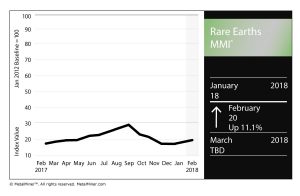

The Rare Earths MMI (Monthly Metals Index) hit 20 for our February meeting, up from 18 last month.

Several of the heavier hitters in the basket of metals posted price increases this past month. Yttrium jumped 3.3%, while terbium oxide rose 12.4%.

Neodymium oxide surged 11.3% and dysprosium oxide rose 6.0%.

U.S. Lab Works to Increase Rare Earth Element Recovery

As we mention here every month, China has overwhelming control of the global rare earths market, meaning supply-side squeezes in the country often yield price spikes for the valuable materials used in things from electric vehicles to smartphones.

Unsurprisingly, the U.S. is looking for ways to increase its ability to recover rare earth elements (REEs) in domestic supplies of coal.

According to the National Energy Technology Laboratory (NETL), it is taking steps toward that goal.

“Four rare earth elements (REEs) recovery projects managed by the U.S. Department of Energy’s (DOE) Office of Fossil Energy and the National Energy Technology Laboratory (NETL) have made significant progress in the development of a domestic supply of REEs from coal and coal by-products by successfully producing REE concentrates,” a NETL release states.

The lab has run four test projects in different parts of the country. According to the release, the results of the projects are as follows:

-

Physical Sciences, Inc. (pilot-scale project) achieved 40 percent REE concentration at 15 percent REE recovery using post-combustion fly ash from burning Central Appalachian Basin coal. Field implementation and testing of physical processing technology will occur in Kentucky, with subsequent chemical processing in Pennsylvania.

-

The University of Kentucky (pilot-scale project) achieved greater than 80 percent REE concentration at greater than 75 percent REE recovery using Central Appalachian Basin and Illinois Basin coal preparation plant refuse. The project team plans to implement and test their technology at multiple field locations in Kentucky.

-

The University of North Dakota (bench-scale project) achieved 2 percent REE concentration at 35 percent REE recovery using North Dakota lignite coal. The University will build and test the technology in their laboratory.

-

West Virginia University (WVU) (bench-scale project) achieved 5 percent REE concentration at greater than 90 percent REE recovery using acid mine drainage solids from the Northern Appalachian and Central Appalachian Basins. WVU plans to build and test their unit in the WVU laboratory.

Of course, any new domestic capacity to recover REEs in the U.S. will be met with happiness by domestic end users, who have to pay a fortune for these rare and valuable materials.

Southeastern Alaska Town to be New Home of Rare Earths Plant

According to the a report in Mining News, the town of Ketchikan, Alaska, was chosen to be the new home of a rare earths processing facility.

Ucore Rare Metals Inc. picked the southeastern Alaska town for a new planned strategic metals complex (SMC).

“Engineering and economic studies have confirmed that Ketchikan is our preferred location to construct our first strategic and critical metals separation facility” said Mike Schrider, Ucore’s vice president of operations and engineering, in a company release. “Additional engineering and product specification criteria are being initiated at this time targeting rare earth by-products and primary concentrates from non-Chinese sourced projects world-wide. The intent is also to maintain the processing flexibility and capacity to accommodate ore concentrate from the Bokan-Dotson Ridge Project, once that project has been developed.”

According to the release, among other factors, Ketchikan’s proximity to the container port and rail head at Prince Rupert was cited as part of the locale’s desirability for the new SMC.

“Ketchikan features deep water port, barge-container facilities and direct access to markets in the US and the Pacific Rim by way of ocean vessel, the lowest-cost mode of bulk transport,” the release states. “Ketchikan offers a unique work force, ice-free harbors and is in close proximity to Ucore’s flagship in-situ development project, the Bokan Dotson-Ridge Rare Earth Project (“Bokan”).