Iron ore futures continue to climb steadily. The Singapore benchmark for iron ore futures exceeded U.S. $130 a ton on Monday. The increase was largely due to improved steel plant profitability and a positive demand forecast in China, the world’s largest steel producer. However, these increases in the price of iron ore remained restrained by […]

Tag: iron ore price

Iron Ore Futures to Rise as China Eases zero-COVID

China’s steady easing of COVID-19 restrictions finally allowed the beleaguered economy to begin reopening. Many experts expect a renewed demand for steel, which means an increased appetite for steel-making raw materials such as iron ore. Both analysts and traders believe the lifting the restrictions was a step in the right direction. This current positivity is […]

Iron Ore Demand Remains Strong, But Will It Last?

Concern over China’s economy notwithstanding, iron ore remained relatively stable in September and October. This is of note because historically, these months are one of China’s highest peak demand periods. That said, whether the iron ore price will continue to weather the economic storm remains a point of intense debate. The Many Factors Affecting the […]

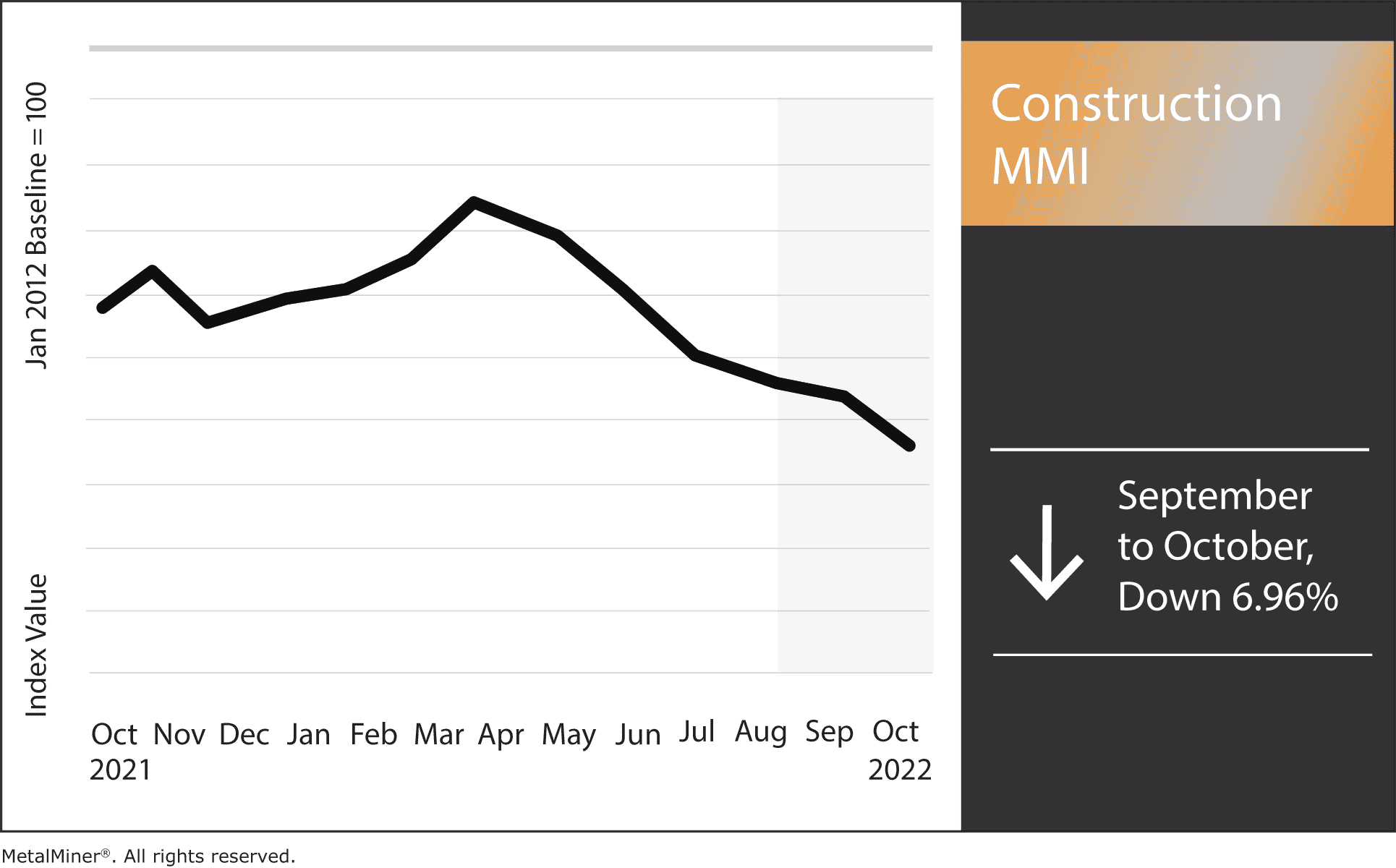

Construction MMI: High Interest Rates Haunt US Construction

The October Construction MMI (MetalMiner Monthly Index) dropped 6.96%. Not only did the construction cost index fall recently, but high interest rates have seriously impacted the US housing construction sector. Billings are on the rise in both the US commercial construction sector and on the consumer end. Meanwhile, new housing construction continues to cool due […]

China Creates New Centralized Company to Tackle Global Iron Ore Market

It’s no secret that China believes in the concentration of power. However, that philosophy extends far beyond governance. It also dramatically affects the way the country does business. For instance, earlier this week, we saw the inauguration of the state-owned and centrally administered China Mineral Resources Group. Many mining companies perceive the move as China […]

Oil Prices: Have OPEC and the IEA Gotten it Right?

Both OPEC and the International Energy Agency are predicting next year’s market to be one of the tightest in recent history. According to a Financial Times post, the two bodies have based this assumption on recovering demand in China and continued growth in India. The prediction also runs counter to widespread fears of recession. With […]

China Steel Mills Hurting, Iron Ore Prices Reeling

2022 has been a roller coaster ride for iron ore prices, which dipped yet again on Monday. Of course, demand from Chinese steel remains the top reason for either a rise or downturn in prices. This week, as it turns out, was no different. In fact, prices tumbled immediately after analysts explained their “bleak outlook” […]

Big Trouble in Big China: Lack of Metals Demand

Metal processors and traders throughout China are facing a grim reality today. Thanks to major economic shifts both within the country and without, metals demand has plummeted. Of course, it’s not great news for the world’s biggest metals manufacturer. But what does it mean for the rest of the world? A Hard Few Years with […]

Iron Ore Prices Show Gains in China, but Is This a Temporary Rebound?

It’s still touch-and-go for the steel sector in China despite the sprouting of the first shoots of a possible manufacturing recovery. However, last Monday, benchmark iron ore prices in the country gained a surprising 7%. This is the biggest daily rise in two-and-a-half months. Is it a sign that we should be more optimistic, or […]

Raw Steels MMI: Steel Prices Fall As Demand Concerns Mount

The ascent for U.S. steel prices faltered as HRC, CRC, and HDG prices began to fall in early May. Plate prices also took a big dip. All in all, the Raw Steels Monthly Metals Index (MMI) fell by 8.9% from April to May. Know what to do when the market shifts. Related article: The […]