Before we head into the weekend, let’s take a look back at the week that was with some of this week’s stories here on MetalMiner: Need buying strategies for steel? Try two free months of MetalMiner’s Outlook What’s going on with steel prices? Have they neared a top? MetalMiner’s Irene Martinez Canorea offered her analysis […]

Category: Public Policy

Aluminum Prices Drop Sharply This Week After Announcement on Potential Easing of Sanctions

What goes up must come down, goes the old adage. Buying Aluminum in 2018? Download MetalMiner’s free annual price outlook Although that adage does not always hold true, it has for aluminum this week following a change of tone from Washington. According to the Financial Times, the U.S. Treasury made two important announcements this week, […]

India Increasingly Looks Eastward in Its Exports

A new report in HSBC’s Navigator series focuses on the long-term ascendancy of the Asian region as it explores both anticipated and actual trends in India’s trade patterns with its nearby neighbors. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook India enjoys a balance of trade surplus in services but a […]

Aluminum Consumers Pose a Not-Unreasonable Question: How High Can Prices Go?

Higher is the simple answer. The world with the exception of China was in deficit before U.S. sanctions against Oleg Derispaska and his aluminum company Rusal. So when the three million tons of primary metal Rusal exports outside of Russia are taken out of a market already worried by the recent partial closure of Norsk […]

Week in Review: Aluminum, KORUS and Section 232

Happy Friday, MetalMiner readers! Here’s a look back at this week’s top stories. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook A number of aluminum associations around the world wrote a joint letter urging G20 leaders to hold a forum on global aluminum overcapacity at this year’s G20 Summit, scheduled to […]

This Morning in Metals: Alcoa Shares Jump 4%, Companies Seek Waivers from Section 232 Tariffs

This morning in metals news, there has been a flood of applications from U.S. companies for exemptions from the Section 232 tariffs. Nickel prices reached a three-year high, stoked by fears of more sanctions, and Alcoa shares jumped in after-hours trade following rosy Q1 results. Need buying strategies for steel? Try two free months of […]

U.S. and India Form Joint Task Force on Natural Gas

India and the United States may be at loggerheads over the recently announced trade tariffs on the import of metals, but that has not stopped the two nations from talking cooperation in other fields like oil and gas or renewable energy. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook On Tuesday, […]

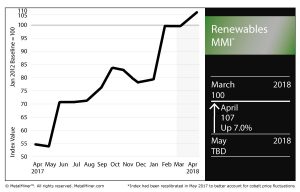

Renewables MMI: Cobalt, U.S. Steel Plate Post Big Price Jumps

The Renewables Monthly Metals Index (MMI) rose seven points on the month, hitting 107 for our April reading.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

Within the basket of metals, Korean, Chinese and U.S. steel plate posted price increases, while Japanese steel plate traced back slightly. U.S. steel plate jumped significantly, posting a 13.6% increase for the month.

U.S. grain-oriented electrical steel (GOES) coil fell on the month, while neodymium picked up by 0.7%.

The always volatile cobalt price shot up significantly last month, rising 10.6%.

Tesla Strategy Places Premium on Neodymium

As we mentioned earlier this week, growing demand for neodymium from electric vehicle (EV) maker Tesla will put even more pressure on what is already a constrained market.

In short, that means rising prices for the material, reflected in this month’s activity.

Tesla is looking to neodymium for magnetic motors in its Model 3 Long Range cars, as mentioned in the Reuters report we cited Tuesday. Last year, supply fell short of demand by 3,300 tons, according to that report.

DRC Looks to Shake Up 2002 Mining Charter

When it comes to anything cobalt, the Democratic Republic of Congo is typically at the center, being the source of the majority of the world’s cobalt.

Earlier this week, MetalMiner’s Stuart Burns wrote about President Joseph Kabila’s move to readjust the nation’s 2002 mining charter to, essentially, secure a bigger piece of the pie vis-a-vis the country’s vast mineral resources.

It comes as no surprise that the multinational miners doing business in the DRC aren’t exactly thrilled by the proposition of increased royalties and levies. However, as Burns noted, value of materials like cobalt and the demand they draw, combined with their relative scarcity, means such multinationals will continue to do business there, no matter what happens with the charter.

“If the state takes a little more of the pie, it will probably be reflected in prices,” Burns wrote. “But with limited alternatives for products like cobalt, it is unlikely to dent mining companies’ enthusiasm for investing in the DRC.”

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Actual Metal Prices and Trends

Is the Hong Kong Property Market Going to be the First Casualty of Fed Tightening?

We have been far from alone in issuing periodic warnings about the implications of rising interest rates for a global debt market that is out of proportion to levels seen even before the last recession. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Fortunately, one of the first test cases has […]

DRC Makes a Grab for a Larger Slice of the Pie

I guess you can’t blame countries like the Democratic Republic of Congo (DRC) for looking to acquire a bigger piece of the wealth from their own supplies of natural resources. Need buying strategies for steel in 2018? MetalMiner’s Annual Outlook has what you need The Telegraph reports that President Joseph Kabila is ripping up the […]