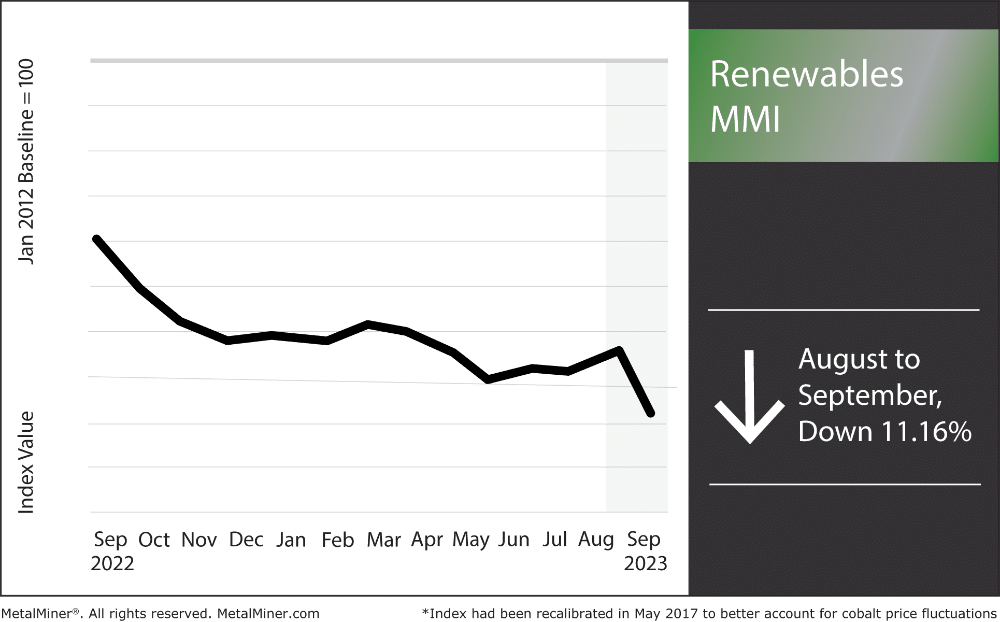

Renewables MMI: Grain-Oriented Electrical Steel Prices Skyrocket

Month-over-month, the Renewables MMI (Monthly Metals Index) ended up dropping significantly by 11.16%. The main culprit for this was cobalt prices dropping significantly in August, despite prices flattening again in the beginning of September. Steel plate prices also found support as of September 6th. Most other components of the index moved sideways or slightly up, including silicon. Despite supply abundance for silicon, China’s economy managed to rebound, thus adding support to silicon prices. However, many factors remain at play for commodity prices regarding China’s economy. Mexico recently picked up commodity production, making it another alternative to Chinese sourced metals like steel. India also continues to ramp up its own steel production and imports. This could potentially impact the renewables index for materials like steel plate used in wind turbine production.

China’s Economic Rebound: Impact on Commodity Prices

Within the past 10 years, China’s economy witnessed periods of rapid growth followed by slowdowns and even deflation. However, in the past few months China’s economy exhibited signs of a resurgence. The pricing of commodities have been significantly impacted by this. Infrastructural expenditure by the government grew, and consumer spending also recovered (to grapple with these market shifts, read The 5 Best Cost-Saving Sourcing Tactics). However, there are worries that China’s economic recovery will prove fleeting given the country’s pressing issues, such as a debt problem, the housing collapse, and a lack of stimulus.

Many countries, including emerging markets, are highly correlated with commodity prices along with China and could potentially alter global commodity prices. India and Mexico, for example, recently stepped up and filled in certain pitfalls in the global economy that China’s slumping economy left open. This means that China might not remain the 800-lb gorilla in the room moving commodity prices. What does this mean for renewable energy materials like steel plate?

Get all of the steel plate price forecasts and purchasing strategies you need for 2024 on MetalMiner Insights. Learn more.

China’s Long-Term Outlook and Other Global Players in the Steel Plate Market

China’s recent economic recovery will provide short-term support for steel plate prices, especially for the development of wind turbines. Currently, steel plate accounts for about 90% of the materials required for offshore wind turbines, making it a significant cost driver for wind projects. This, in turn, represents the installation costs for offshore wind projects, amounting to approximately 40% of the total cost.

The question remains if this recovery will continue and whether this fresh support will bring more bullish sentiment to steel plate prices in the long-term. Some factors to consider:

- Experts predict that Chinese steel prices shall continue declining until 2024, mainly thanks to slowing demand and over capacity.

- In January 2023, China Steel Corp raised the cost of cold-rolled coils and hot-rolled plate steel by NT $500 to NT $1,000 per tonne.

- China Steel Corp raised domestic steel prices up to NT $1,200 per tonne for delivery in March 2023.

- Steel makers are now trying to raise up steel prices to keep bullish sentiment. However, these costs will likely not be accepted by the consumer/end-user.

It remains hard to say if China’s economic recovery will provide long-term support to steel plate prices, especially in correlation to wind projects in the US. Even though local steel prices have recently increased, China Steel Corp. have also experienced sudden price drops in the past. Moreover, other players like India and Mexico are making progress in the global steel trade sector. This suggests that these nations now possess more capacity to impact steel prices and demand worldwide.

MetalMiner’s 2024 Annual Metals Outlook releases this week. Get the full scope of 2024 industrial metal price forecasts, sourcing strategies and contracting mechanisms to maximize ROI.

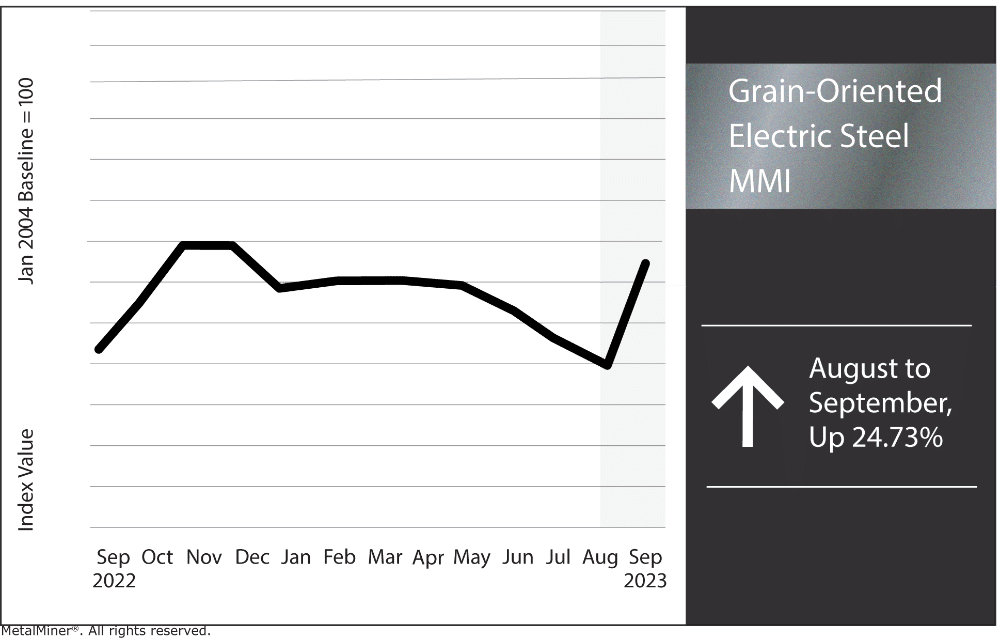

Grain-Oriented Electrical Steel MMI

The GOES MMI witnessed a significant price boost, rising a grand total of 24.73% month-over-month. China’s newfound economic growth aided the index in rising. The GOES market struggled throughout Q1-Q2 with fluctuating demand, China’s weak economy, bank collapses and high construction costs. With inflation cooling and China’s momentary recovery, it seems prices have discovered newfound support. However, construction cost still remain high in the US, along with interest rates which the Fed hasn’t begun lowering. Therefore, the battle for long-term bullish sentiment continues.

MetalMiner covers a full range of grain-oriented electrical steel and non-oriented electrical steel price forecasts and sourcing strategies. Learn more.

Renewables/GOES MMI: Biggest Price Shifts

- Chinese neodymium rose in price by 5.54%, leaving prices at $84,374.87 per metric ton.

- Chinese cobalt cathodes dropped catastrophically by 20.91%, dropping prices from $46,838.73 per metric ton to $37,042.63 per metric ton.

- Chinese silicon prices moved sideways, moving up a mere 2.98% which brought prices to $1,858.99 per metric ton.

Leave a Reply