A striking aspect of the aluminum premium and the aluminum market turmoil currently unfolding after Trump’s aluminum tariffs is how differently it’s playing out in the U.S. versus other regions. While premiums inside of the U.S. are rising, outside the United States, aluminum premiums are actually falling. With U.S. tariffs shutting out or discouraging some […]

Category: Metal Prices

Global Precious Metals MMI: “Yellow Metal” Come Out Once Again as Hedging Safe Haven Amidst Tariffs

The Global Precious Metals MMI (Monthly Metals Index) saw a significant bullish action month-over-month, rising by a total of 8%. The U.S. precious metals market (and precious metals prices in general) saw dramatic swings over the past five weeks amid a backdrop of stubborn inflation, evolving interest rate expectations, new tariffs and geopolitical tensions. All […]

Construction MMI: China Tariffs Climb to 145%. What it Means for China-Sourced Construction Materials

The Construction MMI (Monthly Metals Index) broke out of its over 6-month-long sideways trend to pivot down 5.41%. This new movement outside of its sideways range could indicate more volatility in the short term than the index experienced in the past 12 months. The new Trump tariffs on China caused some volatility in the price […]

Aluminum MMI: How Suppliers Handle Tariffs and What Aluminum Buyers Need to Know

The Aluminum Monthly Metals Index (MMI) remained sideways, as most components appeared consolidated. Overall, the index slid 0.74%, while aluminum prices experienced continued instability. Aluminum Price Volatility After Tariffs Aluminum prices have appeared increasingly volatile since the announcement of tariffs. Prices plunged after reaching a mid-March peak, breaking below their sideways range. The implementation of […]

Copper MMI: What’s Next for Copper Prices After Peak

The Copper Monthly Metals Index (MMI) moved up, accelerating gains from the previous month. The Bullish U.S. price of copper saw the index rise by 4.75% from March to April. Price of Copper Finally Finds Peak Although they have subsequently been delayed, reciprocal tariffs helped copper prices find a peak. At the start of 2025, […]

Automotive MMI: New 25% Automotive Tariffs in Effect, How is the Market Responding?

The Automotive MMI (Monthly Metals Index) rose by 4.33% month-over-month. With the 25% Trump tariffs now in effect, the market could be in for a bumpy ride. New Wave of Trump Tariffs Hit The Trump Administration implemented two sweeping trade actions, collectively known as the “Trump Tariffs,” that are reverberating across U.S. industries. First came […]

Stainless MMI: Stainless Market Extends Slump as Reciprocal Tariffs Spare Steel

The Stainless Monthly Metals Index (MMI) remained sideways, with an upside bias. Meanwhile, nickel prices dropped to lows last seen in 2020. Overall, the index rose by 2.16% from March to April. Buyers Hold Back from Stainless Market The U.S. stainless steel market remains lackluster. While March witnessed a modest increase in shipments, some suppliers […]

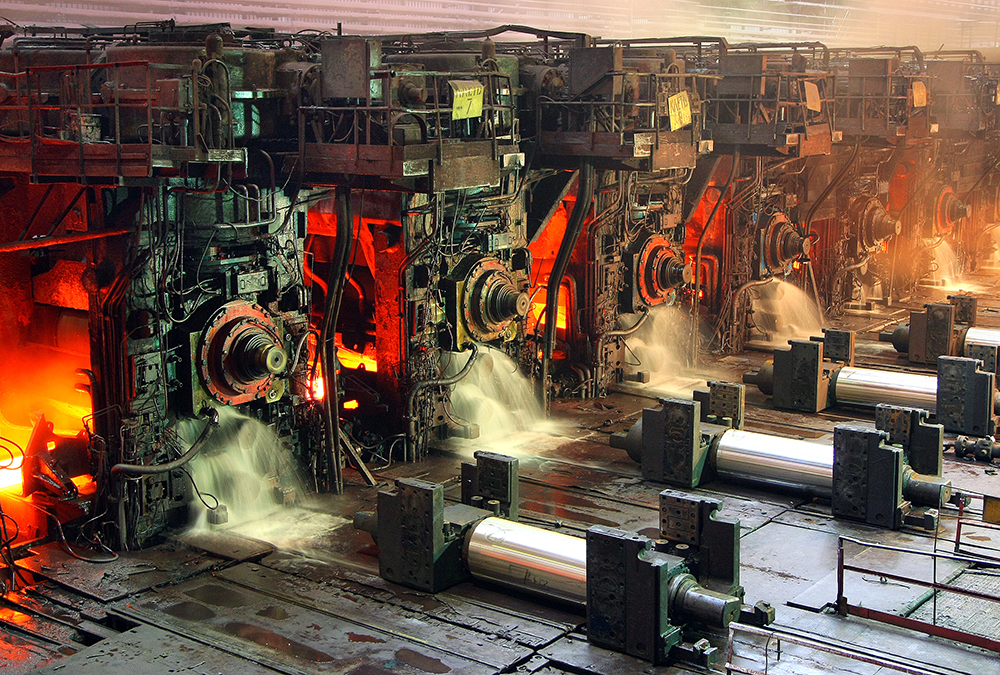

Raw Steels MMI: Steel Prices Level Off, Lead Times Shrink

The Raw Steels Monthly Metals Index (MMI) returned to the downside. Overall, the index witnessed a modest 0.75% decline from March to April. Steel Prices Find Peaks as Reciprocal Tariffs Spare Steel Steel prices either found a peak or began to stabilize by the start of April. As of April 4, hot rolled coil prices […]

Rare Earths MMI: Rare Earths Market Rattled by Myanmar Earthquake and Tariffs

The Rare Earths MMI (Monthly Metals Index) moved sideways, edging up by a slight 1.82%. The global rare earth market has taken a significant hit lately, thanks to a combination of natural disasters and big geopolitical moves. A strong earthquake in Myanmar and the recent wave of U.S. tariffs have thrown this somewhat delicate industry […]

Historical Price Trends for Industrial Metals Over the Past Decade

Over the last ten years, industrial metal prices have gone on a wild ride, rising, falling and rising again, thanks to everything from global economic swings to supply chain hiccups and geopolitical drama. If you’re in manufacturing, investing, or policy, keeping tabs on these price trends isn’t just helpful, it’s essential. Steel Historical Price Trends […]