This morning in metals news, the metals supply situation is complicated, Russian steel producer NLMK‘s output rose 3% last year and copper dropped the most it had in almost six weeks. MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel What is the Supply Situation? According to Reuters, stocks of metals in LME industrial […]

This Morning in Metals: Rio Tinto Finds Copper at Grasberg for First Time Since 2014

This morning in metals news, Rio Tinto made a copper discovery at its Grasberg mine for the first time since 2014, automakers urge Trump not to withdraw from the North American Free Trade Agreement (NAFTA) and copper hits a 3 1/2-week low. MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel Rio Makes Copper […]

The January MMI Report: Prices Rise as Industry Awaits Trump’s 232 Decision

It’s that time — our latest Monthly Metals Index (MMI) report is in, covering the final month of 2017. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook So, before we move onto 2018 for good, let’s take one last look at our newest MMI report and recap some of the highlights: […]

This Morning in Metals: Steel Wins Big with New Ram, Chevy Models

This morning in metals news, two new vehicles made mostly with steel represent a victory for the steel industry, iron ore prices are down and the U.S. International Trade Commission (ITC) voted to continue its investigation into common alloy aluminum sheet from China. New Ram Pickup, Chevy Silverado Made with Steel As the steel industry […]

Week in Review: Section 232 Report Moves to Trump, MMIs and Oil

Before we head into the weekend, let’s take a quick look back at the week that was here on MetalMiner: Need buying strategies for steel? Try two free months of MetalMiner’s Outlook This week we wrapped up the latest round of posts for our January Monthly Metals Index (MMI) — check out this week’s posts […]

Section 232 Steel Probe Report Moves on to President Trump

After a couple of self-imposed deadlines blown by and a lot of waiting, the next step in the Section 232 process has finally arrived. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Thursday evening the Department of Commerce announced Secretary of Commerce Wilbur Ross had completed his Setion 232 steel report […]

This Morning in Metals: U.S. Steel Imports Rise 15.5% in 2017

This morning in metals news, U.S. steel imports rose significantly in 2017, Shanghai nickel hits a 2-month high and the Peruvian government is considering a $2.4 billion railway project in light of rising copper output. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Steel Imports Up by 15.5%; 2017 Market Share […]

Renewables MMI: International Trade Commission Mulls Extending 18-Year Steel Plate Tariffs

The Renewable Monthly Metals Index (MMI) picked up a point for our January reading, rising from 78 to 79 (a 1.3% jump).

Need buying strategies for steel in 2018? MetalMiner’s Annual Outlook has what you need

Several of the heavier hitters in this basket of metals posted price increases this past month.

U.S. steel plate rose 4.0% and U.S. grain-oriented electrical steel (GOES) coil rose 3.8%. Korean steel plate also increased, rising by a whopping 8.9% for the recent monthly window.

Chinese silicon and cobalt cathodes also posted notable price jumps. Meanwhile, Chinese steel plate fell slightly, while Japanese steel plate posted a small price jump.

Continuation of Steel Plate Tariffs on the Table

U.S. Rep. Pete Visclosky (D-Merrillville, Indiana) testified before the International Trade Commission recently on the subject of extending 18-year-old duties on cut-to-length carbon-quality steel plate from India, Indonesia and South Korea, the Northwest Indiana Times reported.

Northwest Indiana, where Merrillville sits, is home to significant domestic steel industry activity, including by ArcelorMittal, which produces steel plate at its Burns Harbor Plate Mill — located in Gary, Indiana — the paper reported.

“As a representative and resident of Northwest Indiana, I am acutely aware of the challenges facing the American steel industry due to the onslaught of illegal steel imports,” the Times quoted Visclosky as saying during testimony at a hearing in Washington, D.C. “The ArcelorMittal facility at Burns Harbor in Northwest Indiana makes cut-to-length carbon-quality steel plate, and every one of those dedicated workers deserve to be able to continue to fairly compete and make the best steel to the best of their ability in our global economy.”

Of course, the issue is one of many metals-related trade issues before U.S. trade bodies (the most headline-grabbing being the Section 232 probes into steel and aluminum imports, for which a ruling is expected this month).

Like the Section 232 probes, which seek to determine whether those imports negatively impact the country’s national security, Visclosky also cited national security concerns vis-a-vis steel plate imports.

GOES Gets a Boost

As reported by our Lisa Reisman yesterday, grain-oriented electrical steel (GOES) got a boost this past month.

GOES prices, as Reisman noted, usually don’t move in tandem with other forms of steel — but it didn’t play out that way in December.

Import levels, however, are something to monitor going forward.

“In addition to prices moving in a similar direction, import levels also followed similar patterns, although GOES imports showed a dramatically higher increase whereas finished steel imports grew by 14.5% on an annualized basis according to the American Iron and Steel Institute (AISI),” Reisman added.

While China is often the subject of much discussion regarding a flood of imports into the U.S., when it comes to GOES, Japan is actually the leader in exports to the U.S.

[caption id="attachment_89715" align="aligncenter" width="580"]

Japan owns about two-thirds of the U.S. GOES import market share, rising significantly despite a drop in overall finished steel sent to the U.S.

The explanation for that disparity?

“Increased domestic efficiency standards have led to the development of higher performance electrical steels (HB), which have taken share away from the more conventional grades produced by the sole U.S. producer,” Reisman wrote. “With no U.S. producer of these grades, the market has become more reliant on exports from Japan.”

Actual Metal Prices and Trends

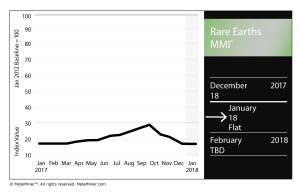

Rare Earths MMI: Global Market Projected to Hit $20 Billion by 2024

The Rare Earths Monthly Metals Index (MMI) held flat for the month, posting a value of 18 for our January reading.

Reflecting the lack of movement in the MMI value, the basket of metals posted modest price fluctuations.

Two-Month Trial: Metal Buying Outlook

Chinese yttrium rose 1.9%, while terbium oxide dropped 0.8%. Neodymium oxide fell 1.3% on the month.

Australian Miner Receives State’s EPA Approval

A $900 million Australian miner received approval from the state’s Environmental Protection Authority (EPA), mining.com reported.

According to the report, Arafura Resources received approval on Friday after a two-year process. The EPA had been considering the environmental impacts of the Nolans rare earths project, the website reported, concluding that those risks at the site could be managed.

According to the report, Arafura estimates the project would create an investment of about $900 million in central Australia.

Global Market to Reach $20 Billion by 2024

The global rare earths market is projected to hit a value of $20 billion by 2024, according to a research report by Global Market Insights, Inc.

“Growing demand for magnets in automobiles, and energy generation will majorly contribute to the growth of global rare earth metals market over the forecast period,” the Globe Newswire release states. “The demand for rare earth magnets is majorly increasing by their consumption in electric and hybrid vehicles, and wind turbines. Increasing focus on utilizing clean and renewable energy is giving a substantial pressure on the electricity providers, to generate energy through renewable sources, which in turn will show a positive impact on the growth of this market.”

Not surprisingly given China’s overwhelming dominance of the rare earths markets, prices will continue to fluctuate somewhat wildly based on Chinese supply.

As for individual metals, neodymium will continue on in its place at or near the top of the rare-earths heap.

“By revenue, neodymium had the highest market share in 2016, with a market share of over 30%,” the release states. “It will dominate the global rare earth metals market till the end of projected period. Neodymium market will grow at a CAGR of 8.2% from 2017 to 2024.”

Free Sample Report: Our Annual Metal Buying Outlook

Actual Metal Prices and Trends

This Morning in Metals: Proposed Law Could Offer Fewer Protections for U.K. Steel Industry than E.U. Regulations, Union Warns

This morning in metals news, a law proposed in the U.K. could have a negative impact on the domestic steel industry as the country moves forward with Brexit talks, steel production in the U.S. Great Lakes region has jumped to start the year, four firms have submitted resolution plans for Electrosteel Steels and the U.S. […]