake in a Canadian lithium mining firm to secure a 10-year supply of battery-grade lithium. Earlier, GM committed $650 million to develop the largest U.S. lithium deposit in Nevada, as covered in mining.com. These deals signal a new era of vertical integration, where carmakers act more like miners to ensure they have the raw materials to keep assembly lines running. For procurement professionals, the takeaway is clear: cast a wider net for suppliers and qualify alternative sources now, not when a crisis hits.

Concerned about overspending on all-or-nothing data packages? MetalMiner Select provides specific price intelligence for only the metals your company sources, enabling you to focus your investment on where it’s important, not unused data.

Manufacturing Impact: Shutdowns, Redesigns and Relocations

Amidst all this, automakers are scrambling to avoid line stoppages by redesigning products and shuffling manufacturing plans. For example, some companies are preparing to build cars minus certain components (such as speaker systems or sensor modules) and park them until parts arrive. This is very similar to what GM and others did during the semiconductor chip shortage. It’s a less-than-ideal workaround, but still better than no production at all.

Meanwhile, engineers are hard at work redesigning components to use fewer vulnerable materials. Notably, EV makers are experimenting with motor designs that cut out heavy rare-earth elements. These designs use alternative magnet materials or clever motor geometries to maintain performance without the usual dose of neodymium or dysprosium. These types of innovations could reduce exposure to future export bans. However, retrofitting existing vehicle platforms is costly and time-consuming.

Geopolitics is also prompting a geographic shuffle in manufacturing. With new U.S. tariffs hitting not just China but even friendly trade partners like Canada and Mexico, companies have an extra incentive to localize production in the United States.

Battling Input Volatility: Costs, Investments and New Tools

These disruptions come with a price tag. Input cost volatility has become a top concern for automakers’ finance chiefs as commodity prices whip around. Over just the past quarter, tariff announcements have caused benchmark steel prices to climb, dip and spike again. Aluminum and copper have seen similar swings amid shifting trade policies and global demand uncertainty. Such volatility can wreak havoc on vehicle profit margins, as raw metals account for a significant share of an automobile’s bill of materials.

Automakers are also doubling down on direct investments to secure supply and stable prices. We’ve seen car companies finance mining projects (lithium, nickel, copper, etc.) not just for supply security but to eventually procure those materials at negotiated, stable prices.

By investing in a lithium mine, an OEM might ensure it can buy lithium at a fixed formula cost for a decade, thus insulating itself from market gyrations. Similarly, some companies are setting up joint ventures for battery material processing, effectively bringing more of the supply chain in-house to control costs. Moves like these are akin to an insurance policy against future price volatility.

Prices Rise as Some Automaker Pass Along Costs

Perhaps the most straightforward strategy is simply passing costs down the line, which can mean renegotiating supplier contracts or adding surcharges to vehicle prices. Industry surveys indicate that new vehicle prices in the U.S. have ticked up in recent months, partly due to higher material costs stemming from the Trump tariffs being passed through. But there’s a limit to how much automakers can raise prices in a competitive market, especially as interest rates and vehicle affordability weigh on demand. Thus, cost containment and smarter purchasing remain paramount.

Need to audit your pricing for tariff compliance? Insights SV acts as a smart audit partner, highlighting discrepancies and ensuring accuracy.

Automotive MMI: Noteworthy Price Shifts

- Chinese lead prices moved sideways, dropping a slight 0.77% to $2,281.96 per metric ton.

- Hot-dipped galvanized steel prices dropped by 8.02% to $1,078 per short ton.

- Lastly, Korean 5052 aluminum coil premium over 1050 prices traded flat, remaining at $4.44 per kilogram.