Both China and India are now jostling for exploration and mining rights across the African continent. Over the last decade, China has rapidly expanded its presence in Africa’s growing copper market, securing critical mineral supplies to fuel its green energy ambitions. With copper demand surging globally due to the growth of electric vehicles, renewable energy, […]

Category: Manufacturing

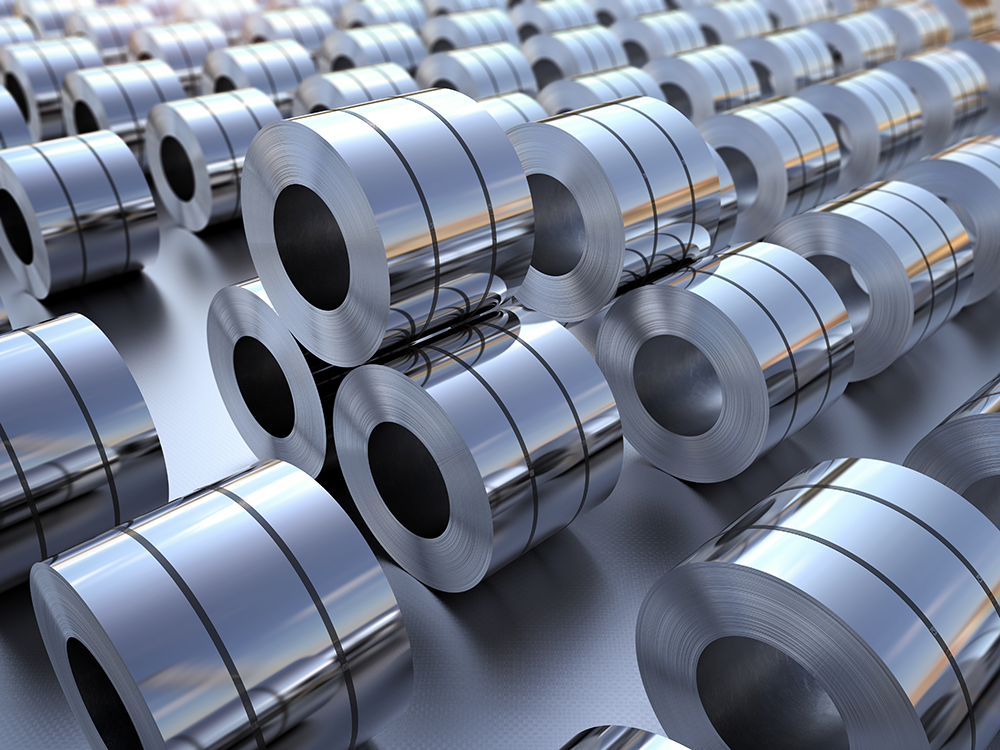

ThyssenKrupp Bets €800M on Strip Mill Overhaul

German flats producer ThyssenKrupp Steel recently commissioned a modernized strip mill at its main site in Duisburg as well as new upstream equipment. On July 4, the steel industry titan released a statement detailing that the modernized hot rolled strip mill will be able to roll 3.1 million metric tons of hot rolled coil in […]

Raw Steels MMI: Steel Prices Steady Ahead of Trade Deals

The Raw Steels Monthly Metals Index (MMI) trended sideways, with a 1.37% increase from June to July. With a few exceptions, steel prices remained largely steady as long-awaited trade deals with the U.S. began to materialize. Nippon Officially Acquires U.S. Steel After an arduous 18-month process, Nippon Steel officially acquired U.S. Steel. Initially blocked by […]

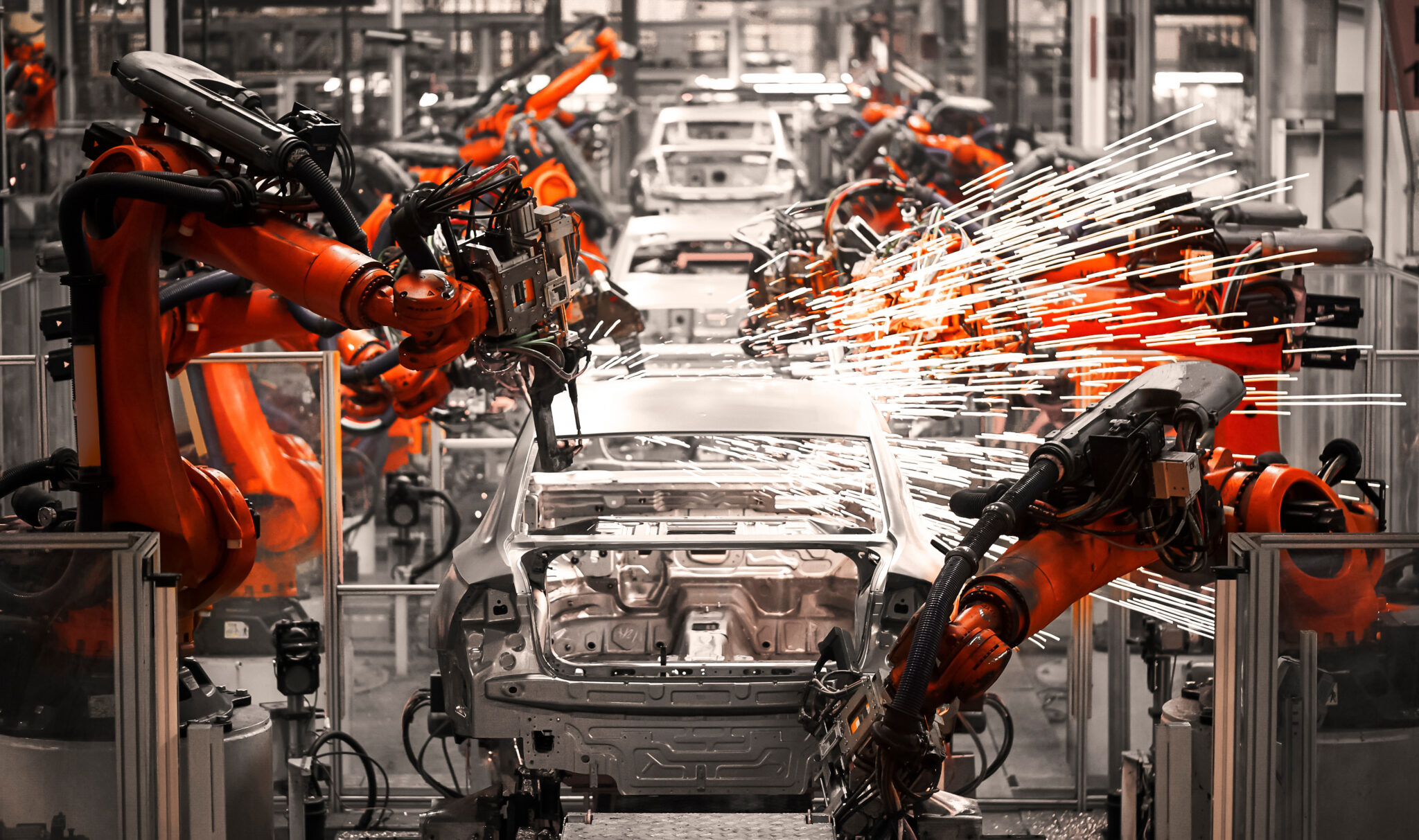

Is BYD’s Hungary Plant a Steel Game-Changer for Europe?

Chinese automaker BYD recently appointed Austria’s Voestalpine as its first steel supplier for the planned production plant in Hungary. On June 24, the Linz-headquartered steel industry leader officially announced it will begin supplying autobody and outer-skin components from its rolling mills to BYD’s Szeged plant in Q4 2025. Szeged sits about 180 kilometers south of […]

Steel Giant Bows Out: Who’s Taking Over Bosnia’s Mills?

ArcelorMittal recently announced the sale of its steel plant as well as its stake in its iron ore mine in Bosnia and Herzegovina, with news reporting stating that the steel industry giant will unload the plant to Bosnian industrial conglomerate Pavgord Group. According to the details of the deal, Pavgord Group will acquire the longs […]

Can a $673M Railway Deal Keep British Steel on “Track?”

British Steel has secured a 5-year agreement to supply rail to Network Rail, the infrastructure manager of the UK’s rail network. Under the tenets of the deal, the steelmaker will provide 70,000 to 80,000 metric tons per year. In a June 17 statement, British Steel reported that the contract is worth £500 million (almost $673 […]

Steel Titans: Who’s Up and Who’s ‘Melting Down’?

According to the World Steel Association (worldsteel), one of the leading providers of steel market information, the China Baowu Group was the largest steelmaker group in 2024, with production remaining stable on the year. In its June 5 report, titled “2025 World Steel in Figures,” worldsteel stated that the Shanghai-headquartered company poured just over 130 […]

Aluminum MMI: Midwest Premium Finds a Peak

The Aluminum Monthly Metals Index (MMI) moved sideways as the global price of aluminum ticked modestly higher. Overall, the index rose 0.73% from May to June. Track other MetalMiner monthly indexes here, and compare how the overall industrial metal market is performing. Aluminum Midwest Premium Finds A Peak The Midwest Premium found a peak in […]

Raw Steels MMI: How Far Will Steel Prices Fall?

The Raw Steels Monthly Metals Index (MMI) traded down during the month. Overall, the index fell 3.82% from April to May. While U.S. steel prices moved sideways throughout April, the bias appeared increasingly to the downside as buyers pulled away from the market due to tariffs. Steel Prices Slide Lower As Bearish Signals Mount After […]

How U.S. Manufacturers Shift Gears and Save Money Amid Metal Price Volatility

U.S. manufacturers in the automotive, appliance and general industrial sectors are overhauling procurement strategies as economic volatility and swings in steel, aluminum and copper prices squeeze margins. Recent U.S. tariff actions have jolted metals markets, sending input costs soaring for downstream manufacturers. According to Reuters, the uncertainty not only triggered panic buying but extended lead times […]