This morning in metals news, China ramped up its aluminum output in December, British police are looking into allegations of pension fraud against steelworkers and India considers a plan to have its steel ministry oversee iron ore and coal operations. Want to see an Aluminum Price forecast? Take a free trial! Chinese Aluminum Output in […]

Category: Ferrous Metals

Steel Prices Pick Up Momentum to Kick Off 2018

Steel price momentum appears significantly stronger with the start of the year. Steel price momentum shifted in December, showing stronger upward movement. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Despite the momentum, MetalMiner remains cautious about steel prices. The U.S. Department of Commerce’s Section 232 outcome might also add some […]

Dept. of Commerce Announces Preliminary Affirmative Determinations in CVD Investigation of Steel Flanges

The U.S. Department of Commerce took another step forward in its investigation of steel flanges from China and India, announcing affirmative preliminary determinations in its countervailing duty (CVD) investigation on Wednesday evening. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook In its release covering the announcement, the department once again touted […]

India’s NALCO Looks to New Projects After Rising Revenues

It’s been great going for India’s state-owned National Aluminium Company (NALCO). Its revenues in sale of alumina are up by 30% year-over-year and it has reported a 94% jump in net profit. Lower your aluminum spend – Take a free trial of MetalMiner’s Monthly Outlook! The company has now lined up some new projects. According […]

Week in Review: Section 232 Report Moves to Trump, MMIs and Oil

Before we head into the weekend, let’s take a quick look back at the week that was here on MetalMiner: Need buying strategies for steel? Try two free months of MetalMiner’s Outlook This week we wrapped up the latest round of posts for our January Monthly Metals Index (MMI) — check out this week’s posts […]

This Morning in Metals: Proposed Law Could Offer Fewer Protections for U.K. Steel Industry than E.U. Regulations, Union Warns

This morning in metals news, a law proposed in the U.K. could have a negative impact on the domestic steel industry as the country moves forward with Brexit talks, steel production in the U.S. Great Lakes region has jumped to start the year, four firms have submitted resolution plans for Electrosteel Steels and the U.S. […]

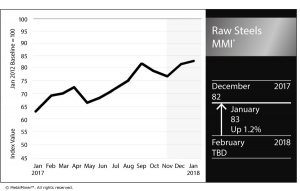

Raw Steels MMI: Steel Picks Up Speed as Industry Awaits Section 232 Outcome

The Raw Steels MMI (Monthly Metals Index) jumped another 1.3% this month, reaching 83 points in January.

Steel momentum seems to have recovered this month. All forms of steel prices in the U.S. increased sharply. Steel momentum typically begins during the middle of Q4, but the increase occurred later this past year. January’s numbers also look bullish.

Benchmark Your Current Metal Price by Grade, Shape and Alloy: See How it Stacks Up

[caption id="attachment_89677" align="aligncenter" width="580"]

In the U.S. market, January will prove to be a decisive month.

The U.S. Secretary of Commerce Wilbur Ross has until mid-January to conclude his Section 232 probes and release a report to the Trump administration, after which the president has 90 days to act.

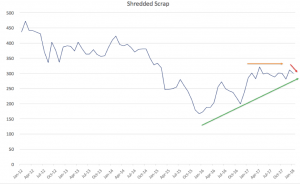

Shredded Scrap

The long-term shredded scrap price uptrend appears to have turned into a short-term sideways trend. Despite steel price increases in December, January scrap prices decreased.

[caption id="attachment_89678" align="aligncenter" width="580"]

Decreasing domestic scrap prices do not currently support steel prices. However, steel prices appear to be on a sustainable upward trend. Therefore, scrap prices could follow steel prices this month and continue their long-term uptrend.

Chinese Prices Still Strong

Chinese steel prices and U.S. prices usually tend to move similarly. Thus, when one reveals a strong upward or downward movement, the other could follow within that month.

Chinese prices were stronger than U.S. steel prices during November and December 2017. After the latest increase in U.S. steel prices, Chinese prices also continued rising.

[caption id="attachment_89679" align="aligncenter" width="580"]

Chinese steel prices have found support from the curtailment campaign in the country. Therefore, steel prices could continue increasing. Chinese Q4 GDP data, expected to show strength, also support Chinese steel prices. Chinese GDP data has come in over annual growth targets for the country.

What This Means for Industrial Buyers

As steel price dynamics showed a strong upward momentum this month, buying organizations may want to understand price movements to decide when to buy some volume. Buying organizations will want to pay close attention to Chinese price trends, lead times and whether domestic mill price hikes stick.

Buying organizations who have concerns about the Section 232 outcome and its impact on the steel industry may want to take a free trial now to our Monthly Metal Buying Outlook. Our February Monthly Outlook will include a detailed analysis of the Section 232 outcome.

Free Sample Report: Our Annual Metal Buying Outlook

Actual Raw Steel Prices and Trends

Stainless Steel MMI: LME Nickel Price Approaches $13K/MT

The Stainless Steel MMI (Monthly Metals Index) jumped six points this month, with a reading of 71. This reading ran higher than November’s (70), which then dropped to 65 for December before bouncing back for our January reading.

Benchmark Your Current Metal Price by Grade, Shape and Alloy: See How it Stacks Up

Skyrocketing LME nickel prices drove the Stainless Steel MMI. However, 304 and 316 Allegheny Ludlum surcharges fell slightly this month.

LME Nickel Makes Big Jump

As reported previously by MetalMiner, nickel price volatility has increased over the past few months.

Nickel prices jumped from the $10,600/metric ton level in October to almost breaching MetalMiner’s current $13,000/mt ceiling.

[caption id="attachment_89668" align="aligncenter" width="580"]

Trading volume remains strong, aligned with the recent popularity of nickel in the base metals complex. Besides stainless steel, nickel’s popularity has increased due to usage in batteries and electric cars. Q4 brought more activity for metals that have a direct impact on electric cars.

Nickel macro-indicators may support this latest rally.

The nickel deficit will continue this year. The International Nickel Study Group (INSG) reported a wider nickel deficit again in 2017, now up to 9,700 tons. A nickel supply deficit may add support to the nickel bullish rally and could create additional upward movements this year.

Buying organizations may want to be aware of these movements to identify opportunities to buy on the dips.

Chinese Stainless Steel

As reported by the International Stainless Steel Forum (ISSF), global stainless steel production increased by 7.4% during the first nine months of 2017. China drove the gains, with an increase in production of 8.8%. Stainless steel prices decreased around 7% in East Asian ports.

[caption id="attachment_89669" align="aligncenter" width="580"]

Chinese stainless steel coil prices increased slightly this month. Chinese prices remain higher than they were in Q2. However, there has not yet been a clear uptrend that signals prices may increase soon.

Domestic Stainless Steel Market

Despite the recovery in momentum of the Stainless MMI, NAS domestic stainless steel surcharges traded sideways this month. Despite trading flat, stainless steel surcharges remain well above last year’s lows (under $0.4/pound).

[caption id="attachment_89670" align="aligncenter" width="580"]

What This Means for Industrial Buyers

Stainless steel momentum appears in recovery, similar to all the other forms of steel.

However, due to nickel’s high price volatility, buying organizations may want to follow the market closely for opportunities to buy on the dips.

To understand how to adapt buying strategies to your specific needs on a monthly basis, take a look at our Monthly Metal Buying Outlook or you can take a free trial now.

Free Sample Report: Our Annual Metal Buying Outlook

Actual Stainless Steel Prices and Trends

This Morning in Metals: China Issues Stricter Rules on New Capacity

This morning in metals news, China has issued stricter rules on building new steel capacity, Chinese steel production is expected to slow down in 2018 and LME copper rises as the dollar loses ground. Benchmark Your Current Metal Price by Grade, Shape and Alloy: See How it Stacks Up New Rules to Put the Squeeze […]

This Morning in Metals: Steel Dynamics Earnings, Iron Ore Price Forecast, China Falling in Love with Used Cars

This morning in metals, a major player in domestic steel announced when its full-year earnings call will drop, China looks to be giving used cars some love, and Australia’s government appears a bit bearish on iron ore in the next couple years. Two-Month Trial: Metal Buying Outlook Iron Ore Price Forecast for 2018-2019 Australia’s Department of […]