Construction MMI: New 50% Aluminum and Steel Tariffs Squeeze U.S. Construction

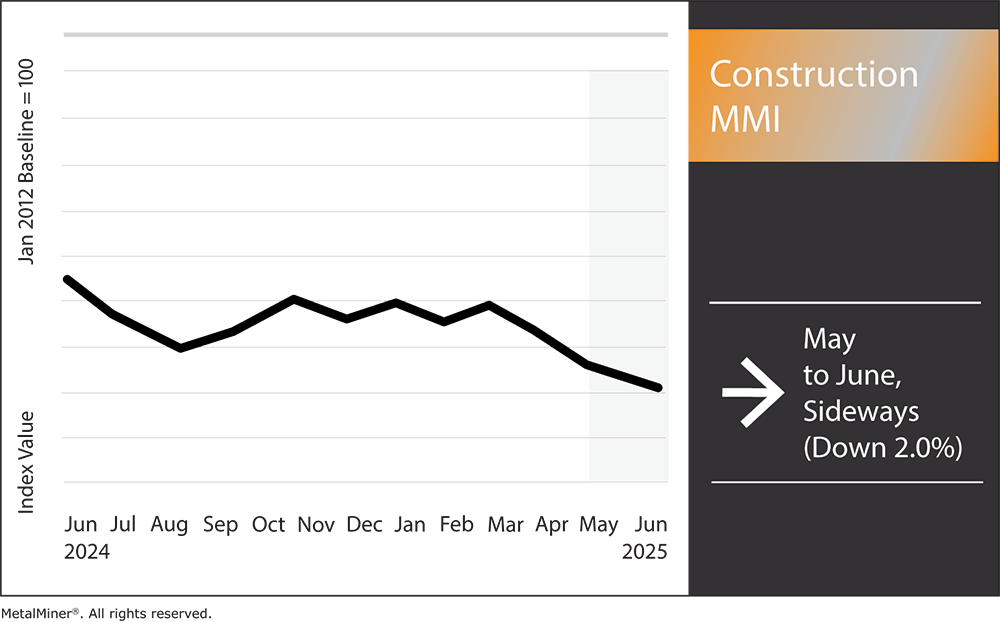

The Construction MMI (Monthly Metals Index) moved sideways, dropping by 2.0% month-over-month. In early June 2025, new Trump tariffs doubled pre-existing steel and aluminum duties from 25% to 50%. As buyers scrambled, U.S. aluminum premiums immediately hit a record 60¢/lb. Meanwhile, the tariff surge is already squeezing the U.S. construction industry.

Construction Input Inflation

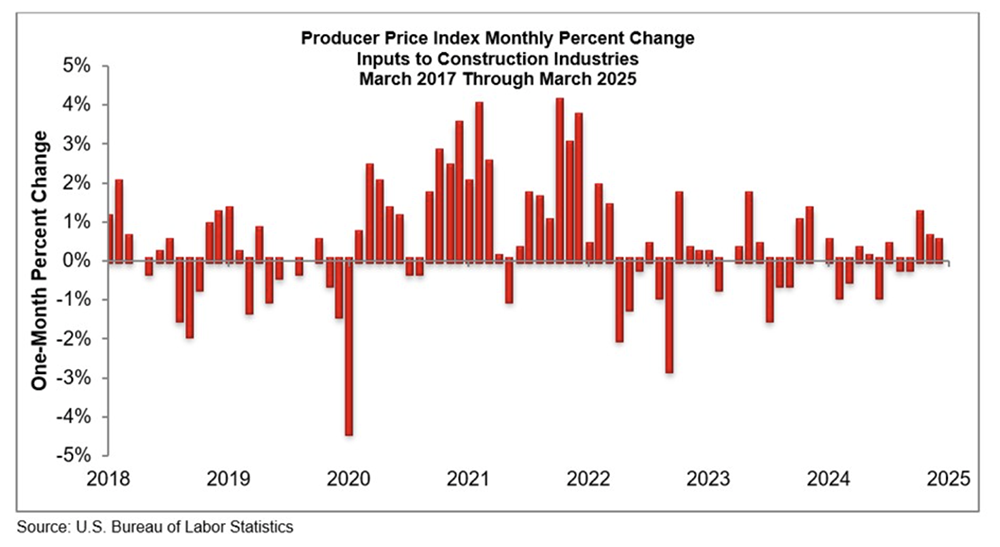

Construction material costs continue to rise alongside mounting pressures from Trump tariffs. According to the Associated Builders and Contractors, March 2025 marked the third month of increased input prices in the U.S.

Steel saw the sharpest climb, with iron/steel and steel mill product prices increasing by more than 5% during the month. Other key materials like copper and lumber also experienced significant price jumps as tariffs further strained supply chains.

Steel & Aluminum Tariff Surge

As detailed in the official proclamation, the new 50% tariffs target virtually all steel and aluminum imports. The White House notes that most U.S. steel (26.2 million tons in 2024) is imported, so duties of this magnitude guarantee higher domestic prices.

For metal buyers, it’s critical to respond proactively. One recommended step is leveraging expert analysis: MetalMiner just published a free “Comprehensive Guide to Steel & Aluminum Tariffs” that decodes the impact of these changes. That guide offers detailed scenarios and strategies so procurement teams can start planning how to mitigate the surging tariffs and protect margins.

Industry Outlook

Looking ahead, demand for steel and aluminum should stay firm on active projects. However, cost pressure will slow some new work. In May, ABC reported U.S. construction backlog easing to 8.4 months (off a 2-year high). Meanwhile, nearly 25% of contractors have delayed or canceled projects due to tariff costs.

Private-sector construction (especially homebuilding) will likely soften under these higher material costs, even as federal infrastructure spending holds up activity. Still, roughly 60% of contractors expect sales to rise over the next six months, fueled by work already in hand.

Our view is that pipelines will keep moving this summer, but with tighter margins. Procurement teams should lock in supplies for critical materials now and explore alternatives (for example, expanded Canada/Mexico quotas or substituting specialty alloys).

Data-driven sourcing is key. This means using live price charts and forecasts to compare contract bids against market trends. That way, you can negotiate smarter and avoid surprises.

Stay on top of metal market changes, Trump tariffs and global economic shifts that directly impact your metal purchases by opting into MetalMiner’s weekly newsletter.

Macro & Policy Trends

Beyond construction, the broader economy shows signs of cooling. U.S. manufacturing contracted for a third straight month in May (ISM PMI 48.5), with many survey respondents explicitly flagging steel and aluminum cost shocks. Meanwhile, delivery times are lengthening as suppliers adjust to the uncertainty. In this environment, information is critical.

Construction MMI: Noteworthy Price Shifts

- Chinese steel rebar prices moved sideways, rising by 2.53% to $479.22 per metric ton.

- Chinese H-beam steel prices moved sideways, dropping by 0.6% to $393.12 per metric ton.

- Chinese aluminum bar prices traded flat, remaining at $2,962.63 per metric ton.

- Lastly, European commercial aluminum 1050 sheet prices also moved sideways, dropping by 2.88% to $3,119.35.