Ongoing geopolitical conflicts, including one active war, combined with market instability, declining steel demand in certain global regions and a rise in protective tariffs on exporting nations, have all come together to force some steel-producing countries, including China, to reassess and refocus their steel industry supply chains. Faced with weak domestic steel demand due to […]

Category: Anti-Dumping

Steel Dumping Tsunami Recedes: China’s Export Peak May Be Behind Us

Has the countdown to the end of China’s steel dominance in its own and international markets begun? Some steel industry reports seem to indicate that this is exactly the case. Many chalk this up to a variety of factors, including a shift in steel demand dynamics, China’s own poor internal demand, its efforts to turn […]

China’s Metal Anti-Dumping is Back. What You Need to Know

Chinese mills are churning out steel, aluminum and even refined copper at near-record levels and sending the surplus abroad, a trend steel industry analysts say could pressure industrial metal prices in the United States. After a year of lagging domestic demand, China’s exports of construction and manufacturing metals have surged, flooding global markets with cheap […]

Iron Ore Defies the Odds: Prices Surge After Tariff Rollbacks

The past week or so has seen quite a yo-yo ride for global iron ore prices. Ore futures, including the most-active September contract on China’s Dalian Commodity Exchange (DCE), dropped by about 2% on May 8. The reasons for this were twofold: the likely consequences of the U.S.-China trade tariff war, and a demand slowdown […]

China’s Steel Flood: ASEAN Struggles as Exports Surge 32% Overnight

There’s no doubt that China is desperately seeking new markets to hawk its goods and commodities after the U.S. trade tariffs kicked in. This is especially true when it comes to the country’s steel industry. In fact, even prior to the trade war, Beijing was actively looking at expanding its access to steel markets. So, […]

U.S. Aluminum vs. European Aluminum: A Comprehensive Short-Term Market Outlook

A striking aspect of the aluminum premium and the aluminum market turmoil currently unfolding after Trump’s aluminum tariffs is how differently it’s playing out in the U.S. versus other regions. While premiums inside of the U.S. are rising, outside the United States, aluminum premiums are actually falling. With U.S. tariffs shutting out or discouraging some […]

Aluminum Trade War Heats Up: How Will China and India React to U.S. Tariffs?

The world now waits to see how two aluminum market leaders, China and India, will react to U.S. President Donald Trump’s imposition of 25% tariffs on metal imports. Between them, these two nations produce about 50 million metric tons (MT) of aluminum yearly. However, China significantly outpaces India, alone producing about 43 MT per year. […]

Trump’s Tariffs: EU Warns of ‘Firm and Proportionate’ Counterstrike

European bodies recently criticized U.S. President Donald Trump’s order to introduce tariffs on all steel and aluminum imports entering the country. Meanwhile, experts at home and abroad continue to evaluate how the trade dispute will affect steel prices and aluminum prices. The European Commission, the European Union’s executive arm, recently vowed that it would respond […]

Trump’s Tariff Talk Sparks Fear: Will US Steel Imports Face the Axe in 2025?

“The import market is slow right now. We have seen a lot of pressure on imports,” one trader said on January 24. They were referring to the anti-dumping investigation on HRC imports from Japan, Egypt, India and Vietnam, which the European Commission started in August. The move followed a request by the European Steel Association, […]

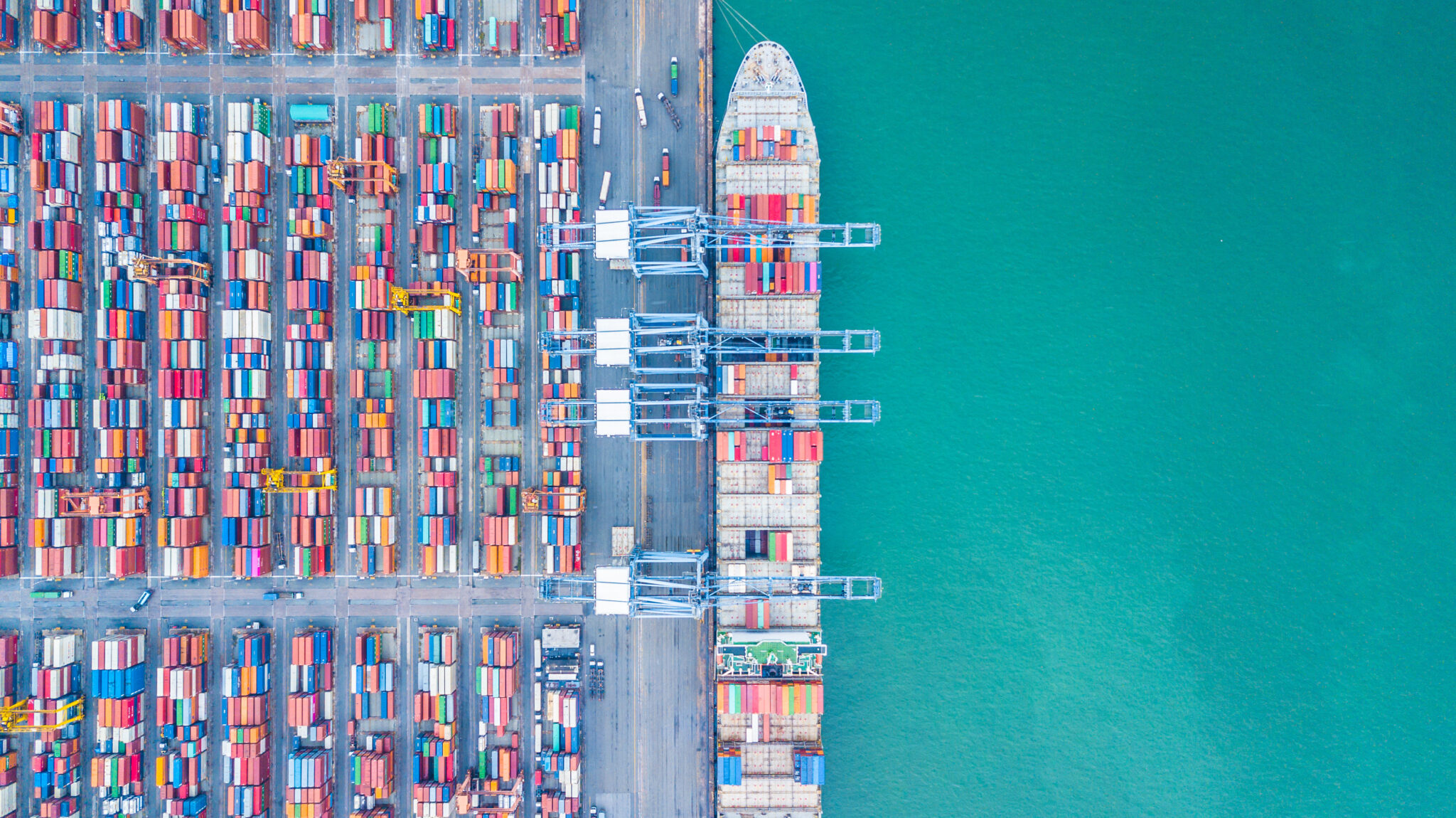

EU Steel Imports Soar 12% as Importers Race Against Anti-Dumping Duties

Steel imports into the European Union rose by an average of more than 12% year on year in the first ten days of Q1 2025. As of January 13, information from Germany-headquartered Metals Consulting International (MCI) indicated that total steel industry import volumes transacted under Tariff Rate Quotas totaled 2.2 million metric tons. This far […]