It’s that time — our latest Monthly Metals Index (MMI) report is in, covering the first month of 2018. Seven out of 10 MMIs posted increases this month. The Renewables MMI was the star of the month, as skyrocketing cobalt and steel plate prices helped push the sub-index up 21 points for a reading of […]

Tag: L9

China’s Aluminum Industry Looking for Outlets for Excess Metal

China is both the world’s largest aluminum producer and consumer. So, not surprisingly, what happens in the Chinese market has a major impact on global aluminum prices. Buying Aluminum in 2018? Download MetalMiner’s free annual price outlook There was a time some years ago when China’s primary aluminum market operated largely in isolation, with primary […]

Liquefied Natural Gas Prices Hold Firm Despite New Supply

With major new projects coming onstream in Australia and the rising output from the U.S. shale producers, the global liquefied natural gas (LNG) market was widely predicted to enter a period of oversupply between 2015-2020, with total supplies growing almost 50%. Buying Aluminum in 2018? Download MetalMiner’s free annual price outlook But somewhat to everyone’s […]

Not All at the Federal Reserve Convinced of Need for Rate Rises

We tend to hear the pronouncements of the Federal Reserve and take them as the all-knowing position of the Fed chairman with the unanimous support of his or her colleagues. Yet in actual fact, even arriving at a rate setting decision, let alone scoping the media announcement afterwards, requires extensive debate and the balancing of […]

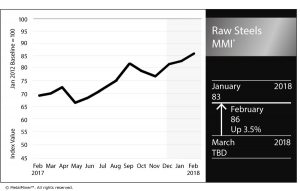

Raw Steels MMI: HRC Prices Hit Highest Level in More than Two Years

The Raw Steels MMI (Monthly Metals Index) inched three points higher this month, reaching 86 points.

Steel price momentum appears to have continued as prices increased sharply in January. February has already signaled a continuation of this uptrend, with HRC prices breaching the $700/st level. HRC prices have reached the highest levels in more than two years and could continue to climb.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

[caption id="attachment_90232" align="aligncenter" width="585"]

The spread between HRC and CRC prices fell this past month, returning to the $140/st level. Since the beginning of 2016, the spread between HRC and CRC prices increased to around $200/st. The spread has returned to normal levels, with HRC prices increasing more than CRC prices.

President Trump has yet to release results from the Section 232 investigation. Commerce Secretary Wilbur Ross sent his Section 232 steel report to Trump last month; the president has 90 days as of Jan. 11 to act on the report’s findings and recommendations.

Global Steel Sector

According to the World Steel Association (WSA), global production of crude steel increased by 5.3% during 2017. The world map below reflects some of the changes in steel production by country and the impact on total steel output.

[caption id="attachment_90233" align="aligncenter" width="585"]

Chinese global production of crude steel increased by 5.7%. However, China’s exports fell to 75.4 million tons last year from the previous 108.5 million tons. Japanese production of crude steel decreased by only 0.1%, while U.S. crude steel production increased by 4%.

According to Eurofer, European steel demand could increase by 1.9%. In 2017, European steel imports fell by 1% due to defensive trade measures.

Shredded Scrap

Shredded scrap prices increased again in January, shifting the latest short-term downtrend to an uptrend. The long-term uptrend remains in place, and scrap prices have now moved together with U.S. steel prices.

What This Means for Industrial Buyers

As steel price dynamics showed a strong upward momentum this month, buying organizations may want to understand price movements to decide when to commit mid- and long-term purchases. Buying organizations with concerns about the Section 232 outcome and its impact on the steel industry may want to take a free trial now to our Monthly Metal Buying Outlook. Our Monthly Outlook will include a detailed analysis of the Section 232 outcome.

For more efficient carbon steel buying strategies, take a free trial of MetalMiner’s Monthly Outlook!

Actual Raw Steel Prices and Trends

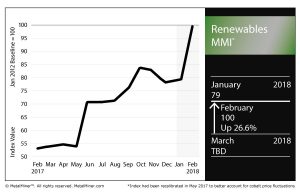

Renewables MMI: Steel Plate, Cobalt Prices Post Sharp Increases

[caption id="attachment_88708" align="alignleft" width="300"]

The Renewables MMI (Monthly Metals Index) skyrocketed this month, gaining 21 points en route to a 100 February reading.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

The basket of metals posted price increases across the board, particularly in the steel plate category.

Japanese steel plate jumped 2.8%, while Korean steel plate rose 2.4%. Chinese plate jumped slightly, by 0.3%, and U.S. plate was up 6.5% as of Feb. 1.

Prices of neodymium, silicon and cobalt from China all posted significant price increases over the past month.

Scarcity of Critical Minerals to Threaten Renewable Industry?

According to a report from Stanford University, a scarcity in rare minerals could undercut the move toward greener forms of energy.

The topic was put forth for discussion at a mineral resources conference hosted by the university last month.

“Due to the rapidly increasing need for mineral resources as Earth’s human population continues to grow exponentially and the need to minimize the environmental and social impacts of mining, it’s essential that Stanford be involved in the field of economic geology — the study of the formation, exploration, and utilization of mineral resources,” said Gordon Brown, a professor of geological sciences at Stanford’s School of Earth, Energy & Environmental Sciences, as quoted in the report.

Uranium, copper, gold, lithium and rare earth elements (REEs) were among the materials cited in the report as critical to the future of renewable energy.

Among the trends impacting the supply of these valuable materials, according to the report, included: humanity’s increasingly growing rate of metal consumption, the concentration of rare elements in a relatively few countries, the quality (or lack thereof) of U.S. mineral mapping and reduction of mineral waste.

Cobalt Price Rises as Congo Seeks More Control of Market

Speaking of the concentration of minerals, the Democratic Republic of Congo is home to more than half of annual global cobalt production each year (in 2016, 66,000 of the 123,000 tons produced worldwide were sourced in the DRC, according to the U.S. Geological Survey).

Prices of cobalt are on the rise, shooting up a whopping 44.8% month over month.

With a number of international mining firms doing business in the DRC, the country’s largest state-owned mining company, Gecamines, is seeking to assert greater control of the market, Bloomberg reported.

“I find it scandalous that when cobalt is discussed, and the explosion of electric vehicles, only the traders and consumers are referenced and Congo and Gecamines are not cited,” Gecamines Chairman Albert Yuma was quoted as saying.

As reported by Reuters, Gecamines wants to renegotiate its contracts with foreign firms in order to work toward asserting further control of that cobalt market.

Cobalt is valuable for, among other uses, its application in electric vehicle batteries.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Actual Metal Prices and Trends

Noble Group Staves Off Collapse to Fight Another Day

Noble Group, the Singapore-listed trading group, started in 1986 by ex-Phibro trader Richard Elman, once had aspirations to rival commodities trader and miner Glencore and oil trading giant Vitol. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook But this week the firm narrowly avoided bankruptcy in a refinancing deal which sees […]

China Set to Wage Long-Term War on Smog

If you thought China’s environmental crackdown on polluting industries during this winter heating period was a one-off effort, think again. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Liu Youbin, a spokesman at the Ministry of Environmental Protection, is quoted by Reuters as saying that Beijing intends to extend its policy […]

Indian Steel Exports Post ‘Unprecedented’ Rise in 2017

There’s a feel-good story emerging out of India vis-a-vis the steel sector. A recent policy document showed a rise in steel exports in 2017, while a freshly released World Steel Association (WSA) report recorded a growth in crude steel production last year. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook The […]

CRB-Dollar Correlation Returns as Base Metals Trade Higher

In January, some base metal prices increased sharply. This month, bullish sentiment in the industrial metals complex has extended to all base metals, as well as steel. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Commodities remain bullish, while the U.S. dollar continues to look more bearish. Back in Trends Commodities […]