The Global Precious Metals MMI (Monthly Metals Index) enjoyed its largest month-over-month increase in a year. Between March and April, the index broke out of its tight sideways range and rose by 6.93%. The current talk of the town for precious metal prices today centers around recessionary fears. Indeed, investors are increasingly turning to precious […]

Tag: gold price

Global Precious Metal MMI: Long Term Price Directions Remain Uncertain

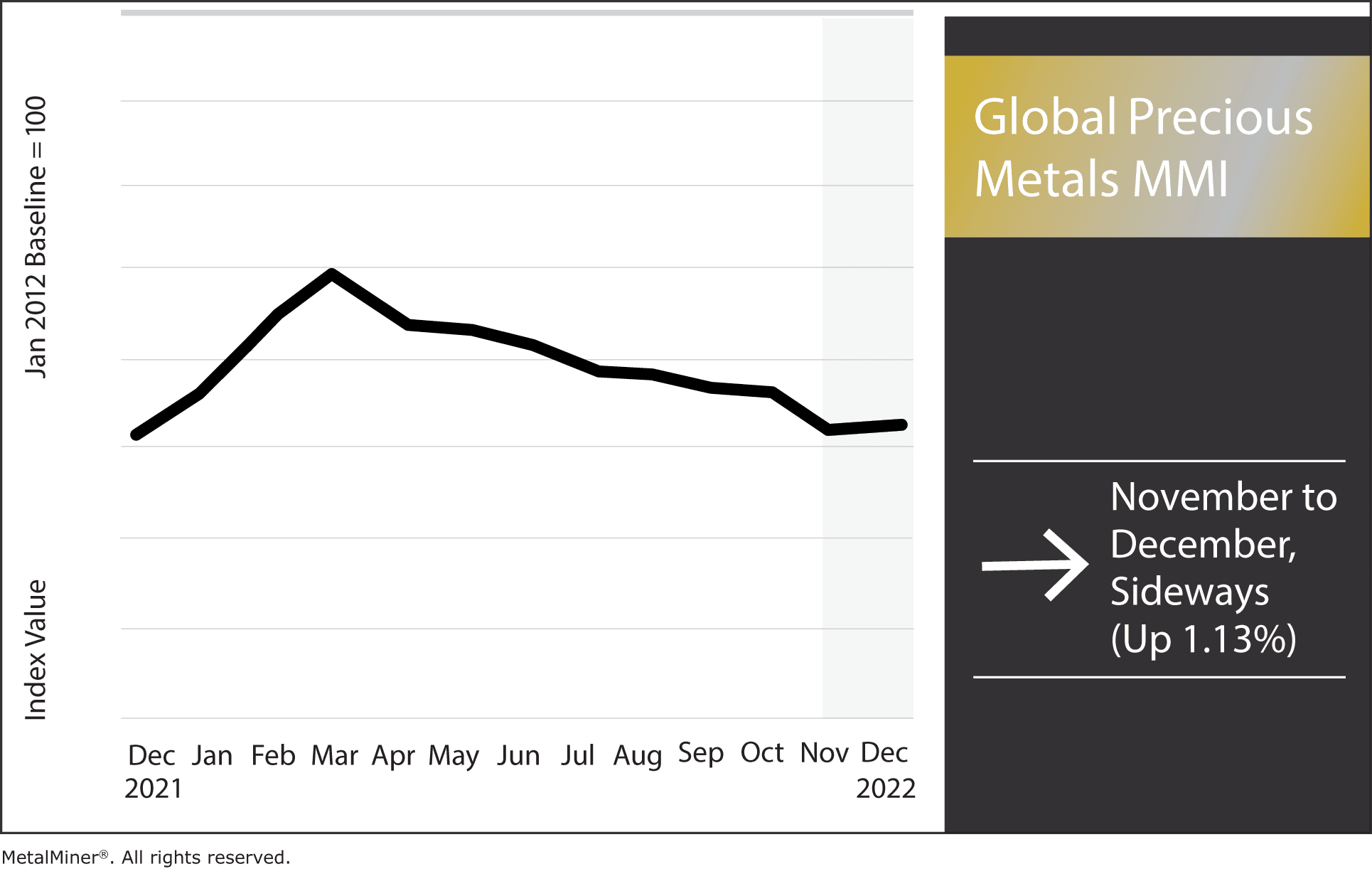

The Global Precious Metals MMI (Monthly MetalMiner Index) stayed within a sideways range this past month. However, precious metal prices did rise by a modest 1.13%. As the US dollar dropped in value over recent weeks, precious metal indexes responded accordingly. Month-over-month, gold, platinum, and palladium all saw a brief rally between Nov 3 – […]

The Robust US Dollar Puts a Damper on the Gold Price Trends in India

October to December is always an interesting quarter in India, especially regarding gold and silver prices and their associated demand. For several reasons, this October is proving to be a less-than-ideal month for gold dealers around the subcontinent. So far, the gold price trend continues to decline when compared to the previous months. India is […]

Global Precious Metals MMI: Gold Hits Yearly Low

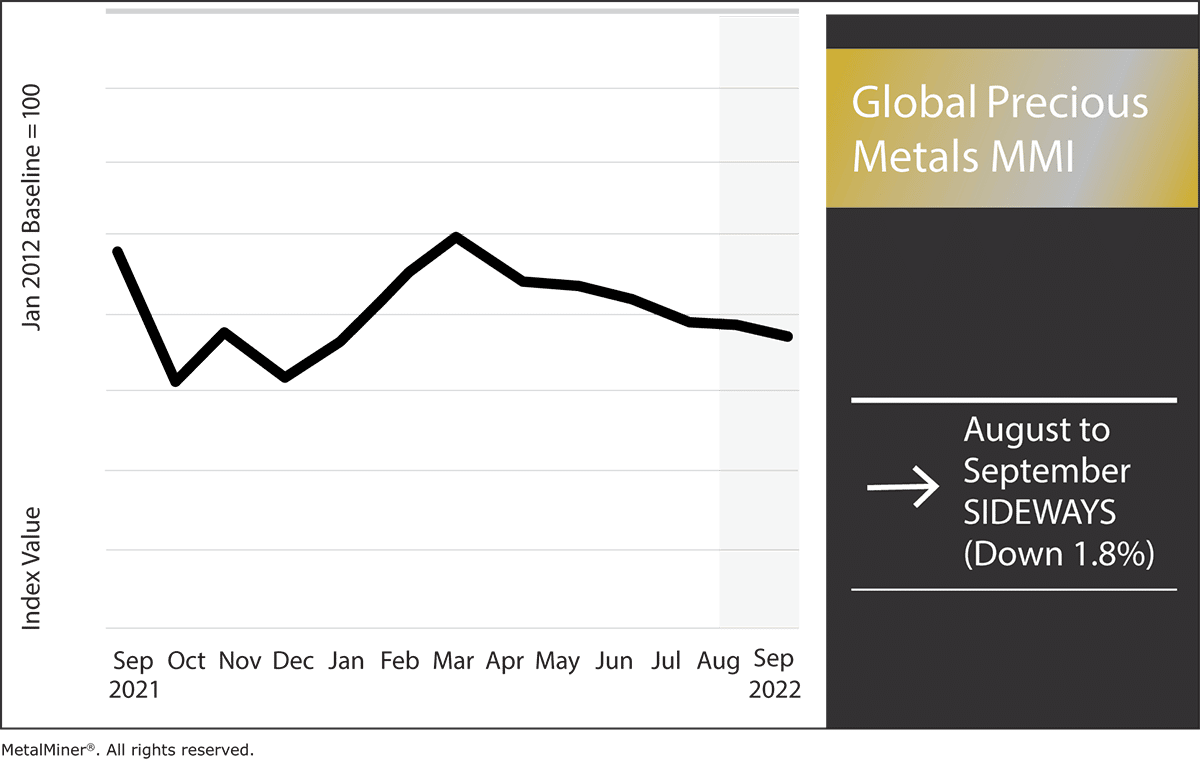

The September Global Precious Metals MMI (Monthly Metals Index) moved sideways, dropping by just 1.8%. Despite the slight loss, month-over-month, gold prices hit lows not seen in around two years. MetalMiner’s FREE September webinar is tomorrow! Learn how to gauge metal prices and explore battery metal pricing. Sign up here! Gold Hits Yearly Low Amid […]

Global Precious Metals MMI Still Dropping

The Global Precious Metals MMI dropped by 3.77% from last month. Leading the trend were silver and platinum, which suffered the most significant drops. Both gold and silver prices appear poised for an additional price drop on the back of elevated interest rates, which are still rising at a higher-than-expected pace. Last month, the Precious […]

Global Precious Metals MMI: Palladium Leads the Precious Metals Bears

The Global Precious Metals MMI dropped by nearly 3% this month. Palladium dropped the most, though silver also looked comparatively weak. Gold Prices Trends: Bullish or Bearish? Gold has started to trade within a range formed by swing lows and highs. A break above either range will clear up the overall direction. Without a “big […]

Global Precious Metals MMI: Silver Prices Lead Index Lower

The Global Precious Monthly Metals Index (MMI) fell by 0.9% for this month’s index reading, largely due to falling silver prices. Did you know that MetalMiner forecasts for several precious metals in the MetalMiner Insights platform? Rising interest rates tend to dampen investor sentiment toward precious metals. Gold and silver typically act as a store of value, […]

Global Precious Metals MMI: monthly index rises on strong palladium prices

The Global Precious Monthly Metals Index (MMI) rose by 6.8% for this month’s reading. This represents the second month in a row of precious metals inswz increases. Last month the index increased by 4.1%. Palladium, and to a lesser extent, platinum drove the index higher. Most of the other precious metals held flat or fell. The […]

Global Precious MMI: Gold prices dip to close November; markets await Fed meeting news

The Global Precious Monthly Metals Index (MMI) fell 4.7% for this month’s MMI value, as gold prices slipped to close November. MetalMiner has launched a full suite of precious metals as part of the MetalMiner Insights platform. Gold price ups and downs As MetalMiner Insights subscribers may have noted — the Insights platform now offers a suite of […]

Global Precious MMI: Gold price falls as dollar gains in September

The Global Precious Monthly Metals Index (MMI) lost ground this month, dropping by 12.9% as the gold price declined and the dollar strengthened last month. More MetalMiner is available on LinkedIn. Gold slides, dollar gains The U.S. gold bullion price fell in September, dropping from $1,814 per ounce as of Sept. 1 to $1,757 on […]