The Raw Steels Monthly Metals Index (MMI) posted a one-point increase this month, moving to an MMI reading of 80. Need buying strategies for steel? Request your two-month free trial of MetalMiner’s Outlook As reported last month, steel prices continued to fall from their historically high levels reached back in the spring of 2018. CRC and […]

Tag: raw steels MMI

Raw Steel MMI: Steel Prices Continue to Lose Momentum

The Raw Steels Monthly Metals Index (MMI) fell again this month, dropping to 83 points. The Raw Steels MMI held at 89 points since August for four consecutive months, but started decreasing in November. Need buying strategies for steel? Request your two-month free trial of MetalMiner’s Outlook The recent slowdown in domestic steel price momentum […]

Raw Steels MMI: Domestic Steel Prices Show Slowing Momentum

The Raw Steels Monthly Metals Index (MMI) decreased this month, dropping two points for an MMI reading of 87 points. The Raw Steels MMI had held at 89 points since August. Need buying strategies for steel? Request your two-month free trial of MetalMiner’s Outlook Domestic steel prices have showed slowing momentum since June 2018. Domestic […]

Raw Steels MMI: Subindex Holds at 89 For Third Straight Month

The Raw Steels Monthly Metals Index MMI again traded sideways this month. Need buying strategies for steel? Request your two-month free trial of MetalMiner’s Outlook This marks the third consecutive month the index has held at 89 points. The current Raw Steels MMI is at May 2018 levels. Domestic steel prices have decreased sharply and steel […]

Raw Steels MMI: Domestic Steel Price Momentum Slows

The Raw Steels Monthly Metals Index (MMI) traded sideways this month, driven by slower domestic steel price momentum. The current Raw Steels MMI fell to May 2018 levels. Need buying strategies for steel? Request your two-month free trial of MetalMiner’s Outlook Domestic steel prices have started to fall slightly. Prices traded lower in August, showing […]

Raw Steels MMI: Steel Price Momentum Slows

The Raw Steels Monthly Metals Index (MMI) fell one point further this month, dropping to 89 from the previous 90 reading. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook The Raw Steel MMI has returned to May 2018 levels. The slight drop came as a result of slower domestic steel price […]

Raw Steels MMI: Steel Prices Sit at More Than Seven-Year High

The Raw Steels Monthly Metals Index (MMI) fell two points this month, dropping to 90 from the previous 92 reading. Domestic steel price momentum continued, as domestic steel prices increased again. Chinese steel prices also increased in June, adding support to domestic steel prices. Need buying strategies for steel? Try two free months of MetalMiner’s […]

Raw Steels MMI: Domestic Steel Price Momentum Continues to Grow

The Raw Steels Monthly Metals Index (MMI) increased three points this month, moving up for a June reading of 92. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Domestic steel price momentum seems to keep going, with domestic steel prices increasing again. Chinese steel prices also increased in May, adding support […]

Raw Steels MMI: Imports From China Rise Despite Section 232 Tariffs

The Raw Steels Monthly Metals Index (MMI) increased one point this month, moving up to 89. Domestic steel price momentum seems slower than at the beginning of 2018, as domestic steel prices traded more sideways. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Domestic steel prices remain at a more than […]

Raw Steels MMI: Domestic Steel Price Momentum Picks Up

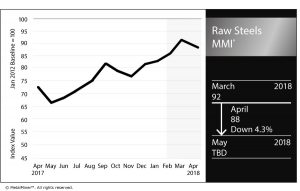

The Raw Steels MMI (Monthly Metals Index) fell four points this month, dropping to 88. Despite the drop in the Raw Steels MMI, domestic steel price momentum has been on a tear throughout March. All prices for the main forms of flat-rolled steel products have reached more than seven-year highs.

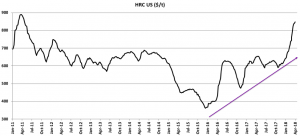

Domestic steel prices accelerated their pace of increases in such a way that HRC domestic prices have risen from the $600-$650/st level to around $850 in the last three months.

[caption id="attachment_91239" align="aligncenter" width="580"]

The steel price increase comes as a result of several factors. First, the long-term trend that started in 2016 created upward movement for steel prices. Second, the delayed steel sector cyclicality (seasonality) has pushed the steel price slope even steeper.

Historically, prices usually increase during Q4 as many companies renegotiate their annual agreements as part of the budgeting season for the following year. However, this year, steel price increases didn’t occur until later. Prices appeared to wait for the Section 232 outcome (with its corresponding tariffs), which acted as a support for domestic steel prices.

However, domestic steel prices seem closer to the end of this latest price rally. Based on historical steel price cyclicality, lower Chinese steel prices and decreasing raw material prices, domestic steel prices may fall in the coming months.

The Divergence in Steel Prices

Chinese steel prices and U.S. steel prices usually trade together. However, the short-term trend sometimes shows some divergences.

Short-term trends may be created by local uncertainty or sudden disruptions with local supply. But these short-term trends tend to correct, and return to their historical pattern.

[caption id="attachment_91240" align="aligncenter" width="580"]

When looking at Chinese and U.S. HRC prices in tandem, the price divergence observed this month leaves no one surprised.

U.S. HRC prices skyrocketed, while Chinese HRC prices continue to fall. It is true that Chinese HRC prices increased sooner in 2017 (starting June 2017), supported by the steel industry cuts in China. The spread between Chinese and domestic steel prices dropped in Q3 2017, as U.S. domestic steel prices traded sideways. The recent drop in Chinese steel prices may create downward price pressure for domestic steel prices.

Global Steel Market

Chinese steel production cuts continue. The city of Handan ordered steel mills to cut around 25% of their steel production to continue the pollution curb measures. These cuts will be extended from April to mid-November. The coking coal industry will also cut production by around 25% over that period. The cuts started on April 1.

According to the Mexican government’s official gazette, the Mexico economy ministry has formally imposed anti-dumping duties on carbon steel pipe imports from South Korea, Spain, India and Ukraine.

Raw Materials

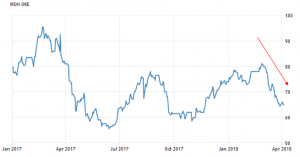

After the prior raw material price increases at the end of 2017, raw material dynamics seem to have slowed down.

Iron ore prices fell sharply in March. Iron ore prices increased slightly at the beginning of this month. However, the sharp decrease in prices last month may not support the current highs in domestic steel prices.

[caption id="attachment_91243" align="aligncenter" width="580"]

Coal prices also fell in March. Coal prices seem to be increasing slightly again this month, even if current prices remain far away from the $110/mt highs in January 2018.

[caption id="attachment_91244" align="aligncenter" width="580"]

What This Means for Industrial Buyers

As steel price dynamics showed a strong upward momentum this month, buying organizations may want to understand price movements to decide when to commit to mid- and long-term purchases. Buying organizations looking for more clarity on when to buy and how much to buy of their steel products may want to take a free trial now to our Monthly Metal Buying Outlook.

Actual Raw Steel Prices and Trends