This morning in metals news, Pittsburgh-based U.S. Steel announced it plans to restart a blast furnace facility in Illinois, Trump talks tough to E.U. and Chile’s trade surplus is powered by strong copper exports. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook U.S. Steel to Restart Illinois Operations U.S. Steel announced this […]

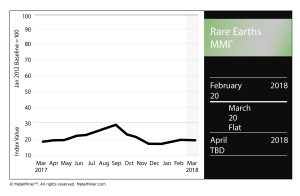

Rare Earths MMI: Toyota Develops Neodymium-Reduced Magnet

The Rare Earths MMI (Monthly Metals Index) held steady, notching a reading of 20 for our March MMI.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

Within the basket of metals, Chinese yttrium dropped slightly, while terbium metal picked up in price.

Europium oxide also dropped slightly, while dysprosium oxide picked up an extra dollar per kilogram.

New Toyota Magnet Not Dependent on Some Rare-Earth Minerals

According to a report by Ars Technica, a new magnet developed by automaker Toyota will not be dependent on some key rare-earth minerals.

Toyota announced it had invented a magnet — for application in electric vehicles — that uses much less of the rare-earth mineral neodymium. According to Toyota, it had developed “the world’s first neodymium-reduced, heat-resistant magnet.”

Of course, cost is a major restraining factor when it comes to electric vehicle (EV) growth. Materials needed for EV batteries, like neodymium, are costly, and many battery makers have sought to reconfigure the percentages of metals used in their batteries to phase out more cost-prohibitive materials (like cobalt, for example).

In addition to reducing the use of neodymium, the new magnet also completely phases out two other rare earth minerals.

“The newly developed magnet uses no terbium (Tb) or dysprosium (Dy), which are rare earths that are also categorized as critical materials necessary for highly heat-resistant neodymium magnets,” according to the Toyota statement. “A portion of the neodymium has been replaced with lanthanum (La) and cerium (Ce), which are low-cost rare earths, reducing the amount of neodymium used in the magnet.”

According to the announcement, the new magnet reduces the amount of neodymium used by as much as 50%.

Europium Market to Hit $308.9M by 2025

The global europium market is set to hit a value of $308.9 million by 2025, according to a recent report by Reportbuyer.

According to the report, consumer electronics, automotive, semiconductors, and energy and mining are the sectors leading the charge in the growth of europium.

Want to see an Aluminum Price forecast? Take a free trial!

Actual Metal Prices and Trends

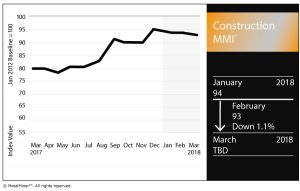

Construction MMI: Spending Flattens as Industry Awaits Tariffs Decision

The Construction MMI (Monthly Metals Index) dropped one point this month, falling to 93 for our March reading.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

Within the basket of metals for the Construction MMI, Chinese rebar and H-beam steel prices dropped on the month. Meanwhile, U.S. shredded scrap steel rose 8.4% on the month, while European commercial 1050 sheet fell 3.0%.

Chinese aluminum bar also fell, dropping 1.0% month over month.

U.S. Construction Spending

Construction spending during January 2018 was estimated at a seasonally adjusted annual rate of $1,262.8 billion, up minimally from the revised December estimate of $1,262.7 billion, according to the Census Bureau.

The January figure, however, was up 3.2% from January 2017’s $1,223.5 billion.

Under the umbrella of private construction, residential construction was at a seasonally adjusted annual rate of $523.2 billion in January, 0.3% above the revised December estimate of $521.8 billion. Nonresidential construction was at a seasonally adjusted annual rate of $439.6 billion in January, 1.5% below the revised December estimate of $446.2 billion.

As for public construction, the estimated seasonally adjusted annual rate of public construction spending was $300.1 billion, 1.8% above the revised December estimate of $294.8 billion.

Within that, educational construction was at a seasonally adjusted annual rate of $76.7 billion, 2.1% above the revised December estimate of $75.2 billion. Highway construction was at a seasonally adjusted annual rate of $92.6 billion, 4.4% above the revised December estimate of $88.8 billion.

Construction and Tariffs

Just like other metal-using sectors, the construction industry would also be impacted by President Trump’s announced steel and aluminum tariffs (especially steel).

Trump’s announcement came just over a month after Trump proposed $1.4 trillion in infrastructure investment over 10 years.

For a construction industry that saw spending flatten in January, a rise in materials costs would not be great news, should the tariffs become the law of the land.

According to Philip Gibbs, an analyst at KeyBanc Capital, the tariffs might give steel stocks a short-term “sugar high,” he told Reuters, but that unsustainable pricing could eat into demand from manufacturers.

The National Association of Homebuilders (NAHB) came out against the tariffs proposal, with the association’s chairman saying the tariffs would hurt consumers and make housing less affordable.

“It is unfortunate that President Trump has decided to impose tariffs of 25 percent on steel imports and 10 percent on aluminum imports,” said Randy Noel, chairman of the NAHB. “These tariffs will translate into higher costs for consumers and U.S. businesses that use these products, including home builders.

“Given that home builders are already grappling with 20 percent tariffs on Canadian softwood lumber and that the price of lumber and other key building materials are near record highs, this announcement by the president could not have come at a worse time.”

Of course, the metals world is still in wait-and-see mode regarding the tariffs, which have yet to become actual law.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Actual Metal Prices and Trends

This Morning in Metals: Nucor CEO Says Tariffs Treat Other Countries ‘How They Treat Us’

This morning in metals news, Nucor CEO John Ferriola weighed in on President Trump’s tariffs proposal, embattled Kobe Steel admits that its data fraud traces back more than five decades and Shanghai zinc has a tough day. Buying Aluminum in 2018? Download MetalMiner’s free annual price outlook ‘How They Treat Us’ As the world waits […]

Automotive MMI: Sales Lag, Auto Stocks Drop After Tariffs Announcement

The Automotive MMI (Monthly Metals Index) stood pat this past month, holding at 100 for the second consecutive month.

Within the basket of metals, U.S. HDG steel rose 5.8% on the month, while U.S. shredded scrap steel jumped 8.4%. Palladium continues to outpace platinum — atypical of the two metals’ historical relationship — and Chinese primary lead dropped 3.8%.

Section 232 buying strategies – grab your copy of MetalMiner’s Section 232 Investigation Impact Report for only $74.99!

Meanwhile, LME copper continued to cool off, dropping 3.5% month over month as of March 1.

U.S. Auto Sales

February was a slow month for a lot of U.S. automakers.

General Motors saw its U.S. sales drop 7.0% year over year, while its year-to-date sales (i.e. through the end of February) are down 3.2%, according to recently released Autodata Corp sales data.

Ford Motor Company, too, had a slow month, posting a 6.8% drop year over year and a 6.6% year-to-date decline.

Fiat Chrysler‘s numbers dropped 1.4% year over year and are down 6.8% in the year to date.

Toyota, on the other hand, had another good month in 2018, posting a 4.5% increase year over year. Toyota’s sales are up 10% in the year to date. Volkswagen also had a strong month, increasing 8.4% year over year and 7.7% in the year to date. Albeit on smaller volumes, Mitsubishi (18.8%) and Mazda (12.7%) also managed strong year-over-year sales jumps in February.

Light trucks continue to be a favorite in the U.S. market. Light truck sales jumped 3.8% year over year, and are up 5.9% in the year to date. Meanwhile, sales of passenger cars dropped 12.6% year over year last month, and their year-to-date sales have dropped 11.9%.

Tariffs Talk

President Donald Trump’s announcement Thursday that his administration plans to impose tariffs of 25% on steel imports and 10% on aluminum imports have sent shock waves throughout the world. Downstream producers, trading allies (like Canada and the European Union) and even U.S. politicians have expressed the hope that the president might reconsider. (For the MetalMiner team’s full analysis of the Section 232 announcement, visit our dedicated Section 232 Investigation Impact Report page).

Naturally, downstream producers, including major automakers, reliant on imports of steel and aluminum are apprehensive. In the marketplace, investors are apparently feeling the same way.

As CNBC reported, a number of automakers saw their stocks drop after Trump’s announcement (which has yet to be officially enacted as policy). GM closed 4% lower, while Ford and Toyota closed 3% lower apiece, according to the report.

The U.S. Motor and Equipment Manufacturers Association (MEMA) came out in strong opposition to the tariffs proposal.

“The tariffs announced today will be detrimental to the motor vehicle parts supplier industry and the 871,000 US jobs it directly creates,” said Steve Handschuh, MEMA president and CEO, in a prepared statement. “We have voiced repeatedly that while we support the administration’s focus on strong domestic steel and aluminum markets, tariffs limit access to necessary specialty products, raise the cost of motor vehicles to consumers, and impair the industry’s ability to compete in the global marketplace. This is not a step in the right direction.”

While those in the steel and aluminum industries have argued price increases that would arise as a result of the tariffs would not be severe, downstream producers, including automakers, have balked at that suggestion.

In another policy arena, the tariffs announcement also has an effect on the ongoing renegotiation talks focusing on the 24-year-old North American Free Trade Agreement (NAFTA). Throughout the proceedings, which began last August and have now gone through seven rounds, the U.S. has sought to win tighter rules on rules of origin for automotive materials, among other concessions.

Canada, the top exporter of steel and aluminum to the U.S., has expressed significant concern about the prospective tariffs. The Washington Post reported that Canada is “flabbergasted” at the tariffs proposal, according to Douglas Porter, the chief economist at the Bank of Montreal.

Wondering how your stainless steel prices compare to the market? Benchmark with MetalMiner

Actual Metal Prices and Trends

This Morning in Metals: Steel, Aluminum Tariffs Could Lead to NAFTA Departure

This morning in metals news, Goldman Sachs’ chief economist said the if the U.S. imposes steel and aluminum tariffs, the decision could preceded an exit from the North American Free Trade Agreement (NAFTA); the president’s trade adviser said exceptions in the proposed new tariffs are unlikely and LME copper holds above its two-week low. Section […]

Week in Review: A Russian Billionaire, Section 232, Trade Policy and Critical Minerals

Before we head into the weekend, let’s take a look back at the week that was and the stories here on MetalMiner: Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Our Stuart Burns writes about the announcement of Russian billionaire Oleg Deripaska’s decision to step down as CEO of Rusal and […]

Hot Off the Presses: MetalMiner’s Section 232 Investigation Impact Report is Out

If you’re in the metals industry, you have likely been waiting a long time for word from the White House on what the president will do vis-a-vis the U.S. Department of Commerce’s Section 232 investigations of aluminum and steel imports. Section 232 buying strategies – grab a copy of MetalMiner’s Section 232 Investigation Impact Report today! The […]

Trump Says Administration Will Implement Steel, Aluminum Tariffs Next Week

After a hectic morning during which it seemed like a Section 232 announcement from President Trump was coming, before it then it seemed like it would be postponed, an announcement did finally come. Section 232 buying strategies – download MetalMiner’s Section 232 Investigation Impact Report today! CNN reported earlier today that Trump said his administration […]

This Morning in Metals: Trump Calls for ‘Smart Trade’ in Tweet on Steel, Aluminum

This morning in metals, the president tweets about steel and aluminum (current Section 232 probes under his consideration), Apple’s move on cobalt and China plans to crack down on aluminum price speculation. Section 232 buying strategies – download MetalMiner’s Section 232 Investigation Impact Report today! Trump Tweets About Steel, Aluminum; Announcement Possibly Coming Today According […]