Chinese mills are churning out steel, aluminum and even refined copper at near-record levels and sending the surplus abroad, a trend steel industry analysts say could pressure industrial metal prices in the United States. After a year of lagging domestic demand, China’s exports of construction and manufacturing metals have surged, flooding global markets with cheap […]

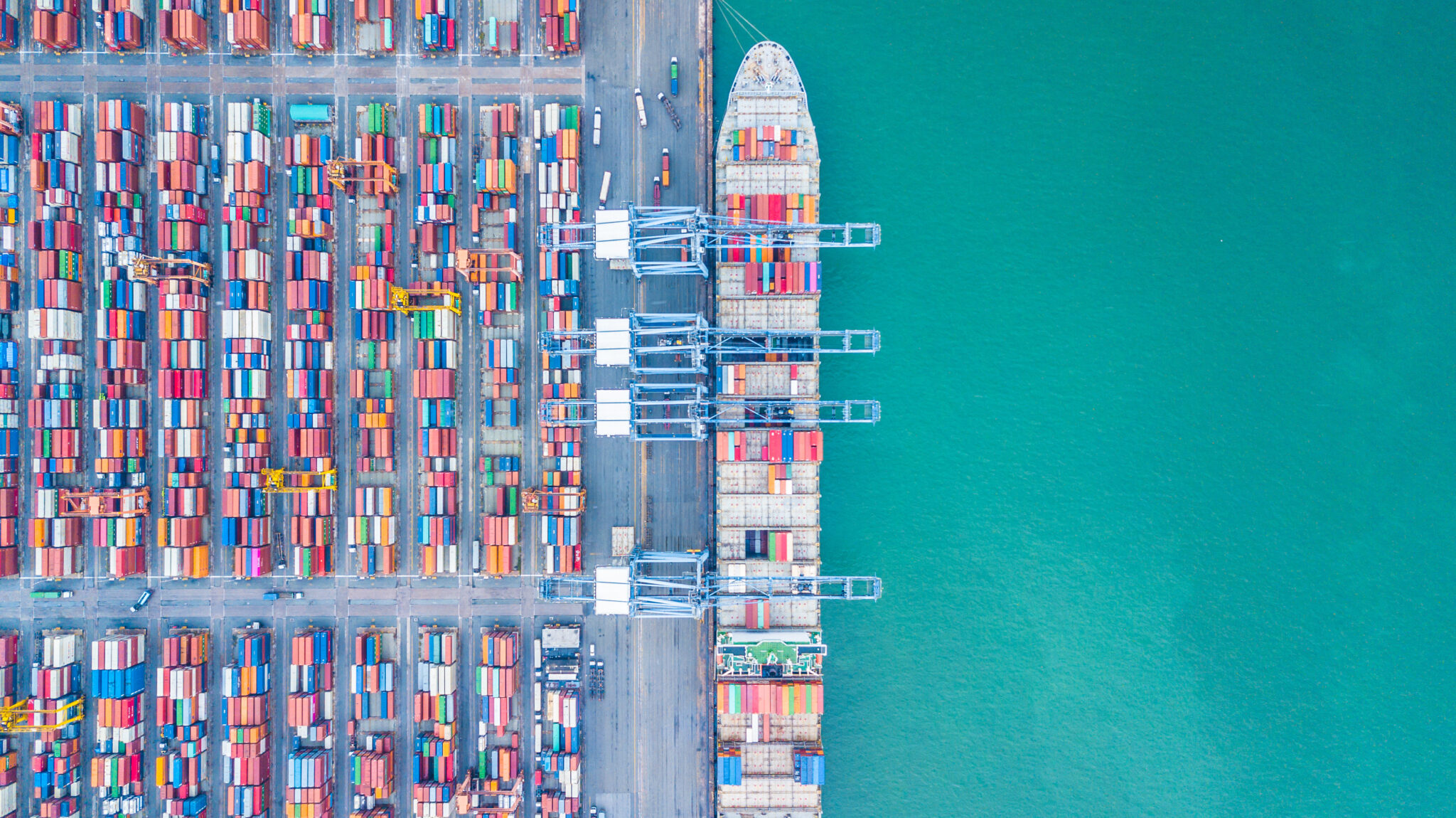

Category: Global Trade

Rare Earth Truce or Trap? China’s Grip Still Chokes Global Supply

With the United States and China ratcheting down the tariff war (for 90 days at least), many expected that the export of rare earths and permanent magnets would soon return to pre-trade war conditions, as MetalMiner’s weekly newsletter weighed in on in the past. However, that does not seem to be happening on the ground. […]

Volatility’s Back, and It’s Wreaking Havoc on Metal Sourcing Strategies

Speculators may love volatility, but metal buyers hate it. As for Trump Tariffs 2025, the jury is still out. The truth is that a bout of unexpected turbulence like we’ve seen over the last couple of months can knock even the best-laid strategies sideways. The reasons are clear: markets nosedived in March and hit bottom […]

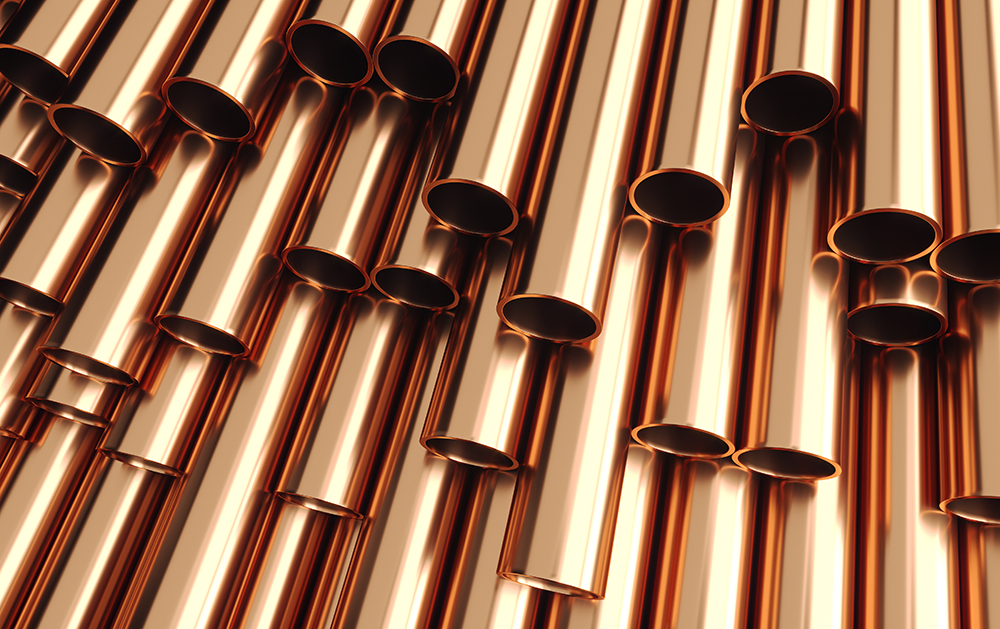

Copper MMI: Copper Prices Volatile on Tariff Shifts

The Copper Monthly Metals Index (MMI) retraced to the downside with a 4.23% decline from March to April. Looking at copper prices today, analysts seem to be struggling with ongoing trade policy shifts. Copper Prices Zigzag Amid Uncertain Trade Policy Comex copper prices have experienced wild swings over the past few months. First, they […]

Renewables MMI: Buyers Stock Up Ahead of 10% Tariff Deadline

The Renewables MMI (Monthly Metals Index) moved sideways, rising a slight 2.83%. Metals prices, including those for copper, steel, lithium and cobalt, have seen significant swings in recent weeks as U.S. companies scramble to source material before tariffs are imposed. For instance, U.S. copper prices surged in Q1 as buyers raced ahead of potential import […]

Iron Ore Defies the Odds: Prices Surge After Tariff Rollbacks

The past week or so has seen quite a yo-yo ride for global iron ore prices. Ore futures, including the most-active September contract on China’s Dalian Commodity Exchange (DCE), dropped by about 2% on May 8. The reasons for this were twofold: the likely consequences of the U.S.-China trade tariff war, and a demand slowdown […]

China’s Steel Flood: ASEAN Struggles as Exports Surge 32% Overnight

There’s no doubt that China is desperately seeking new markets to hawk its goods and commodities after the U.S. trade tariffs kicked in. This is especially true when it comes to the country’s steel industry. In fact, even prior to the trade war, Beijing was actively looking at expanding its access to steel markets. So, […]

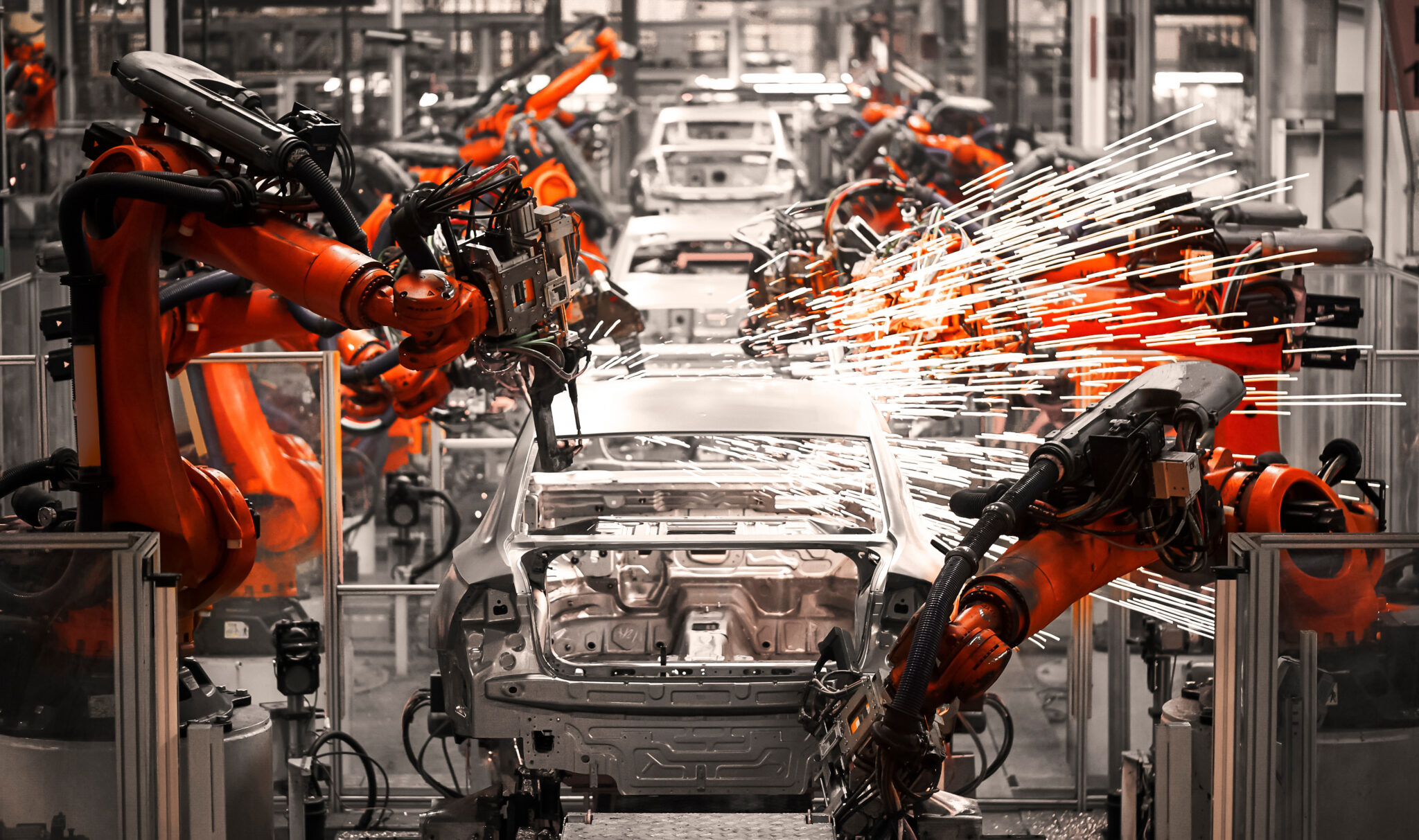

Automotive MMI: Volatile Steel and Copper Prices Shake U.S. Auto Industry

The Automotive MMI (Monthly Metals Index) moved sideways this past month, dropping a slight 1.74%. The US automotive industry faces a bumpy ride as key metal prices continue to swing wildly. In recent weeks, critical inputs like hot-dipped galvanized steel, copper and lead have seen rapid price shifts amid new tariffs and supply chain jitters, […]

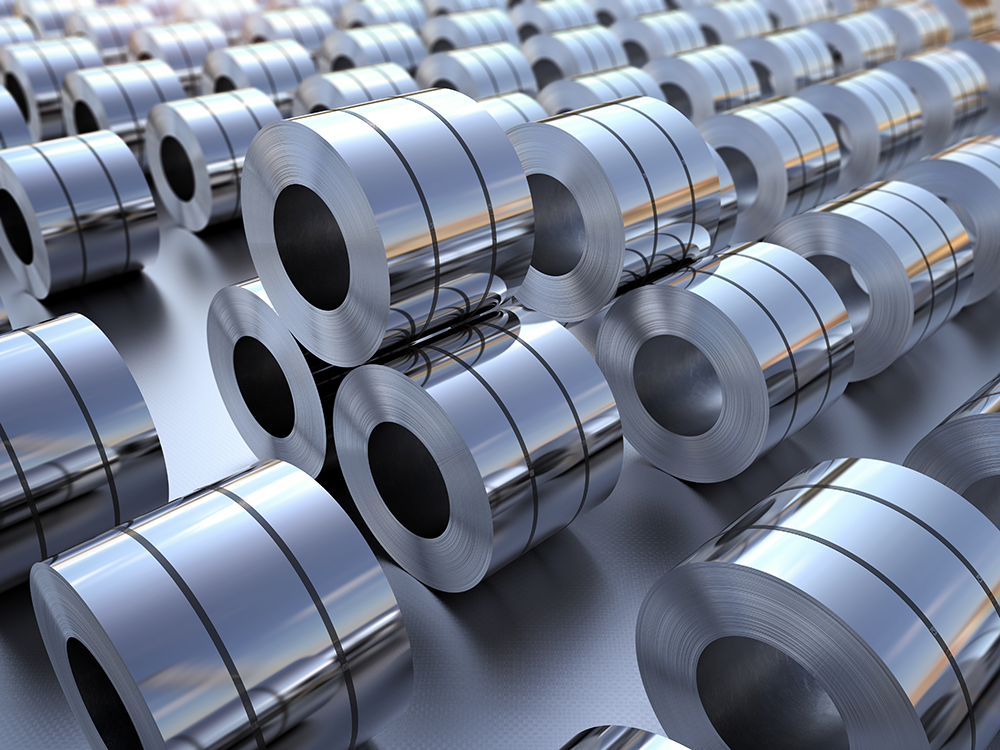

Raw Steels MMI: How Far Will Steel Prices Fall?

The Raw Steels Monthly Metals Index (MMI) traded down during the month. Overall, the index fell 3.82% from April to May. While U.S. steel prices moved sideways throughout April, the bias appeared increasingly to the downside as buyers pulled away from the market due to tariffs. Steel Prices Slide Lower As Bearish Signals Mount After […]

How U.S. Manufacturers Shift Gears and Save Money Amid Metal Price Volatility

U.S. manufacturers in the automotive, appliance and general industrial sectors are overhauling procurement strategies as economic volatility and swings in steel, aluminum and copper prices squeeze margins. Recent U.S. tariff actions have jolted metals markets, sending input costs soaring for downstream manufacturers. According to Reuters, the uncertainty not only triggered panic buying but extended lead times […]