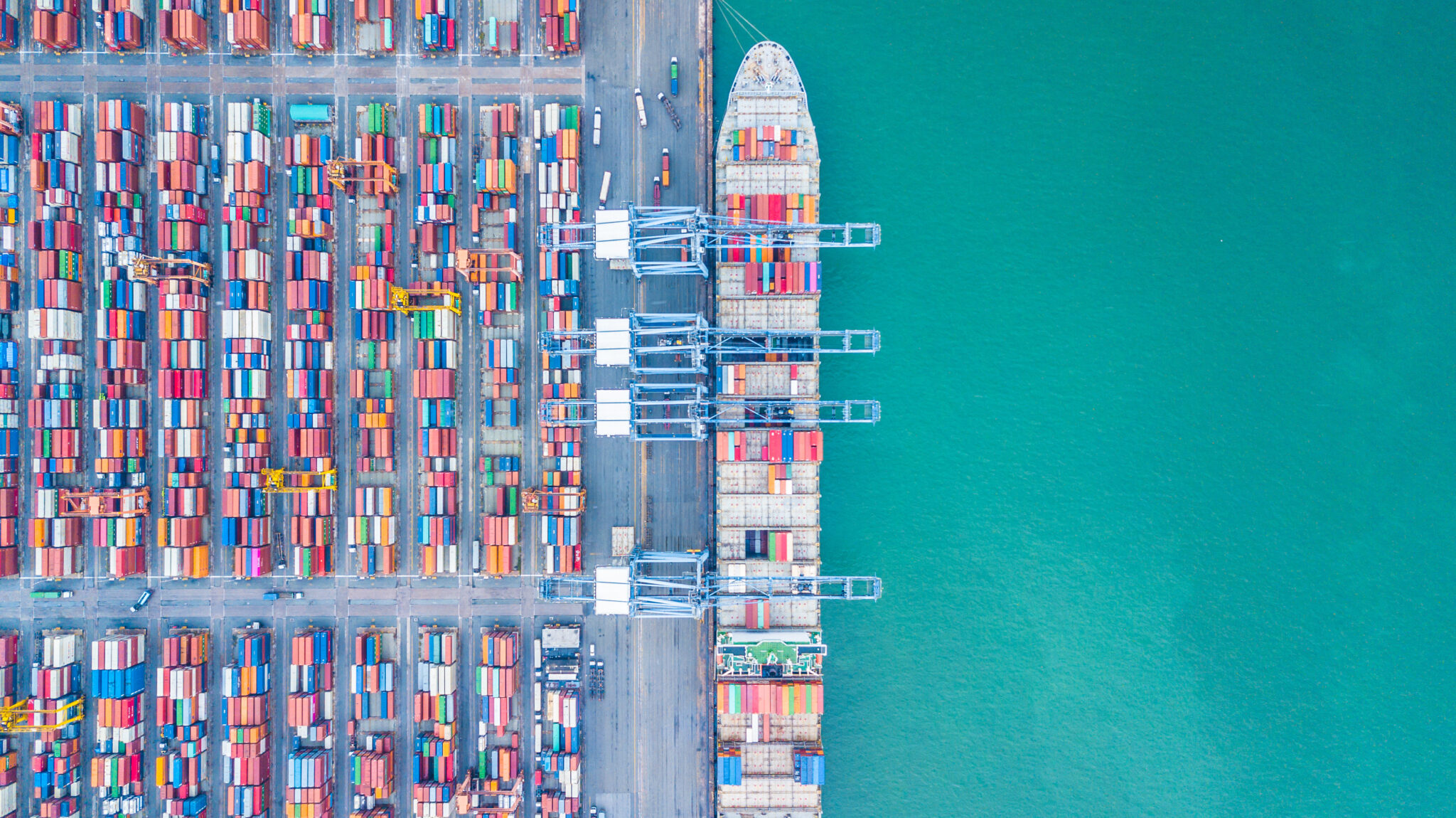

Chinese mills are churning out steel, aluminum and even refined copper at near-record levels and sending the surplus abroad, a trend steel industry analysts say could pressure industrial metal prices in the United States. After a year of lagging domestic demand, China’s exports of construction and manufacturing metals have surged, flooding global markets with cheap […]

Tag: Steel

China’s Steel Flood: ASEAN Struggles as Exports Surge 32% Overnight

There’s no doubt that China is desperately seeking new markets to hawk its goods and commodities after the U.S. trade tariffs kicked in. This is especially true when it comes to the country’s steel industry. In fact, even prior to the trade war, Beijing was actively looking at expanding its access to steel markets. So, […]

Construction MMI: Construction Market Braces Itself as Recession Fears Loom

The Construction MMI (Monthly Metals Index) moved sideways month-over-month, dropping by 2.72%. In the wake of fresh federal policy moves this spring, construction news reports indicate that the industry is navigating a sudden spike in material costs. Over the past month, new government tariffs and trade measures have caused significant price fluctuations in critical inputs […]

Raw Steels MMI: How Far Will Steel Prices Fall?

The Raw Steels Monthly Metals Index (MMI) traded down during the month. Overall, the index fell 3.82% from April to May. While U.S. steel prices moved sideways throughout April, the bias appeared increasingly to the downside as buyers pulled away from the market due to tariffs. Steel Prices Slide Lower As Bearish Signals Mount After […]

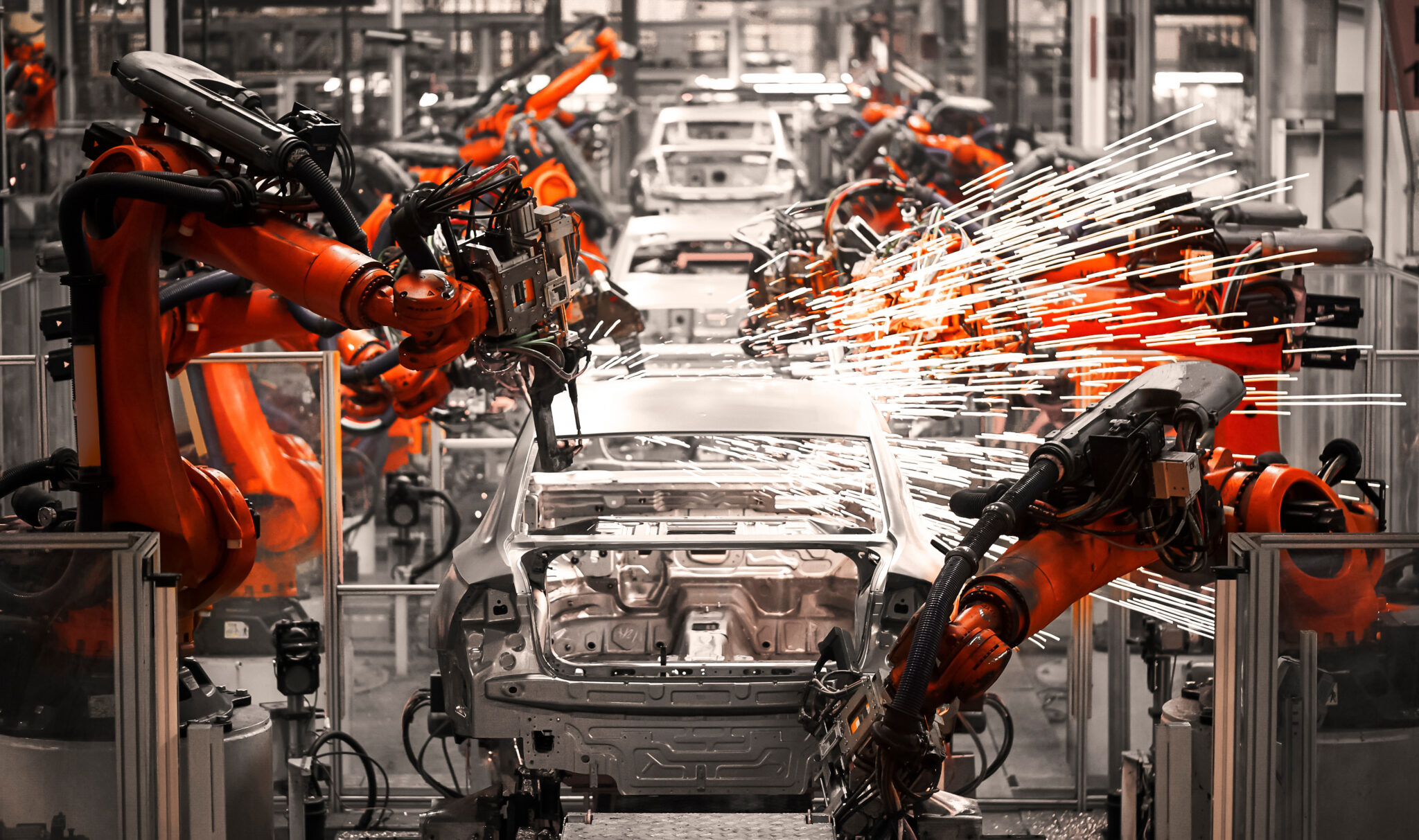

How U.S. Manufacturers Shift Gears and Save Money Amid Metal Price Volatility

U.S. manufacturers in the automotive, appliance and general industrial sectors are overhauling procurement strategies as economic volatility and swings in steel, aluminum and copper prices squeeze margins. Recent U.S. tariff actions have jolted metals markets, sending input costs soaring for downstream manufacturers. According to Reuters, the uncertainty not only triggered panic buying but extended lead times […]

Auto Shock: Trump’s 25% Tariff Sends Europe Reeling

The “Trump Tariffs” continue to shock global markets, affecting multiple major sectors. Recently, European auto manufacturing ombudsmen reacted with alarm to President Donald Trump’s imposition of a 25% import tariff on auto imports into the United States. EU Auto Leaders React to Trump Tariffs Hildegard Müller, president of the German Association of the Automotive Industry, […]

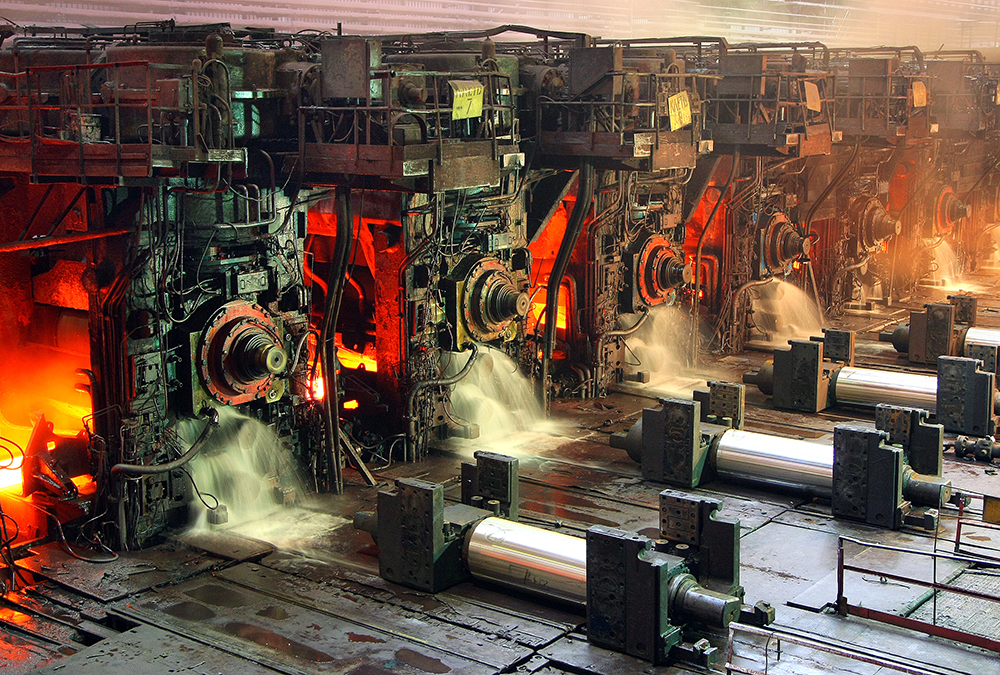

Did the UK Take a Steel Giant Hostage to Save Its Industry?

The UK Parliament recently passed a law allowing the government to take control of British Steel, a major player in the local steel industry. The move follows Chinese owner Jingye’s plans to shut down two operating blast furnaces at its Scunthorpe site. A Bold Move Towards UK Steel Industry Preservation The House of Commons, Parliament’s […]

Tata Steel Ups its Game at Port Talbot With $1.56B Overhaul

Tata Steel recently signed an agreement to install a new pickling line at its Port Talbot site in Wales. The steel industry leader’s latest move will offer 50% more capacity than the existing line. According to the company’s April 9 announcement, the new equipment will have an annual capacity of 1.8 million metric tons and […]

Fortress Europe? EU Slams the Gate on Steel Imports in Dumping Crackdown

Amid chaos from steel tariffs, the European Commission plans to tighten steel import quotas on April 1 over fears of dumping on the bloc. Those fears primarily stem from U.S. President Donald Trump’s implementation of 25% duties on all steel and aluminum imports into the United States, which came into effect in early March. The […]

Raw Steels MMI: Steel Prices Level Off, Lead Times Shrink

The Raw Steels Monthly Metals Index (MMI) returned to the downside. Overall, the index witnessed a modest 0.75% decline from March to April. Steel Prices Find Peaks as Reciprocal Tariffs Spare Steel Steel prices either found a peak or began to stabilize by the start of April. As of April 4, hot rolled coil prices […]