Renewables/GOES MMI: Steel Prices Rise, Experts Doubt Solar Energy Efficiency

After holding a pretty steady sideways trend since October, the Renewables MMI (Monthly MetaMiner Index) decreased by a considerable 8.56%. Indeed, multiple components of the index trended downward, including cobalt, neodymium, and silicon. Meanwhile, Chinese silicon costs continue to drop due to overcapacity. Other reasons for the drop included multiple silicon producers coming online and reduced trading volumes due to high prices in February. However, all of this contrasts with rising steel prices. Still, the positives proved insufficient to pull the index up instead of down month-over-month.

Recessionary times make it difficult to map out metal spending wisely, especially with spending freezes. Join MetalMiner’s free April workshop Squeezing out Costs in a Falling Demand Market. Sign up here.

High Interest Rates Squeezing Green Energy Initiatives, Plate Steel Prices Hold Steady

Renewable energy investors continue to face challenges due to higher interest rates and building costs. The sharp increase in interest rates has strained an industry already under pressure. Of course, steel is integral to producing solar panels and wind turbines. As a result, the renewables industry could see increased project delays and supply constraints. While silicon moves to more reasonable price levels due to supply abundance, climbing steel prices and high interest rates continue to put more strain on renewable energy projects.

However, this situation is still causing renewable energy investors to feel the heat tenfold. As a result, they continue to face increased difficulties in raising funds for their projects. That said, the revenue side is also increasing. This serves to help protect returns in a high-interest-rate environment. Ultimately, there returns could help balance out high construction costs and interest rates.

Are you under pressure to generate steel cost savings? Make sure you are following these strategies.

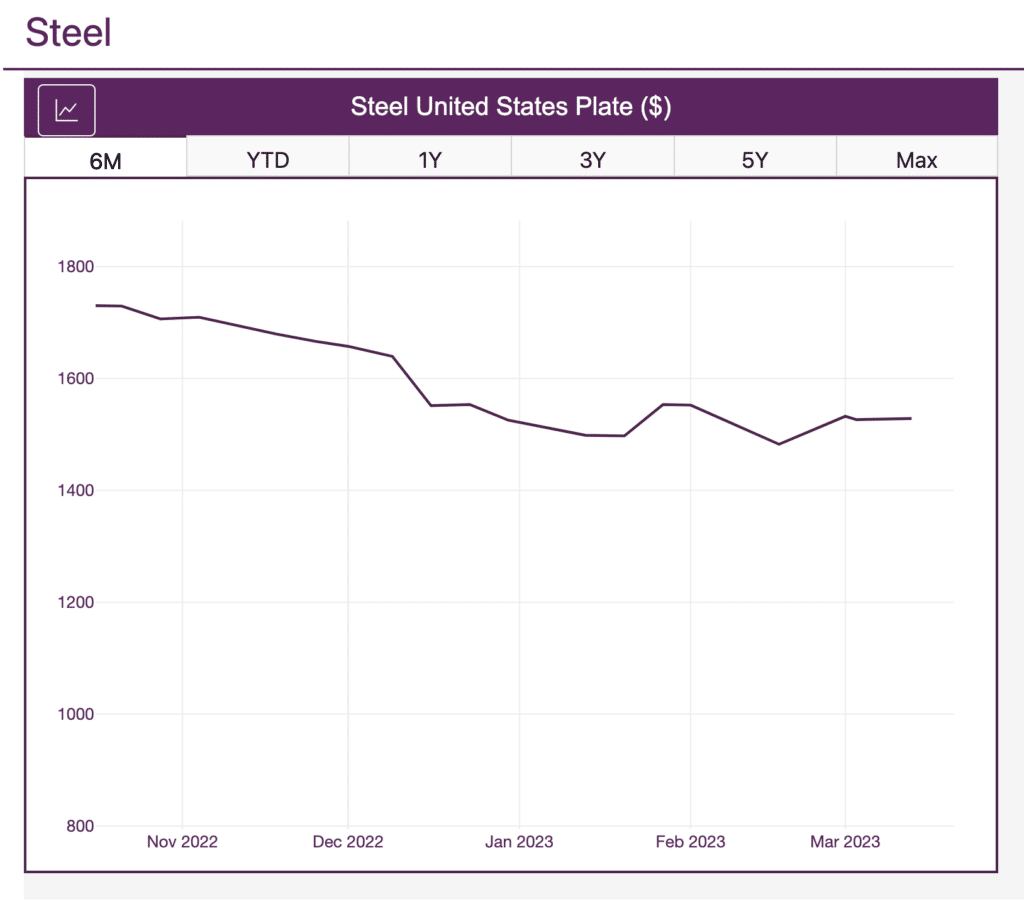

It’s true that rising steel costs could significantly threaten wind turbine production in the short term. However, prices for steel plate, one of the most commonly-used steel forms in the renewables industry, remain an outlier to HRC and HRC costs, which are currently soaring. For the moment, plate steel prices continue to move within a tighter sideways range than rolled steel forms. No doubt, this could provide some relief for wind turbine producers.

Solar Renewable Resources Facing Challenges

The solar energy industry still faces abundant challenges. One of these issues is rising costs due to skilled labor shortages caused by COVID-19. Another issue solar energy continues to fight is inconsistency in the amount of sunlight. The sun must be out for a specific amount of time for panels to gather enough energy stores to satisfy current energy demands. This becomes more realistic in places like Southern California, where sunshine is abundant. However, states further to the north have longer winter days with less sunlight, or more diverse weather patterns which impact sunlight. In these instances, relying on solar power alone is far less practical.

However, there are still incentives for investing in solar energy, such as those provided by the Inflation Reduction Act. In addition, silicon prices continue to drop, making manufacturing solar panels more cost-effective. Despite this, solar power must still prove they can meet current energy demands.

A recent article revealed an experimental project conducted by SUNLAB team at the University of Ottawa. The team proposed placing solar panels with two faces, AKA double-sided solar panels. SUNLAB says that the second panel could react to various ground textures, such as snow, grass, and soil. Indeed, this would allow them to consider how different conditions affect sun illumination.

Steel prices and other commodity markets are constantly shifting. Get all of the latest updates with MetalMiner’s weekly newsletter.

Will Solar Curb Significant Levels of Carbon Emissions?

Despite advancements, it is important to consider whether this improved solar technology can really rise to meet global energy demands in a reasonable amount of time. Moreover, can it really add to the growing green energy movement in a way that meets zero-carbon goals? Current estimates indicate that solar technology will meet about 16% of global energy demand by 2050. While the percentage seems impressive, it is a far-off goal, 25+ years down the line. At the moment, even the most efficient solar panels can only convert about 23% of captured sunlight into energy. And while 25 years leave a lot of time for solar energy to advance, solar needs to become much more efficient to significantly lessen global reliance on carbon emissions.

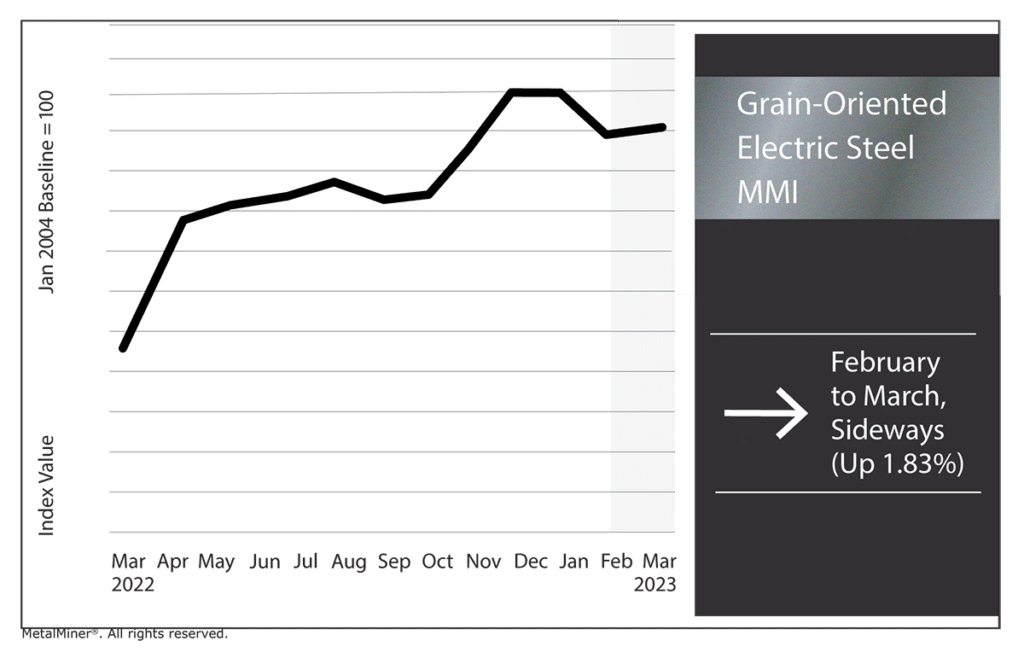

GOES MMI: Prices Edge Sideways

The GOES MMI (Monthly MetalMiner Index) trended sideways, rising a mere 1.83%.

Looming Global Recession Impacting Energy Markets

While steel prices for HRC and CRC are spiking, numerous other metal types are trending down. Many factors continue to work to keep metal markets volatile, and a looming global recession is no exception.

Government mitigation strategies have sharply curtailed fossil fuel usage and the demand for conventional energy due to reduced economic activity. Therefore, price signals remain essential to meet energy demands and stimulate supply. There are many concerns about energy prices and supply shortages affecting the global economy. However, it remains unclear whether they have an impact on current energy demands or not. For instance, global oil and natural gas price spikes historically result in turmoil in energy markets. Such shocks help drive domestic inflation, as witnessed over the past year. While energy is a high-demand industry, it’s still not bulletproof. The energy market, along with countless other markets, could face serious threats in the face of a global recession.

Renewables MMI: Notable Moves for Steel Prices, etc.

- US grain oriented electrical steel coil traded sideways, inching up by 1.83%. This left prices at $4741 per metric ton.

- US steel plate prices traded sideways, reaching $1532 per short ton.

- Chinese silicon dropped by 2.97%, bringing prices to $2505.82 per metric ton.

- Finally, Chinese cobalt prices dropped a staggering 13%, leaving prices at $38,965.33 per metric ton.

Recessionary times make it difficult to map out metal spending wisely, especially with budget cuts. MetalMiner Insights significantly reduces this risk by providing metal price forecasting and advice about when and when not to purchase metal. Schedule a consultation here.

Leave a Reply