Let’s dive deeper into the electrifying waters of lithium-ion batteries, where the University of Liverpool’s recent breakthrough is making waves. Their latest technology promises a future where “fast” is an understatement when it comes to charging our electric chariots and techno-gadgets. In this brave new world, conventional lithium-ion batteries, dependable but somewhat sluggish beasts, are […]

Tag: Green

Renewables/GOES MMI: The “Dirty” Business of Disposing of Solar Panels

Numerous factors continue to pull at the Renewables MMI (Monthly Metals Index) as it moves through Q1. This past month, the index largely moved sideways, only exhibiting a slight upward movement of 1.66%. Meanwhile, renewable energy news indicated that metals like cobalt and silicon could remain in oversupply for some time. Moreover, expanding mining operations […]

Aluminum Market Projections for 2024: Stability Amidst Economic Uncertainty?

Recently, I had the pleasure of interviewing Hydro, a green aluminum producer with multiple plants and locations around the globe. Mike Stier, Hydro’s Vice President of Finance, and Duncan Pitchford, President of Hydro Aluminum Metals in the U.S. (whom I’ve had the pleasure of interviewing before), sat down to discuss Hydro’s views on aluminum performance […]

Will Electric Cars Benefit or Threaten Europe’s Aluminum Industry?

Are electric cars going to benefit or threaten Europe’s aluminum industry? At first, it might appear a stupid question. However, it is also one that aluminum industry news sources continue to ask. The average European EV contained 283kgs of aluminum in 2022 compared to 169kgs for ICE vehicles. That is according to a study by […]

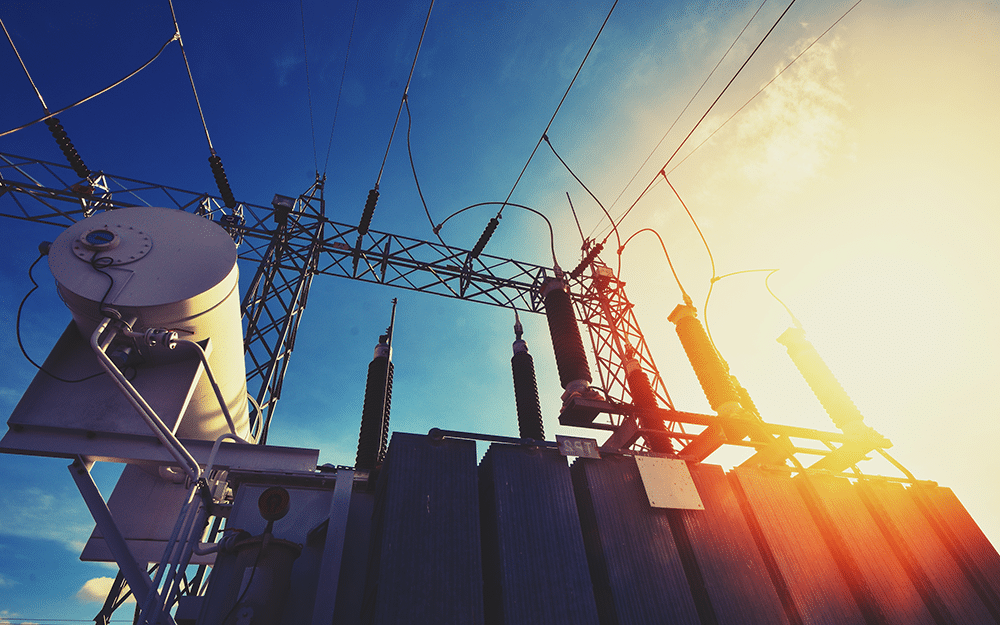

Renewables/GOES MMI: U.S. Transformer Shortage Pain Continues into 2024

The Renewables index began 2023 fairly sideways. However, it broke that trend in Q3 and Q4 when it edged downward. Numerous components of the index, including silicon and cobalt, experienced market oversupply. This caused prices to drop and pulled the index down with it. Grain oriented electrical steel also experienced market volatility in Q3 and […]

UK to Impose Carbon Tax for Steel and Aluminum Production

HM Treasury recently announced that the UK plans to enact a carbon tax on certain metals and natural resource imports into the country by 2027. The December 19 announcement said that steel, aluminum, and iron ore will be subject to the tax. This tax is currently known as the Carbon Border Adjustment Mechanism (CBAM). “Goods […]

Green Aluminum Market: Insight From Hydro’s Duncan Pitchford

Aluminum supply remains a major topic of discussion among metal buyers. Traditional smelting and metal manufacturing remain the most widely used metal manufacturing methods worldwide. However, “green” metal initiatives have witnessed growth in recent years. Recently, I interviewed representatives from Norsk Hydro, a recycled and green aluminum company based out of Norway, to gain insight […]

Construction MMI: Construction Spending Rises but Construction Index Falls

The Construction MMI (Monthly Metals Index) strayed from its sideways trend to drop 6.84% month-over-month. A drop in European commercial aluminum 1050 sheet prices was the main culprit in the index’s decline. Construction news sources indicate with steel prices finally flattening out in recent weeks, the index could face further bearish pressure. Despite this, construction […]

Renewables/GOES MMI: Index Turns Down and Possible EV Trade War?

The Renewables MMI (Monthly Metals Index) remains volatile, especially when it comes to EV battery technology. Starting in August, the index experienced sharp up-and-down movements from month to month. Indeed, between October 1 and November 1, the index dropped 4.22%. Most index components, including grain-oriented electrical steel, dropped, with only a few managing to move […]

India and China Plan to Discuss Carbon Tax with the EU

Both India and China continue to denigrate the Carbon Border Adjustment Mechanism (CBAM), or “carbon tax” as it has come to be known, proposed by the European Union. Meanwhile, the EU claims the new scheme is integral to its plan to achieve zero emissions across six earmarked industries. The new tax regime recently moved into […]