The Stainless Monthly Metals Index (MMI) dropped 4.68% from February to March. Meanwhile, the price of Nickel also fell significantly. Does your company have a stainless buying strategy based on a recessionary market? Stainless Spot Pricing for Buyers U.S. cold rolled stainless steel import licenses remain depressed. Indeed, many importers appear apprehensive, as it remains […]

Tag: Ferrous Metals

NLMK La Louvière Mill to Stay Shuttered Until Summer

In steel news, Belgium’s NLMK La Louvière is unlikely to resume operations at one of its two hot rolling mills before summer in Belgium. NLMK shuttered the mill after a series of fires in late 2022 knocked it out. “One of the two lines does not work at all,” a source close to the plant […]

Construction MMI: Construction Industry Battles Labor Shortages & High Building Costs

The November Construction MMI (Monthly MetalMiner Index) dropped by 4.16%. The trend over the past 3-4 months reflects a more sideways market than a bullish one. However, October to November proved a particularly volatile month for the construction index. Meanwhile, fluctuating steel prices have put all eyes on China. The market remains plagued with widespread […]

ArcelorMittal Steel Manufacturing Suffers More Shutdowns

As markets prepare for more bad steel news, ArcelorMittal plans to idle one of two blast furnaces at its Fos-sur-Mer site in southern France. The Luxembourg-headquartered group stated on November 4 that the move was a direct response to current market conditions. “In a sharply deteriorated macro-economic context, coupled with a major impact from soaring […]

Chinese Steel Manufacturing Profitability Down 20%

Is it all doom and gloom for Chinese steel manufacturing? It’s hard to tell at the moment. Indeed, China finds itself in a precarious place financially. What’s more, a sizable section of global financial and stock analysts have predicted the crises will only get worse as the country prepares to face its toughest winter yet. […]

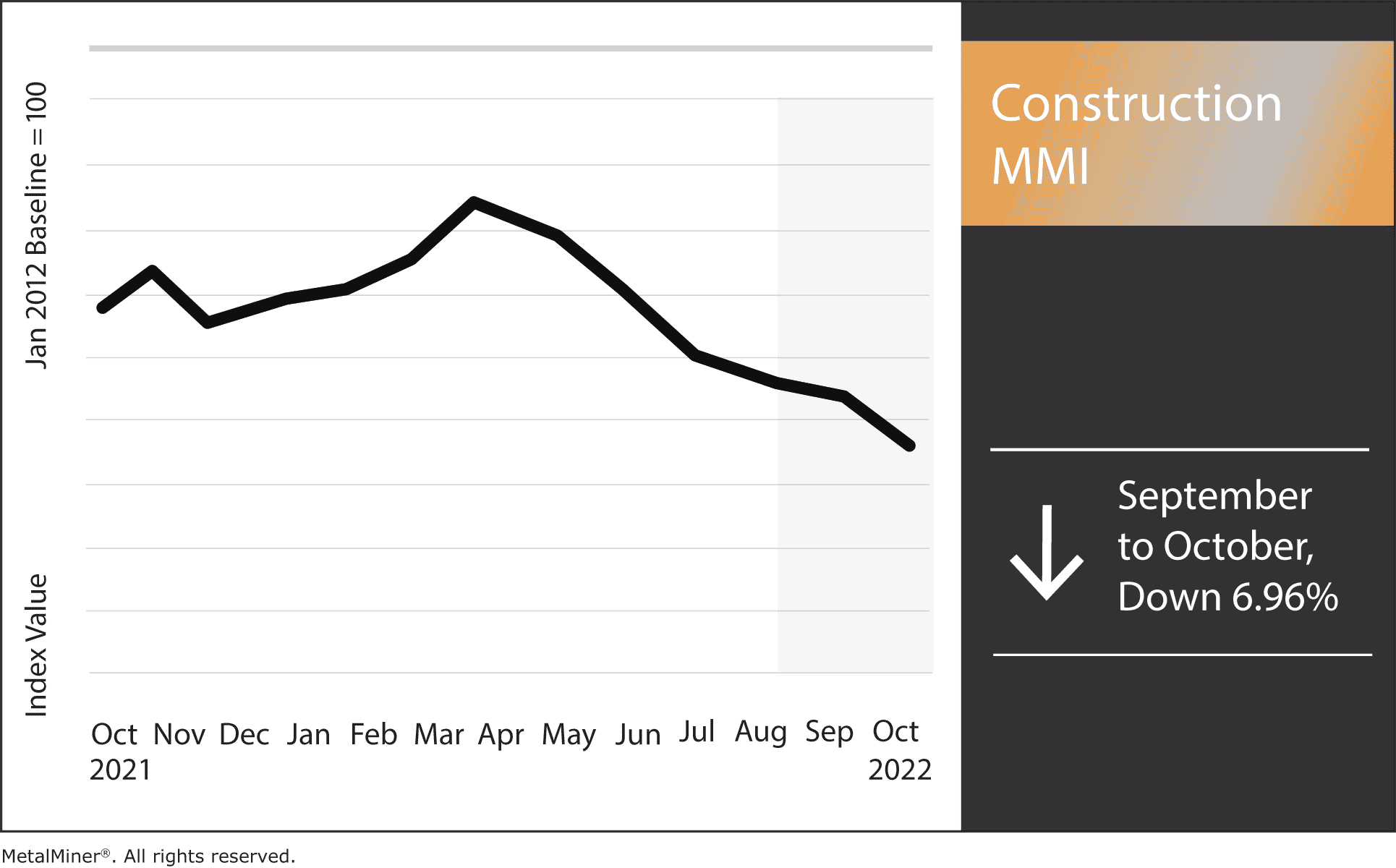

Construction MMI: High Interest Rates Haunt US Construction

The October Construction MMI (MetalMiner Monthly Index) dropped 6.96%. Not only did the construction cost index fall recently, but high interest rates have seriously impacted the US housing construction sector. Billings are on the rise in both the US commercial construction sector and on the consumer end. Meanwhile, new housing construction continues to cool due […]

Automotive MMI – Car Demand Growing, but Steel Supply Strained

The MetalMiner Automotive MMI (Monthly MetalMiner Index) dropped substantially in October, dipping by 9.08%. Manufacturing limitations due to energy shortages and smelter shutdowns remain the ongoing trend in car manufacturing. However, consumer demand for cars, especially in the US, still holds firm. This leaves many in the automotive industry trying to find a balance between […]

ArcelorMittal Doubles Down on Indian Steel Manufacturing

ArcelorMittal appears quite bullish on India. In fact, the company recently announced its intention to double steel manufacturing at one of its primary plants. ArcelorMittal-Nippon Steel India Ltd. (AM/NS India) plans to spend US $5.1 billion at its Gujarat plant in western India. Betting on strong growth in domestic consumption, the company hopes to boost […]

HRC and CRC Steel Prices Stagnate Amid Energy Crisis

Hot rolled coil steel prices in Western Europe remain largely unchanged since early September. However, as various market participants told MetalMiner, this is despite attempts by at least one steelmaker to increase them According to our sources, multiple factors continue to suppress demand for flat rolled products. These include a slowdown of public works programs […]

Low-Carbon Demand Could Positively Impact US Steel Prices

The Biden-Harris Administration today announced that they would “prioritize the purchase of key low-carbon construction materials, covering 98% of materials purchased by the Federal government.” As steel plants shutter around the world, this is a boon to U.S. manufacturers concerned about dropping steel prices. The announcement highlights the latest section of the “Buy Clean” initiative, […]