Construction MMI: Construction Market Braces Itself as Recession Fears Loom

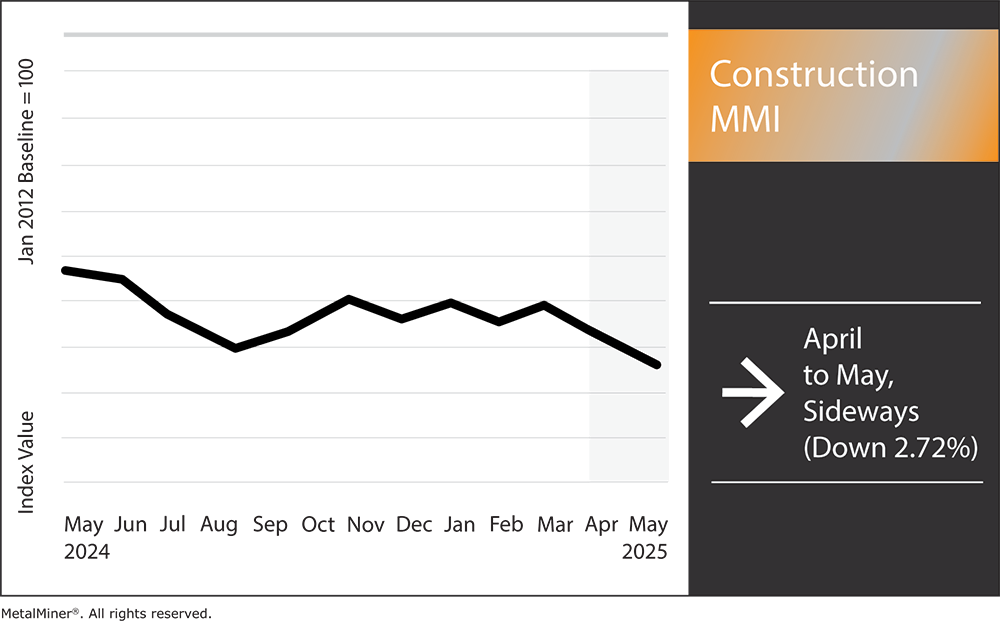

The Construction MMI (Monthly Metals Index) moved sideways month-over-month, dropping by 2.72%. In the wake of fresh federal policy moves this spring, construction news reports indicate that the industry is navigating a sudden spike in material costs. Over the past month, new government tariffs and trade measures have caused significant price fluctuations in critical inputs like H-beam steel, rebar and aluminum.

Steel Tariffs Send Shockwaves Through Building Sector

For construction staples like structural beams and reinforcing bar, recent policy shifts delivered an immediate jolt. Suddenly shielded from some foreign competition, domestic steel mills wasted no time hiking prices. U.S. steel beam prices jumped as buyers absorbed a $35 per ton increase in March and another $25 in April.

Exporters from Turkey, South Korea and Mexico managed to retain their U.S. market share by splitting the tariff costs with buyers, with traders eating about half the 25% levy and passing along the rest. In other words, the market continues to find creative ways to adapt. For instance, overseas suppliers are cutting deals to soften the tariff blow, preventing a complete cutoff of imported steel.

The latest construction news indicates that rebar is seeing a similar trend. Domestic rebar producers initially raised prices about $40/ton in February when tariff plans emerged. However, they gave back some of those gains in April amid lukewarm demand. Even so, industry indexes show U.S. rebar costs hovering well above last year’s levels, with some reports citing double-digit percentage increases since the tariff announcements.

Construction news and metal prices go hand in hand. Stay ahead of unpredictable price swings and make smarter sourcing decisions by subscribing to MetalMiner’s weekly newsletter.

Aluminum Prices Turn Volatile

Steel isn’t the only metal feeling the pinch. Aluminum costs have also experienced massive fluctuations following the tariff shake-up. In March, the U.S. Midwest aluminum premium, a key benchmark for physical aluminum prices, surged nearly 20% in a single day. By early April, that premium was over 70% higher than at the start of the year, reflecting the new import costs being effectively baked in.

Construction news reports indicate that aluminum producers are passing on as much of the tariff cost as they can, and buyers are feeling the burn in everything from window frames to HVAC ducting.

MetalMiner Select offers customized forecasts to your company’s needs, allowing you to pay only for the metals that impact your bottom line, giving you more financial control.

Construction Firms Feel the Squeeze

For contractors and developers, these material cost spikes are hitting the bottom line. As a result, some builders are fast-tracking purchases of critical materials to lock in prices before the next price rise. While such stockpiling efforts have the potential to strain cash flow, they also provide a hedge against further increases.

Ultimately, contractors face a dilemma: absorb the higher costs and eat into already thin margins or pass them along to clients via change orders and higher bids. Industry observers warn that if these elevated costs persist, we could start to see project delays or even cancellations. Already, uncertain pricing and supply chain disruptions are making some owners hesitate to green-light new projects.

Early-stage projects are especially at risk. For example, a developer might pause a planned high-rise condo until there’s more clarity on steel prices. Dodge Construction Network reports that projects are already taking longer to move from planning to groundbreaking, a trend now exacerbated by tariff-related jitters.

Recession Fears Also Cloud the Outlook

Compounding the materials crunch are broader concerns of a looming recession. In recent weeks, a slew of economic signals and forecasts have turned more pessimistic. Stubborn inflation and past interest rate hikes have already cooled some sectors, and now the bond market and many economists are flashing warning signs about a 2025 downturn. According to a Reuters analysis, the odds of the U.S. entering a recession by the end of this year have jumped to about 50% (up from 40%).

There is also lingering uncertainty around future trade policy. After all, the tariff roller-coaster isn’t necessarily over. As of April, the administration floated the idea of expanding tariffs to even more materials and countries. This includes a possible extra 25% duty on imported copper and lumber and a broad 25% tariff on all European Union goods.

The uncertainty extends to the ongoing U.S.–China spat. Negotiators have yet to resolve the disputes that prompted the initial tariffs, and if talks falter, even higher tariffs or prolonged duties are on the table. For an industry that thrives on predictability, this mix of economic anxiety and policy unknowns has construction taking a more defensive stance.

Not all Doom and Gloom

Amid the flurry of troubling construction news, some positives remain. For instance, order books are robust, infrastructure projects are forging ahead (often with “Buy America” mandates that favor domestic producers), and if a recession does hit, the hope is it will be mild.

Moreover, if inflation continues to ease, the Federal Reserve might cut interest rates later this year, which could relieve some financing pressure on construction projects. However, construction leaders are playing it safe for now. This means keeping an eye on Washington policy moves, hedging against commodity swings and ensuring contingency plans are in place.

Construction News: Noteworthy Metal Price Shifts

Construction news is just part of the story. MetalMiner Insights covers price points, correlation charts and price forecasting for a full suite of industrial and precious metals. See our full metals catalog.

- Chinese H-beam steel prices dropped by 7.2% to $390.78 per metric ton.

- Chinese steel rebar prices moved sideways, dropping by 0.61% to $467.40 per metric ton.

- Lastly, European aluminum commercial 1050 sheet prices moved sideways, dropping by 1.29% to $3,211.81 per metric ton.